Author: Da Yan

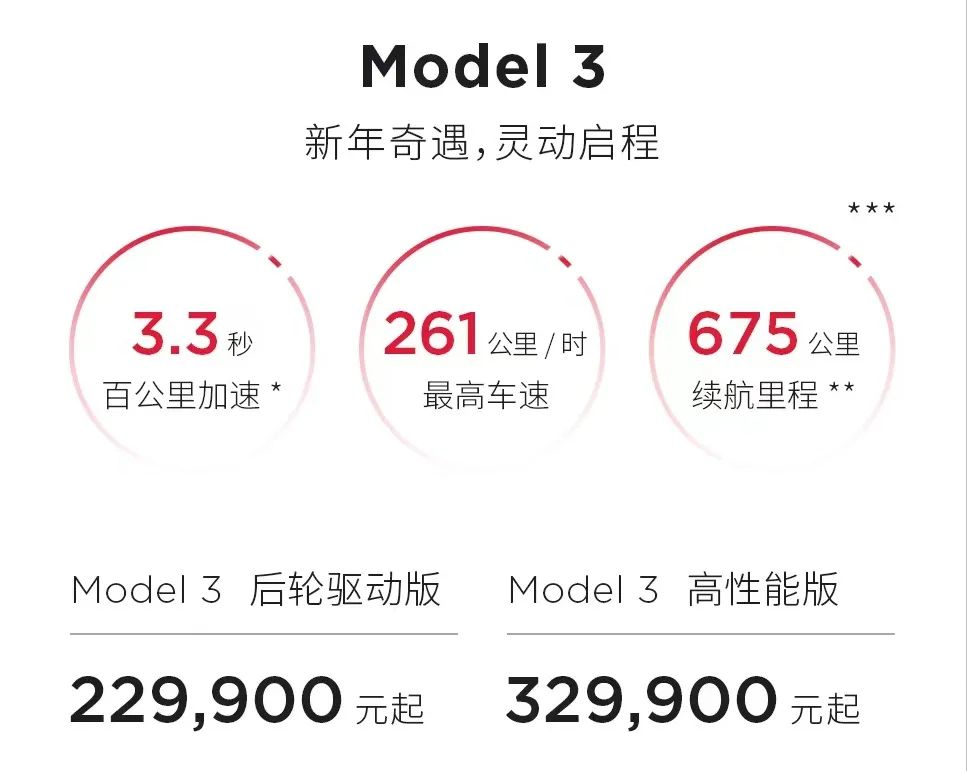

On January 6th, the Tesla China official website displayed a significant reduction in prices for domestic Tesla models. After the adjustment, the starting price for the domestically produced Model 3 rear-wheel drive version is 229,900 RMB, and the starting price for the Model Y rear-wheel drive version is 259,900 RMB. This price is not only a historic low, but the delivery period for domestic models is only 1-4 weeks.

This price reduction is the second reduction within three months after the price reduction in October last year. Recently, Tesla seems to have lost its past invincibility. But will Tesla’s price cut push new forces in the domestic car industry into a corner?

The omen of Tesla’s price cuts

Tesla’s price cuts have actually had a prelude. In September last year, Tesla first provided insurance subsidy promotions. For car owners who completed the delivery from September 16th to September 30th, Tesla provided up to 8000 RMB insurance subsidies, which could be directly used to reduce the car price. This insurance subsidy was almost a trial of the market reaction to its price reduction.

On October 24th, just one month later, Tesla directly started a comprehensive price reduction for domestic models, with a reduction range of 14,000 RMB to 37,000 RMB. Among them, the starting price for the Model 3 was reduced from 279,900 RMB to 265,900 RMB, and the starting price for the Model Y was reduced from 316,900 RMB to 288,900 RMB. After less than three months, Tesla reduced prices again. The two price cuts combined resulted in the starting price of the Model 3 being reduced from 279,900 RMB to 229,900 RMB, a reduction of 50,000 RMB and a reduction rate of 17.86%. The starting price of the Model Y was reduced from 316,900 RMB to 259,900 RMB, a reduction of 57,000 RMB and a reduction rate of 17.99%.

Regardless of the absolute amount or proportion of price cuts, Tesla hopes to release its price advantage as soon as possible.

Why start price cuts?

For automakers, the most direct reason for price cuts is when sales are in crisis.

Although Tesla’s global deliveries achieved a year-on-year growth of more than 40% in 2022, it still failed to achieve the sales target of 1.5 million vehicles. In addition, multiple channels have confirmed that Tesla’s reserved orders have significantly declined. On November 30, 2022, Tesla’s reserved orders were only 190,000 vehicles, while this number was close to 400,000 in August 2022, and even close to 500,000 earlier.

On the other hand, with the Berlin and Texas factories completing their production capacity ramp-up, Tesla’s production capacity shortage has been greatly eased. Europe, which originally needed support from the Shanghai Gigafactory, will now be able to rely on the on-site production capacity of the Berlin factory. The production capacity freed up by the Shanghai factory will need to be absorbed locally. Therefore, at this time, Tesla’s price cuts are also urgent in order to harvest some domestic sales.

Another point that we must mention is Tesla’s stock price. For an American automaker, the importance of a company’s stock price is self-evident, and in some respects, it can even more directly relate to the CEO’s fate than sales.

In 2022, Tesla’s stock price plummeted throughout the year. From the beginning of 2022 to the close on December 27, 2022, Tesla’s stock price has fallen by nearly 70%. Its closing price on January 5 was only $110.34, with a market value of less than $350 billion, far from the trillion-dollar market value companies at that time. If it were not for Elon Musk’s own star halo, if it were other professional managers, they would have been fired by the Tesla board of directors four or five times. In this situation, Tesla’s price cuts to increase terminal sales can also stabilize the stock price.

Has Tesla Fallen From Its High Pedestal?

If this question had been asked during Tesla’s peak market value period, many would have thought the author was daydreaming. After all, at one time, many of the concepts introduced by Tesla and the technological advantages it established made it seem impossible for domestic automakers to catch up.

At Tesla’s annual Technology Day, the company presents technological achievements that traditional automakers are not involved in nor have the capability to develop, such as AI chips and autonomous driving technologies, humanoid robots, batteries, and even supercomputers. Some of these technological accomplishments have indeed enabled Tesla’s relevant car models to lead the global electric vehicle market in terms of technology.

However, as technology deepens, like Apple phones, it becomes increasingly difficult to continuously innovate and maintain a leading position. Just like when we criticized the Cook era of Apple, it was far less surprising compared to the Jobs era. Now, compared with the early days, Tesla’s innovation momentum in the electric vehicle field has also dimmed.

As an automaker, in addition to lowering prices, Tesla needs to quickly promote the launch and delivery of the Semi truck and Cybertruck pickup, especially the electric Cybertruck, which has a promising sales prospect in the North American market. At the same time, Tesla needs to update its car models to enhance its attractiveness and avoid customers purchasing other competitors’ car models due to aesthetic fatigue, whether it is renovating Model 3 and Model Y or quickly launching the entry-level sedan Model Q priced at $25,000. In the global market, almost all traditional automakers have locked their competition against Tesla’s electric vehicles. If Tesla wants to maintain its leading position, the new car effect is an important factor that cannot be ignored.

# Is Tesla Just a Car Company?

# Is Tesla Just a Car Company?

But is Tesla just a car company? The answer is no. From the perspective of market capitalization, Tesla’s stock price is still high as a car manufacturer. However, both Tesla and Elon Musk himself hope that Tesla can be shaped as a high-tech company.

As a high-tech company, Tesla still has enough room for growth in its current stock price. Therefore, if Tesla wants to return to its former glory in terms of market valuation, the path it needs to take is not to launch more car models, but to achieve another breakthrough in core technologies.

Will domestic brands be caught off guard?

With the termination of new energy vehicle purchase subsidies in China on December 31, 2022, many manufacturers, including BYD, have raised their prices to shift some of the cost pressures caused by the subsidy decline. For example, BYD announced that it will officially adjust the official guide prices of related models from January 1, 2023, with an upward adjustment of 2000 to 6000 yuan.

Against the backdrop of domestic car companies raising prices, Tesla did not follow suit to proactively reduce prices, catching domestic brands off guard.

For most domestic brands, they don’t have the capital to engage in a price war with Tesla. According to Tesla’s official financial data, its gross profit margin is around 30%, far higher than that of most domestic car companies. Following Tesla’s lead in a price war is undoubtedly self-destructive. For example, Weima, BYD, and Geely, being traditional automakers, reducing prices now is not a reasonable choice.

For the vast majority of domestically produced electric vehicles, Tesla’s price reduction is a black swan event. Various black swan events will appear in the development process of a company, just like the lockdowns in 2022, earlier chip shortages, and rising lithium prices. It is most important to do one’s own things, step by step according to their own development rhythm, and maintain one’s strategic composure. Tesla’s price reduction will undoubtedly attract some customers who were originally planning to purchase domestically produced EVs to turn to Tesla, this is a predetermined fact.

However, from another perspective, the significant price cut by Tesla within 3 months is not only irresponsible to its existing customers, but also raises concerns for more potential buyers. No one wants to buy a Tesla today and find the price has considerably dropped tomorrow. For the brand image, this is not a positive thing.

However, from another perspective, the significant price cut by Tesla within 3 months is not only irresponsible to its existing customers, but also raises concerns for more potential buyers. No one wants to buy a Tesla today and find the price has considerably dropped tomorrow. For the brand image, this is not a positive thing.

For domestic car companies, it is much wiser for them to focus on developing their own unique features and strengthening their advantages continually than following Tesla’s price cuts. Considering Tesla’s profit margin, it may not be the last time for Tesla to cut prices. If the boost to end sales is not significant, Tesla still has the capital to cut prices further. If local brands or new forces always follow, it won’t be long before we lose our feet.

Nevertheless, for domestic car enterprises, learning from Tesla’s ability to control costs under such high profit margins is worth it, and they should improve their own cost management.

Perhaps, with the recent continuous price cuts and inventory reductions by Tesla, Tesla’s sales are no longer an unreachable goal. And when Tesla enters the most popular sales market pool below CNY 200,000, the good drama for the domestic electric vehicle market may just be beginning.

Currently, domestic brands and new forces have been increasing their efforts to expand into the overseas market. Only by winning the battle with Tesla on the home field can they have the confidence to fight across the globe.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.