Special Contributor: Pleasure and Comfort

Editor: Qiukaijun

Editor’s Note: This article represents the views of the special contributor and does not reflect the position of EV Observer.

As we approach the end of the year, the eventful year of 2022 is about to come to an end. So what kind of changes will 2023 bring to the new energy passenger car market in China?

Today, I will share with you my top ten predictions for the 2023 Chinese passenger car market.

Prediction 1: The overall passenger car market in 2023 will achieve a growth rate of over 3\%.

Every year at this time, major agencies predict the sales volume of the market for the coming year. Currently, both the China Association of Automobile Manufacturers (CAAM) and the China Passenger Car Association (CPCA) are not optimistic about the market next year.

CAAM predicts that the sales volume of passenger cars in 2022 (including exports) will be 23.5 million units, a year-on-year growth of 9.4\%; in 2023, the sales volume of passenger cars (including exports) will reach 23.8 million units, a year-on-year growth of 1.3\%. This means that if exports continue to maintain a growth rate of over 40\% in 2023, then domestic passenger car sales will remain flat or even decline.

CPCA predicts that the total retail sales of passenger cars in 2023 will be 20.6 million units, which is a zero-growth trend. The wholesale sales volume of passenger cars will increase by 1\% due to the inertia of export growth. The wholesale sales volume of new energy passenger cars is expected to reach 8.4 million units, an increase of 30\%, while the wholesale sales volume of traditional fuel vehicles is estimated to reach 15.1 million units, a year-on-year decrease of 10\%.

In fact, my personal prediction for next year’s market is cautiously optimistic: the overall market will be slightly better than what most agencies predict, with a situation of “low in the beginning and high in the end”. Q1 of 2023 will be the lowest point of the year, and the market will start to improve from Q2. The market in the second half of the year may exceed many people’s predictions. In the end, the overall sales volume of the passenger car market in 2023 will exceed 20.5 million units (according to the insured amount)!

Of course, the trend and changes will be structured, rather than a “we are all good” situation.

Prediction 2: The year-on-year decline of traditional fuel vehicles in 2023 will exceed 15\%.

Since 2020, the sales of traditional fuel vehicles have been declining year-on-year for three consecutive years: a year-on-year decline of 7.71\% in 2020, 2.9\% in 2021, and a projected decline of 16.39\% in 2022.

If we look at the absolute numbers, the sales of traditional fuel cars decreased by 1.52 million units in 2020 compared to 2019, decreased by 540,000 units in 2021 compared to 2020, and will decrease by 2.97 million units in 2022 compared to 2021. This means that over the three-year period, the sales of traditional fuel cars have decreased by a total of 5.03 million units, accounting for over 25\% of annual sales.

In 2023, relying solely on price reduction will no longer be able to save the collapse of traditional fuel cars! On the one hand, this year’s price reduction has made dealership channels unbearable, and there will even be a large number of dealers leaving the industry in the first quarter of next year. On the other hand, with the further popularity of plug-in hybrid models, traditional fuel cars will begin to be completely replaced.

It is estimated that in 2023, the proportion of sales decline of traditional fuel cars will exceed 15\%! This means that at least 2 million units of sales must be reduced!

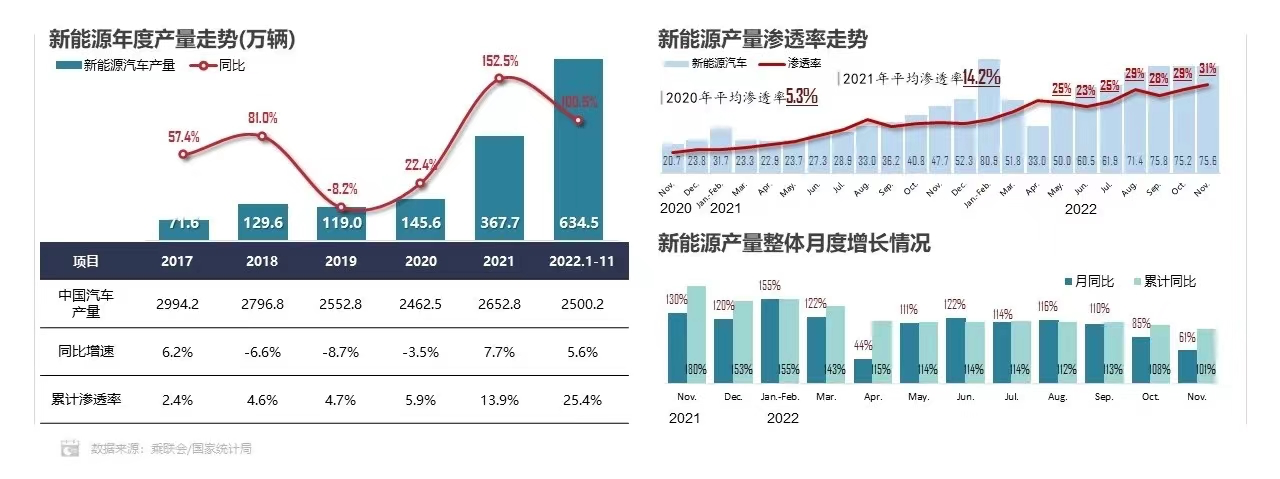

Guess 3: The penetration rate of new energy vehicles will exceed 38\% in 2023

Since 2022, the penetration rate of new energy vehicles has remained stable and rising. In Q1, it quickly climbed to a high of 28\%, but in Q2 and Q3, due to the factors of the epidemic and the purchase tax subsidy for traditional fuel cars, the penetration rate did not show a significant increase until September when the penetration rate of new energy vehicles exceeded 30\% for the first time. It is estimated that the annual penetration rate this year will be around 28\%, an increase of 13.2 percentage points compared to 14.8\% in 2021.

In 2023, with the cancellation of national subsidies for new energy vehicles, many people are beginning to worry about the sales of new energy vehicles. However, if we look at the total volume of the passenger car market, estimated to be 20 million units, the decrease in traditional fuel cars equates to the growth of new energy vehicles – if traditional fuel cars decline by 15\%, it means that the sales of new energy vehicles will reach 7.5-7.8 million units. The corresponding penetration rate is approximately 37.5-39\%.

From the current situation, the penetration rate of new energy vehicles will exceed 38\% in 2023! After the cancellation of national subsidies next year, the sales and penetration rate of new energy vehicles will truly test their competitive strength!Prediction 4: By 2023, the market share of domestic brands will exceed 55\%.

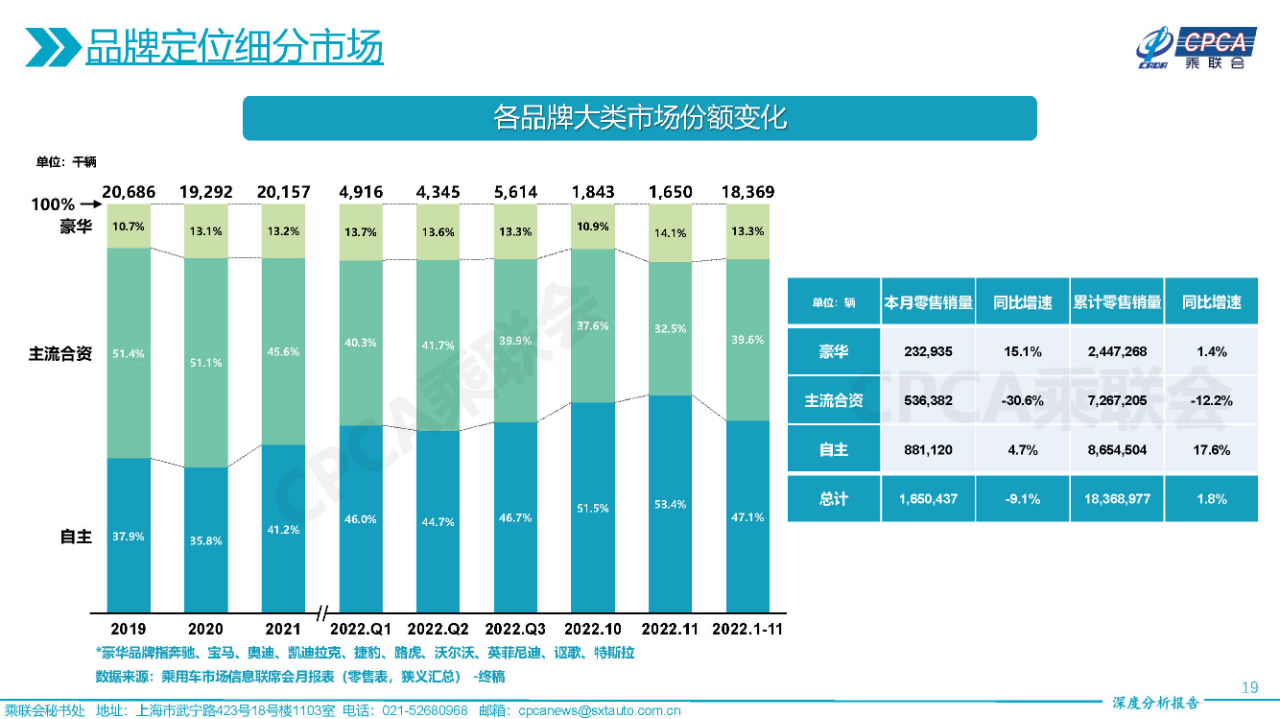

In 2022, it was a year of comprehensive rise for domestic brands, as their market share began to surpass the critical point of 50\% from October onwards.

From January to November, the market share of domestic brands was 47.1\%, which was the highest in the past 10 years.

However, this is still far from enough. Looking at countries with the capability of complete vehicle production and manufacturing, the market share of domestic or regional brands is over 60\% and even exceeds 80\% in certain countries.

In November, the monthly market share of domestic brands was 53.4\%.

By 2023, the annual market share of domestic brands will break through 55\%! Among them, the monthly market share can reach 60\% or more. (In China, 1\% market share means a sales volume of 200,000 vehicles, and 5\% market share means an additional sales volume of 1 million!)

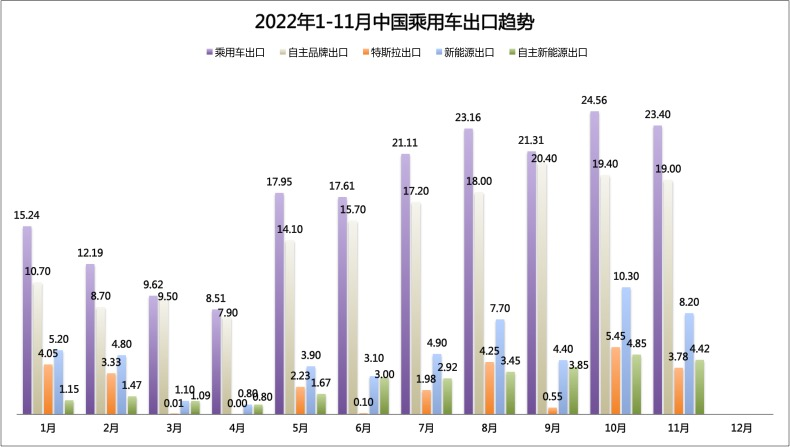

Prediction 5: The export volume of passenger cars will exceed 3 million units in 2023.

Since 2020, due to production constraints (such as chips and energy) on the production side, the production of overseas passenger cars has been relatively limited. At the same time, benefiting from the increasing strength of Chinese manufacturing, the export volume of Chinese passenger cars has shown significant growth since 2021.

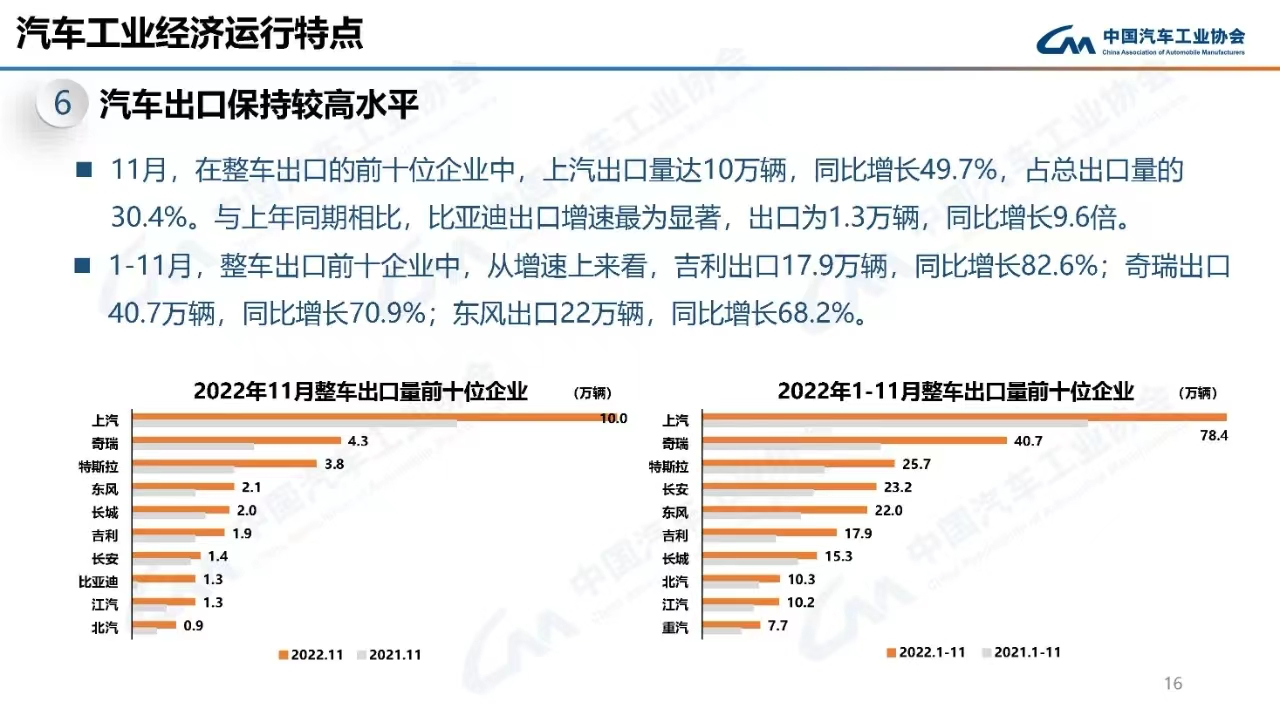

In 2020, the export volume of passenger cars was 660,000 units, an increase of 10\% YoY. In 2021, the export volume of passenger cars was 1.52 million units, an increase of 130\% YoY. From January to November 2022, the export volume of passenger cars was 2.05 million units, an increase of 46\% YoY. Among them, the export data of domestic passenger car brands also showed a clear growth trend.

According to the data from China Association of Automobile Manufacturers (CAAM), except for Tesla, all Top 10 automakers in China from January to November 2022 were domestic brands.

According to the data from China Association of Automobile Manufacturers (CAAM), except for Tesla, all Top 10 automakers in China from January to November 2022 were domestic brands.

At the 2022 Paris Motor Show and Thailand International Motor Expo, we can see more and more domestic brands entering the global market, such as BYD’s new energy vehicles going abroad, Great Wall’s layout across multiple regions, and MG 4, the first global model of MG, being hot-selling in overseas markets. In 2022, China’s new energy vehicle exports reached 290,000 units, and we believe that this number will increase by at least 150\% in 2023 with the export of several major domestic new energy vehicle brands.

By maintaining a 50\% growth rate in passenger car exports in 2023, China can achieve a historic breakthrough of 3 million units!

Prediction 6: Luxury brands such as BBA will continue to decline

Since 2020, sales of luxury brands have entered a growth phase, with sales of 3.6 million units in 2020, 3.95 million units in 2021, and 3.5 million units from January to November 2022, and the full-year data is expected to remain the same as in 2021 or have a slight increase.

The sales of BBA brands also increased, reaching 2.25 million units in 2021 and 2.28 million units in 2022. However, the sales of the leading BBA brands have decreased since the beginning of 2022, with 1.97 million units from January to November 2022, and the full-year sales are expected to be around 2.15 million units.

One of the main reasons for this is the negligence and slackness of BBA brands in the new energy field. With the overall market penetration rate of new energy exceeding 25\%, the new energy penetration rate of BBA is only 5.17\%, and Audi’s penetration rate is even as low as 1.60\%.

Although BBA has tried various methods to increase sales of new energy vehicles, including pricing tactics, we can see Mercedes-Benz’s flagship EQS model being discounted by 300,000 yuan and EQE officially lowered its price in 2022…

However, one fact cannot be ignored: in the field of new energy, the aura of BBA brands has disappeared.

Another reason is the rise of Tesla and domestic new energy vehicle brands. Tesla’s market share in the luxury car insurance market has doubled from 5.64\% in 2020 to 11.42\% from January to November 2022. NIO occupies over 70\% of the market share of pure electric vehicles priced above 400,000 yuan.Starting from 2022, BBA’s brand halo is hard to sustain in the new energy era. So, what will the market landscape of 2023 be for BBA? The entry-level market of 250,000-400,000 yuan will be reshuffled by new energy! The market of over 400,000 yuan will be further diluted by the emerging forces! 2023 is destined to be a year when BBA’s year-on-year sales will have a double-digit decline!

Guess 7: Non-mainstream joint venture brands have no future

Here, non-mainstream joint venture brands mainly refer to brands with annual sales of less than 250,000 vehicles, which are: Beijing Hyundai (224,500 vehicles), Chevrolet (173,100 vehicles), Ford (145,700 vehicles), Jetta (131,000 vehicles), Mazda (97,800 vehicles), Kia (83,900 vehicles), Citroen (27,200 vehicles), and Peugeot (25,700 vehicles).

Hyundai: In just two years, its annual sales have dropped from over 400,000 vehicles to just over 250,000 vehicles, a decrease of 45\%;

Chevrolet: Its sales have also dropped from 250,000 to 200,000 vehicles, a decrease of 20\%;

Ford: Its sales have dropped from 200,000 to 160,000 vehicles, a decrease of 20\%;

Jetta: As a newly established joint venture brand, its sales have never exceeded 200,000 vehicles;

Mazda: Its sales have dropped from 200,000 to 120,000 vehicles, a decrease of 40\%;

Kia: Its sales have dropped from 200,000 to 100,000 vehicles, a decrease of 50\%;

Skoda: Its sales have dropped from 150,000 to 50,000 vehicles, a decrease of 66\%;

Citroen and Peugeot: have always maintained at around 30,000 vehicles;

Among these brands, those traditional brands with monthly sales of less than 10,000 vehicles are losing their market share of fuel vehicles rapidly. If we take a look at their proportion of new energy sales, we will find that they will not only lose the present but also the future!

Guess 8: By 2023, BYD’s sales will exceed 3.5 million vehicles

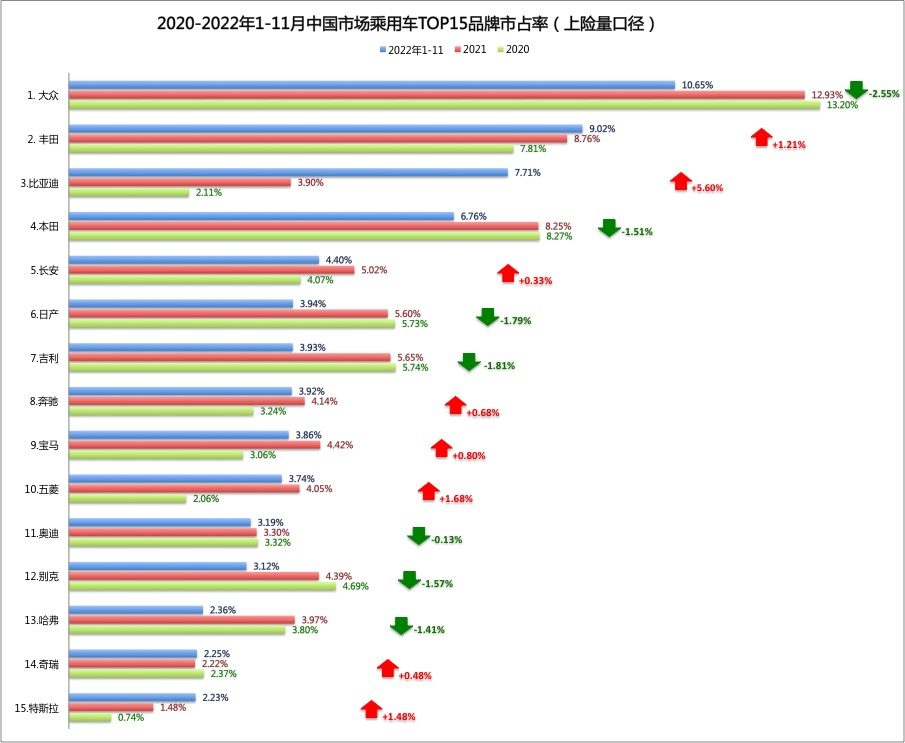

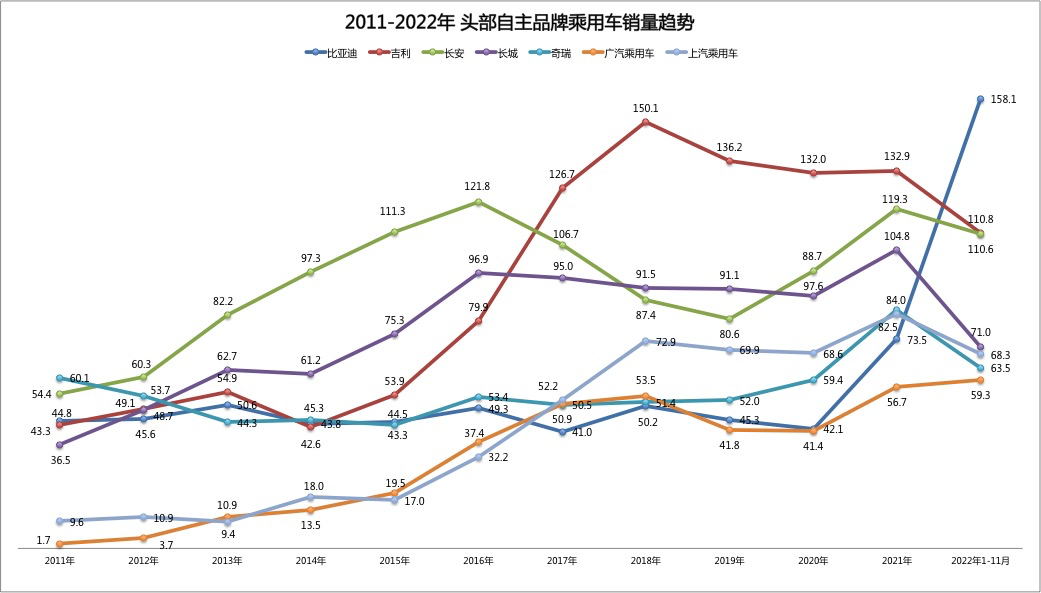

For BYD, 2023 will be another outbreak that surpasses most people’s cognition. From a monthly sales of 100,000 vehicles at the beginning of the year to a monthly sales of 230,000 vehicles in November, it only took one year to double the monthly sales. It also took three years to achieve a leap from 400,000 vehicles to 1.8 million vehicles, which is also very rare in the history of China’s passenger car market.From the data in Shangxianliang, in 2020, BYD’s market share was only 2.11\%, ranking 17th among all brands; in 2021, BYD’s market share was 3.44\%, ranking 13th among all brands; by 2022, BYD’s market share reached 67.71\%, and the brand’s ranking rose to third. In November, BYD surpassed Volkswagen to become the first monthly champion among all brands.

If we estimate the sales in 2023 based on the sales volume in December of this year, BYD will be able to achieve a sales volume of at least 3 million vehicles, plus additional export sales. If BYD really achieves such sales volume, it will become the first domestic brand to win the sales championship in the history of Chinese passenger cars!

Compared with the peak sales volume of Volkswagen of 4 million vehicles and a share of 19.8\%, BYD’s feat of achieving domestic sales of 3.2 million and overseas sales of 300,000 in 2023 is remarkable!

Prediction 9: Great Wall cannot rely on SUVs to weather the storm again

If we look at the changes in Great Wall Motors in recent years, it can be said to have taken advantage of the favorable opportunities, relying on the explosive growth of SUVs in the Chinese market to become one of the top 3 selling domestic brands since 2013.

The Haval H6 has been the best-selling SUV in the Chinese market for 64 consecutive months, but this year it was comprehensively surpassed by two new energy SUVs: the BYD Song and the Tesla Model Y.

The sales of the Haval brand have also seen a significant decline this year, with a cumulative sales volume of 572,224 vehicles from January to November, a year-on-year decrease of 15.30\% (a decline similar to the overall market for fuel vehicles).“`

In the overall brand, except for the Tank brand’s year-over-year increase, all other sub-brands have declined by more than 15%.

Looking at the sales ranking of new energy vehicles, from January to November, the total sales of Great Wall new energy vehicles including export sales were only 120,833 vehicles, with domestic sales of 114,502 vehicles. This data is equivalent to the pure electric vehicle sales of BYD in one month. Great Wall’s ranking in the new energy vehicle sales ranking has dropped from fifth place in 2021 to tenth place from January to November 2022. Unless there are unexpected developments, Great Wall is expected to drop out of the top 10 in December.

This kind of sales performance has resulted in an 11.5% decline in Great Wall’s total sales, while the overall market has maintained a slight increase.

If we look at the sales target of 1.9 million vehicles that Great Wall set at the beginning of the year, by November, Great Wall had only achieved 990,000 vehicles, completing only 52% of the target.

Previously, Great Wall only lacked a sedan brand, but in the current new energy vehicle market, the real challenge is the fuzziness and poor implementation of the new energy strategy.

In 2023, due to slow introduction of Great Wall’s plug-in hybrid models, it will be difficult for them to achieve a breakthrough in sales in the new energy vehicle market. At the same time, with the further decline of gasoline vehicles, Great Wall cannot rely solely on the “SUV” strategy to achieve a comeback.

Prediction 10: More automobile brands will exit the market in 2023

In 2022, we saw Acura, Fick, Borgward, NIO, and even rumors of Skoda giving up on the Chinese market.

In 2023, we will see more brands facing difficulties: Infiniti, Genesis, DS, Zotye, and Evergrande and Baoneng (Guanqi).

With the increasing strength of independent brands, especially second-tier joint venture brands, it will become increasingly difficult for previously successful joint venture brands to survive in the Chinese market.

As the chaotic 2022 comes to an end, and an uncertain 2023 is approaching, what kind of market changes can we expect? How many of the predictions presented above will come true?Let’s look forward to the hopeful and uncertain year of 2023 together.

——END——

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.