Author: Xie Ruxin

In the past, people had a trick when buying traditional fuel vehicles – waiting for discounts before making a purchase. This often saves quite a bit of money for those who are not in a hurry to get a vehicle. However, this trick does not always work when buying new energy vehicles. People often find that they can make a profit by selling new energy vehicles purchased last year, and the vehicles bought in the first half of the year may be cheaper than those bought in the second half of the year. Incomplete statistics show that nearly 30 automakers have announced price increases for new energy vehicles this year. More than half of the automakers have raised prices by more than 10,000 RMB, with multiple price increases, and some have raised prices by 20-30,000 RMB.

The reasons for the frequent price increases for new energy vehicles this year are also clear. First, the national subsidy is being phased out, and second, the prices of raw materials have increased sharply. According to the current subsidy policy in 2022, plug-in hybrid models are subsidized 4800 RMB, and pure electric models can be subsidized up to 12,600 RMB. The subsidy will end on January 1st of next year, which means that the profit for each new energy vehicle will be reduced by 4800-12600 RMB. In fact, in previous years, the state subsidy was higher, and over time, the profits of new energy vehicles have dropped significantly, leading to difficulties for some automakers who rely on subsidies to survive.

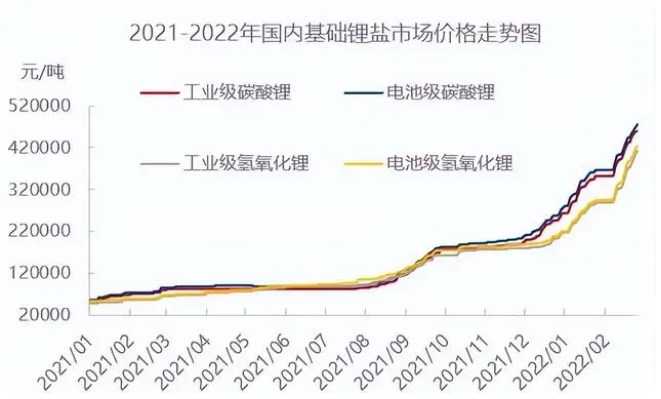

As the saying goes, “It never rains but it pours.” Relevant data shows that the main raw material for power batteries, lithium carbonate, was sold in late November this year for about 580,000 RMB per ton, compared to about 50,000 RMB per ton in January last year. In less than two years, the price of this material has increased by more than ten times, resulting in a significant impact on new energy vehicle manufacturers. Some automakers have stated that the purchase price of power batteries has increased by 20,000 RMB in a short period of time. “Working for the battery factory” is not just a joke in the new energy vehicle industry, but a joke that automakers tell themselves to comfort each other.

However, people have also noticed an outlier in new energy vehicle manufacturers, Tesla. It has actually reduced prices at the end of the year, and by a significant amount. In October of this year, Tesla announced a reduction in prices for all models by 14-37,000 RMB, and subsequent policies such as insurance discounts and faster delivery were also introduced. Why is it that when most automakers are struggling to maintain, Tesla can still provide discount promotions? On the one hand, Tesla itself has a high profit margin, and on the other hand, Tesla has signed relevant agreements with the Shanghai municipal government, requiring the former to increase sales as much as possible this year.According to survey data, the average profit of Tesla single car reaches $9,711, which is about 69,000 yuan, higher than first-tier luxury brands such as Mercedes-Benz and BMW. The huge single-car profits make Tesla have ample room for regulation, and it can be effectively implemented by exchanging price for quantity when necessary. However, for We Xiaoli, whose single-car profit is negative, it is difficult to control the total profit through price adjustments.

Another strange thing is BYD, which is currently the only automaker to announce a price increase after the national subsidy ends next year. However, BYD still bears part of it for consumers. From January 1st next year, BYD’s entire line will increase by 2,000-6,000 yuan, which is less than the reduction of national subsidy. Why does it dare to raise prices first? Because in the new energy market of 100,000-250,000 yuan, BYD can be described as the leader in the sales volume. In addition, BYD’s average single-car profit reaches $1,466, which is more than 10,000 yuan, and its production and sales volume, profitability and other indicators are very healthy.

However, this also directly reflects how great the impact of subsidy reduction and raw material price increases is. Even BYD needs to raise prices to maintain profits, and it is even more difficult for car companies with low single-car profits or even negative profits. The choices facing all car companies are very difficult. If they do not raise prices next year, the single-car profit will be too low. If they do raise prices next year, the competitiveness will weaken and the sales volume will not increase.

Although the survival environment is so difficult, most new energy vehicle companies still decide to withstand it with users until the end of the subsidy. According to the official announcement of Zeekr, for WE version orders placed this year (the specific time period will be notified separately) that cannot be delivered by 2022 due to Zeekr’s reasons, if the order meets the conditions for applying for the new energy subsidy in 2022, Zeekr will provide users with the difference subsidy according to the 2022 new energy subsidy standard.

AITO Automobile announced that for customers who completed the order before November 20th, 2022, if they cannot complete the registration by December 31st, 2022 due to AITO Automobile’s reasons, AITO Automobile will provide users with difference subsidies according to the 2022 national new energy vehicle purchase subsidy standard.NIO also announced subsidy programs this month. Customers who purchase ES8/ES6/EC6/ET7/ES7 and pay the deposit and lock in production before December 31, 2022, will be eligible for 2022 national subsidies. As the ET5 booking deposit channel was closed at zero o’clock on September 9 this year, all ET5 booking deposit users prior to that can enjoy the 2022 national subsidy as long as they pick up the car before June 30, 2023 (inclusive). After that, the subsidy policy will be based on the time of the car’s pick-up for ET5 customers who place orders.

To repay users, Changan Shenlan announced that users who place orders and lock in their orders before December 31 and whose orders meet the conditions for applying for the 2022 new energy national subsidy, the difference will be subsidized by Changan Shenlan, and users will still pay the guided price at the time of placing the order.

In addition to the above official subsidy policies, some car companies have revealed relevant policies through 4S stores, which roughly refer to the ability to continue to enjoy the national subsidy car price if they place orders before the end of this year, such as XPeng, Roewe, RisingAuto, Jihoo, Leapmotor, etc.

As for the future market situation of new energy vehicles next year, car companies themselves find it difficult to judge accurately. Currently, the mainstream view is that there will be a round of price increases at the beginning of next year. However, the author suggests that if friends who are not in a hurry to buy a car may wish to wait and see for a while, after all, the overall production capacity of new energy vehicles is oversupplied. Only head car companies have bargaining power, and even if most car companies raise prices, the expected price increase will not be too high. On the other hand, relevant departments of the country have clearly required strict crackdown on hoarding, price gouging, and unfair competition in the upstream and downstream of the lithium-ion industry, so the supply and demand relationship of raw materials for domestic power batteries is expected to improve. In the long term, there is still room for the overall price of new energy vehicles to decline.

For friends who need to buy a car in the next six months, it can be confirmed that locking in discounts before the national subsidies are canceled is still a wise choice, at least in the short term, to get a relatively low price.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.