Author: Zhu Yulong

Due to the recent tracking of weekly data, the impression of poor domestic auto insurance data for October has been persistent. The actual data:

-

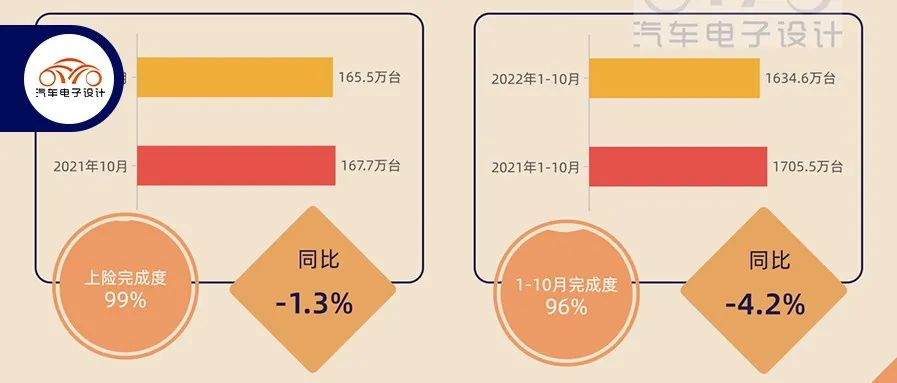

The domestic auto data for October was only 1.655 million units, a year-on-year decrease of 1.3% and a month-on-month decrease of 11%;

-

The overall data from January to October of this year was 16.346 million units, a year-on-year decrease of 4.2%.

The overall situation this year is indeed unfavorable, even with the implementation of purchase tax reductions and local efforts to stimulate the market. Such is the current economic environment, and the auto industry is affected as well. They have made their efforts as much as they can.

After reaching a high point in June, the data for 2022 has been fluctuating, and there was a significant month-on-month decrease in October.

Overview of the Overall Data

The comparison between domestic and foreign brands shows that the domestic brands were still resilient in October.

Top Three Domestic Brands

BYD with 160,369 units, Changan with 104,545 units, and Geely with 93,033 units.

Top Three Foreign BrandsVolkswagen (including both North and South) sold 239,826 vehicles, Toyota (including both brands) sold 151,060 vehicles, and Honda (including both brands) sold 98,582 vehicles. SAIC-GM Terminal Data was 81,200 and Nissan was 65,000, which differs greatly from our impressions. High-end vehicles don’t seem to be selling well either. BMW sold a total of 60,400 vehicles and Mercedes-Benz sold 58,500 vehicles; the growth curve of the entire luxury car market is not significantly better than last year due to the chip shortage.

Looking at foreign brands, the overall total sales of major car manufacturers have been on a downward trend since June.

Compared with foreign brands, the concentration of domestic independent brands is also increasing. Now, except for relying on exports, the second-tier domestic brands, including Chery, GAC (fuel vehicles), SAIC (Roewe and MG), and Dongfeng, are all facing the possibility of dealerships joining BYD once their sales drop to a few thousand units.

Regarding new forces, the total sales of six new force companies from January to October 2022 was 518,000 units, and the high point of the previous year was in June. The overall trend is consistent with the auto market.

BYD and Tesla

BYD

BYD needs to be focused on every month. The total sales volume this month was just over 160,000, of which 78,500 were pure electric vehicles and 81,600 were plug-in hybrid electric vehicles. It is worth noting that although it has increased by 99% compared to the same period last year, it has decreased by 3.9% compared to the previous month, which is really strange. According to the theory, BYD’s production capacity has been continuously released, and the wholesale data has always looked good.

The total sales volume from January to October 2022 was 1.21 million. According to the current progress, the last two months will aim for 450,000 (not excluding higher), and the estimated number of insured cars this year is 1.66 million.

Comparing the two types of BEV and PHEV, it can be clearly seen from the figure below that the larger the vehicle, the higher the acceptance of DM-i, which is most fully reflected in the comparison of Tang BEV and PHEV, and the same is true for SUVs such as the Song Plus. The energy consumption of sedans is lower, and BEVs can also travel a little further.

The influence of the sea lion on the sales volume of Model 3 is indeed significant, and Model 3 should continue to lower its price to maintain sales.

This is the climbing situation of the DM-i series, which climbed from 40,000 units at the beginning of the year to 80,000 units. As of October 2022, the total number of plug-in hybrid vehicles is 581,400.

The situation of pure electric vehicles is also relatively stable, basically around 80,000 units. In the future, the replacement of Huai Bao and the production of Seagull A00 small cars may help BYD’s pure electric vehicles to advance further. As of October 2022, the total number of pure electric vehicles is 609,000 units.

Tesla

In October, Tesla’s data is 18,281 units, with 15,223 units of Model Y and 3,058 units of Model 3 being the main selling models. As of October 2022, Tesla’s total sales are 338,000 units, with 103,000 units of Model 3 and 235,000 units of Model Y. I understand that in the next two months, Tesla will strive to reach about 110,000-130,000 units in China this year, with a total of approximately 450,000 units.

Summary: Due to the relatively lagging upstream data, the automotive market this year has shown a different trend compared to previous years. Under the one-sided market trend in Q4 of previous years, if sales are not satisfactory, disharmonious data may appear in the year-on-year data for total sales and new energy vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.