Author: Qiukaijun

Editor: Qiukaixun

Near the end of the year, many car companies have launched price-protection policies to stimulate potential consumers to buy cars before the end of the year.

Wuling Motors is even more aggressive.

On December 10, Wuling Motors issued a notice, “Limited-time 2 billion yuan car purchase subsidy to help people’s travel.” Among them, the “God Car” Hongguang MINI EV is on sale for a limited time at a special price of 29,800 yuan, returning to the price of below 30,000 yuan when it first became popular. This means there is a discount of more than 3,000 yuan. More advanced models can enjoy up to 8888 yuan in car purchase subsidies.

This preferential policy will end in 2022.

For the Hongguang MINI EV series, which has an official guide price of 32,800-99,900 yuan, this discount is already very significant.

Among all cars, the Hongguang MINI EV is the bottom line of the car purchase price – there are almost no cheaper cars. The “bottom line” has been undercut, and the transmission effect can be imagined, and other A00 manufacturers will be strongly impacted.

From the perspective of Wuling Motors, it is using 2 billion yuan to launch a pure electric A00 defensive war.

Continuous preferential, a heavy-handed play at the end of the year

On May 28, 2020, Wuling Hongguang MINI EV started pre-sale at 29,800 yuan. Against the background of high cost of electric vehicles and relatively high prices compared to fuel vehicles, this price shocked the industry.

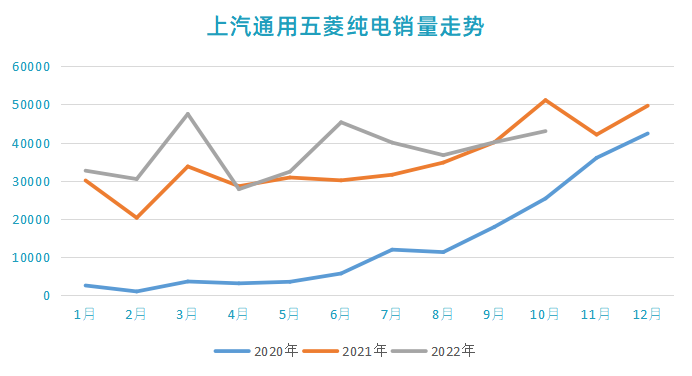

This model quickly went on sale and sold well, breaking through the monthly sales of 10,000 units and even reaching more than 40,000 units in December of that year, which is rare in Chinese history. In 2021 and 2022, Hongguang MINI EV has derived many models and prices have been adjusted several times, but the total sales volume has always been high.

In 2022, affected by factors such as the epidemic, the sales of models represented by Hongguang MINI EV have been affected, and the sales for two or three months have been lower than the same period in 2021.

An sales manager of a competing car model told “Electric Vehicle Observer” that, “Around this autumn, Hongguang MINI EV series will cut prices and offer discounts gradually. The starting model now has a discount of over 3000 yuan, which is the peak of recent discounts.”

An sales manager of a competing car model told “Electric Vehicle Observer” that, “Around this autumn, Hongguang MINI EV series will cut prices and offer discounts gradually. The starting model now has a discount of over 3000 yuan, which is the peak of recent discounts.”

“To be honest, it’s real money.” said the general manager of a core dealership of Wuling. He introduced that “Now, Hongguang MINI EV series comes with free compulsory insurance, worth nearly 950 yuan, and there is a “two people discount” of 500 yuan. In addition, there is the epidemic prevention fund of 1000 yuan starting from the beginning of the month, as well as some discounts provided by dealers themselves. Added up, they exceed 3000 yuan. The original price of 32,800 yuan for Hongguang MINI EV is now equivalent to less than 30,000 yuan.”

As for the Macaroon, KIWI, GAMEBOY, NANO and convertible versions, the discounts are even greater.

In addition, in the past, the 32,800 yuan car was priced without inventory and it was difficult to get the car, but now it can be sold normally.

Why such great discounts?

As the year end approaches, the usual actions of other car companies are to maintain prices, so why does Wuling take such a big discount?

A natural association is that this year’s orders will be delivered next year and this lays the foundation for next year’s sales.

However, this dealer also revealed that the official guidance price of vehicles will be adjusted starting from January 2023. In addition, it is difficult to say whether there will be any discounts at that time. That is to say, only those who pick up their cars this year can enjoy this policy. Of course, the dealer can pick up the car first and sell it next year.

In any case, Wuling hopes to make a final push before the end of 2022.

This year, Wuling’s sales of pure electric vehicles are not ideal.

Against the background of nearly doubling the overall market growth, Wuling new energy has grown weakly. Wuling’s officially announced sales volume of new energy vehicles was 535,000 units up to November, a year-on-year increase of 34.8%. However, if only the terminal insurance numbers for pure electric vehicles until October are considered, it was only 375,800 units, an increase of only 13.47% compared to the first ten months of last year.

This dealer said that Wuling’s Hongguang MINI EV was a pioneer and later players in the A00 market for pure electric vehicles will “definitely refer to our products, fully analyze them, and then make some differentiated products…If all kinds of styles come out, there will definitely be some degree of diversion.”

In 2022, two groups are eating into the market share of Wuling Hong Guang MINI EV the most.

One is the group that is similar to Wuling, coming from major host factories and launching products targeting short-distance travel and commuting markets. They have greatly impacted the sales of Wuling Hong Guang MINI EV. Brands such as Changan Automobile’s Nuoyumi and Chery’s BingGeelyng have achieved double-digit growth.

The other group is the low-speed electric vehicle industry that has upgraded and launched products targeted at the short-distance commuting market. Redding, BAIC Motor Corporation, Jimai Automobile, and others have taken a part of the sales, although the volume is not high.

The year-end big promotion from Wuling can be seen as a “counterattack” against these two groups and will cause a great impact.

“We have already positioned the price at this level, and it is impossible to go lower than our price,” said the dealer.

However, there is bad news for Wuling – the sharp drop in sales of Wuling gasoline vehicles, which has occurred simultaneously with the slow growth of pure electric sales. According to SAIC Group’s sales report, as of November, Wuling’s total sales were 1.4064 million units, a decrease of 2.63% compared to last year’s 1.4444 million units. The decline is not deep, but it is achieved under the condition of selling nearly 138,000 new energy vehicles, which is equivalent to selling about 140,000 fewer gasoline vehicles.

The above-mentioned dealer also sells Wuling gasoline vehicles. He said that, in terms of Wuling, gasoline vehicles are more affected by their own electric vehicles in the family car market.

In addition, due to the impact of the epidemic, Wuling’s commercial vehicles – Weimian and Weihuo, whose main customers are small business owners, “have encountered a very difficult market this year, and the sales volume has decreased drastically.”

To make the total sales volume look good, Wuling has no choice but to compete with new energy.

How is the trend of A00?

Since China’s promotion of electric vehicles has turned toward private consumption, the Hong Guang MINI EV has almost single-handedly created the A00 category and has long been seen as a cost killer.Five Ling also admits that it used to sell cars at a loss in the early days. However, after breaking through the scale of one million vehicles and experiencing price increases, Five Ling’s A00 is now profitable.

However, there is no doubt that upstream cost pressures have always loomed over Five Ling’s profitability. This time, with such a large discount, it is probably also tough for Five Ling to endure.

In this regard, can the A00 pure electric market still see a big development?

This Five Ling dealer predicts that the A00 market should still grow in 2023. As far as the user group of Five Ling Hongguang MINI EV is concerned, the majority are demand for commuting in urban areas of second- and third-tier cities. Relatively speaking, these customers are either normal commuting to work or picking up and dropping off children. The income fluctuations of these groups due to the epidemic will not have a significant impact.

“After the relaxation of epidemic prevention and control policies, everyone’s mobility will be stronger, and this market will definitely continue to expand.” he said.

Zhou Lijun, the dean of the Yiche Research Institute, holds a similar view. He believes that the demand for female users as the main group of electric vehicle purchasers will still exist in the long term. The epidemic will also increase the purchase of economically prominent car models, and the market for A00 will continue to grow.

Li Jinyong, executive chairman of the China Federation of Industry and Commerce Automobile Dealers Chamber of Commerce, believes that subsidies will be withdrawn next year, which will have a significant impact on A00 costs. “The first half of next year will definitely be a very significant shrinkage.” Yang Zhao, a long-time observer of new energy vehicles, also said that from the perspective of battery costs and other factors, the market for A00-level car models is not optimistic.

In any case, Five Ling’s large year-end discount shows that in the A00 pure electric market, Five Ling will firmly maintain its dominance. Any opponent who wants to challenge its dominance must consider how to pass the Five Ling hurdle.

—-END—-

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.