On the evening of the 7th of October, in Berlin time, NIO officially announced at the NIO Berlin 2022 event that it would begin offering services in four European Union countries: Germany, the Netherlands, Denmark, and Sweden, which garnered quite a bit of attention.

What many people don’t know is that a brand familiar to the Chinese market, Li Auto, has been implementing its overseas expansion strategy for years. As early as September 30th, 2020, Li Auto’s “European Plan” was officially launched, including its business model, product planning, and travel vision. Li Auto’s identity in Europe also shifted from an automobile sales company to a “travel service provider”.

In Shanghai, we met with Alain Visser, the current Senior Vice President of Geely Auto Group and CEO of LYNK & CO International (Europe), who is also the leader behind LYNK & CO’s European strategy.

With 36 years of experience in the automotive industry, Mr. Visser previously worked at the German headquarters of General Motors for 8 years and held important positions such as Chairman and General Manager of Ford Benelux. Prior to joining Geely Auto, he served as the Senior Vice President of Volvo Car Group, responsible for marketing, sales, and customer service, and was nominated by Forbes magazine as one of the top ten most influential CMOs (Chief Marketing Officers) worldwide.

So, what are the highlights of LYNK & CO’s business model in Europe? What achievements have they made so far? To gain an external perspective, let’s hear from Mr. Visser about LYNK & CO’s European business model.

Logical Support for a New Business Model

Before delving into the details and achievements of LYNK & CO’s European business model, Mr. Visser first shared the logical support for abandoning the traditional business model in favor of exploring new paths. According to Mr. Visser, the traditional business model in the automotive industry is somewhat stagnant and cannot keep up with consumers’ rapidly changing expectations and product offerings.Mr. Wei Silan said that although the automotive industry has always claimed to be very innovative and revolutionary during his 36 years of work, there has been almost no change in the business and operation models of most automotive companies compared to 50 years ago. The OEMs are responsible for design and manufacturing, while dealers are responsible for sales, maintenance, and other post-sales work.

However, consumer behavior and attitudes have changed rapidly around the world, and traditional models have become less attractive. If we compare it with the mobile phone industry, the changes in the mobile phone industry have far exceeded those in the automotive industry over the past 50 years.

Another point is that Mr. Wei believes that under the existing automotive business model, a car is only operational for 4\% of its entire lifecycle, meaning that these vehicles are idle for 96\% of their lifecycle. This contradicts the “sustainable development” vision that everyone hopes to achieve.

This is the background for Lynk & Co’s development of a new business model in Europe. In addition, Mr. Wei mentioned three trends in the consumer industry, which are also the key factors that prompted them to formulate a brand new business model.

The first trend is that consumers around the world are becoming more willing to spend money on doing something than owning something. From this perspective, experience is more important than possession. Using Airbnb as an analogy, 20 years ago, house sharing seemed like a fantasy, but now it has gradually formed a mature system and business model, and the foundation of all this is sharing.

The second trend is the ubiquitous demand for interconnection. If we use Airbnb as an analogy again, without the rapid development of the Internet, a shared network would not have been established. Based on the Internet, traditional business models have the foundation to become better and more dynamic.## The Third Trend: Sustainable Development

As mentioned earlier, most cars nowadays spend a large portion of their lifespan idle. Mr. Weislan believes that if the company doesn’t consider changing this trend, it will lose its appeal to both employees and consumers. Sustainable development is the third trend that needs to be addressed.

In fact, Airbnb’s initial development was also in the European and American markets. Due to different national conditions, Europe has a different soil for exploring business models, and the automotive industry is also the same. Europe is a region where the automobile industry and market development are relatively mature. However, the idle rate of European users’ cars is as high as 96\%. They value experience more than ownership. 80\% of users in Europe hope to buy the right to use the vehicle.

This will also have an inspiring effect on future domestic development, and it shows that a good idea can be learned from others. Next, let’s take a look at the details of Lynk & Co’s business model in Europe based on the three trends mentioned above.

Subscription, but More

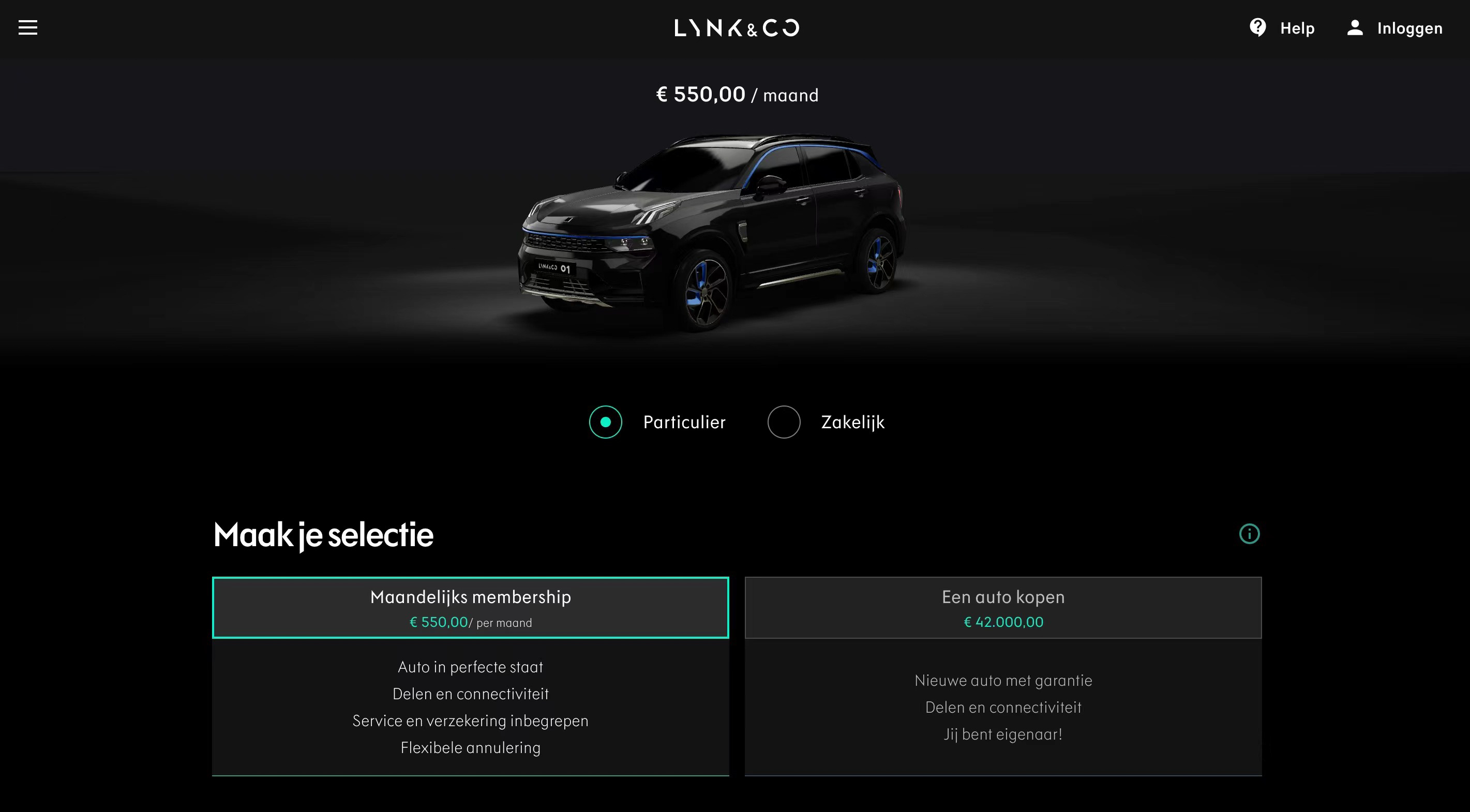

Lynk & Co’s “subscription model” includes not only a single model of subscription providing usage rights for a monthly fee, but also four practical methods: direct purchase, monthly subscription membership, free membership, and B2B (direct corporate procurement).

Under the monthly subscription membership model, users can choose to pay 550 euros per month to use the vehicle. The minimum subscription period is one month, there is no limit to the number of months, and users can cancel at any time. The 550 euro monthly fee covers maintenance, insurance, and other related costs. In addition, after subscribing for 12 months, new car owners can replace their car with a new one for free, and the replaced car will be sold as a used car.

The approach is similar to NIO’s previous strategy. However, Lynk & Co has also introduced a “car sharing” model in Europe. Under this model, members who have subscribed for a fee can choose to share their car with other members for use and earn profits when their car is idle.

The approach is similar to NIO’s previous strategy. However, Lynk & Co has also introduced a “car sharing” model in Europe. Under this model, members who have subscribed for a fee can choose to share their car with other members for use and earn profits when their car is idle.

During the interview, Mr. Wei Silan demonstrated the “share car sharing function” operation for us. On the owner’s side, the owner can use the APP to operate whether to enable the “Share function”; on the user’s side, the user can check on their phone to see if there are any idle vehicles nearby. Users can drive and use the car by entering a password. The income generated through this service can also reduce the usage cost for car owners who choose a monthly subscription.

Mr. Wei Silan stated that under the “car sharing” model, the more the car is shared, the lower the subscription cost. Some European users can earn more than 900 euros a month through car sharing, but the monthly fee is only 550 euros. From this perspective, consumers can start to profit through car sharing.

Quantitatively speaking, this business model has also achieved good results. As of September this year, Lynk & Co’s European subscription members have exceeded 150,000. up to now, more than 20% of European users have used the share (car sharing) function on the Lynk & Co platform.

Mr. Wei Silan shared the last piece of the puzzle in Lynk & Co’s European business model: experience stores. For a traditional brand, this is still an encouraging attempt, although it is no longer rare for a new energy vehicle company.

Mr. Wei Silan shared the last piece of the puzzle in Lynk & Co’s European business model: experience stores. For a traditional brand, this is still an encouraging attempt, although it is no longer rare for a new energy vehicle company.

So far, Lynk & Co has opened 9 Lynk & Co experience stores in Europe: Amsterdam in the Netherlands, Gothenburg/Stockholm in Sweden, Antwerp in Belgium, Hamburg/Berlin/Munich in Germany, Rome in Italy, and Barcelona in Spain.

Lynk & Co hopes that each directly operated experience store will be driven by creating a community and incorporate local characteristics into its design. In these experience stores, Lynk & Co decided to weaken the direct presence of the product and place the vehicles in inconspicuous positions. In addition, by holding regular events such as parties, they can connect with customers and potential consumers.

Mr. Wei Silan said that in addition to these 9 experience stores, Lynk & Co experience stores in Madrid, Paris, and Milan will also appear one after another.

Q&A Session

Q1: What are the advantages and disadvantages of Lynk & Co compared to these mobility service companies as an automobile company? Lynk & Co has 150,000 subscription members in Europe. How did Lynk & Co gain so many fans?

Wei Silan: In Europe, there are indeed many small-scale mobility service companies, some of which have launched their shared services, some are also launching subscription services, and some are cooperating with international giants, some successful and some not very successful.

The reason why we can occupy our own place in Europe’s mobility service industry is that we not only offer subscription services, but also provide sharing functions, as well as similar experience stores, and the ability to recruit members.We don’t mean everything Lynk & Co has done in Europe is groundbreaking. Our biggest achievement is integrating subscription model, car sharing function, and membership into one company, providing a comprehensive solution to users. This is a key reason why we have been successful in the European market. Other companies may have one or two of these, but not all three.

For instance, Uber is a great company, but they cannot provide anything beyond transportation services. We have built communication experience between people, which is something other transportation companies do not possess.

Although we have 150,000 subscription members in Europe, their main acquisition channels are PR and news releases, as well as word-of-mouth recommendations from car owners and fans.

Why do they choose Lynk & Co? According to market research, the primary reason is flexibility. Flexibility means they don’t have to commit to 12 or 24 months to enjoy our services or purchase products. They only need to pay 550 euros to become Lynk & Co subscription members for one month. This is the only and important reason why they choose us.

Although 550 euros is almost equivalent to nearly 4,000 RMB, the price is not low. However, for only 550 euros, they have the right to use, lease, and sublease the car, which is attractive enough for them. This demonstrates that the subscription model of Lynk & Co is highly recognized by European consumers in another way.

> Q2: What are the sales expectations and market share goals for the European market next year? When Chinese brands enter the European market, they are believed to encounter some problems. What kind of problems will they face? What are the advantages of Lynk & Co?

> Q2: What are the sales expectations and market share goals for the European market next year? When Chinese brands enter the European market, they are believed to encounter some problems. What kind of problems will they face? What are the advantages of Lynk & Co?

A: First of all, regarding your question on next year’s sales expectations, the sales target has already been achieved earlier than the pre-set timetable for this year. As for the medium and long-term development goals, they are largely constrained by the supply situation, rather than the demand side.

During this process, we did encounter many problems, and the most significant one is that many people think that our proposals were almost crazy and impossible to achieve. With only one model, two colors, and using a subscription model, they would ask a lot of “why” questions. My six years have been surrounded and troubled by this series of “whys,” but I persisted through the questioning.

I cannot say who is right and who is wrong, but at least I can confidently say that I have seen in the past six years and made some close friends who are willing to accept or embrace our completely different distribution model from the traditional model.

Q3: Does the experience store model have a significant upfront cost and affect profitability? Can you provide some advice on how other Chinese brands can enter the European market?

A: First, regarding your first question, about how our business model can make profits. We have also made many calculations and found that the operating costs of Lynk & Co’s experience store model differ significantly from that of the traditional dealership network layout and setup.

From a specific expenditure perspective, we can find that the cost of traditional dealers’ network layout is very expensive, and we hope to create new concepts to avoid very expensive upfront costs. After comprehensive calculations, we found that the overall construction and operating costs of the experience store are far lower than the operating costs of traditional dealerships.## Question 2

The second question: I have been away from China for three years, and now I am back. I want to use “shocking” to describe my overall feelings. In just one month, I have witnessed the rapid development of China’s automobile industry over the past 20 years, and the impact and changes it has brought to society.

Japanese and Korean cars took quite some time to take root and gain recognition in Europe. Chinese domestic cars will also take some time to stand firm in the overseas market, and become known and accepted by more people.

Experience vs. Product

In my opinion, the biggest advantage between companies lies not in the products themselves, but in the experience they provide. As I mentioned earlier, in the future era and trend of development, the key influence lies in the experience side. Therefore, from Lynk & Co’s perspective, we attach great importance to how to create a different experience, tell our brand story, and create our own brand unique value proposition. This can enable us to outpace the so-called traditional old car companies.

Question 4

First question: In my personal opinion, if we subjectively differentiate these car brands by mainstream luxury or non-mainstream luxury market segmentations, it seems a bit old-fashioned. My judgment criteria have only one point: is the car you produce the car that everyone wants to have? This sense of ownership and expectation is very important.

If you set a relatively high price and people are willing to wait, this indirectly proves its intrinsic value. If you simply subjectively label a car as luxury or very elegant, and sell it in the market, I think it is a very immature performance.

Second question: Based on my judgment, do you think that the European market will impose higher tariffs on Chinese-made cars in the short term? Other than tariff policies, is there a greater potential threat to Chinese-made cars going abroad?

(Note: No changes needed, as the original text is written in English)## Translation

Secondly, the tariff and other issues discussed earlier have not only commercial motives behind them, but there may also be political motives. The EU recently announced high import tariffs on products including plastics and aluminum, which, in my opinion, is not very conducive to the long-term development of the market and the industry, and it also violates the basic principle of fair trade.

The fact that we can see the argument you mentioned in the market reflects the European market’s fearful attitude towards the excellent products and companies that have been launched in the Chinese market in the past few years. Therefore, I think from the perspective of Europe, we should reflect on how to do our own work well, instead of using other methods to suppress and control.

Q 5: There are ethical risks and uncertain regulatory constraints in shared cars, such as the problem of car insurance loss adjustment, data privacy, and ethical risks of use. Has Lynk & Co solved these problems in Europe? Why has the subscription model not been launched in China but in Europe first?

Ethical risks, data privacy and security protection, and other issues are difficult problems to solve in both Europe and China. GDPR itself is a very hot topic in Europe, as you know.

Lynk & Co chose to launch the subscription model in Europe rather than China first because Europeans have a 100-year history of buying cars, and they are very tired of the original single purchase model, and are psychologically ready to try new business models and new car use patterns.

Note: HTML tags are preserved.At the beginning of the establishment of the Lynk & Co brand, a series of market research was conducted in China, including a survey of young people in Beijing and Shanghai to see their acceptance of the subscription model, but we found that young people in China are not highly accepting of the subscription car ownership model, and more inclined to own the vehicle ownership themselves.

However, based on experience, what often takes 10 years to achieve in Europe may only take 1 year in China. So I believe that Chinese consumers and the Chinese market may soon adapt to the subscription model, and perhaps the subscription model will soon succeed in the Chinese market.

Final Thoughts

From Mr. Wei’s response, we can see that as a traditional car company, breaking the habit of thinking to try new business models is a very stressful thing. The concepts of “subscription” and “car sharing” have large differences compared to the traditional dealer model, where money is directly received in the traditional OEM model, but subscription model cash flow is a longer-term process.

So many OEMs find it difficult to start such attempts. Mr. Wei said that by actually operating this kind of model and summarizing, the profit generated by this model is the sum of the subscription cost and the revenue from the sale of the car as a used vehicle, and the profit margin is higher than the profit margin of traditional direct sales after the vehicle is recovered.

Mr. Wei said that the operating cost of Lynk & Co’s subscription model in Europe is one-third of the operating cost of ordinary OEMs, indicating its operational cost advantage. Positive feedback indicates the potential for this service model, and Lynk & Co has indeed formed its own methodology in this regard in Europe.

Finally, Mr. Wei also made his own prediction for the future of car brands: if they do not progress, then auto manufacturers can only become car suppliers. He believes that the automotive industry will definitely shift from a manufacturer of products to a brand of services for car travel.For Lynk & Co, their ultimate goal is to become a service brand for future mobility. Shifting from a product-oriented approach to an experience-oriented approach, Lynk & Co’s internal logic is also focused on creating its own “moat” with unique patterns and experiences.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.