Author: Zhu Yulong

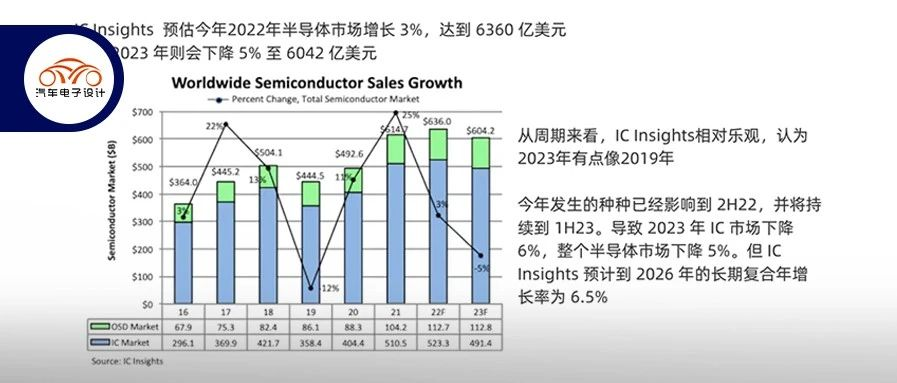

In the current emphasis on hard technology and the core of manufacturing, the semiconductor industry is really a weather vane. The problem now is that, influenced by the global economy, the semiconductor industry, rooted in consumer electronics, industry, and various industries, may shrink in the forecasts of major institutions next year. IC Insights is still relatively optimistic – estimating that the semiconductor market will grow by 3% to reach $636 billion in 2022 this year, and then drop by 5% to $604.2 billion in 2023, which is already relatively optimistic among several institutions.

For 2022, everyone’s predictions are relatively positive: Cowan LRA Model predicts 8.1% for November 2022, IC Insights predicts 3%, and Semiconductor Intelligence predicts 1.5%. But under the macroeconomic impact, everyone agrees that the semiconductor market will definitely decline in 2023. IC Insights predicts a decline of 6%, and Semiconductor Intelligence predicts a decline of 14%. Future Horizons predicted in August that it would drop by 22% in 2023.

Trend predictions from various institutions

Currently, due to the rise in inflation and energy costs, the cost of living for residents worldwide is rising, and consumer demand is weak. Therefore, the decline in consumer confidence directly affects smartphones and PCs, causing a reduction in memory demand, inventory expansion, and a sharp drop in the average selling price (ASP) of DRAM and NAND flash. According to the outlook of various electronics companies in the fourth quarter of 2022, the second half of 2022 will drop by more than 10% compared to the first half of 2022. The decline in the second half of 2022 will be the largest half-year decline since the global economic crisis in H1 2009 and H2 2008, which fell by 21%.“`

Looking at the nearest quarter of Q4, the overall demand for both memory and non-memory companies worldwide is declining. However, the growth of the automotive industry offsets the decline in other fields. The value of the automotive business can also be highlighted. During the rapid growth of mobile phones and consumer electronics, the industry was overlooked due to high demands and slow growth. But its business characteristics are clear, it is a stable and profitable industry. Especially with the advent of the new generation of intelligent electric vehicles, the semiconductor industry has opened its arms.

Therefore, overall, as the shortage of chips for automobiles is relieved next year, automotive chips will still be a relatively good part. The global inventory of automobiles is indeed not high. By the inventory cycle of 2023, the demand for automotive chips will continue to increase.

Trends in capital expenditure

As for the capital expenditure, many institutions were optimistic before, especially with the American Chip Act bringing in many investment plans. However, with the changes in the macro environment, companies such as Intel and Micron are reviewing their capital expenditure plans for 2023, and IC Insights has revised its forecast (the growth rate in 2022 was originally +19%, reaching USD 181.7 billion). It’s expected that the industry’s spending will drop by 19% to USD 146.6 billion in 2023, which is the largest drop since the global financial crisis in 2008-2009, as shown in the figure below.

“`

Over the past 50 years, the semiconductor market has experienced double-digit declines only in 1975, 1985, and 2001. Institutions predict that in 2023, based on the following assumptions:

-

Semiconductor inventory correction will be resolved in the next 2-3 quarters.

-

PCs and smartphones will return to pre-pandemic levels by mid-2023.

-

There will be no global economic recession in 2022 and 2023, and no major uncertain events will occur.

If any of the above assumptions do not come true, the semiconductor industry’s downturn may continue throughout 2023, resulting in a year-on-year decline of more than 20%.

Conclusion: As the semiconductor industry has a pre-positioning feature, to be honest, this industry is generally more sensitive to changes in the entire market. Therefore, paying attention to this field can dynamically reflect the future economic situation as a whole. Of course, terminal demand will also be transmitted layer by layer. It seems that market strategies really need to consider the upstream and downstream demands combined together comprehensively.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.