Author: Tao Yanyan

Editor’s Note: We have selected ten power battery companies according to 2022 data and forecast their future development. Let’s start with several overseas companies with relatively small ranking controversies: LG, SK on, SDI, and Panasonic. Today we will discuss Samsung SDI.

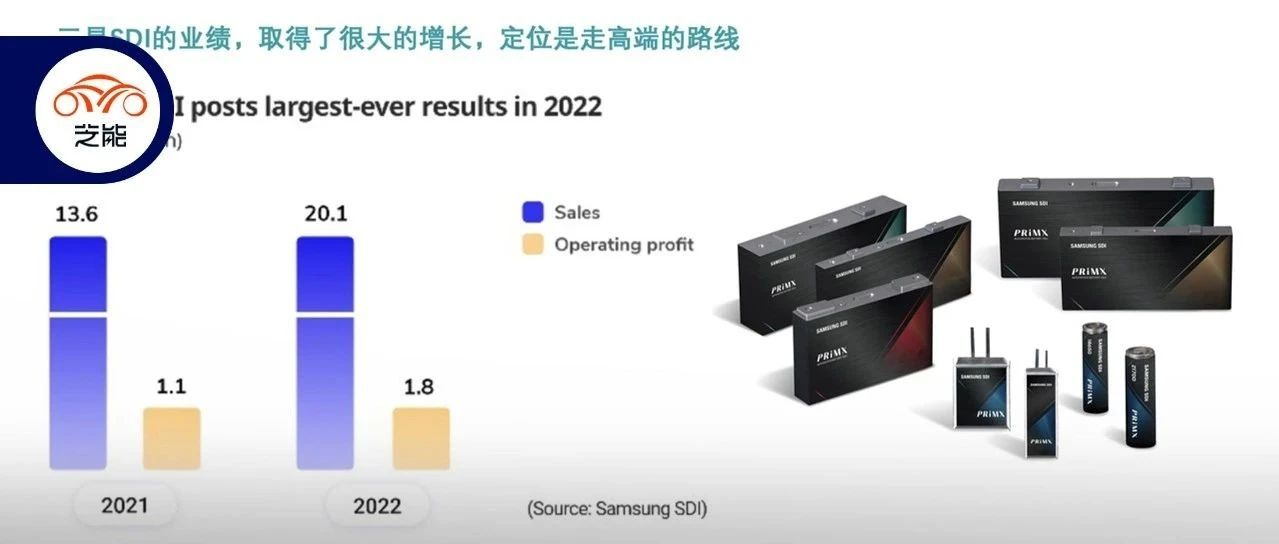

From the data, Samsung SDI’s operation is still very stable. The total revenue in 2022 was about CNY 111.15 billion, a year-on-year increase of 48.5%. Operating profit was CNY 9.99 billion, a year-on-year increase of 69.4%. The operating profit margin was 9.0%, and net profit was about CNY 11.26 billion, a year-on-year increase of 63.1%. The company’s performance this year benefited mainly from the revenue growth of Samsung’s large battery business (power and energy storage).

Samsung SDI’s battery sector had a total revenue of approximately CNY 97.02 billion in 2022, a year-on-year increase of 60.5%. Operating profit was approximately CNY 6.92 billion, a year-on-year increase of 133.2%. The operating profit margin was 7.1%. This is also a power battery company that is making money.

Note: The data on the report shows that the annual sales revenue was KRW 20.1241 trillion, and the operating profit was KRW 1.808 trillion. The above results are converted according to the exchange rate.

Production Capacity and Customer Structure

According to EV Volumes’ data, SDI’s growth is relatively stable, with seasonal improvements, mainly starting from the increased demand in Q4.

Samsung SDI’s customers mainly include Stellantis, Ford, BMW, Volkswagen, Hyundai, and US new forces (Rivian and Lucid), among others.

-

BMW: mainly supplies overseas PHEVs, and electric vehicles have increased rapidly in volume with the rise of I3 and other demands, accounting for more than 49.2% in a single quarter.

-

Volkswagen Group (Audi): mainly provides early versions of BEVs for Volkswagen, and jointly supplies Audi’s cars with LG.

-

Stellantis: FCA’s project, a complete solution for the small car FIAT 500, accounts for more than 10% now.

-

Rivian: this is a relatively rapidly growing new demand.

-

Ford: mainly PHEVs, and the demand for this area has not increased as Ford is mainly promoting electric vehicles.

Overall, the main problem faced by Samsung SDI is that its customers are relatively concentrated and mainly high-performance batteries. Currently, BMW has a large demand for P5 (Gen.5), and with the expansion of the P5 production line in Hungary, the sales of batteries for new models will soar, and the revenue of power and energy storage batteries will achieve a substantial increase year-on-year.

Therefore, Samsung SDI currently lacks customers. It is expected that SDI’s large-scale battery production capacity will reach 50GWh in 2023.

- 11GWh in Korea: mainly for export

- 15GWh in China: mainly for export and energy storage use, no expansion plan for now

- 40GWh in Europe: building the third electric vehicle battery factory in Hungary, which will produce brand new square batteries and provide BMW with shell batteries.

- 5GWh in the US: negotiating with General Motors (discussing cylindrical batteries) and Volvo to establish a joint venture battery factory, with a total cost of about $8 billion. Samsung SDI plans to invest $4 billion, and both companies plan to build factories with an annual capacity of about 50GWh.# Cylinder-shaped Batteries

Large cylinder-shaped batteries, which are mainly produced in the 46 series cell production line established in Tianan factory, are scheduled to be completed in Q1 2023 and begin operation in the first half of 2023.

Technology and Development

SDI’s breakthrough is currently focused on the 46 series of large cylinder-shaped batteries. The 46 pilot lines invested in the Tianan factory are expected to start operating after equipment installation is completed in 2023. By using high-nickel NCA positive electrode materials and SCN positive electrode material technology, the capacity can be maximized. SDI is currently discussing cooperation methods with various customers and planning to begin mass-producing samples online and promote commercialization.

In terms of solid-state batteries, SDI’s pilot line is the first pure fully solid-state battery production line in the industry. It is expected to be completed in the first half of 2023 and will produce small sample cells to carefully test the battery performance and material components in the second half of the year. Increasing the battery size and ensuring production amplification technology are important tasks for achieving commercialized solid-state batteries in the future.

Conclusion: From the perspective of choosing diverse batteries globally and dispersing risks, SDI, which seems the least active, has a bit of a “lay back and win” attitude. Developing high-end fast charging cores and relying on battery quality to gain trust seems to be an appropriate development model for SDI, despite seemingly slow and sluggish competition.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.