EV Battery Observations by Quarter

Contributing Author: Zhu Yulong

Editor: Wang Lingfang

Starting from this article, my observations on EV batteries for “Electric Vehicle Observer” will be done on a quarterly basis. I hope to share my thoughts on China’s EV battery industry from a short-term, medium-term, and long-term perspective.

As of late October in 2022, third-quarter data has been released, and the overall trend for the year can be roughly ascertained. Due to global trade conflicts and the trend of industry independence, the global landscape of EV batteries is undergoing significant changes. My predictions are as follows:

- The production volume of EV batteries in 2022 is expected to reach around 530GWh, an increase of 1.42 times compared to last year;

- The growth rate of China’s new energy vehicle sales may decrease in 2023, and there may be an oversupply of EV batteries;

- It is inevitable for Europe and the US to build their own EV battery industries. Chinese battery companies should actively participate in global competition, shifting from manufacturing in China to exporting from a manufacturing base in China.

Momentum Will Continue into Q4

1) Monthly Data Overview

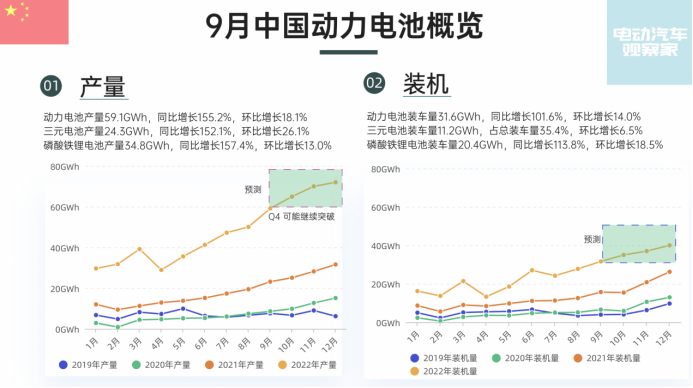

Let’s start with monthly data. In September, the production volume was as follows:

- EV battery production volume was 59.1GWh, a year-on-year increase of 155.2% and a month-on-month increase of 18.1%;

- Ternary battery production volume was 24.3GWh, a year-on-year increase of 152.1% and a month-on-month increase of 26.1%;

- Lithium iron phosphate battery production volume was 34.8GWh, a year-on-year increase of 157.4% and a month-on-month increase of 13.0%.

In terms of production volume, 59GWh is a new high for this year. With the exception of fluctuations in April, the overall production volume has been on a steep upward trend. There is a subsidy reduction point at the end of 2022, so it is important for car manufacturers to produce cars and obtain their certificates this year. Therefore, it is estimated that the momentum of production volume will continue to accelerate in Q4 of 2022.

The installed capacity of EV batteries is based on domestic certificate data, and in September, the installed capacity was as follows: 31.6GWh for EV batteries, a year-on-year increase of 101.6% and a month-on-month increase of 14.0%; 11.2GWh for ternary batteries, accounting for 35.4% of the total installed capacity, with a month-on-month increase of 6.5%; and 20.4GWh for lithium iron phosphate batteries, a year-on-year increase of 113.8% and a month-on-month increase of 18.5%.

Some EV batteries produced in China are exported, and since 2022, the export volume has been growing rapidly. Data from Battery Alliance shows that the export volume in September was 6.8GWh.

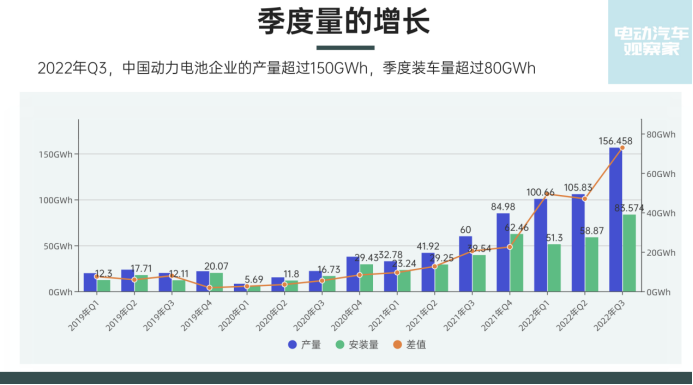

The difference between the production capacity from January to September and the domestic installed capacity is 169.2 GWh, with exports of 90.6 GWh. There is also 78.6 GWh that could be used as inventory or due to classification differences. Currently, there is a huge gap between the production capacity of the United States and Europe and that of China. Our industry chain has strong competitiveness in terms of maturity and scale globally.

The difference between the production capacity from January to September and the domestic installed capacity is 169.2 GWh, with exports of 90.6 GWh. There is also 78.6 GWh that could be used as inventory or due to classification differences. Currently, there is a huge gap between the production capacity of the United States and Europe and that of China. Our industry chain has strong competitiveness in terms of maturity and scale globally.

Looking at quarterly data, China is experiencing significant growth and a continuous increase in production capacity, from 100 GWh in the first quarter to over 150 GWh in the third quarter, with an estimated 170-175 GWh in the fourth quarter. The annual production of power batteries in China is expected to reach around 530 GWh, an increase of 1.42 times compared to last year.

Excessive production capacity may arise next year

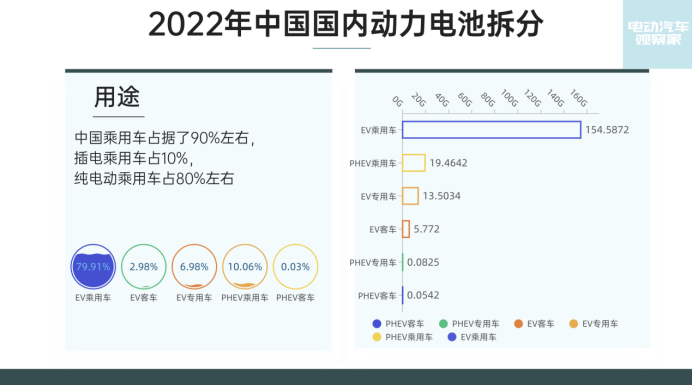

The surge in power battery production capacity is inseparable from the development of China’s new energy vehicles. The distribution of new energy vehicle models also directly affects the power battery structure.

In 2022, more than 90% of China’s new energy passenger vehicles will be electric, with pure electric vehicles accounting for 80% and plug-in hybrid electric vehicles accounting for 10%. In the next step, as the penetration of new energy vehicles continues downward, the growth of plug-in hybrid electric vehicle models in second- and third-tier cities will be faster. The rise of oil prices has also stimulated demand for 1-2kWh hybrid electric vehicles. China may have an accelerated trend towards hybridization in the next three years, which means that power batteries for hybrid systems will gain development opportunities.

In summary, there are mainly two trends:

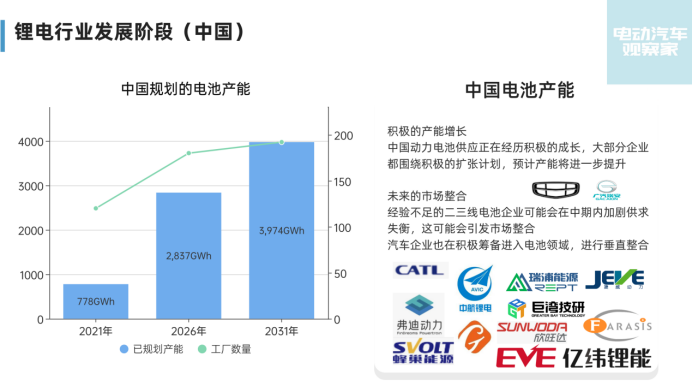

1) Continuous and positive growth in production capacity: China’s power battery supply is rapidly increasing, and most companies have positive expansion plans, with expected increases in production capacity.

2) Future market integration: Second- and third-tier battery companies with limited supply experience may face an imbalance in supply and demand in the medium term, which may trigger market integration. At the same time, automobile companies are actively preparing to enter the battery field and vertically integrate.The lithium-ion battery industry in China has entered a red ocean phase. With the double drive of government subsidies and high oil prices, the penetration rate of new energy vehicles has reached a high level. However, it should be noted that currently, one-third of the penetration rate is overdraft of the future, so it will be very difficult to continue to break through the growth.

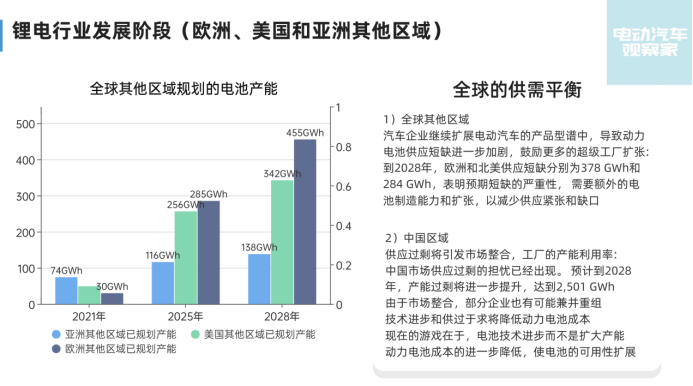

Concerns about oversupply in the Chinese market have emerged. In 2028, China’s battery production capacity will reach 2501 GWh.

Currently, the growth rate of new energy vehicles in the Chinese domestic market is likely to decline by 2023, and the battery supply will be oversupplied. Oversupply of production capacity will trigger market integration, and the capacity utilization rate of factories will decrease.

Due to market integration, some enterprises may also merge and reorganize. Technological advances and supply overhang will further reduce the cost of power batteries.

At this point, companies are not competing for production capacity but for technology. By further reducing the cost of power batteries through technology, the availability of batteries can be extended.

Thirdly, Ningde Times is far ahead in the tri-cobalt industry; the pattern of iron-lithium may continue to change.

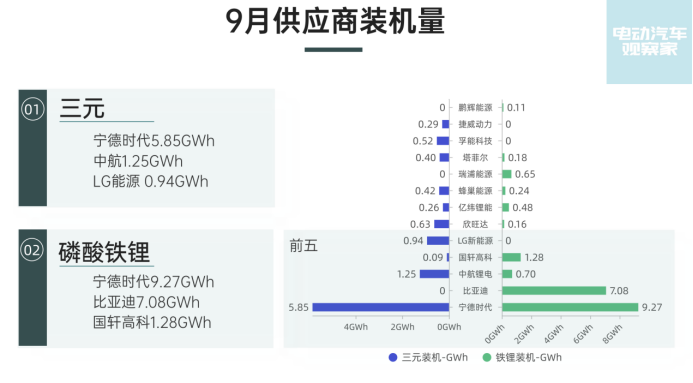

From the perspective of suppliers, in terms of ternary aspects, in September, Ningde Times installed 5.85 GWh, with a limited increase compared with the previous month; CATL installed 1.25 GWh, and LG Energy installed 0.94 GWh.

Currently, the main players continuing to expand in this field include CATL, Xinwanda, CATL, and EVE Energy. BYD and Guoxuan High-tech have shifted their main supply to the lithium iron phosphate battery field.

In terms of lithium iron phosphate, in September, Ningde Times installed 9.27 GWh. This data has a lot to do with Tesla’s delivery in China. Ningde Times’ supply to Tesla has been stable for the export and North American standard range versions. In September, BYD installed 7.08 GWh. As Tesla gradually balances, the gap between the two companies will gradually narrow.

In September, Guoxuan High-tech installed 1.28 GWh, and CATL’s installation data was 0.7 GWh, indicating that the production capacity of lithium iron phosphate has also risen, and the volume of Rieter Lanjun has also been raised to 0.65 GWh.

The competition in the field of battery power is fierce, with few companies able to keep up with the three-element battery enterprises’ pace of Ningde Times. Many companies focus their innovation on high-speed stack technology. However, second-tier companies are also producing blade-like batteries in the lithium iron phosphate field. With the emergence of various cutting-edge technologies, it is expected that the competition among lithium iron phosphate battery companies will change dramatically by 2023.

The competition in the field of battery power is fierce, with few companies able to keep up with the three-element battery enterprises’ pace of Ningde Times. Many companies focus their innovation on high-speed stack technology. However, second-tier companies are also producing blade-like batteries in the lithium iron phosphate field. With the emergence of various cutting-edge technologies, it is expected that the competition among lithium iron phosphate battery companies will change dramatically by 2023.

Expansion Overseas

By 2028, there will be shortages of 378GWh and 284GWh in power battery supplies in Europe and North America, respectively, indicating the severity of the expected supply shortages. At the same time, automotive companies are continuing to expand the product spectrum of electric vehicles, further exacerbating the shortage of power battery supplies and encouraging more super factories to invest in construction.

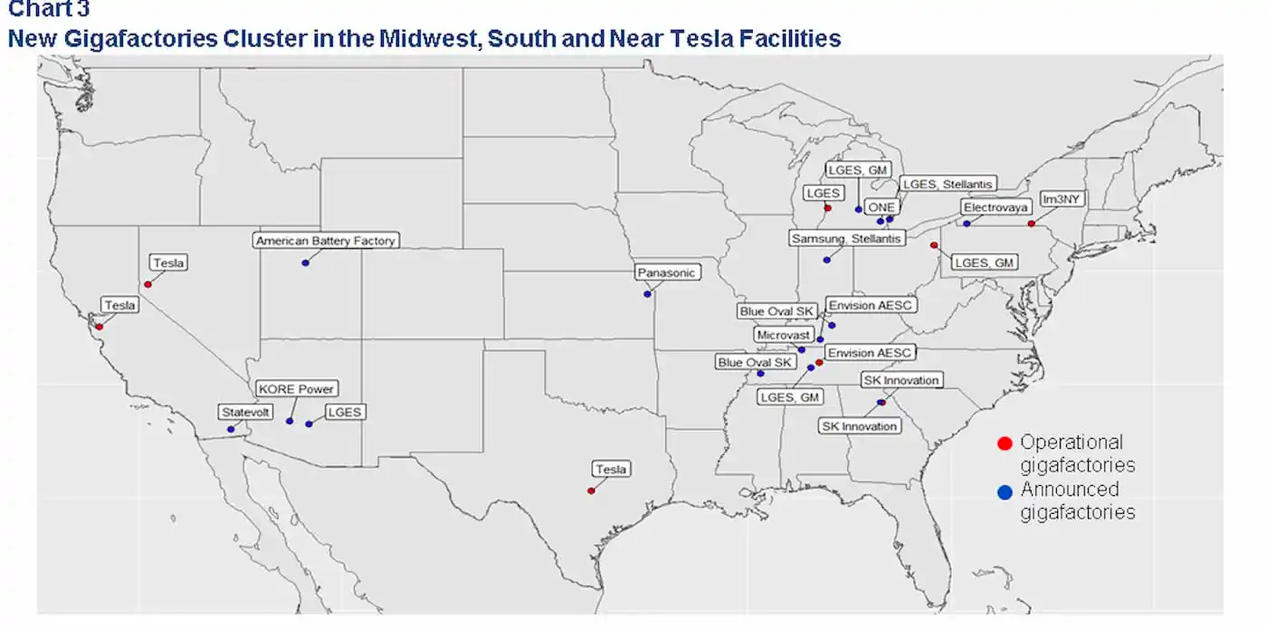

Due to the requirements of the “Lower Inflation Act,” the United States has opened a construction frenzy. Since early 2021, the United States has invested in 15 battery projects that are expected to increase production capacity by more than five-fold by 2026 and 86% by 2031. Most of the newly announced super factories are located in the same geographic region, also known as the “US Battery Belt.”

We see that Japanese and Korean battery companies, as well as US vehicle manufacturers, are very active in the US Battery Belt to build battery production capacity.

According to this plan, the United States will develop an independent battery industry chain.

The battery industries in both the United States and Europe are thriving. How should we objectively view this Act and the global competition faced by China’s battery industry?

It is understandable for a country to want to develop its own industry and to strive for advancement in a new era, especially if the country is at a disadvantage. The main issue is that we are not used to being second; the United States, Europe, Japan, and Korea are all ahead of us.

Regarding battery companies, I believe there are two points worthy of attention:

First, China’s industrial chain has an advantage due to being first, but if we set our sights too high, we may easily be replaced by other countries’ enterprises as talent and technology spill over.

Second, an effective strategy is to participate in global competition and build factories in Europe and the United States. Only by continuous running and iteration can we hope to maintain our lead. From China’s domestic manufacturing to its exporting manufacturing base, this is an inevitable trend towards globalization of the industrial chain.

Lastly, I believe it is necessary to give a thumbs-up to China’s battery industry chain. It can be seen that the companies leading the industry are under great pressure. Developing new energy vehicles and power batteries has become the consensus of countries with automobile industries, so the path we have taken and effective policies we have implemented will be learned and firmly executed by other countries.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.