Author: Zhu Yulong

This year, besides MG (SAIC) and XPeng Motors, NIO and BYD are all using the European market as a big springboard. The rationale is very clear:

-

Major European countries such as Germany, France, Italy, and many Western European countries all have subsidies, and after the subsidies in Nordic countries run out, there are tax incentives. The same models can be priced higher in Europe than in China. Manufacturing and exporting to Europe from China can result in a premium.

-

European car companies, from BBA to Volkswagen, Toyota, Honda, and French cars, are all facing issues in China, such as slow iteration and relatively high prices. We have a gap in competitiveness and internal circulation.

Recently, ACEA President and BMW CEO Oliver Zipse said on some occasions that “To ensure a recovery in growth, to move a larger share of sales to electrified cars, Europe urgently needs to set the right framework conditions – greater flexibility in the European supply chain, the EU critical raw materials law to secure strategic access to materials needed for building electrified cars, and accelerated roll-out of charging infrastructure. Significant events in the past few years, such as Brexit, the COVID-19 pandemic, the semiconductor supply bottlenecks and the Russia-Ukraine conflict have impacted prices and energy supply, with the speed and depth of change in the world being unpredictable. This applies in particular to the geopolitical backdrop, which exerts a direct effect on the industry and its closely entwined value chain.”

In simple terms, various regulations in Europe severely affect the development of European car companies, and combined with various policies, the European automobile industry is in a weak period. ACEA has revised its initial forecast that the EU car market will recover growth in 2022, and is expected to shrink again this year by 1% to 9.6 million units. Compared with the data in 2019, car sales have fallen by 26% in just three years.

In fact, Chinese car companies entering Europe at this particular moment may not know how much money they can earn in terms of economic benefits, but the challenges it poses geopolitically are significant. The effects brought about by earning tens of billions in revenue may need to be carefully assessed, somewhat similar to the entry of Japanese car companies into the US market. One thing to note is that the correlation between employment population and the automotive industry in Europe, and subsequent economic and ZZ problems, are all rooted in the same problem.

The Homogenization in the Global Automotive Industry

With the background of the global automotive demand declining, the automotive production countries are competing for market share and attempting to improve production capacity utilization. The competition between automotive products inevitably extends to the competition for markets, and competition in the domestic market is relatively easy.

Europe faces particularly significant challenges. As shown below, European automotive production has declined for four consecutive years.

In 2021, the EU exported 5.1 million passenger cars, which were among the top ten destinations for EU passenger cars globally (the United Kingdom, the United States, China, Turkey, Ukraine, Switzerland, Japan, South Korea, Norway, and Middle Eastern countries).

Despite people’s expectations, only 410,000 European cars were exported to China in a year, and this number may decrease in 2022. The equity of the European automotive industry in China mainly revolves around the investment of German automotive companies and part of imported cars.

According to IHS data, the sales of new energy passenger cars worldwide reached 7.83 million units from January to August 2022, with Chinese new energy passenger cars accounting for 38.6% of the market share. Europe is the second-largest market, accounting for 27.2% of the market share. Among them, the sales of pure electric passenger cars worldwide were 5.05 million units, of which Chinese pure electric passenger cars accounted for 46.2% of the market share, and Europe was the second-largest market, accounting for 21.8% of the market share.

Chinese Automotive Companies in Europe

Chinese new energy automotive companies have been active in Europe lately:

- In the second half of the year, BYD announced a strategic partnership with Hedin Mobility, a leading dealer group in Europe, to provide high-quality new energy automotive products for the Swedish and German markets.- In early October, NIO held the NIO Berlin 2022 event in Berlin and officially announced the adoption of an innovative subscription model to provide a full system service in four countries, including Germany, the Netherlands, Denmark, and Sweden, and opened reservations for three NIO NT2 platform models: ET7, EL7, and ET5.

In fact, we have seen Chinese brands, including MG, Maxus, and Polestar from Geely, selling in Europe. In my understanding, it is important to enter the European market to occupy it.

Europe has also issued the “EU Battery Regulation”, which covers various stages of the entire life cycle of batteries, from the production and processing of battery raw materials, to the use of battery products, and to the recycling and reuse of retired and scrapped batteries. In response to the new requirements proposed in the new regulations, companies need to take action in product development, raw material procurement, and supply chain management, and formulate and implement medium- and long-term response plans in a timely manner. In fact, this battery regulation will bring considerable challenges to the battery value chain, especially new energy vehicle and power battery production enterprises, when entering the EU market.

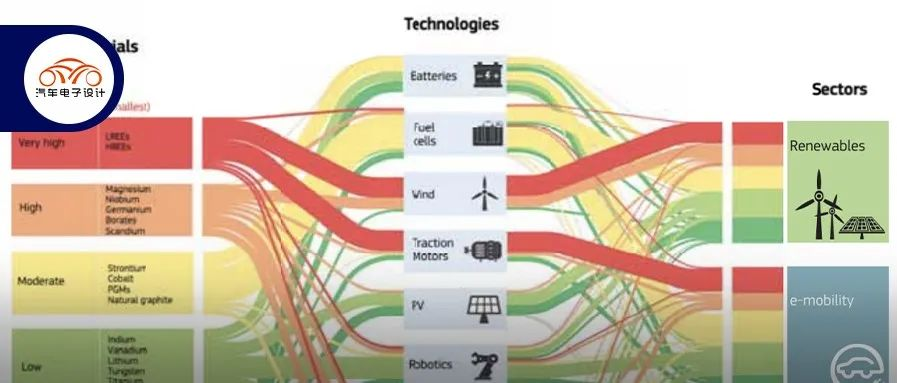

In September, European Commission President von der Leyen stated that the EU needs to strengthen its ties with reliable countries and key growth regions, and ensure the supply of lithium and rare earths to promote the green economic transformation. She will push for the approval of trade agreements with Chile, Mexico, and New Zealand, and strive to promote negotiations with partners such as Australia and India. The EU needs to avoid dependence in the transition to the green economy, just like the dependence on oil and gas. She pointed out that currently, 90% of rare earths and 60% of lithium are processed by us. The European Commission will propose a new legislation, the “European Critical Raw Materials Act”, to identify potential strategic projects and establish reserves in areas facing supply risks. Whether it will be similar to the US’s IRA, we all need to discuss in further.

Summary: For your reference, I think the road to industrial rise is full of thorns, and we cannot seek temporary gains. We need to look at the problem from a more comprehensive perspective.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.