Author: Yi Wang

Recently, the concept of “solid-state batteries” has caused a stir in the new energy vehicle industry.

On February 7th, Ganfeng Lithium announced that their electric SUV, Seres-5, equipped with their ternary solid-liquid hybrid lithium-ion batteries, will begin delivery in March this year. Driven by this heavyweight news, related concept stocks of solid-state batteries are also starting to move.

As early as at the beginning of 2021, NIO revealed that its flagship sedan, the ET7, will be equipped with newly-developed solid-state batteries. Their solid-state battery technology can achieve a maximum energy density of up to 360 Wh/kg.

We know that the most widely used types of batteries in new energy vehicles are chemical batteries, among which ternary lithium batteries, lithium iron phosphate batteries, and nickel-metal hydride batteries are the most widely used and can be regarded as “veterans”.

As a newcomer in the battery field, solid-state batteries and semi-solid-state batteries are being highly anticipated due to their stronger comprehensive performance, especially safety.

So, what are solid-state batteries and semi-solid-state batteries? What advantages do they have compared to traditional lithium batteries? How many well-known car companies have been attracted to invest in research and development, given their hot-topic concepts? What will be the future of new energy batteries?

What are “semi-solid-state batteries”?

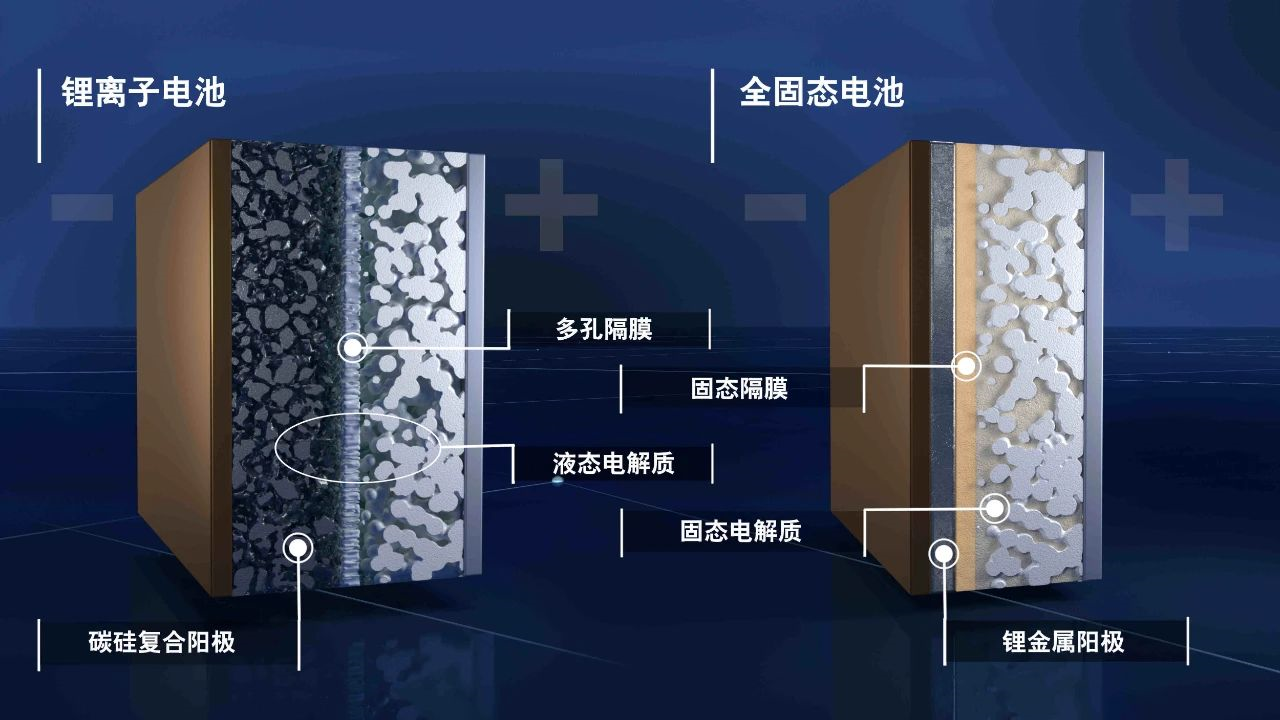

In fact, solid-state batteries use solid electrolytes instead of liquid electrolytes in lithium-ion batteries.

The flammability of liquid electrolytes is one of the fundamental reasons for safety issues in new energy vehicles. Solid-state batteries convert liquid electrolytes into non-flammable solid electrolytes. The mechanical and chemical properties of the electrolyte are more stable, and both the static and cycling life have been significantly improved. In addition, the energy density of solid-state batteries has now reached nearly 400 Wh/kg, which is far superior to the energy density of traditional batteries of 250 Wh/kg. Therefore, their advantages are very significant.

Solid-state batteries are non-flammable, non-corrosive, high-temperature resistant, and non-volatile, which greatly improves safety.

Semi-solid-state batteries are a type of solid-state batteries, but their electrolytes are in a solid-liquid hybrid state, about 5-10% of the battery electrolyte is liquid.

For the membrane structure, semi-solid-state batteries still need to retain the membrane to separate the positive and negative poles, while it is not certain whether the membrane needs to be retained in full solid-state batteries due to differences in design solutions.At present, whether in terms of market supply chain or technological mass production and application, semi-solid-state batteries are an intermediate existence between liquid lithium batteries and full solid-state batteries.

Therefore, there is another voice in the industry that semi-solid-state batteries are still liquid batteries, and the so-called semi-solid-state batteries are more of a word game.

In any case, whether or not we can eventually transform from traditional lithium batteries to fully applied solid-state batteries, it is particularly important to successfully develop the path of semi-solid-state batteries in between.

What is the prospect of “semi-solid-state battery”?

Compared with fuel-powered cars, new energy vehicles have always had the disadvantage of short endurance and greater safety hazards, which has greatly affected consumers’ car purchasing preferences. Traditional liquid lithium batteries not only limit battery performance, but also easily age and have high safety hazards, and are already in a bottleneck period of development. Solid-state batteries will significantly improve energy density and safety performance, and are undoubtedly a gospel in the field of new energy vehicles.

However, for now, achieving industrialization of solid-state batteries still has a long way to go. On February 20th, Yin Zhongshu, chief analyst of electric power equipment and new energy at China Everbright Securities, said: “Due to the technical difficulties of full solid-state batteries, based on the current development stage of the entire industry, if full solid-state batteries are to achieve commercial production, it may take at least five years, or even more time.”

In addition to technical difficulties such as unstable electrolyte interfaces, the production cost of solid-state batteries and the degree of impact on existing supply chains are also important reasons why it cannot be industrialized in the short term.

In this dilemma, the semi-solid-state battery, as a “compromise solution,” has become the preferred “second choice”.

On the one hand, the cost of semi-solid-state batteries is lower, and although the energy density is not as high as that of the full solid-state batteries, it is still high enough and has certain advantages over traditional ternary lithium batteries and lithium iron phosphate batteries.

On the other hand, compared with full solid-state batteries, semi-solid-state batteries have much less impact on the industrial chain. The positive and negative electrodes of semi-solid-state batteries basically continue the lithium battery technology route, and their supply chain has a higher degree of coincidence with the existing supply chain. Therefore, it will not cause disruptive impact on the existing supply chain.

In addition, replacing some electrolyte with solid electrolyte makes the electrolyte of semi-solid-state batteries less likely to evaporate and expand, and can more effectively suppress battery ignition and leakage, which also significantly improves the safety factor.

Therefore, it seems that the popularity and application of solid-state batteries is obviously the trend.# Partial list of “semi-solid-state batteries” suppliers

Currently, the major domestic developers of semi-solid-state batteries, such as Weilan New Energy, Ganfeng Lithium, Guoxuan High-tech, and Funeng Technology, have all achieved industrialization of their products.

Weilan New Energy uses in-situ solidification technology and has developed a solid-liquid hybrid energy storage battery with a capacity of 150Wh/kg, a high-energy solid-liquid hybrid battery with a capacity of 270Wh/kg for drones, and a hybrid solid-liquid power battery with a capacity of 300Wh/kg.

Weilan New Energy and NIO have cooperated to produce the semi-solid-state battery product, which has a capacity of over 350Wh/kg, and allows the ET7 car to travel up to 1000km with a single charge. In November 2022, Weilan New Energy’s first semi-solid-state battery was produced in Huzhou. It is expected that products with a capacity of 400Wh-500Wh will be launched in 2024-2025.

In 2021, Ganfeng Lithium signed a contract with Dongfeng Motor Corporation, with the main product being the Dongfeng E70 solid-state battery system, which has a range of over 500 km. Its module adopts an aluminum alloy frame and upper and lower high-precision seam laser welding technology, which leads the industry average level of soft pack modules. In August last year, Ganfeng Lithium signed a strategic cooperation agreement with Guangqi Yi’an.

Pioneering enterprises such as Funeng Technology and Guoxuan High-tech are also actively conducting research and development on solid-state and semi-solid-state batteries and have achieved significant results, and are entering the stage of industrialization.

In addition to cooperating with domestic well-known car companies, Hyperdrive Innovation has also signed cooperation agreements with Mercedes-Benz and Vietnamese automaker Vinfast last year.

The following figure shows representative products and their characteristics of some semi-solid-state battery manufacturers.

“Semi-solid-state batteries” installation situation

This year, as the technology of semi-solid-state batteries is becoming more and more mature, many new energy vehicle companies have accelerated their pace of developing cooperation in this field.# Dongfeng’s [Voyah](“Chasing the Light”) car seizes the first-mover advantage with the 82 kWh battery pack using a semi-solid-state battery, marking the first production-ready case of a passenger car in the industry. On January 13, Voyah Chasing the Light’s first mass-produced model was officially launched.

On February 6, Qin Lihong, the president of NIO, stated during a media interview that the ET7 model with a 150-kWh semi-solid-state battery pack will be officially launched in the first half of this year.

The next day, Ganfeng Lithium announced that the Seres-5 pure electric SUV equipped with its ternary semi-solid-state battery will be launched in 2023.

The gradual deployment of semi-solid-state batteries in vehicles marks the key breakthrough stage of solid-state battery penetration in China. Industry insiders predict that the commercial turning point of semi-solid-state batteries will occur in 2024-2025, while full solid-state batteries may achieve commercial applications in 2030.

In fact, solid-state lithium batteries have already sparked an upsurge throughout the world.

Recently, numerous well-known car companies such as BMW, Volkswagen, and Toyota have intensified relevant research and development. Predictions from relevant institutions suggest that by 2030, global demand for solid-state batteries is expected to reach 500 GWh, and a market worth over CNY 300 billion will be formed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.