The Impact of US Chip Restrictions on China’s Automotive Industry

Author: Wang Lingfang

Editor: Qiu Kaijun

Although the United States’ chip restriction policies against China do not explicitly mention “automobiles”, their long-term impact on the industry is significant.

On August 9th, US President Biden officially signed the “Chip and Science Act” (referred to as the “Chip Act”); on October 7th, the US BIS published the latest sanctions under “New Export Controls on Advanced Computing and Semiconductor Manufacturing Items Exported to China”.

Foreign media also referred to this ban as an attempt by the United States to send China’s semiconductor industry back to the “Stone Age”.

From the latest legislation, it can be seen that the scope of the US’s chip restrictions against China is very narrow but precise. The purpose is to restrict China’s development of advanced chips and supercomputers.

If we were still in the era of gasoline-powered cars, perhaps the impact of chips on automobiles would be minimal. However, as we move into the era of electrification and intelligent vehicles, the chips that power autonomous driving and intelligent cabins are the most crucial. The process and computational power will inevitably advance, and it’s only a matter of time before it falls within the United States’ restrictions.

If we follow the purpose of the legislation, the United States hopes that Chinese AI chip design companies will face the embarrassment of having no available tools and semiconductor foundries to manufacture chips, ultimately leading them to withdraw from the market competition altogether.

“Electric Vehicle Observer” consulted with several industry experts, as well as the technical heads of leading suppliers of automotive electronic solutions. When talking about the impact on chips, they were divided into two groups: one group was pessimistic and believed that China’s future in intelligent electric vehicles may be at risk. The other group was optimistic that the chip blockade would encourage industry development. Perhaps within ten years, China’s mainland could establish its own high-end chip supply capacity.

Why are chips crucial for intelligent electric vehicles?

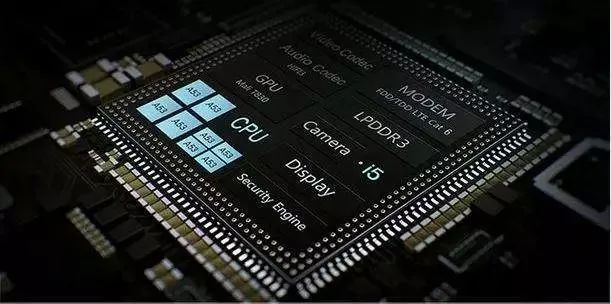

Academician of the Chinese Academy of Engineering and President of the China Society of Automotive Engineers Li Jun summed up the significance of chips for intelligent electric vehicles by stating: “Software defines cars, data develops cars, and chips manufacture cars“.In a conversation between Zhao Fuquan, a professor at the School of Vehicles and Transportation Engineering of Tsinghua University and the director of the Automotive Industry and Technology Strategy Research Institute, and Li Jun, Zhao Fuquan further elaborated on the significance of chips for automobiles. “Chips carry the processing power of data and the running ability of software. Without chips, functions such as autonomous driving cannot be realized, and even the best automotive hardware cannot play a big role. As the brain of intelligent vehicles, chips will become the core of future automotive products. At the same time, chips will also become a key link in intelligent automotive manufacturing.”

If traditional automobiles are similar to traditional feature phones, then intelligent automobiles are like the currently popular smartphones, which require software updating and complex logical data processing abilities.

Perhaps it can be summarised more simply, “No chips, no intelligence”.

Intelligent driving has brought about a surge in demand for semiconductor devices, mainly including vehicle controllers, analog chips, main control chips, power semiconductors and storage chips.

Firstly, in terms of controllers, according to the forecast of GAC Research Institute, the number of controllers in traditional automobiles is 40-70, and the number of chips is 400-700. “The number of controllers in new energy vehicles is expected to be 45-80, and the number of chips is 500-800.”

Secondly, there is an increasing demand for analog chips. Intelligent driving needs to obtain a large amount of data through sensors. The real signals from nature are extracted through sensors and become analog signals. Analog signals need to be processed by analog chips before they can be used by digital chips. The role of analog chips is to convert analog signals into digital signals, or digital signals into analog signals.

Deloitte’s recent analysis shows that the number of sensors for L4 level autonomous driving can reach 29, and it will reach 32 when it comes to the L5 level. Therefore, the demand for analog chips will increase significantly.#### Thirdly, the computing power of the main control chip is improving rapidly. As the number of intelligent sensors increases, the amount of data collected in the future will also be colossal. From low-level L1 and L2 to high-level L3 and L4, the demand for computing power is increasing at a geometric rate, with some new car models already embedded with computing power over 1000TOPS.

Fourthly, the value of power semiconductor is also growing exponentially. According to data from TF Securities, the value of power semiconductors for traditional fuel cars per vehicle reached $87.6, while the value per vehicle in the new energy vehicle market reached $458.7, achieving an increase of over 4 times.

In addition, the demand for storage chips is also growing rapidly. As the level of intelligence increases, the capacity and performance of automotive storage systems will also increase rapidly.

Experts: Short-term impact is not significant

According to the Electric Vehicle Observer, after communicating with people in chip design companies and multiple experts in the industry, the US chip restrictions will not have a significant impact on the Chinese automotive industry in the short term, but the long-term impact cannot be ignored.

To analyze the level of impact, we need to first understand what the US has specifically restricted.

According to the summary of a telephone conference of the Bureau of Industry and Security (BIS) of the US Department of Commerce held on October 13th, the US government is seeking an “advantage in leadership” in advanced logic and storage chips rather than “relative advantage” as before.

To maintain this “advantage in leadership,” a series of specific measures have been taken, including restricting high computing power chips, supercomputing chips, and semiconductor manufacturing equipment.

In addition, there are also many restrictions on chip companies and practitioners. If they provide restricted services to China, they are basically presumed guilty, and Americans cannot participate in any business related to the Chinese chip industry, including US citizens, green card holders, and asylum seekers, and even those listed on US company payrolls.The United States has previously required NVIDIA to suspend shipment of A100 and H100 GPUs to mainland China, demanded AMD to halt shipment of MI200 GPUs, and any system involving these chips will be subject to export control, with A100 as the benchmark, and subsequent peak computing power and chip-to-chip I/O performance equal to or greater than A100. Unless it obtains an export license from the U.S. Department of Commerce.

Furthermore, chip design manufacturers in mainland China, silicon wafer foundries manufacturing supercomputing chips, and overseas foundries that use American technology to produce chips for Chinese supercomputing chip design companies will all be subject to U.S. export control.

All mainland Chinese chip manufacturers will also be subject to restrictions, with the scope of restrictions expanding from 10 nm and below to 16 nm or 14 nm logic chips. The purchase of American semiconductor equipment required for SMC international 28 nm and higher production expansion also needs to go through a rigorous review process by the U.S. and obtain a license to proceed.

Currently, the mainstream size of automotive chips is generally in the range of 14-40nm and is mostly within the mature process range.

Especially for analog chips, most of them are within the mature process range, and the technology and products are relatively mature. Although many of them also rely on enterprises such as Samsung and TSMC for production, they are not within the scope of the U.S. restrictions.

However, the digital chips that are most closely related to smart technology are the products with the fastest iteration, which have higher requirements for computing power and the process.Professor Li Zhaolin, a tenured professor at the Department of Computer Science and Technology of Tsinghua University and the chief chip expert of the National New Energy Vehicle Innovation Center, told “Electric Vehicle Observer” that the current common production process for autonomous driving SoCs is 16/14nm, while intelligent cockpit SoCs are mostly 7-10nm.

Most domestic companies’ intelligent driving chip products are still within the mature process range. Companies like Horizon Robotics, whose J5 process is at 16nm and below the US restriction range, can still be produced and used normally.

Even for chips with high processes, the computing power of their mass-produced products has not yet reached the US restriction range, and therefore are temporarily safe.

In Li Zhaolin’s opinion, the current US ban does not directly affect chips used in cars, such as MCUs and autonomous driving SoCs, but in the long run, the impact of this bill on the development of intelligent and network-connected cars is huge. After all, the functionality and performance of chips play an increasingly important and determinative role in the intelligence and network connectivity of cars.

Why do SoCs’ computing power and production process need to be constantly improved?

Intelligent cockpit SoCs and autonomous driving SoCs conform to the characteristics of digital logic chips.

The characteristic of logic chips is to emphasize the speed of operation and cost ratio, and new designs or processes must be constantly adopted.

Generally speaking, the process will affect the chip area, which in turn directly affects the chip price. By increasing the chip area, more transistors can be placed in a chip.

From Intel’s Moore’s Law, the strength of a chip depends on the number of transistors on the chip. The more transistors there are, the stronger the circuit’s logic control ability over the current, and the more functions the chip can perform.In addition, a larger chip made up of the same number of larger transistors will increase the delay in signal transmission through the corresponding increase in wiring connections, resulting in a decrease in computing efficiency. Therefore, the overall performance of a chip increases by about 30% as its size decreases by 1nm.

Aside from performance, improved manufacturing processes also reduce production costs. It should be noted that XXnm refers to the width of the transistor gate. The higher the manufacturing process, the smaller the width of the transistor gate. This allows for more densely packed transistors, resulting in a smaller chip area and reducing the amount of wafer consumption. As a result, the net profits of chip manufacturers will increase.

Both chip design and manufacturing companies will try their best to improve the manufacturing process of their chips.

Logic chips have the highest market share and the fastest product updates, and are also leading in the manufacturing process.

Currently, the latest high-end SoC chip has a manufacturing process of 5nm, while dedicated SoC chips such as smart audio chips have a general manufacturing process between 16-55nm.

It appears that Horizon Robotics will be directly affected. Their next-generation J6 chip is expected to have a computing power of 1000TOPS and adopt 7nm manufacturing process, with the potential to become a central computing platform for smart vehicles. However, there is a significant risk as to whether this chip can actually be developed and brought to market.

Is it necessary to improve the manufacturing process?

Absolutely. A higher manufacturing process means lower manufacturing costs and stronger performance. As Zuo Si Research Director Zhou Yanwu put it, “If someone else’s performance is 10 times better than yours and the price is one-tenth of yours (assuming they have improved the manufacturing process), what can you do?”

In other words, stagnation in China’s chip manufacturing process while there is still room for improvement in overall intelligent driving SoC and cockpit SoC manufacturing processes means that Chinese chip products will lack competitiveness internationally and will be phased out.

Li Zhaolin stated that China is currently capable of producing manufacturing processes of 14\28\40nm, and that these processes will still be used for the main car core chips in the next 3-5 years.Of course, the expansion of 14nm production capacity is also restricted.

According to Li Zhaolin, the reason why the autonomous driving system-on-chip (SoC) does not pursue a more advanced process blindly is that, in addition to performance, factors such as cost, reliability, and safety need to be considered.

Looking at it from another angle, this window of balancing performance, safety, cost, and reliability is also the golden window period for China’s chip industry to catch up with the development.

The impact of Nvidia A100 chip restriction

Let’s take a look at the impact of the restrictions on Nvidia A100 and H100 on intelligent electric vehicles.

The restricted export of Nvidia A100 and the soon-to-be-shipped H100 are mainly deployed in high-performance data center servers for high-performance application scenarios, such as large-scale cloud AI training, and are a key part of the AI system training. If the supply of these high-end chips is cut off, it will slow down the speed of AI training, and the impact on high-demand fields such as autonomous driving in terms of AI computing power will also be significant.

There are reports that Chinese new energy vehicle companies and autonomous driving technology companies, such as NIO, XPeng, Ideal, WM Motor, SAIC, Jidu, and Xiaoma Zhixing, are all using Nvidia’s AI chips.

However, in Zhou Yanwu’s view, most car companies do not need to build their own data centers, as the cost is too high. Adopting a public or hybrid cloud model is more cost-effective.

Of course, data security may be another issue at this time.

Moreover, AI training chips are not short-term consumables, and stocking up on them will be enough to meet expansion needs for several years. For example, the chairman of XPeng Motors believes that the company’s current inventory can meet the demand for the next few years.

In addition, Zhou Yanwu also stated that there are no shortage of related substitutes in the market.

Nvidia has also released a substitute product. On November 8th, Nvidia announced that it will launch a new A800GPU to replace the A100 in China, which complies with U.S. export control regulations.To comply with recent U.S. export control regulations, the performance of the A800 is definitely inferior to that of the A100. The A800’s chip interconnect data transfer rate is 400GB per second, lower than the A100’s 600GB per second. For larger data centers, there will be a slowdown in processing speed.

A domestic enterprise’s chip was expected to replace Nvidia’s A100, but it was halted. This chip is Biren Technology’s BR100. The chip’s production was suspended due to the indirect influence of the U.S. “chip bill”: TSMC decided to suspend the production of advanced chips for the Chinese start-up Biren Technology to comply with the new U.S. regulations.

Biren claims that its 7nm AI graphics processor BR100, which uses Biren’s original “Biren” chip architecture, contains nearly 80 billion transistors, and is three times more powerful than Nvidia’s A100, reaching 10 trillion calculations per second.

According to Taiwan’s Liberty Times, Shanghai Biren Intelligent Technology, which was suspended by TSMC, suffered a heavy blow and will lay off one-third of its staff.

As seen from this, the most direct impact is on the chip industry, and the impact on car companies is not significant, but the long-term effects on China’s intelligent electric vehicle industry cannot be underestimated.

When discussing the impact on China’s smart electric vehicle industry, experts’ attitudes are divided into two factions: pessimistic and optimistic.

Pessimistic commentators believe that for Chinese intelligent electric vehicle manufacturers, the lack of independent and controllable supply means that there will be another bottleneck, with manufacturers facing the problem of a supply chain that is subject to others, high costs, and a loss of international competitiveness in the field of intelligence.

Note: The original Markdown text contains a broken image link, so it cannot be displayed as an image here.“US can cut off your supply from TSMC at any time, or delay it,” said an industry insider.

Because the Chinese chip industry is located at a relatively low-end position in the chip manufacturing process such as chip manufacturing equipment, EDA tools, chip IP cores, etc., it has a high reliance on other countries. It is not easy to achieve independent control of the industry chain. “There is a risk of generational gaps in China’s high-end chip process.”

However, Mr. Huang, the technical director of a leading supplier of automotive electronic solutions, is relatively optimistic. Mr. Huang believes that “blocking will also force development. Short-term pressure is inevitable, but it is also conducive to helping domestic companies create a complete closed loop. When downstream users start to choose chips designed and manufactured in China for supply security, it will greatly promote the development of the industry chain and technology.”

In Mr. Huang’s view, chip production and manufacturing is actually an engineering problem. “The Long March, Nan Ni Wan and Shangganling all came over. Engineering problems can definitely be solved. Maybe it won’t take ten years.”

Long-term blockade of China by Europe and the United States has made China the only country in the world with a complete industrial system. It is uncertain whether the US blockade of China’s high-end chips will help China establish a complete chip industry chain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.