Karakush

On the morning of the 8th, Nio held a European launch event at the Tönnieshall music hall in Berlin, Germany, placing three latest products and unique Nio mode on the crown of the European automotive industry.

They also entered the markets of the Netherlands, Denmark, and Sweden – but you don’t care so much about them. Reason tells you they are not worth the effort, but ultimately they will succumb to the boiling enthusiasm: Germany is the true strategic location, and only with a foothold in Germany can one stand among the national industries.

Resistance gives meaning to conquest. It’s like a German coming to China to play table tennis, and you can’t help but show a big-country condescending, “I love you” look in your mind. Twenty years ago, Timo Boll of the small town of Saxony carried this kind of inexplicable fear and came to Jinan, defeated Wang Liqin and Kong Linghui, and won the men’s singles championship of the Table Tennis World Cup.

Today many friends are looking forward to seeing Nio’s same dramatic growth: “taking a hatchet to a polished design”, not just a small axe for Nio, but a comprehensive victory for Chinese hatchets.

At the same time, doubts and praises were sprayed loudly on their heads.

The biggest controversy comes from Nio’s promotion of the “subscription model” in the new European market, and only renting instead of selling. The competitiveness seems to have dropped from nuclear war to finger-guessing where you are not necessarily unbeatable. How to count to invade, how to do high-level, is there still a chance to win over BBT?

On the afternoon of that day, Li Bin and Qin Lihong also admitted at the communication meeting that there had been a lot of controversy about the subscription, “Overall, the controversy in China is greater than that in Europe.” Here we explain why Nio chose this model, what is its underlying logic, and how we should understand the overseas strategy of Chinese brands today.

Subscription is not inferior

From the perspective of business decision-making, Li Bin made several explanations for the subscription model:

First of all, after sufficient research on high-end users in Europe, Nio found that in the D/E/F high-end market, usage rights users are actually the mainstream, accounting for nearly 60%. The traditional “company car” in Europe provides an environment for using subscriptions, in addition to being used as production equipment to support business, it is also provided to employees as a physical welfare, or assigned to senior management as a car in the travel atmosphere (comes with the suit 😉 ).

The concept is not unfamiliar, but the scale is what matters. According to Deloitte’s statistics in 2017, in the new car sales in Western Europe in 2010, the share of enterprise channels was almost equal to that of private channels, but later on, it surpassed with two thirds of new car sales flowing into enterprise channels, with the majority being company cars (other enterprise channels also include leasing companies, dealerships, OEMs, etc.).

This is completely different from the capacity of B2B customers in China, which is very unique on a global scale and cannot be directly compared. Regional uniqueness comes from policies. In many European countries, if you buy a car in your personal name, you may have to pay the full price; however, if you buy a car in the name of a company, you can often pay much less by applying for value-added tax returns and depreciation write-offs.

In the mainstream eight countries for company cars (accounting for 87% of the European company car market), only the UK and the Netherlands receive more tax revenue from company cars than private cars, while the other six countries are much more favorable towards private cars.

According to statistics from the NGO organization Transport & Environment in 2020, the EU 27 countries and the United Kingdom subsidize company cars to more than 32 billion euros each year, and Germany is even the oldest subsidy provider, close to 8 billion euros (however, Germany is also the only mainstream country with an average subsidy per car less than 1,000 euros, which is still incredibly large).

The overall design promotes company cars as a compensation for ownership of private cars. Of course, there still exist individual users who insist on buying cars. Part of this group “just likes to buy cars,” with modification demands, and NIO judged it accounts for about 20% of the total; and the other part may be because their company does not have relevant policies, or they simply have not reached the level to enjoy policies.

These build the market foundation: consumption of usage rights is a widely understood and accepted mainstream car consumption model, and it is solidified through the tax system. The subscription model is not squeezing soft persimmons, or like those assumptions that leasing can quickly clear inventory and increase production online (in terms of production capacity and pricing, it is something else); rather, it is a concentration of resources to prioritize attacking the larger common denominator, and it is a commercial choice that takes reality into account.

Different realities lead to different business decisions. For example, Norway is the first European market that NIO entered, where there is no import tax or value-added tax for electric cars, and usage rights users account for less than 10%. Therefore, NIO still does not provide subscriptions in Norway, instead directly selling cars at comparatively lower prices.

Li Bin stated that in places where selling cars is the focus, they sell cars, and in places where subscriptions are the focus, they focus on subscriptions. They won’t both sell and subscribe because the two are entirely different logics. Currently, the European team is in the process of expanding, and each business system needs to focus. When the business is on the right track, the system and team are mature, and if users still want to buy, they will add a permanent subscription option, “but that’s certainly not now.”

Moreover, NIO finds that there are many pain points for users now, and the more painful it is, the more opportunities there are. The unique position of NIO is that it directly enters the automobile industry, which is not common.

Management companies that offer usage rights services (including subscription and leasing) are roughly divided into three types: one is a banking system background, such as several big players, ALD belongs to the French Industrial Bank, Arval belongs to the French Bank of Paris, and LeasePlan belongs to a multinational fund consortium; the second is the background of the automobile company, such as Alphabet under BMW, Athlon under Daimler, and VWFS (Volkswagen Financial Services) owned by Volkswagen; and the third is a small group of independent companies.

Whether compared with other automobile brands, third-party, or financial companies, the characteristic of NIO’s model is to reduce intermediaries, and even without dealers, it introduces a retail-like direct selling concept in the subscription system, which can definitely bring efficiency improvement to the system. On the other hand, by serving users directly, it can better create value around the usage rights and subscription model to enhance the experience.

These advantages have been verified in direct sales.

To be specific, what pain points can NIO solve and what value can it provide? For example, greater flexibility. Qin Lihong cited two details:

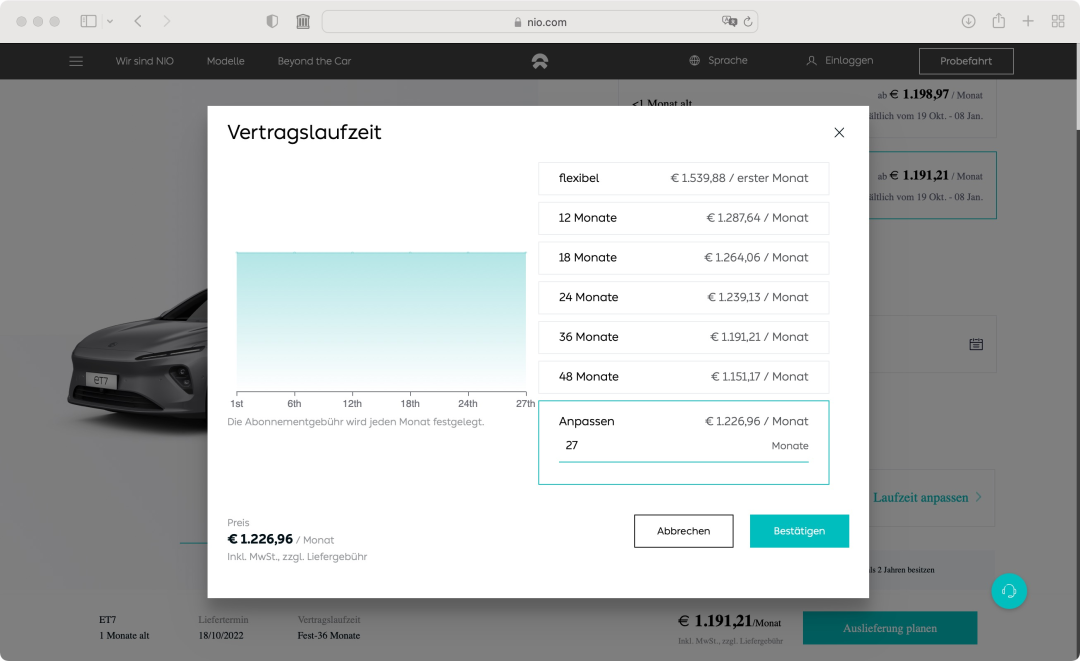

One is the contract period, which is very flexible, starting from one month (not daily rent), and it also provides relatively long-term plans, such as up to 60 months, which is five years. Except for two fewer transfer procedures, it is no different from the holding experience of a purchased car.

The “fixed price” announced at the press conference is actually the short-term subscription unit price under 12 months. For long-term subscriptions of 12-60 months, NIO has also announced stable preferential prices. The longer the contract period, the more preferential the corresponding monthly average unit price is, and each number corresponds to a different unit price.

Other platforms do not have such delicate choices and gradients, nor do they have such wide-ranging lengths. For example, they only offer two options of 6 months and 12 months, which is convenient for management, but not so close to the needs of consumers.

The other is “one car, one price.” When opening the configurator, every one of hundreds of cars has a benchmark price that belongs to it, and the price is slightly different according to the configuration (and in the future the condition of the car).The devil is in the granularity, which is crucial in improving individual experience but also tests the operational capability. Thus, compared to car selling, subscription is a more challenging system. The pricing mechanism alone is more complicated, not only considering the vehicle cost but also the cost of funds, service, subscription rate, renewal rate and profits.

“If you compare our subscription options on the app to what others are doing in Europe, you’ll see a big difference,” said Li Bin. “Flexibility is the new premium.” This statement not only defines the high-end experience brought by Nio, but also implies that only through system innovation can Nio have the ability to support such changes.

The real change lies not only in the subscription model targeting the European market, but also in Nio’s systematic thinking about subscription. In fact, friends who know about Nio’s practices know that Nio hasn’t done single-point innovations based on certain technologies, services, special needs or competitors, but has established a complete system innovation from a long- term perspective. This is the premise of its strategic vision.

Subscription is the same. From the bottom-up logic, long-termism can be summed up into a core question, “What changes are happening these years?” Li Bin pointed out that cars will eventually become services. “Cars are not houses, but a consumer product, just a durable product with high value. But as a consumer product, users still have a lot to worry about. We hope to simplify the user interface for services. Nio has made many attempts over the years, such as BaaS.”

Car subscription is a similar attempt. BaaS is to add services to the battery, while subscription is to add services to the entire vehicle (let’s call it CaaS, shall we?). “Launching this needs the right timing, geographical location and people,” said Li Bin. Europe is the right time, having undergone a development process, the so-called “soil”, which is not only a friendly consumer market, but also a mature infrastructure and link for online services.

The evolution of “cars as a service” can be significantly seen from the development of corporate vehicles. Initially, company vehicles were the assets of the enterprise itself. Then there were third-party fleet management companies, which reduced the ownership costs, especially the two big items of depreciation and operating costs. Now, more and more companies are providing mobile total cost optimization solutions, which is a kind of service-oriented transformation.If we look beyond the automotive industry, many industries are shifting from selling products to “products as services”. We are familiar with subscription content such as streaming, music, and cloud storage; whereas in the B2B sector, it is already quite exciting, such as KUKA robot second-hand leasing, Rolls-Royce aircraft engines charging by usage/time, and Kaeser air compressors charging by cubic meter of air (indeed called air-as-a-service).

The fundamental changes can be summarized into two points: first, the separation of asset management costs; and second, flexible supply and demand. For automotive consumers, when cars are separated from bulk consumption assets and return to consumer goods, we will no longer have the pressure of depreciation when buying a car; and when car services become more flexible, our expenses will be more accurately tailored to our travel needs, reducing individual costs and improving operational efficiency.

This is an intensive and universally beneficial endgame view, which will inevitably come to fruition.

Can the NIO model penetrate Europe?

Under the long-term strategy, the short-term problem is whether NIO has a competitive advantage under the subscription model.

First, is the pricing too high?

Some netizens pointed out that NIO’s pricing is higher than that of leasing, which is a wrong criterion; NIO’s subscription model should be compared with Auto-Abo, which includes a lot of services such as insurance, summer/winter tires, pick-up/drop-off, maintenance, etc. that are not included in leasing, except for all-inclusive energy.

Qin Lihong said that we will insist on our way and let everyone get used to our pricing system; after getting used to ours, they will find it inconvenient or insincere for other non-all-inclusive pricing systems. This is our “positive strategy”.

Looking at it from the perspective of Auto-Abo, NIO’s pricing is not unreasonable. According to Qin Lihong, it is reasonable for NIO’s pricing to be close to some Porsche models, which is the level that NIO should have. “Many people are used to thinking that Chinese brands should be much cheaper than German brands for the same car, but we don’t consider this factor. We still let the product return to its value essence.”

In addition to upholding high-end dignity, NIO also follows a long-term pricing strategy. The biggest variable here is the subscription rate. Based on a high subscription rate, NIO considers economic returns. If the subscription rate is too low, like stocking inventory in retail, even with high prices, it will lose money. Assuming the subscription rate can reach 95%, a flexible pricing structure can still be profitable.

“We won’t do things that lose money to get attention. We still need reasonable gross profit margin and sustainable operation.”

Taking the above factors into consideration, NIO’s goal in Europe is not about quantity, but whether it can win a reasonable market share through products and services, and win respect through consumer voting.

Secondly, can Europeans accept NIO-style innovation?

Compared with other Auto-Abo luxury car subscriptions, a special advantage of NIO is to provide the “NIO user experience”, from Bull House, space, community and user activities to battery swapping stations, complete export. The scale is initially smaller, for example, there are more than 20 battery swapping stations by the end of this year, and more than 120 by the end of next year; based on the population dividend of China, manual services will also become unmanned self-services.

Does this new model still work in Europe to help NIO open up the situation?

After all, we had a perception in the past that the demand for cars in Europe and China is very different. It is reflected in those honest products that are not innovative, good at design and driving, but can achieve good results in Europe. The heavy investment in intelligent cockpit and automatic driving, service system, circle socialization by NIO is not the rigid demand of Europeans.

However, NIO does not look at it that way. It is not only about the company’s initial globalization vision and layout but also standing above global demand-

“We really cater,” Li Bin said, “really building a research and development, supply chain, and product system in accordance with the trend of the development of intelligent electric vehicles, really building a brand interaction with users in the era of mobile socialization, establishing a community based on cars, and building the entire company’s business and mission from all aspects.”

It is not to catch up with the actual performance but to restore the appearance of the natural; it is not shaped by the world, but shapes the world. This idealism can be understood by everyone and can be universally recognized.

For example, at the press conference, Nomi, AR glasses, and 150-degree batteries that were highly sought after, as well as the lively Bull House in Oslo, it is difficult to say that Europeans refuse innovation, and refuse technology to reshape cars. It’s just that they haven’t been given such a choice before.

“If you say what the advantage of NIO is, it is the opportunity to rebuild a comprehensive system for the future from vision to action, a brand new system and business model. We have no worries, and we have no burdens. This is our biggest advantage.”

You may say that such NIO cannot afford to create a paradigm for contemporary China’s going global. Just as Qin Lihong said, “We cannot represent all Chinese brands, we can only represent ourselves.”

But such a brand is enough to let the world see that a brand from China can cross the boundaries between people, culture, and civilization, and provide a common value. “We believe that the bottom-line logic is good products, good services, and a community that is full of positive energy and connects people more closely, which is unbreakable.”In today’s fragmented world, efforts to flatten the differences in the human community in an attempt to treat everyone as part of a shared destiny are both warm and worthy of respect.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.