SK on: A battery enterprise with a fast-developing market in China

Author: Tao Yanyan

Editor’s note: This year, the market situation for domestic power battery enterprises has changed dramatically. We have selected ten power battery companies based on 2022 data and offered an outlook on their future development, while also providing a systematic summary of their situation in recent years. Let us begin by looking at several foreign companies with low ranking controversies: LG, SK on, Panasonic, and SDI. Today, we will report on SK On, which is the second company in this series.

Among the three battery enterprises in South Korea, SK On has benefitted from strong support from its parent company since it was spun off in 2021. It is also pursuing LGES’s IPO route to success. By the end of 2022, SK On’s total increase in capital was KRW 2.8 trillion, with KRW 2 trillion was invested by SK Innovation and KRW 0.8 billion by Korea Investment Private Equity.

Financial Situation:

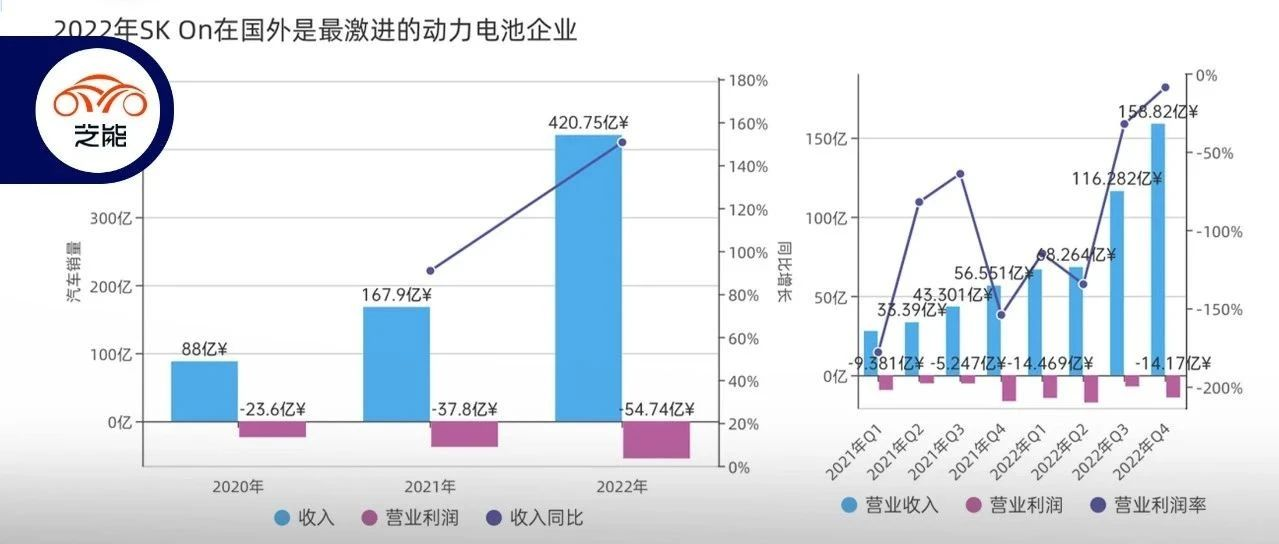

In Q4 2022, SK On’s battery division revenue was CNY 15.882 billion with a YoY growth of 170% and MoM growth of 31%. In the entire year of 2022, the total revenue was CNY 42.075 billion. In terms of profit, the operating loss for Q4 2022 was CNY 1.417 billion, with an operating profit margin of -9%. From the perspective of SK On, the expansion of the battery sector has continuously increased its operating revenue. The demand from customers has driven the operation of new factories, which has led to a continued increase in sales. However, SK On’s operating losses have expanded due to the increase in fixed costs caused by capacity expansion.

Based on SK’s predictions and the increase of SK On’s overseas factories, we expect a doubling of the battery business revenue in 2023.

According to EV Volumes data, SK On’s overall shipment volume has been increasing steadily, but it has not yet been reflected in the rapid growth of operating revenue. Currently, the main driving force for sales is the massive promotion of pure electric vehicles by Ford and Hyundai-Kia. The demand for PHEV’s battery required a higher order than expected.“`markdown

Capacity and Customer Layout

There were many changes in the market in 2022, and the most important for Korean battery companies was the shift from building capacity bases around Europe to the United States. Therefore, SK On’s major new battery capacity additions in 2022 are:

◎ US NO1 Factory and NO2 Factory: US NO1 Factory 10GWh was put into production in Q1 2022, and US NO2 Factory 12GWh was put into production at the end of 2022, creating a capacity of 22GWh, which is important for 2023.

◎ European Hungary NO 2 Factory.

It is expected that the new factory will be put into operation in full in 2023, serving new customers such as Ford and Volkswagen, which will expand demand beyond Mercedes-Benz and Hyundai-Kia.

Looking ahead to 2025, with the full implementation of IRA, SK ON plans to build 129GWh, which will be put into production in Q1 2025, and through the construction of the local battery supply chain layout, it will drive the construction of positive pole material factories in North America.

In Europe, the Hungarian NO3 factory will begin operation in Q1 2024, and SK On’s investment and layout in Europe has slowed down due to the delay with Ford’s factory in Turkey.

In China, the main focus is on meeting the demand in Asia. The Yancheng (Phase II) factory will be put into operation in Q2 2024.

By the end of 2022, SK On’s global factory achieved a capacity of 89GWh, faster than originally planned, and the planned capacity for 2025 has been increased to more than 220GWh.

SK On’s problem is actually the same as LGES’s, it is difficult to completely bind customers. Therefore, Ford chose to build a battery factory in Turkey through a joint venture with LGES and Turkey’s Koc Group, with an annual capacity of 25GWh, which will be put into production in 2026.

SK On has added investment in its Seosan plant in Korea, which will begin commercial production in 2024 and provide electric vehicle batteries produced in Ulsan to Hyundai vehicles, expanding its current production capacity of 5GWh per year to 10GWh, mainly aimed at the Genesis G80, GV60, and GV70 series.

## Technological development

In collaboration with Hyundai-Kia, SK On has done a lot of work in improving the fast charging speed of electric batteries. Currently, SK On's batteries can reduce the charging time of electric vehicles to 18 minutes. The key to technology is injecting lithium during the charging process to reduce anode resistance. The main method is to develop a special coating to reduce the anode resistance while using less adhesive.

SK On's manufacturing process is different from LG's, with differentiated battery assembly processes and Z-fold:

In terms of soft pack structure design, SK On now mainly promotes the S-Pack with the EV CTP(Cell-to-pack) technology. From a safety perspective, it has achieved enhanced safety and prevented heat transfer (ensuring that in the event of abnormal use that causes the battery to catch fire, heat will not spread to the system or vehicle).

S-Pack maximizes the volume ratio of the battery pack by simplifying internal structures and related components.

Summary: SK On has already initiated the migration from soft packs to other products at the development level and aims to expand to other fields beyond just automotive batteries. In terms of high-level strategy, the development trajectory of SK On is very similar to that of LGES. I understand that even from a global perspective, competition among enterprises for customers of power batteries is very fierce. However, to increase production capacity overseas, SK On’s response is to pursue an independent IPO.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.