Author: Winslow

Tesla’s Q3 financial report released today can be summed up as: “Saving one dollar is better than earning five dollars – the show of the cost control freak“.

The pre-tax net profit margin for Tesla as a whole (including the automotive, solar, and after-sales service departments) is 17.2% (compared to 14.6% in the previous quarter). The automotive department alone accounts for 87.1% of Tesla’s total revenue (compared to 86.2% in the previous quarter). At the same time, the pre-tax net profit margin for the automotive department is 19.7% (compared to 16.8% in the previous quarter).

The gross profit margin of the automotive department (excluding carbon credits) is 26.8% (compared to 25.6% in the previous quarter).

The company’s overall gross profit is $5.38 billion (compared to $4.23 billion in the previous quarter), and its operating net profit is $3.68 billion (compared to $2.46 billion in the previous quarter).

The free cash flow is $3.29 billion (compared to $0.62 billion in the previous quarter).

Compared to the difficult Q2, the operating data for Q3 has fully rebounded, mainly due to the Shanghai super factory resuming full production, production, production!

Assuming no surprises, Tesla’s free cash flow is likely to be higher every quarter going forward than this quarter, meaning that Tesla will soon join the club of net cash inflows of $20 billion per year and the growth will continue. This data is significant because strong and stable cash flow can provide a broad space for the company’s all-round research and development and response to capital market fluctuations.

Below are the long-term trends for specific operating data.

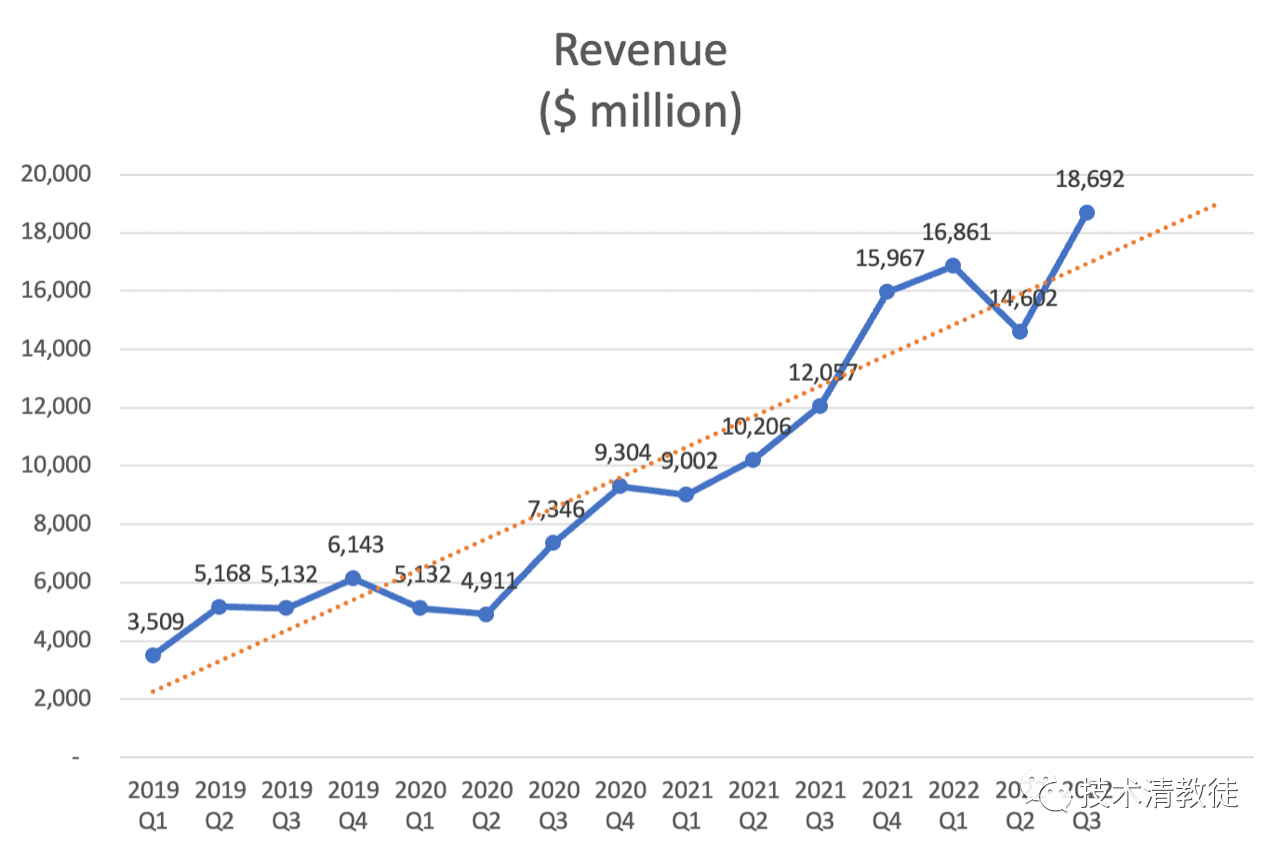

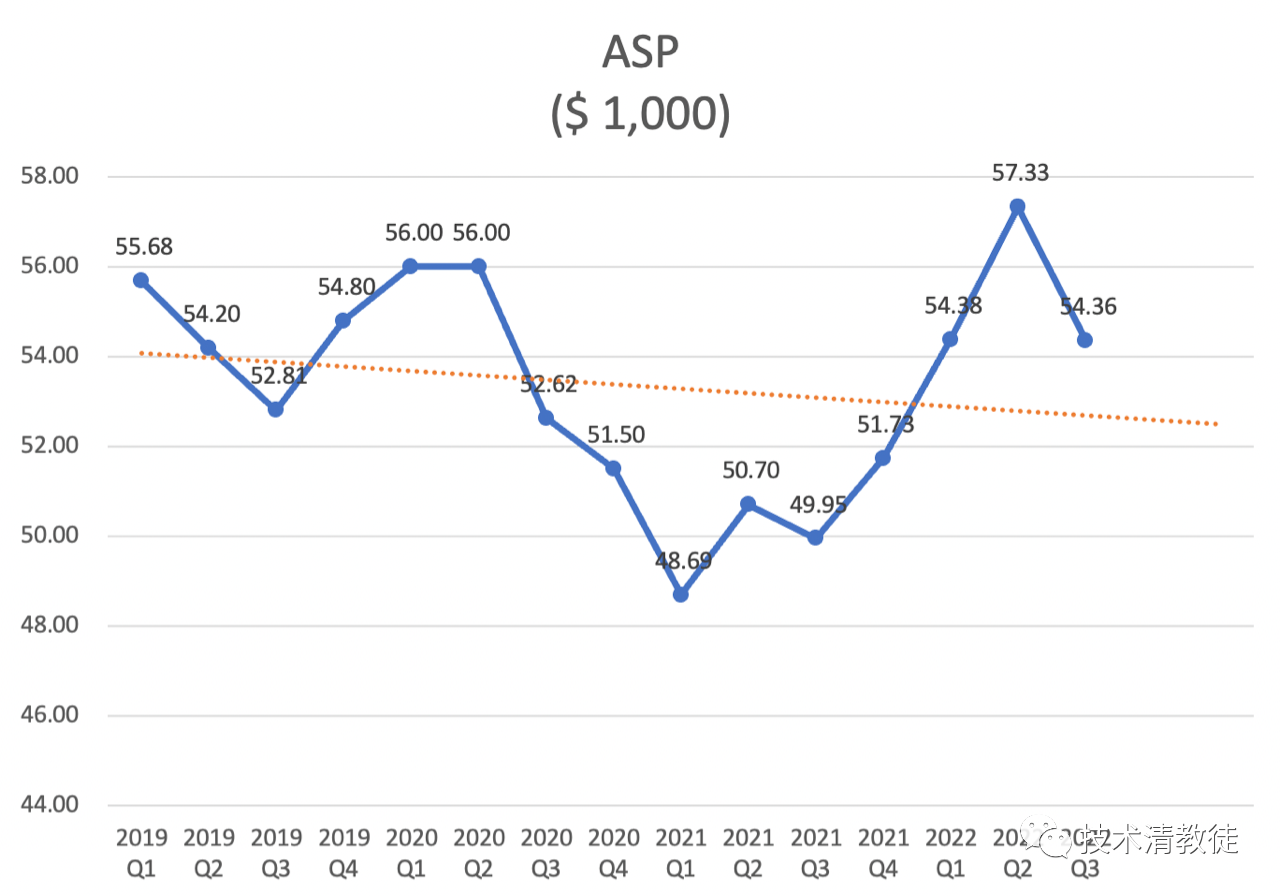

Revenue, selling price and gross profit

The production capacity of the Shanghai super factory has returned, global deliveries have rebounded, and quarterly revenue has reached a new high.

Shanghai’s super factory is delivering vehicles locally at full capacity, resulting in the lowest average sales price in the world for the Chinese market, which has led to a drop in ASP.

The gross profit of individual cars has continued to decline for two quarters, possibly due to a poor economic environment and intense competition in the Chinese market, which caused the terminal price to start falling.

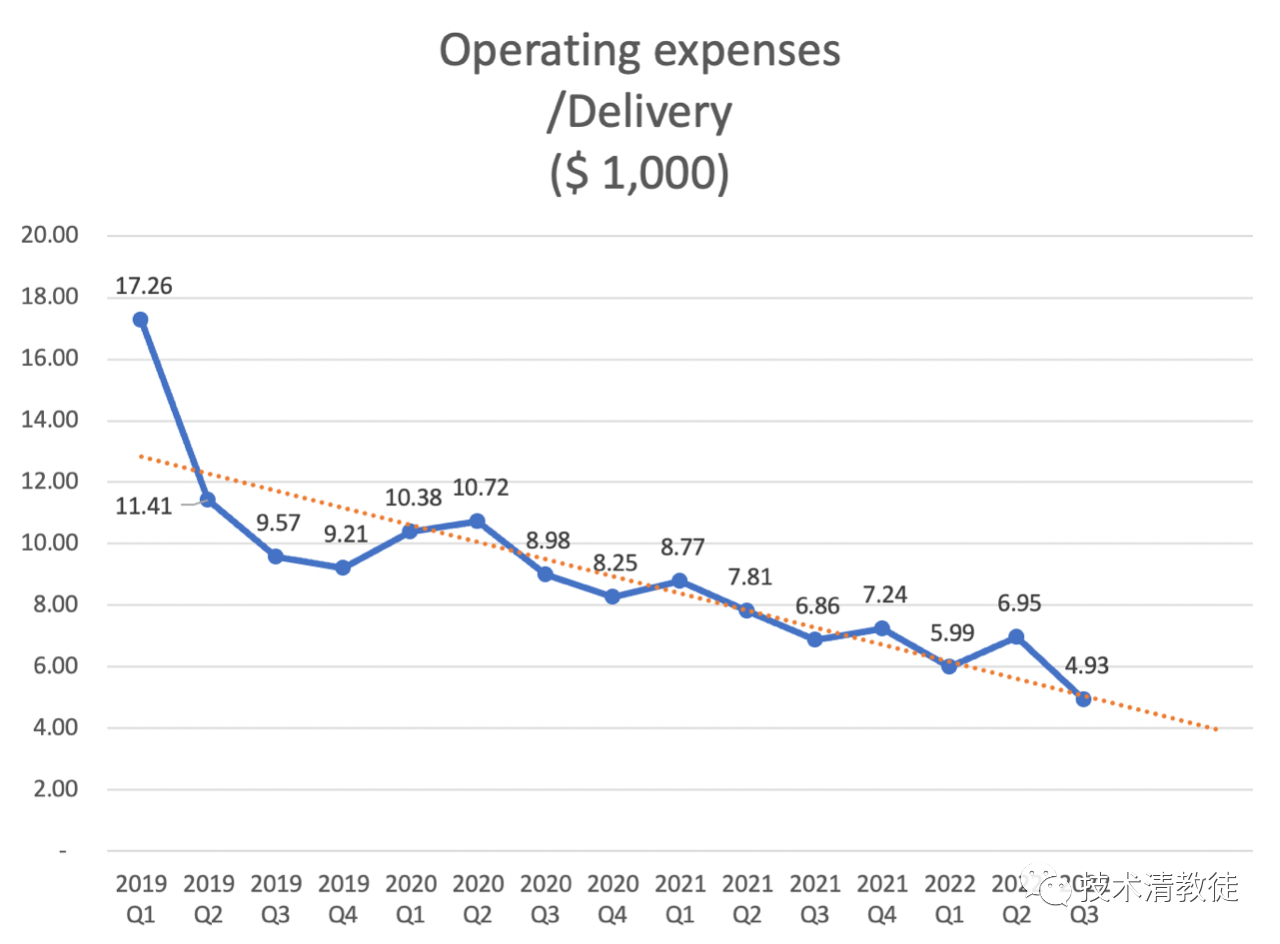

Operating expenses

One of Tesla’s biggest highlights this quarter is the cost control, which can continuously reduce the average operating cost per vehicle in high inflation.

Profit

Despite the decline in gross profit of individual cars, strong operating expense control has resulted in Tesla’s profit regaining its upward momentum.

Production Asset Efficiency

Depreciation and amortization per car continue to decline as efficiency continues to improve, and it is expected to reach a new low soon.

Depreciation and amortization per car continue to decline as efficiency continues to improve, and it is expected to reach a new low soon.

R&D Investment Efficiency

During the economic downturn, although Tesla may not be able to stand alone, it can be said that the new energy industry is one of the industries that should be less affected during the era when fossil fuel vehicles are still abundant. It is also gratifying that Tesla has demonstrated the appropriate posture to face the impact – strict control of costs and expenses, as making one dollar less in a recession has a higher level of certainty than earning five dollars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.