Encouragement Plan of US New Energy Vehicles

Author: Zhu Yulong

The encouragement plan for new energy vehicles in the United States is well planned, including the assembly of car components, battery production, and the supply of battery raw materials. In fact, from 2010 to 2021, 70% of electric vehicles in the United States were produced domestically, and a large number of batteries were also produced in the United States. The support of this policy is considered in the long term. Most of the electric vehicles sold in the United States are assembled domestically, with 81% of BEVs and 33% of PHEVs.

Note: There are variables here besides Tesla’s attempt to export lithium iron phosphate batteries from China to the United States.

I have always been curious, why do American automakers attach so much importance to building battery factories and securing battery raw materials? Anyway, let’s start with a few visible companies to discuss this matter.

General Motors and Stellantis

In terms of securing raw materials, Ford, General Motors, and Stellantis are constructing battery joint ventures and directly procuring battery raw materials.

Overview of Ford

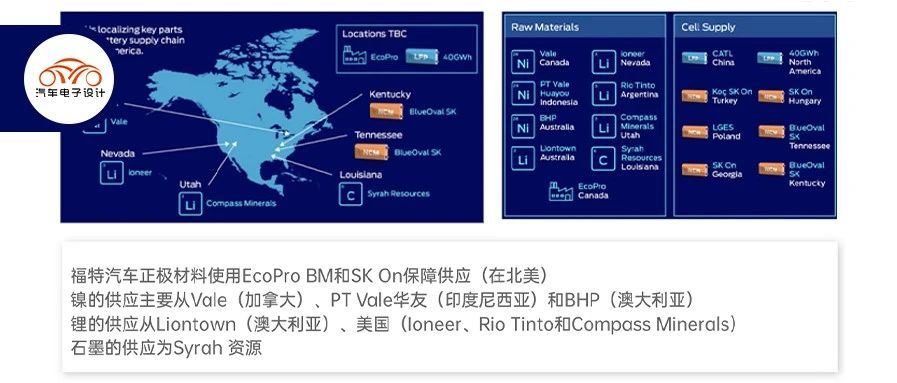

Ford’s main guarantee includes:

◎Vale Canada Ltd.: Explore the entire electric vehicle value chain.

◎PT Vale Indonesia and Huayou Cobalt Industry: Explore nickel processing projects and reach purchase agreements with Huayou to provide the equivalent of 84,000 tons of nickel per year.

◎BHP Billiton: Nickel supply from the Nickel West business in Australia, beginning in 2025.## Translation in English

Ford

Ford has secured several important lithium contracts, including a significant lithium offtake agreement with Liontown Resources for its Western Australia mining assets, and is exploring important lithium procurement agreements at its Rincon project in Argentina with Rio Tinto.

EcoPro BM and SK On

EcoPro BM and SK On have signed an MOU to establish a cathode production facility in North America.

ioneer

ioneer has signed a binding off-take agreement for lithium carbonate in its Rhyolite Ridge project in Nevada.

Compass Minerals

Compass Minerals has signed non-binding MOUs for hydroxide and carbonate lithium in its Utah Great Salt Lake operation.

Syrah Resources and SK On

Syrah Resources and SK On have signed a non-binding MOU to ensure the procurement of natural graphite from their Vidalia processing plant in Louisiana.

General Motors (GM)

Materials are primarily secured for lithium, cobalt, and nickel.

-

Lithium: Livent provides hydroxide lithium and Controlled Thermal Resource is also highly active in the geothermal sector.

-

Cobalt: LG Chem and Queensland Metals in Australia.

-

Nickel: Vale in Brazil and Queensland Metals in Australia.

High-capacity battery cells will be produced in partnership with LG Chem and Pohang Chemical in North America in the future.

Tesla

The material supply of Tesla batteries is typically assured relatively early given the volume it uses, and sources are listed in the front of the article.

Stellantis

Stellantis previously procured batteries from China and South Korea, with all materials except Umicore cobalt sourced in China. Vulcan Energy has signed separate agreements with Stellantis and Controlled Thermal Resources to supply hydroxide lithium for Europe and North America respectively in response to new regulatory requirements. Stellantis has also signed non-binding memoranda of understanding with GME regarding future cobalt sulphate and nickel sulphates for battery production.

Picture 4. General Motors’ materials guarantee

Picture 5. Tesla’s materials guarantee

Forcible Conversion

In my personal opinion, the value ratio of local vehicle and battery manufacturing, as well as the sources of materials, has been discussed with several automakers a long time ago. It is certain that the US sourced 36 GWh of power batteries in 2021 and a total of 111.9 GWh from 2011 to 2021. From 2022 to 2024, production capacity will increase greatly from 90 GWh to 346 GWh, and reach 838 GWh by 2025 at a very fast pace.

The supply of batteries in the entire United States mainly revolves around three regions: the United States, Japan, and South Korea, with a large number of batteries manufactured in Poland also used in the United States. Only a small portion of batteries produced in China are used.

The main battery suppliers in the US market are Panasonic and LG Energy, with CATL entering the US market through three automakers: Tesla, BMW, and Mercedes-Benz.

From this benchmark, the opportunity in the US power battery market will quickly emerge with the next increase in demand. During this process, I think it is reasonable for the final automaker to lock in the battery raw materials. In other words, after seeing what happened in the Chinese market, automakers can no longer trust battery manufacturers to handle the purchase of raw materials, which simply cannot control prices.“`

Summary: In my opinion, with the development of the global market, power batteries are not only about R&D technology and manufacturing yield, but also about the control of the entire material, which has become a major problem. The fact that there are only a few car companies and battery factories in the US market forces car companies to invest heavily in terminal battery manufacturing. The difference with China is that US car companies do not invest, and battery companies dare not build production capacity, which has led to the current situation.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.