Author: Zhu Yulong

I caught a cold in the past few days, so the update is delayed. The test result is negative, and I feel like catching a cold is a preparation for welcoming Omicron in the future.

This is a part of the monthly report on vehicles and batteries in December. I have excerpted some information for everyone’s reference. Today’s content mainly provides some ideas from the perspective of geographical latitude, exploring the depth of the penetration rate of China’s new energy vehicles by region, price segment, and positioning.

The information in the table below mainly includes the total market volume in November and the penetration rates of four types of vehicles: gasoline vehicles, hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV), and battery electric vehicles (BEV).

If we visualize the penetration rate based on the geographical distribution of the total volume, we can create a pie chart. The following image shows the current sales (circle size) of cars in China and the distribution of different types. Pure electric vehicles are colored green, plug-in hybrid electric vehicles are colored blue, and gasoline vehicles are colored yellow.

Analysis by Price Segment and Grade

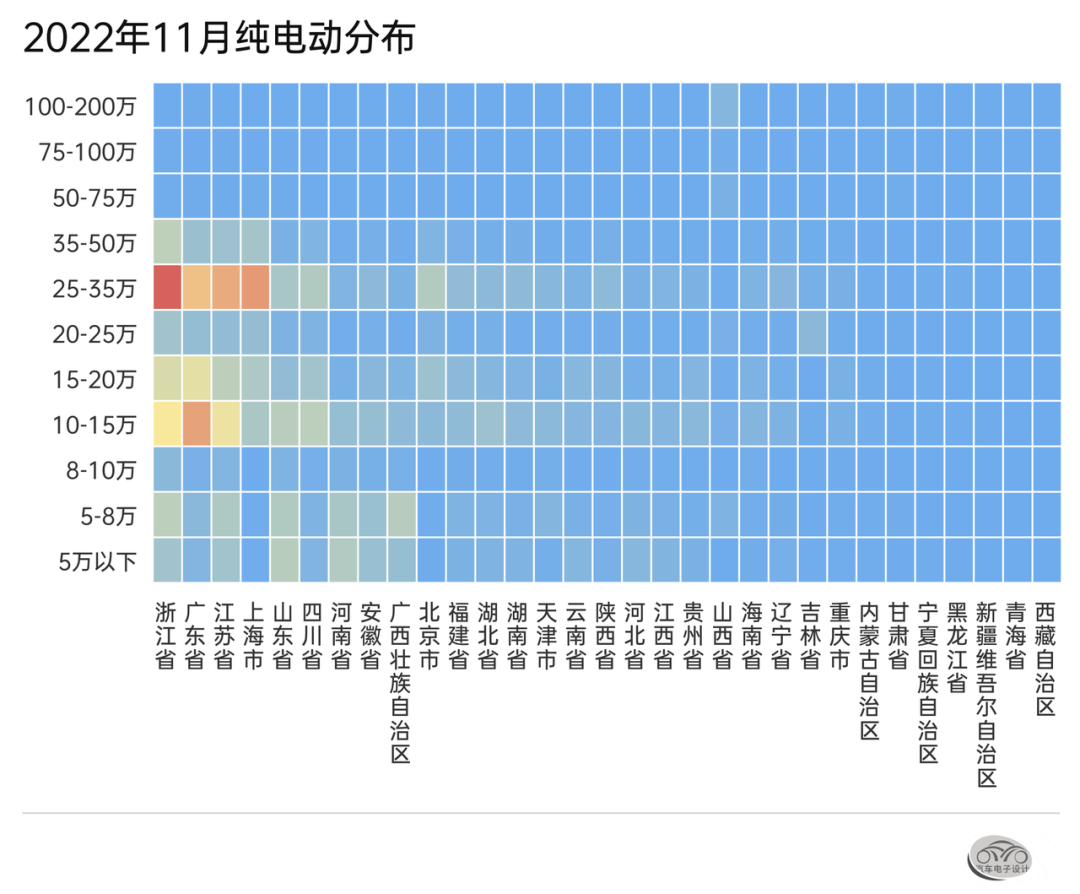

To help everyone better understand the penetration situation, I used a Cartesian heat map and listed the BEV and PHEV. The following images show the data for pure electric vehicles:

From the data for a single month, we can see that several affluent provinces are the basic market for Tesla and new forces, including Zhejiang, Guangdong, Jiangsu, and Shanghai. At the same time, the demand for 100-150,000 yuan is also evident in these regions. Of course, this is also closely related to the overall climate suitability for electric vehicles.

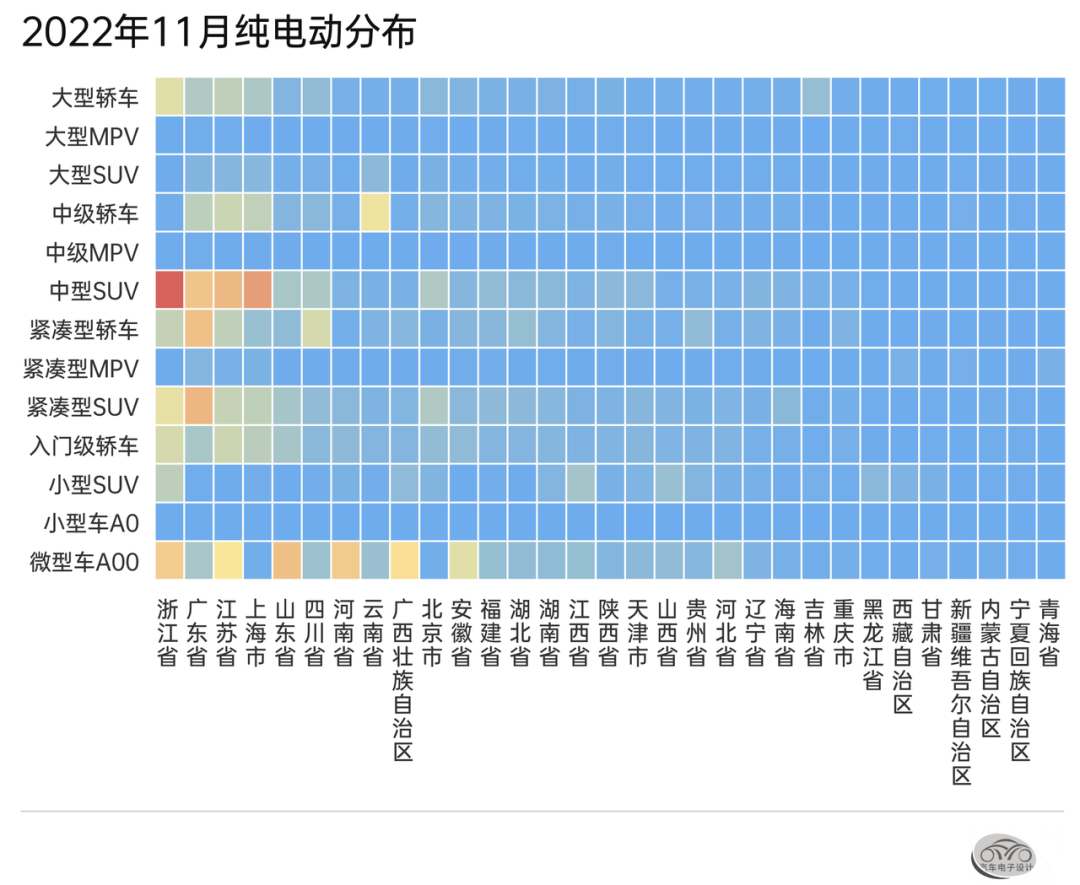

Corresponding to the price is positioning. After segmenting different models, we can see the situation of models in different price segments. This data allows us to see the current actual state of the models more clearly.

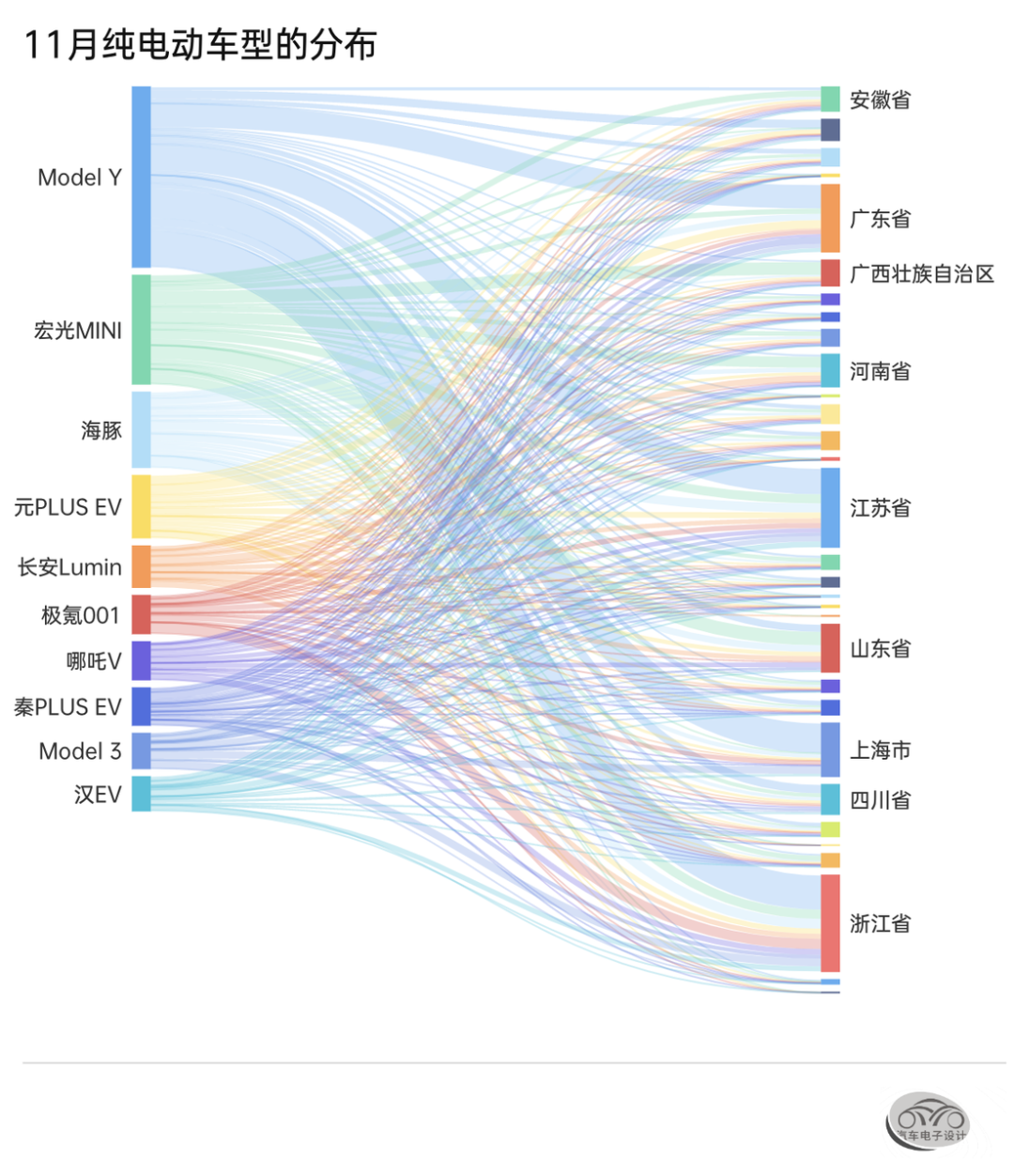

Through these two charts, we can still see the current state of pure electric vehicles. The main demand is centered around medium-sized SUVs, compact SUVs, and micro A00 vehicles. If we distribute the top 10 vehicle models, we can see the following:

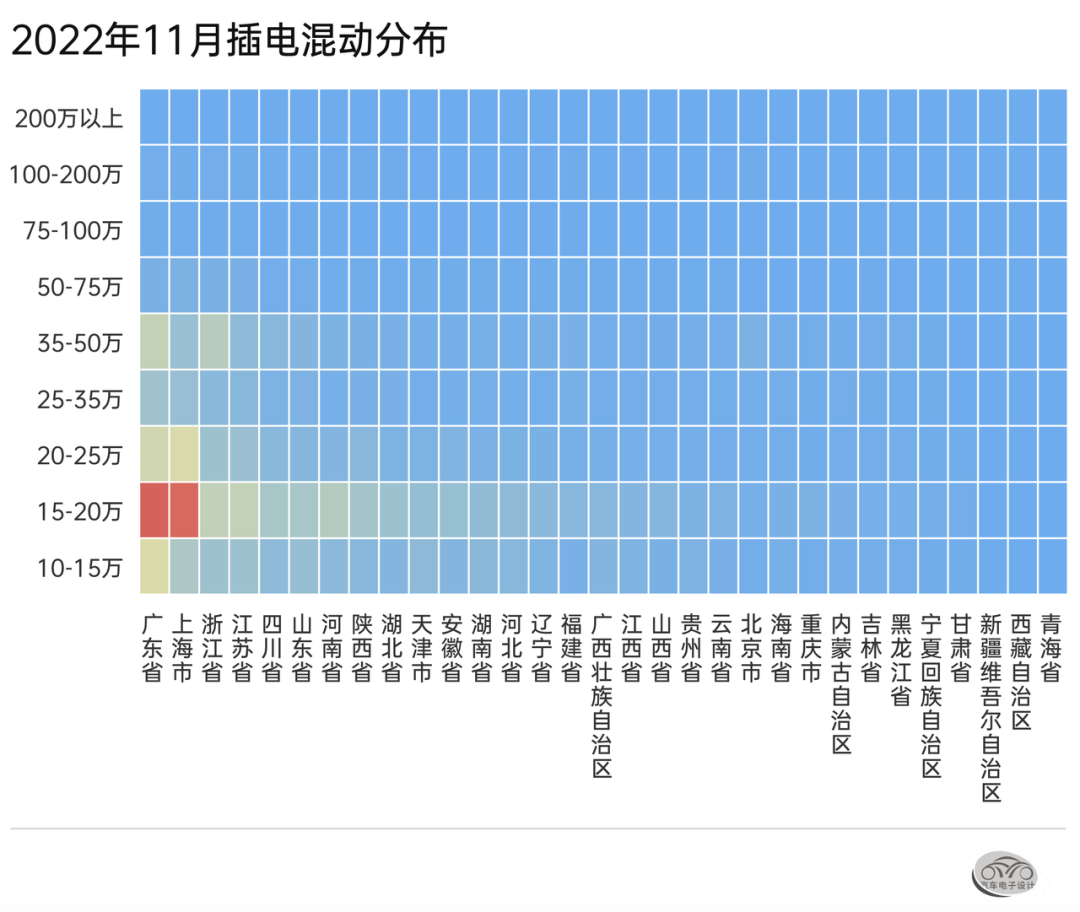

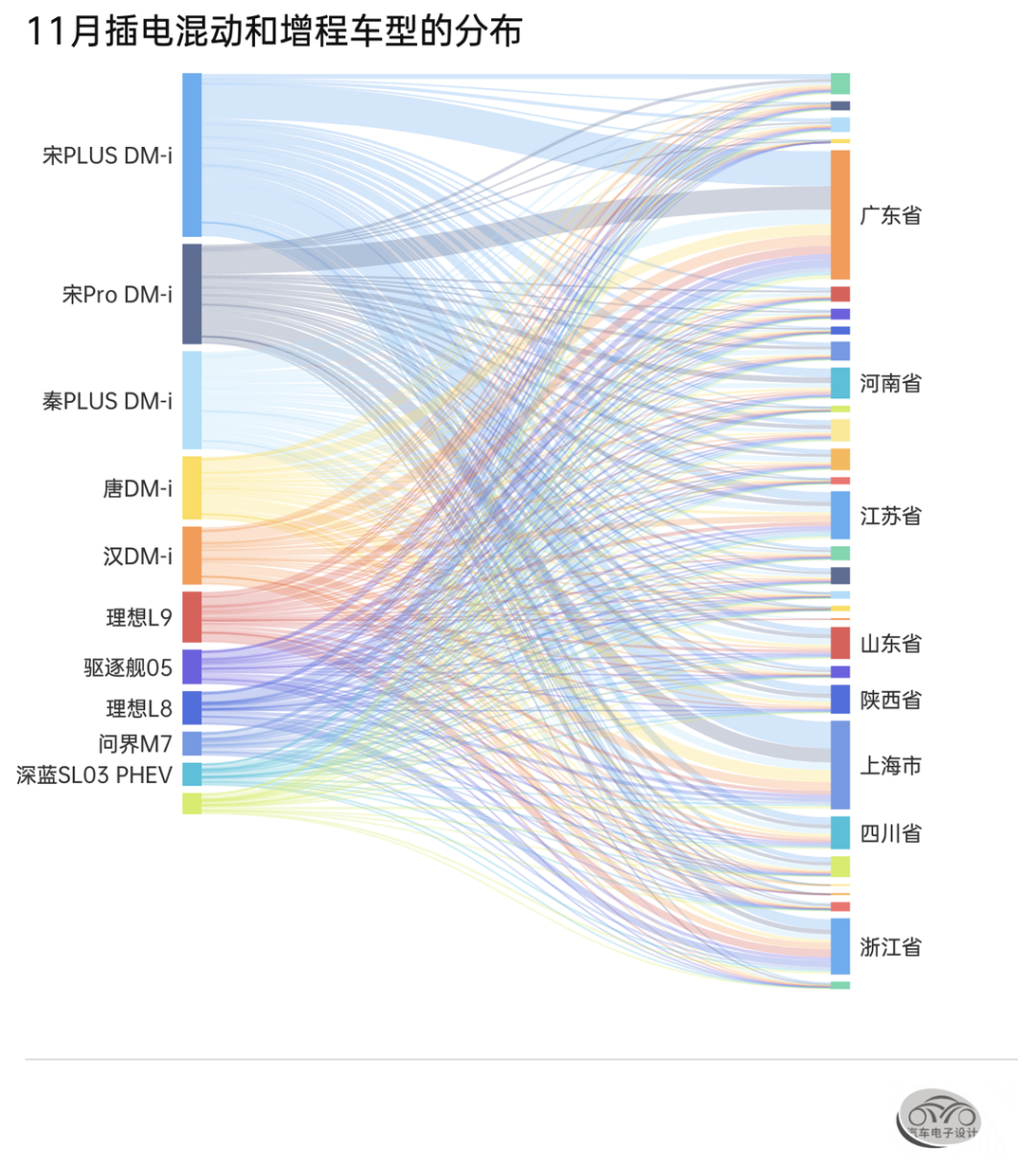

Plug-in Hybrid Electric Vehicles

As the license plates in Shanghai have been given out by December 2022, the delivery of PHEVs is concentrated on this time point. The situation in Guangdong may be similar. Nobody knows whether the several cities that give out license plates will continue to do so after 2023, and it is different from what we thought. Currently, plug-in hybrid electric vehicles have been delivered in a concentrated manner.

The distribution of plug-in hybrid electric vehicles and range extenders based on the distribution of the top 10 vehicle models can better reflect the problem.

For information mining based on geographic latitude, we can also focus on cities. I am trying to observe the changes based on different visual effects. Putting together the changes in different months and time periods can reveal some things.## Battery Section

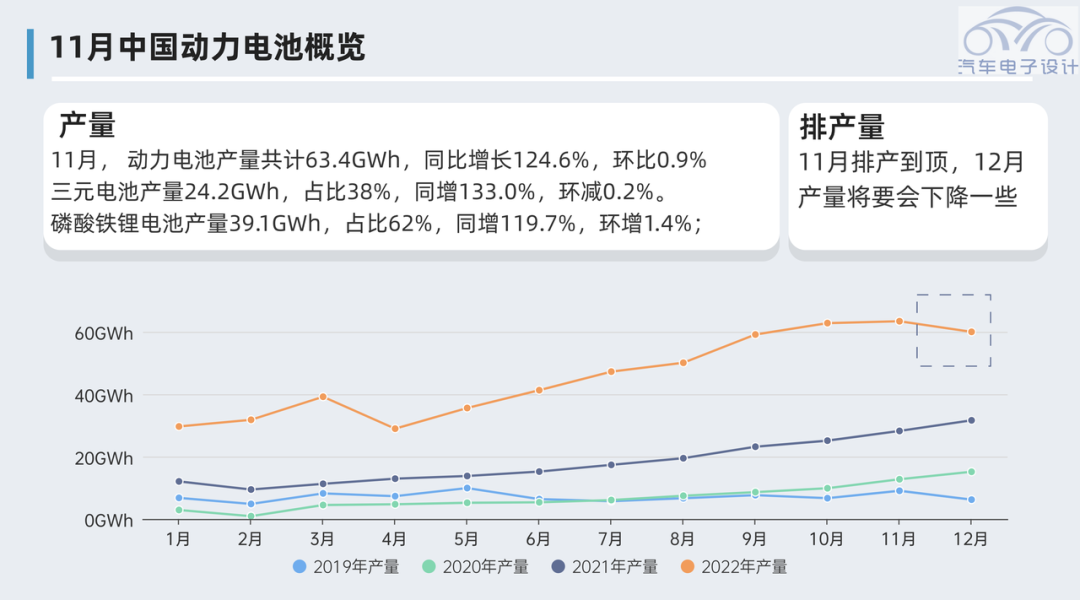

Power Battery Production

November is a peak for production, and judging from this momentum, it is likely to increase in December, which is also a high point in the short term. Since January is the Spring Festival and there are many uncertainties, the current production may be used for Q1 of 2023.

In November, China’s power battery production reached a total of 63.4GWh, with a year-on-year increase of 124.6% and a month-on-month increase of 0.9%. Among them, the production of ternary batteries was 24.2GWh, accounting for 38%, with a year-on-year increase of 133.0% and a month-on-month decrease of 0.2%. The production of lithium iron phosphate batteries was 39.1GWh, accounting for 62%, with a year-on-year increase of 119.7% and a month-on-month increase of 1.4%;

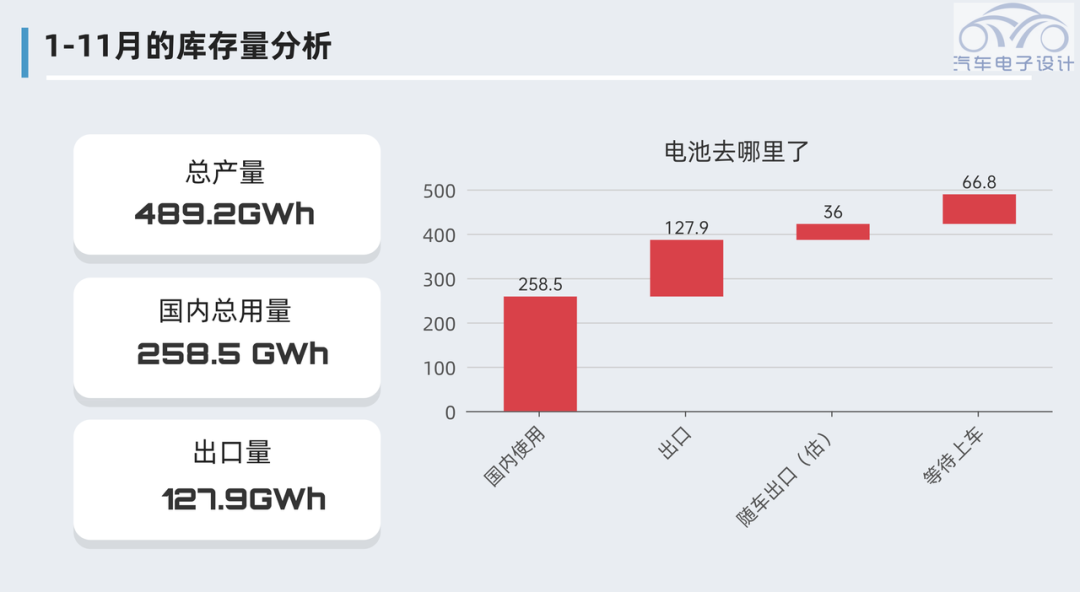

From January to November, China’s cumulative power battery production was 489.2GWh, a cumulative year-on-year increase of 160%. Among them, the cumulative production of ternary batteries was 190.0GWh, accounting for 38.8%, with a cumulative year-on-year increase of 131%. The cumulative production of lithium iron phosphate batteries was 298.5GWh, accounting for 61.% with a cumulative year-on-year increase of 183%.

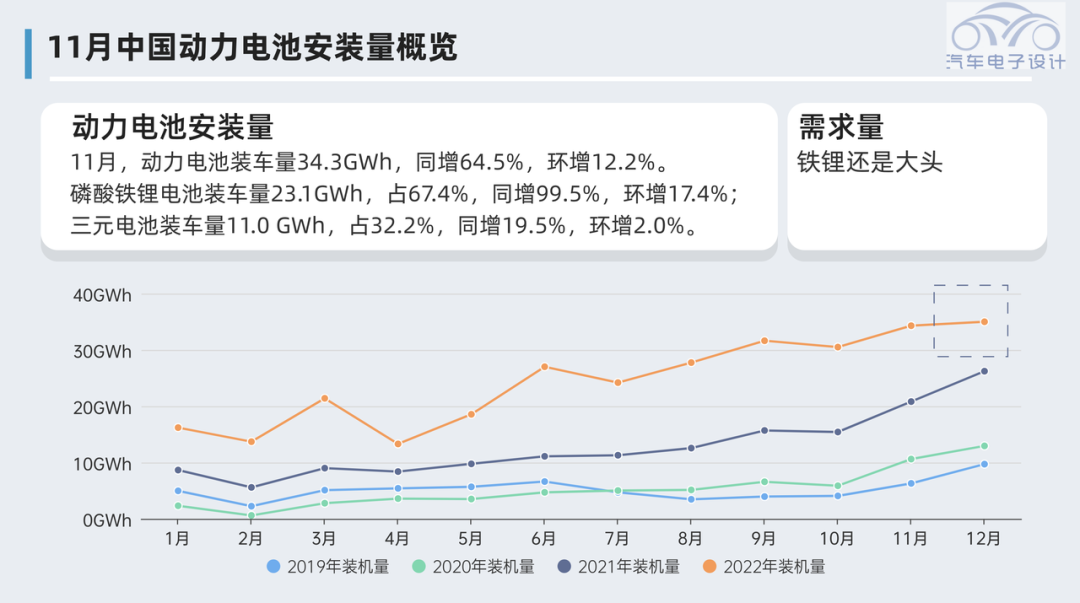

Power Battery Installations

In November, China’s power battery installations were 34.3GWh, with a year-on-year increase of 64.5% and a month-on-month increase of 12.2%. Among them, the installations of lithium iron phosphate batteries were 23.1GWh, accounting for 67.4% of the total installations, with a year-on-year increase of 99.5% and a month-on-month increase of 17.4%. The installations of ternary batteries were 11.0 GWh, accounting for 32.2% of the total installations, with a year-on-year increase of 19.5% and a month-on-month increase of 2.0%. In November, China’s power battery exports totaled 22.6GWh. This number is very high, and it is almost comparable to the domestic consumption. The exports of lithium iron phosphate batteries were 16.8GWh, while the exports of ternary batteries were 5.7GWh.

Due to the subsidy reduction next year, there may be some situations where vehicles are invoiced first and then transferred later. Because there will be a price increase (I’m telling you that the price will increase by 3000-8000), this operation is inevitable. This will cause some inventory of vehicles to exist, and there may be some data analysis disorder at the end of 2022 due to objective reasons.

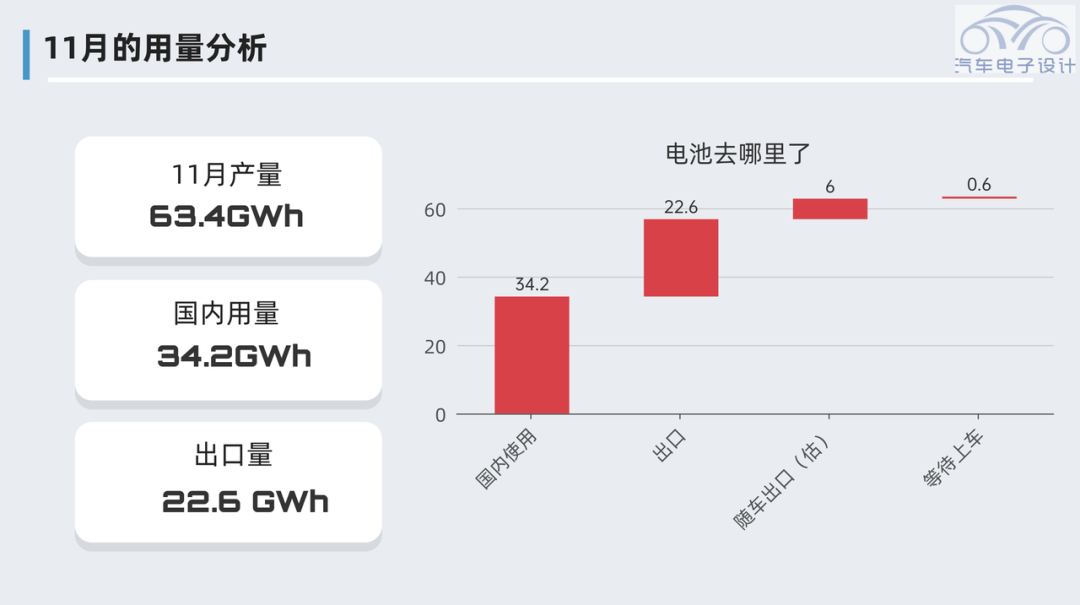

Power Battery Export Volume and Domestic Usage

From January to November, the cumulative installation of power batteries in China reached 258.5GWh, representing an increase of 101.5% over the same period last year. The cumulative installation of lithium iron phosphate batteries was 159.1GWh, accounting for 61.5% of the total, with a growth rate of 145.5%. The cumulative installation of ternary batteries was 99.0GWh, accounting for 38.3% of the total, with a growth rate of 56.5%.

In terms of the overall battery usage, the domestic usage is 258.5GWh, while the total export volume, including those exported with vehicles and directly exported, is close to 160GWh. This figure reflects the competitiveness of China’s power battery industry objectively. It also confirms that if Europe and the United States do not implement policies on local production, China’s exportation of batteries (European and American cars + Chinese cores) will be the driving force for their pure electric vehicle industry.

Objectively speaking, it is difficult to sustain such a situation.

Summary: Personally, I believe that the Q1 data in 2023 will be relatively bleak due to social factors and artificial adjustments, resulting in a significant gap both month-on-month and year-on-year, which can be anticipated. Most likely, 2023 will also be a unilateral year and will begin to recover from Q2 as China’s economic vitality returns- this is the rhythm I have predicted.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.