Author: Zhu Yulong

The data of European cars is gradually being disclosed. Today I will give you a preview of the overall situation. When the statistics are more abundant in 2022, we will make a detailed summary of the situation in Europe in 2022. Although Europe has overcome the impact of the pandemic, the main markets of the European automobile market in 2022 have declined due to factors such as the Russo-Ukrainian war and the energy crisis. Only a few markets such as the German automobile market are relatively stable. From the sales data of European cars in 2022, it does reflect the objective economic environment. If there is an economic recession in 2023, the overall sales figures for Europe in 2023 may not look good.

The good news is that from October onwards, Europe has experienced positive growth in November and December. This is also a good sign for the supply chain to overcome problems such as chip supply.

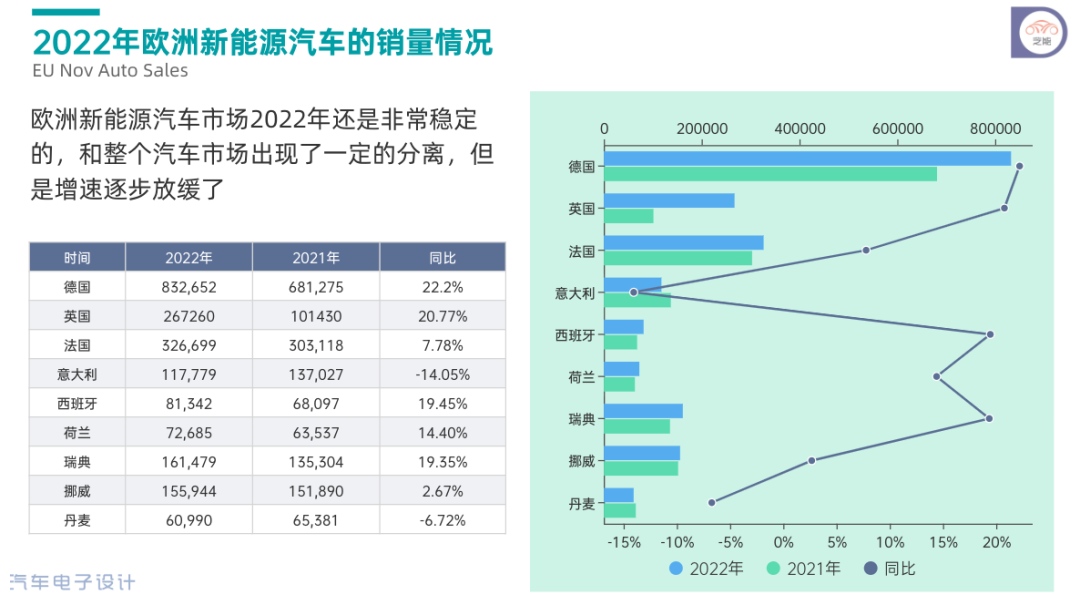

The European new energy vehicle market was very stable in 2022, which diverged from the entire automobile market to a certain extent, but the growth rate gradually slowed down. Europe experienced a 20% growth in most markets, but there were also negative growth rates. Therefore, I personally think that we must have a psychological expectation that the growth rate will slow down when the penetration rate reaches a certain level.

Penetration Rate of New Energy Vehicles in Europe

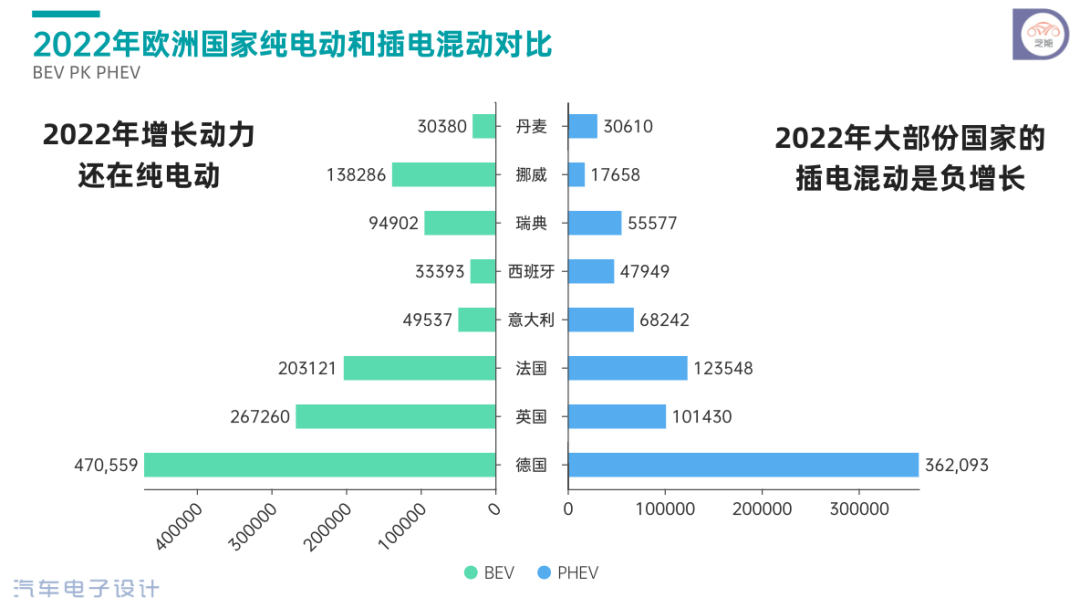

PHEV and BEV

Europe has raised systematic doubts about the actual effectiveness of PHEVs. Because of the energy consumption problem after the battery is depleted and the fact that it has to be plugged in, Europe’s PHEVs in 2022 have almost fallen into a stagnant and declining state. As subsidies further concentrate on BEVs, plug-in hybrids will further fall into a trough in Europe in 2023-2024.

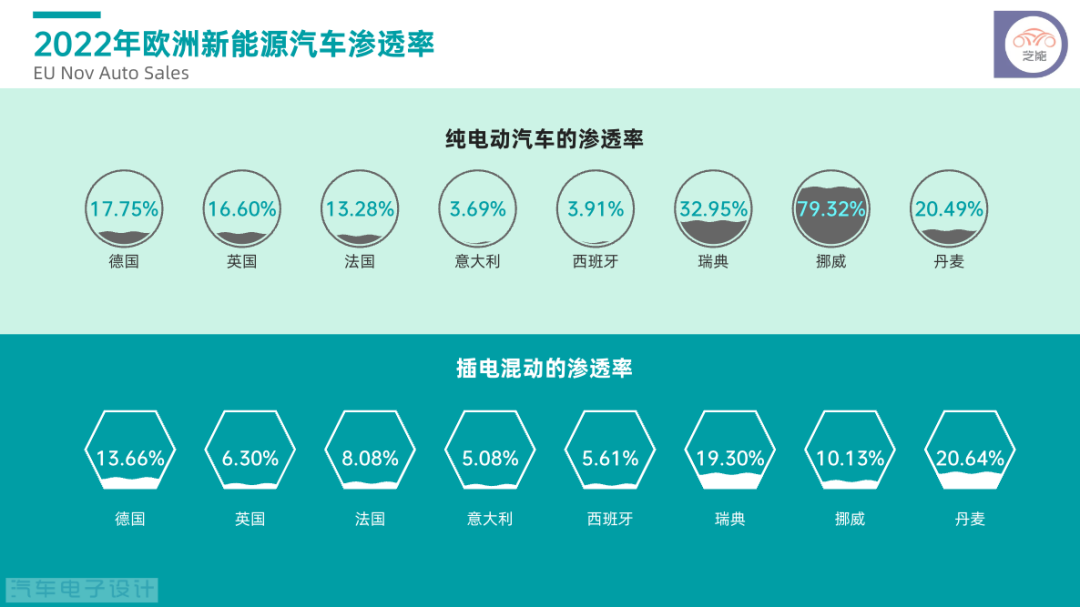

Penetration Rate

The corresponding penetration rates are shown in the figure below. From the perspective of absolute penetration rate, China has achieved the level between France and Germany, slightly higher than the UK. It is difficult to approach high penetration rate countries such as Sweden and Norway with a market of 20 million.

Essentially, we still need to explore a core issue: the development of the automobile industry in global countries aims to promote employment and the development of the industrial chain, and to make automobiles a high value-added industrial product to form competitive advantage. It must be market-oriented to realize 30%-50% penetration, which means that manufacturers need to transition from subsidies to the market, and upstream and downstream industries need to have a certain profit margin. Only in this way can a healthy development model be achieved in terms of tax revenue and employment. It is certain that the adult ceremony for the industry developed through policies must be experienced.

Ranking of Major Countries

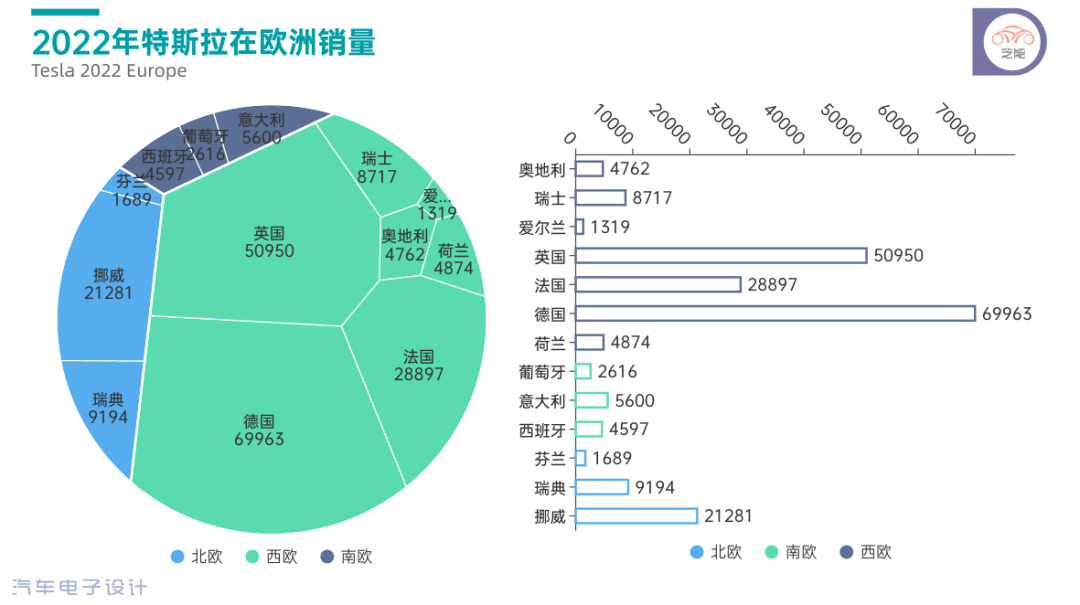

Since the data of new energy vehicles in each country has not been fully released, Tesla and Volkswagen are difficult to distinguish from each other in Europe. Generally speaking, based on the overall data this year, Tesla may be slightly higher than Volkswagen, especially after Tesla’s data in the UK and France come out.

Tesla’s 2022 sales in Europe, this number was disclosed relatively quickly, and the following figure reflects it better. Sales began to focus on Germany, France, and the UK. According to the incomplete statistics below, sales have reached 215 thousand units, and it is estimated that Tesla will have about 230-240 thousand units in Europe this year.“`

Summary: This is a preview of the content, and here is where it stops. After we collect the complete data, I think there are still some details to be explored, especially the performance of Chinese automakers in Europe in 2022 and their prospects for 2023!

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.