Author: Zhu Yulong

As the automotive industry continues to advance, the evolution of automotive electronic EE architecture itself has resulted in increased regional computing power, which combined with cloud computing, has become a must for the next generation of intelligent vehicles. Complex and efficient interconnectivity and integrated systems inside and outside of vehicles are the key vertical integration technologies invested by each automaker.

The development of automotive electronics technology has resulted in a need for large-capacity storage. It is foreseeable that, in addition to computing chips, the demand for DRAM and NAND solutions in the global automotive market will continue to rise. As with the recent problem encountered, how many chips will be needed in the storage field during stable development of the automotive industry? What if there is no reliable supply?

Automotive Memory Requirements and Market Estimates

In traditional electronic control units (ECUs) for automotive electronic control units, the storage requirements are not high. In DCUs in the era of domain control, large-capacity requirements for automatic driving assistance and cockpit systems are mainly needed.

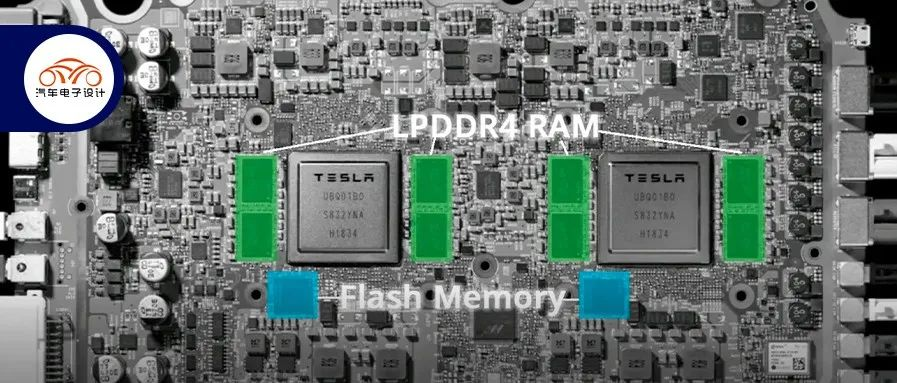

With the evolution of image technology, intelligent vehicles use 8-12 cameras, with a resolution of 8 million pixels, a refresh rate of 60 frames/second and a depth of 16 bits, resulting in a data flow rate of nearly 10GB/s. The LPDDR4 and LPDDR5 used in mobile phones are now also being used in cars. In order to meet the higher automotive-level certification requirements compared to mobile applications, their functionality is being enhanced. LPDDR5 is particularly suitable for the larger displays used in the latest vehicles, and can manage the control area of the increasingly complex navigation images and driver cockpit units.

The computing power consumption of intelligent vehicles is limited, and future E/E architecture and automotive memory also need to become more energy-efficient to cooperate with the calculation process. The next-generation automotive memory needs to continuously break through the limits in bandwidth, latency, power, and capacity. Large-capacity NAND flash modules also play an important role in many automotive applications and systems, and many storage functions use non-volatile memory.

The computing power consumption of intelligent vehicles is limited, and future E/E architecture and automotive memory also need to become more energy-efficient to cooperate with the calculation process. The next-generation automotive memory needs to continuously break through the limits in bandwidth, latency, power, and capacity. Large-capacity NAND flash modules also play an important role in many automotive applications and systems, and many storage functions use non-volatile memory.

According to Yole’s 2021 data, the growth of the automotive industry is indeed increasing rapidly. From 2020 to 2026, DRAM grew at 35% (GB per system), NAND at 57%, which is three times faster than the growth of smartphones and tablets.

Yole’s report also has a schematic diagram, and in fact, the speed of the transformation of intelligent vehicles is relatively slow, and the base is small compared to consumer electronics such as mobile phones.

Characteristics of Automotive Storage

Due to the requirements of the automotive industry, memory companies need to support AEC-Q1004 automotive-grade quality standards, establish standard processes, and cover the design stage of R&D to production complying with IATF 169495 standard. From a software development perspective, the improvement of automotive software performance conforms to the ASPICE6 standard and functional safety (ISO 26262 standard). These automotive industry standards help to ensure clear communication among stakeholders throughout the entire product lifecycle. Traceability not only enables product designers, engineers, and testers to confidently engage in development work, but also makes the market safer and vehicles more reliable. Following these standards will help to improve quality and efficiency and reduce failure rates.The development of in-vehicle memory requires error correction code (ECC)8, built-in self-test (BIST)9, and cyclic redundancy check (CRC)10. It needs bit units with better temperature resistance and error correction for DRAM wafers that lose charge during the refresh process.

NAND Flash has an erase-and-write limit, and the requirements for vehicles in the automotive field are usually either six months or ten years. Depending on the workload, selecting an 8GB capacity storage can support up to 20TB of total writes in ten years. The problem with Tesla’s choice of capacity is that many new and updated applications continue to emerge, and as the workload increases with usage, the consumption of NAND Flash vehicle capacity may accelerate, leading to situations where the vehicle may not start in the fourth or fifth year when originally it would have been able to operate safely for eight or ten years.

In conclusion: embedding in hardware is ultimately necessary, therefore selecting a larger capacity storage for the sake of the vehicle’s life expectancy is worth considering. To further advance the progress of intelligent vehicles, it not only requires pioneering companies like Apple and Tesla to push forward with software development but also necessitates high computing power, large storage, and an efficient service backend.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.