Contributing Author | Pleasant and Comfortable

Editor | Wang Lingfang

In the previous article, we wrote about the current state of joint venture brands and received many affirmations and criticisms from our readers. We would like to thank all of our readers for their comments and interactions. We have read them all carefully and hope that you will continue to follow and interact with our articles in the future.

Today, we will continue to talk to you about the luxury car market, focusing on BBA and the changes that have taken place this year, based on the volume of insurance data (including imported sales) from three aspects: sales volume, sales structure, and price changes.

Has BBA really started to “get off the pedestal”?

Sales Volume: From BBA to BBAT

(1) Overall Market Data: New Energy and Independent Brands Are Rapidly Changing the Landscape

First, let’s take a look at the overall market data:

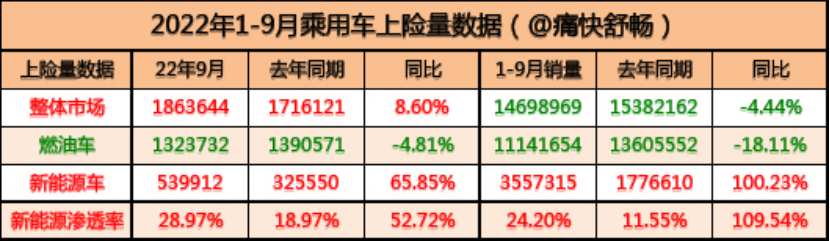

In September 2022, the overall market insurance volume was 1.8636 million vehicles, a year-on-year increase of 8.6%; of which 1.3237 million were fuel vehicles, a year-on-year decrease of 4.81%; 539,900 were new energy vehicles, a year-on-year increase of 65.85%. The monthly penetration rate of new energy is 28.97%.

From January to September 2022, the overall market insurance volume was 14.699 million vehicles, a year-on-year decrease of 4.44%; of which 1.114 million were fuel vehicles, a year-on-year decrease of 18.11%; 3.5573 million were new energy vehicles, a year-on-year increase of 100.23%. The year-to-date penetration rate of new energy is 24.10%.

Let’s take a look at the classified market structure:

From January to September 2022, the number of registrations for Chinese domestic-branded cars with car insurance was 5,877,600, showing a YoY increase of 5.98%, and their market share was 39.99%, an increase of 3.93 percentage points from the same period last year.

The number of registrations for joint venture cars was 5,946,000, showing a YoY decrease of 12.63%, and their market share was 40.45%, a decrease of 3.79 percentage points from the same period last year.

The number of registrations for luxury cars was 2,875,400, showing a YoY decrease of 5.12%, and their market share was 19.56%, a decrease of 0.14 percentage points from the same period last year.

It can be said that these two sets of data show the market trend of this year: new energy vehicles are rapidly replacing fuel vehicles, and domestic-branded cars are quickly overtaking joint venture and luxury brands.

The once dominant luxury brand representative, BBA, has seen its sales and market share start to hit a ceiling and decline.

(2) Luxury brand data: BBAT pattern emerges

Next, let’s take a look at the specific sales rankings of luxury car brands:

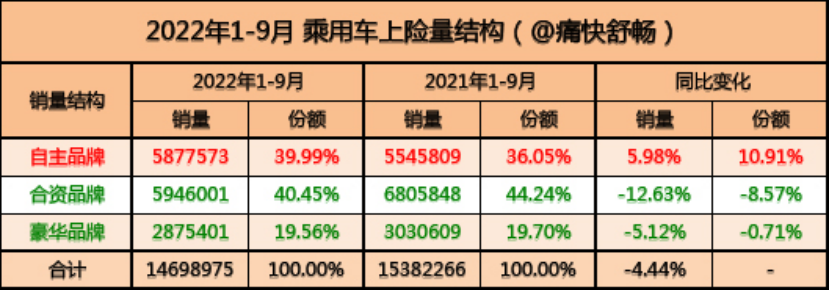

In September, Tesla sold 76,881 cars, surpassing BMW and Mercedes-Benz to become the sales champion of luxury brands, with a year-on-year growth of 47.93%. BMW sold 74,641 cars, ranking second, with a year-on-year growth of 22.33%; Mercedes-Benz sold 69,331 cars, ranking third, with a year-on-year growth of 42.09%; Audi sold 57,380 cars, ranking fourth, with a year-on-year growth of 49.08%.

In September, Tesla sold 76,881 cars, surpassing BMW and Mercedes-Benz to become the sales champion of luxury brands, with a year-on-year growth of 47.93%. BMW sold 74,641 cars, ranking second, with a year-on-year growth of 22.33%; Mercedes-Benz sold 69,331 cars, ranking third, with a year-on-year growth of 42.09%; Audi sold 57,380 cars, ranking fourth, with a year-on-year growth of 49.08%.

Many people may say that BBA’s year-on-year data looks good, right?

The real reason is: July to October last year was a period of chip shortage troubles for various joint venture automakers. Therefore, a growth of more than 20% during the same period this year is also normal.

The key point is that BBA’s cumulative data is down compared to the same period last year, which is quite interesting.

From January to September, Mercedes-Benz sold 583,150 cars, ranking first, with a year-on-year decrease of 2.52%;

From January to September, BMW sold 570,822 cars, ranking second, with a year-on-year decrease of 11.74%;

From January to September, Audi sold 484,904 cars, ranking third, with a year-on-year decrease of 13.38%.

Some friends may say: In April, the East China region was particularly affected and lost more than a month’s sales, so a year-on-year decrease of about 10% is reasonable.

However, we still need to note two points: First, in 2021, affected by the “chip shortage,” all luxury brands (except BMW) have already experienced a decline of around 5%. Second, after the epidemic, the halving policy of the purchase tax introduced this time includes “passenger cars with a displacement of 2.0 liters or less and a single-car price (excluding value-added tax) not exceeding 300,000 yuan,” which is actually favorable for the entry-level models of luxury brands.

Therefore, from the data perspective, only Mercedes-Benz in BBA has not been affected too much, and BMW and Audi have declined significantly. The second-line luxury brands that are more severely affected are Lexus and Cadillac, with a year-on-year decline in sales of more than 20%.In the first 9 months of this year, only Tesla, Hongqi and NIO achieved year-on-year sales growth, which increased by 54.98%, 3.31% and 22.78%, respectively (which essentially conforms to the trend of new energy and independent brands).

Among luxury brands, if we exclude Tesla, we will find that the overall sales of luxury brands have declined by more than 6.11%. It can be said that this year’s luxury car market is dominated by Tesla and NIO.

In terms of monthly average sales, Mercedes-Benz and BMW have monthly average sales of more than 60,000 vehicles, while Audi lags behind at around 50,000 vehicles. Tesla has a monthly average sales of more than 35,000 vehicles, and the monthly average sales of Hongqi, Cadillac, Volvo and Lexus are more than 10,000 vehicles.

By latest next year, we may see that the structure of the head luxury brands has evolved into a BBAT or even BBTA pattern.

Sales structure: Mercedes-Benz becoming more luxurious, BMW focusing on localization, Audi falling behind

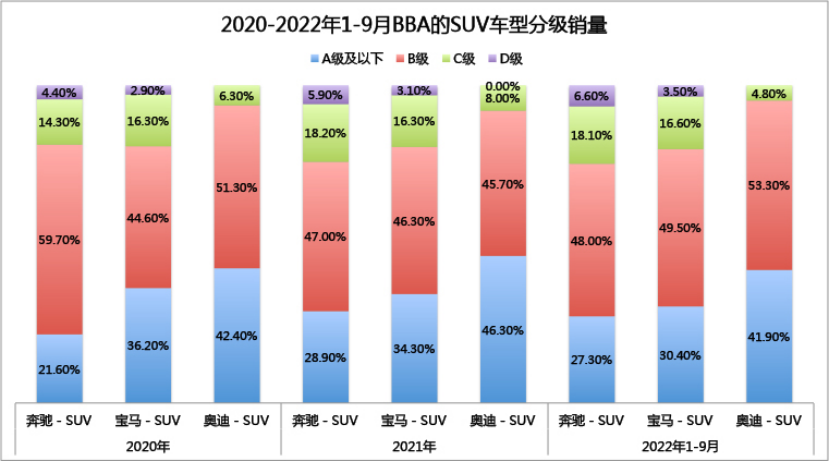

Next, let’s take a look at the sales structure changes for BBA sedans and SUVs from 2020 to 2022.

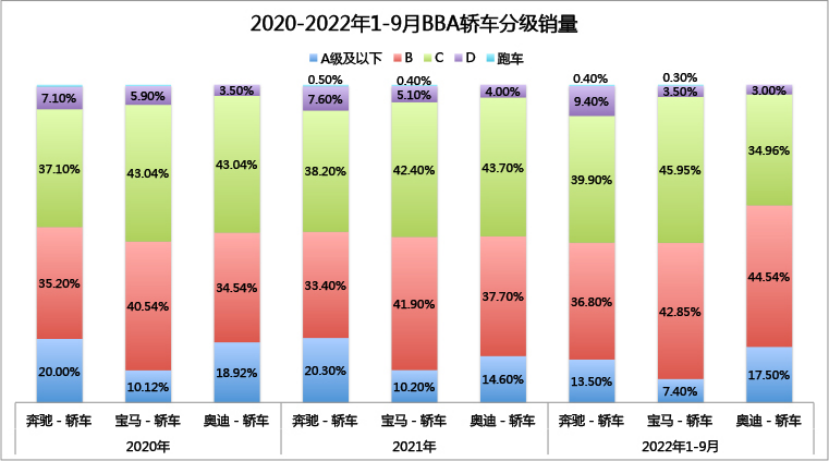

(1) Sedan market (including imports): Mercedes-Benz and BMW focus on medium-sized and above high-profit models

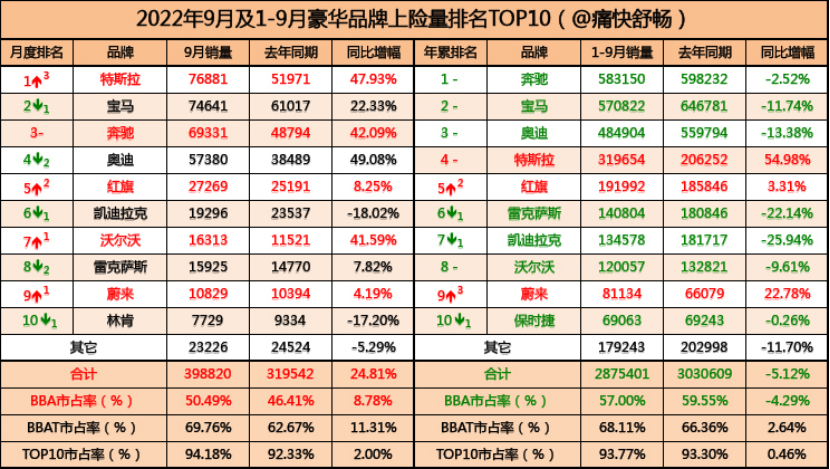

In the A-level and below market, the proportion of entry-level Mercedes-Benz sedans has decreased from 20.3% in 2021 to 13.5% from January to September 2022; the proportion of entry-level BMW sedans has decreased from 10.2% in 2021 to 7.4% from January to September 2022; while Audi has increased from 14.6% in 2021 to 17.5% in 2022.In the B-level market, the sales of BMW 3 Series are leading, followed by Audi A4, and Mercedes-Benz C-Class ranks third, but the cumulative sales gap of these three products is only about 10,000 units.

In the C-level market, which is the main market for BBA, BMW 5 Series sold 134,400 units, Mercedes-Benz E-Class sold 110,800 units, and Audi A6L only sold 88,500 units.

Audi is obviously falling behind in the higher-level market.

In the D-level market, flagship import models of each brand are the main products. Only Mercedes-Benz’s market share is increasing, and it accounts for nearly 10%, while the market share of flagship sedans of BMW and Audi is only around 3%, and there is a continuing downward trend. Audi has the least presence, with the market share of its flagship sedan decreasing by more than 8 percentage points compared with last year.

From the perspective of the structure of the sedan market, Mercedes-Benz and BMW are continuously reducing the sales volume of entry-level products and increasing the sales volume of products above the E-Class, while only Audi is maintaining its overall sales volume by increasing the sales volume of entry-level products.

If we look at the strategy Mercedes-Benz released this year: emphasizing profit first, emphasizing that million-yuan vehicles are Mercedes-Benz’s biggest advantage, and reducing the product scale and investment in the A-level car market, we will find such a sales structure performance is not unexpected.

(2) SUV Market (including imports): Audi can only maintain sales volume through the entry-level A-Class products

The sales structure of SUVs is basically consistent with that of sedans.

Mercedes-Benz and BMW are both reducing the sales and scale of their A-Class SUVs, gradually focusing on higher-profit products in the B-Class and above. Meanwhile, Audi, whose flagship SUV is already lacking, has a blank spot in the large SUV category, and even in the mid-to-large SUV market, Audi’s sales account for only 4.8%. In contrast, Mercedes-Benz and BMW’s flagship SUVs (mid-to-large and large), account for 24.7% and 20.1% of sales, respectively.

Mercedes-Benz and BMW are both reducing the sales and scale of their A-Class SUVs, gradually focusing on higher-profit products in the B-Class and above. Meanwhile, Audi, whose flagship SUV is already lacking, has a blank spot in the large SUV category, and even in the mid-to-large SUV market, Audi’s sales account for only 4.8%. In contrast, Mercedes-Benz and BMW’s flagship SUVs (mid-to-large and large), account for 24.7% and 20.1% of sales, respectively.

Therefore, in order to maintain sales, Audi has to boost sales of its entry-level SUV products, resulting in a more than 40% sales share of A-Class and below SUVs, while for Mercedes-Benz and BMW, their respective same-level products have only around 30% market share.

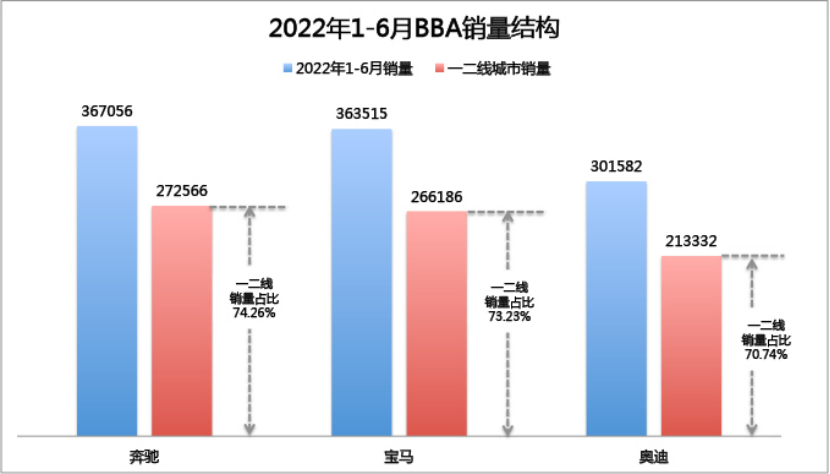

(3) BBA’s Sales Structure: Mercedes-Benz and BMW’s Sales in First and Second-Tier Cities Account for Over Two Thirds

Let’s take a look at the sales distribution of Mercedes-Benz, BMW, and Audi in different tier cities: Mercedes-Benz’s sales share in first and second-tier cities is 74.26%, BMW’s is 73.23%, and Audi’s is the lowest at 70.74% (Tesla has the highest at 93%)

From the perspective of regional influence, it can also be seen that Audi’s products are sinking.

It can be seen that Mercedes-Benz is focusing on higher-end markets while reducing entry-level products and sales; BMW is accelerating the localization of mid-to-high-end models through the X5 to further boost sales; and Audi is facing serious product weaknesses, and can only maintain sales by leveraging price and selling more entry-level models.

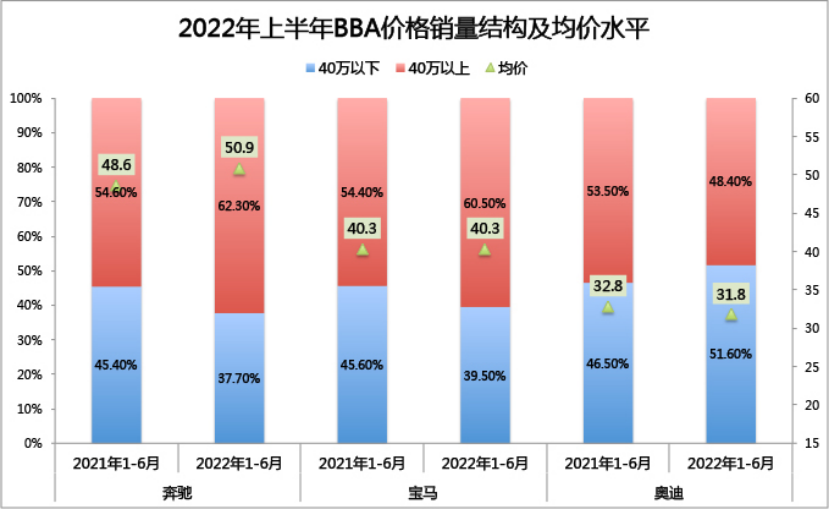

BBA’s Average Prices: Mercedes-Benz is Over 500,000 Yuan, BMW is Over 400,000 Yuan, and Audi is Over 300,000 Yuan

Let’s take a look at BBA’s product price structure and average price levels for the first half of this year.

Mercedes-Benz: The sales ratio of products above 400,000 yuan increased from 54.60% in the first half of 2021 to 62.30%, driving the overall average price from 486,000 yuan in the same period last year to 509,000 yuan, an increase of 23,000 yuan;

BMW: The sales ratio of products above 400,000 yuan increased from 54.40% in the first half of 2021 to 60.50%. Due to the gradual localization of the X5, the overall average price remained unchanged at 403,000 yuan, maintaining the same level as last year;

Audi: The sales ratio of products above 400,000 yuan decreased from 53.50% in the first half of 2021 to 48.40%, leading to a decrease in the overall average price from 328,000 yuan in the same period last year to 318,000 yuan, a decrease of 10,000 yuan;

From the average price level of the three luxury brands, it can be seen that Audi has already started to lag behind Mercedes-Benz and BMW in terms of both sales structure and average price level. Even if Audi chooses to lower prices to maintain sales, it is very likely to be surpassed by Tesla in 2023.

The Dilemma of BBA’s Transformation: Luxury Brands Are Gradually Coming Down from Their Pedestals

Through the data of the overall market, we can see the trend: new energy and independent brands are rapidly changing the market.

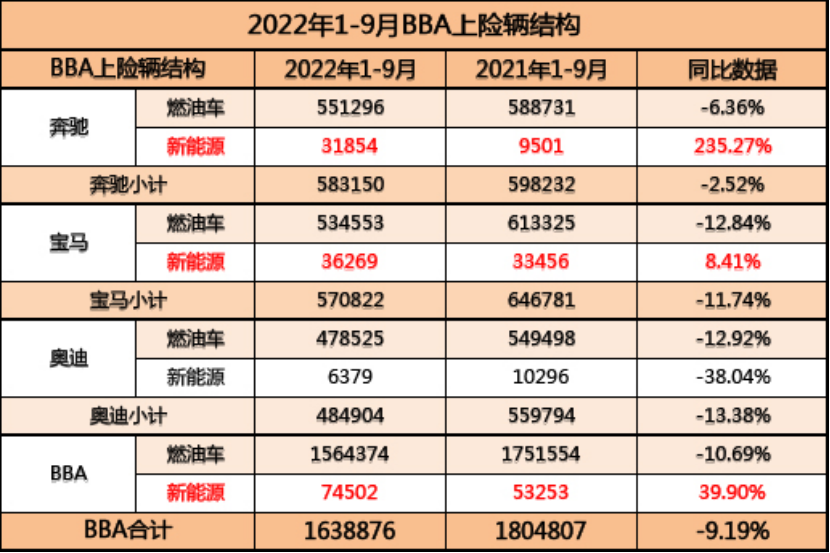

So how effective is the new energy in BBA’s sales structure?

(1) Overall Sales Structure

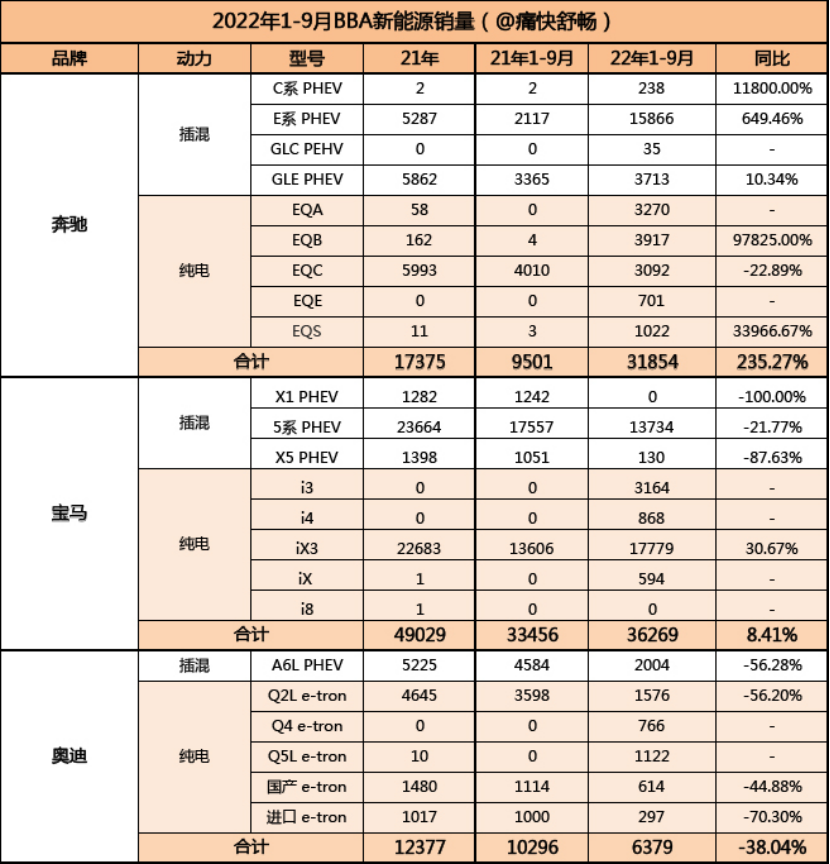

## Sales Figures of BBA (BMW, Benz, Audi) from Jan. to Sep.

## Sales Figures of BBA (BMW, Benz, Audi) from Jan. to Sep.

- Benz: The sales volume of fuel cars was 551,300, decreased by 6.26% year on year; the sales volume of new energy cars was 31,900, increased by 235.27% year on year, accounting for 5.46% of the total sales.

- BMW: The sales volume of fuel cars was 534,600, decreased by 12.84% year on year; the sales volume of new energy cars was 36,300, increased by 8.41% year on year, accounting for 6.35% of the total sales.

- Audi: The sales volume of fuel cars was 478,500, decreased by 12.92% year on year; the sales volume of new energy cars was 6,400, decreased by 38.04% year on year, accounting for 1.32% of the total sales.

The sales volume of fuel cars for BBA has been shrinking rapidly. Meanwhile, the proportion of their new energy car sales is much lower than the overall market penetration.

Among them, Audi is the only brand whose sales of both fuel and new energy cars have decreased year on year, while Mercedes-Benz has regained some market share thanks to the sales growth of PHEVs. BMW is still the fastest-growing luxury brand in the field of pure electric vehicles.

(2) New Energy Vehicle Sales Structure

BMW has the best sales performance of new energy vehicles, and it is also the luxury carmaker that has introduced the most pure electric car models this year, with a total of 3 models available for sale. Among them, the iX3 is the star model of BBA’s new energy vehicles, and it sold 17,779 units from January to September.

Mercedes-Benz launched the E-series PHEV model last year, with a sales volume of 15,866 from January to September this year, which has driven the overall sales growth of new energy vehicles for Mercedes-Benz. However, the sales performances of the core models, EQA/B/C, and even EQE and EQS are mediocre.

Although Audi has launched the Q5L e-tron model through SAIC-Audi this year, its sales performance can still be described as dismal, with only 1,122 units sold, even lower than the sales of BMW iX3.

The weakness of BBA’s transformation in the new energy field can also be seen from the price changes of various models: Mercedes-Benz EQS once had a price reduction of over 300,000 yuan; BMW iX3 only achieved a slight breakthrough in sales after a 70,000 yuan official price reduction across its entire lineup; The official launch price of the top-of-the-line Q5 e-tron is 30,500 yuan lower than the presale price, but the sales performance is still poor.

In the era of fossil fuel vehicles, “official price reduction” was a rare event for any luxury brand. However, in the field of new energy, the phenomenon of official price reduction mentioned above is common.

This also reflects the predicament faced by luxury brands in their new energy transformation — creating new energy in the same way as fossil fuel vehicles. This directly leads to the fact that compared with new forces such as Tesla, BBA is significantly behind in new energy product innovation.

“The decline in sales of traditional fossil fuel vehicles, coupled with weak new energy products, BBA seems to be struggling to keep up with this era.”

The decline in sales of luxury brands represented by BBA means that it is difficult for luxury brands to continue to gain incremental users through simple product releases and channel expansion. Therefore, Mercedes-Benz and BMW’s strategy is to emphasize profit first and try to increase the gross profit margin of existing markets as much as possible.

However, in the stage of the full-scale transformation of the automobile industry to new energy, if traditional luxury brands continue to emphasize profit and prioritize profits, this is fundamentally conservative, and even belongs to flatlining. In the future, they will face further declines in sales and market share.

Today, even as powerful as BBA, which once occupied 60% of the luxury car market, it will face a double challenge of new energy + the rise of independent new brands.The wheel of time always rolls forward, and it will not stop for the conservatism of certain brands.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.