On October 8 at 00:15, a heavyweight overseas press conference marked the end of the National Day holiday for automotive media professionals.

NIO officially launched its European market products and sales service system in Berlin, Germany, entering the European market in a similar way to long-term leasing, and the first batch of ET7 deliveries will begin on October 16.

Before watching this press conference, I never thought that an overseas press conference of a Chinese car company could be so exciting. What was released is not important, it is all familiar to us, what really excites people is the way NIO pushes its brand, products and sales service system to overseas markets.

I dare to say that NIO is definitely the first Chinese local car brand that can introduce a brand-new foreign pure electric car brand to European consumers in a way that European consumers are familiar with on the European continent. This is an unprecedented achievement in the history of the Chinese automobile industry.

I estimate that many friends will be surprised when they read this sentence and think that I am exaggerating. Let’s talk about it and see if my evaluation of NIO makes sense.

How many cars can a brand that talks about international sales without any preparation actually sell?

Since Geely acquired Volvo many years ago and staged a snake-eating-elephant drama, the dream of Chinese domestic cars going global has never ceased.

Unfortunately, the objective gap between the Chinese and foreign automotive industries is here, and many policy issues have made it difficult to realize the dream of Chinese domestic cars going international. Until in the last decade, Chinese automakers have accumulated enough capital strength and product technology strength. Chinese-made cars, even those carrying Chinese brands, have truly tried out overseas cargo ships and entered international auto markets where Chinese brands have never set foot before. A few successful cases, such as Lynk & Co in Europe, Haval in Australia, and BYD in Japan, have allowed overseas consumers to intuitively feel the strong product power and outstanding cost-effectiveness of Chinese cars.

At the same time, we should also see that many Chinese local car companies merely use “going global” as a gimmick to cater to the capital market, or seek new sales channels for cars that cannot be sold in the Chinese market. For example, Aiways, which announced in May that it was exporting to “fifteen countries overseas”, actually only exported 1676 units in 2021, and many of the sales were absorbed by overseas leasing companies, without possessing real impact on the C-end market.Do not laugh at AIWAYS, some car companies that made big offshore declarations have even worse results than AIWAYS.

Is it worth promoting the sales of Chinese car companies overseas? Of course. Sales are the most appropriate quantitative data to measure the market performance of car companies. However, I personally believe that data such as sales volume and delivery volume, which can be mixed with water, are not suitable to be the only evaluation criteria for the internationalization achievements of Chinese car companies at this stage. Just like the experience of Volkswagen Group entering the Chinese market in the 1980s, a car company wanting to truly develop in a brand-new overseas market is not as simple as finding a cooperative dealer locally, opening a store and then shipping Chinese-made cars overseas.

NIO’s “premeditated” seven-year offshore plan

The weaker the offshore story of other brands, the more prominent the sense of weight of NIO’s offshore plan. NIO’s internationalization has never been as simple as sending hundreds of cars abroad.

The beginning of the story dates back to London about seven years ago.

In June 2015, the first season of the FIA Formula E Championship ended in London, UK. The team that won the first championship of the FIA top-level event was the Chinese team, NextEV NIO TCR Racing Team, based in the UK.

Previously, any international event of the same level as the FIA had almost no connection with Chinese car brands. This is a field belonging to world-class car companies or racing brands.

A year and a half later, still in London, NIO held its first brand launch event in the UK, announcing the name change from NextEV to “NIO” and also releasing its first product, the NIO EP9, a limited-edition pure electric hypercar with record-breaking track performance.

In the UK of 2016, talking about intelligence and autonomous driving as an auto brand was likely to appeal to only a few people. After all, this is a country that has nurtured old luxury car brands such as Jaguar, Land Rover, Aston Martin, and Rolls-Royce and is also one of the most technologically advanced racing countries in the world. At this time, NIO chose to declare the birth of its brand with a high-performance pure electric hypercar, undoubtedly using a still-weak brand to challenge the minds of petrol heads in the UK and even Europe.

Since then, until the first NIO Day in November 2017, NIO’s activity in the overseas market has not diminished in the slightest.In March 2017, NIO participated in the Southwest by South Music Technology Festival in the United States, where they showcased their autonomous driving version EP9 and NIO EVE concept car. This event helped push the development of numerous cutting-edge cultural phenomena in the US, and expanded NIO’s brand highlight from racing tracks to more accessible and futuristic intelligent technology.

In May 2017, NIO announced that the EP9 had set a new “fastest lap record of a production vehicle” at the Nurburgring North Loop with a time of 6:45.900, beating the previous “fastest lap record of an electric vehicle” set by themselves by nearly 20 seconds.

We can see that many of the groundbreaking events of NIO’s early years did not happen in China. During NIO’s initial entrepreneurial phase, the company built up a good reputation among Chinese consumers by telling stories that were popular with Europeans and Americans. They broke track records in the UK and Germany, won the Formula E championship, and talked about autonomous driving in the technology-innovating United States.

Indeed, the NIO UK team in charge of the EP9 and Formula E projects was not cheap, but it was difficult to deny the value of the investments NIO made in the early days when Li Bin, founder and CEO of NIO, showed off these glorious stories to the European media at today’s NIO Berlin conference. These stories have continued to shine in NIO’s brand message house over the years.

Here, let’s also remember Martin Rich, the deceased co-president of NIO in 2016, who was in charge of NIO’s supercar and FE projects. On the day of his passing, NIO’s official website released an obituary signed by Li Bin.

So when NIO shifted their attention from overseas back to mainland China and sold the Formula E team during a financial crisis, retaining only the naming rights, did they stop laying the groundwork for overseas markets?

Not at all. Rather than causing trouble overseas, what NIO did that was more clever was to consider the preferences of overseas consumers even while in China, and expand their boundaries using a means that could be recognized by consumers at home and abroad.Actually, I believe the information presented at the NIO Berlin launch event early this morning is not worth staying up all night for Chinese consumers, because over 95% of the information presented has already been released in China, with only a focus on battery swapping stations, the NIO House network, and sales modes being new.

The real highlight is how NIO showcased its capabilities.

While watching the event, I was surprised to see that NIO has taken many things it has done in the Chinese market, such as operating NIO Houses, setting up user trust funds, launching the Clean Parks ecological co-construction plan, NIO Summer Exploration camps, the design language of NT2.0 products, and the cool naming of intelligent systems, and transformed all of them for European consumers in a matter of seconds. For example, the name NOMI is simply “Know me”, which is almost unbelievable that this is how NIO named it.

NIO really understands consumers in Europe. They have integrated Western models into the products and services previously offered to Chinese consumers, so much so that the same story can be told in different languages, winning over consumers in China and Europe.

Furthermore, NIO is not just imparting “information” to European consumers, but “values”, which is something that can establish brand recognition in the depths of the human brain. For example, the design philosophy shared by Andreas Nilsson, Senior Director of NIO Design Center, has the ability to elevate the conversation from a low-level discussion of “Is the ET7 good-looking?” to one that focuses on the underlying design philosophy behind NIO’s work.

I believe that the European road trip of Li Bin and Qin Lihong is not just about researching the local market environment and business, but is also about shortening the emotional distance between these two East Asian entrepreneurs and European consumers before the NIO Berlin launch event.

# NIO’s Localization Efforts in Europe

# NIO’s Localization Efforts in Europe

NIO’s forward-looking vision and localization capabilities are possibly unparalleled in the global automotive industry, which has helped NIO establish a closer relationship with users, media, and KOLs in Europe. It is worth noting that European media’s independence from commercial enterprises is high. The fact that media such as the Southern German Newspaper, Germany Commercial Newspaper, Reuters, Financial Times, Auto Bild and others landed exclusive interviews before the NIO Berlin launch must have been due to NIO’s international PR team’s localization communication abilities and NIO’s brand influence in Europe.

Of course, NIO has also done many practical things in Europe: Investment in building the NIO Energy Europe factory in Hungary; More than 20 battery swap stations went online this year, and the layout will exceed 100 next year; NAD’s localized research and development and operation; Building the NIO House direct sales and NIO Service service network… These actual achievements form the business foundation for NIO to continue its storytelling.

After years of deep deployment, today’s NIO is capable of presenting a very complete system to the European market and has not shown any signs of being incompatible with the local environment. Its European localization is not inferior to that of European brands. Such hard-earned localization achievements are the result of NIO’s continuous efforts over the past seven years.

A car company that tells its story and does its job so seriously should not have a significant gap between its actual performance. If the worst-case scenario happens, it is also worth analyzing it in depth.

Birds of a Feather Flock Together

In any country, cars are a large consumer item for families and individuals. People are more likely to choose brands that they are familiar with and more traditional.

We should be clear that Chinese car brands have poor sales in Europe and the Americas besides uncontrollable factors such as import and export policies. The most crucial limiting factors are the sales and service system and the brand foundation, not the product’s power. As the saying goes, “birds of a feather flock together”. No matter how good your car is, if consumers do not recognize you, and sales cannot talk about it, and quality service cannot be guaranteed after purchasing the car, how can you achieve good sales?

Therefore, when Chinese brands already have excellent products and want to enter overseas markets, they must first focus on building their brand to allow consumers to identify with them. Only then, with positive feelings established, can consumers get to know the product, and eventually become loyal customers.Unfortunately, many Chinese new energy vehicle companies have misunderstood their brand influence and believed that their achievements in the Chinese and international capital markets are enough to prove their dominance.

Let’s take NIO as an example.

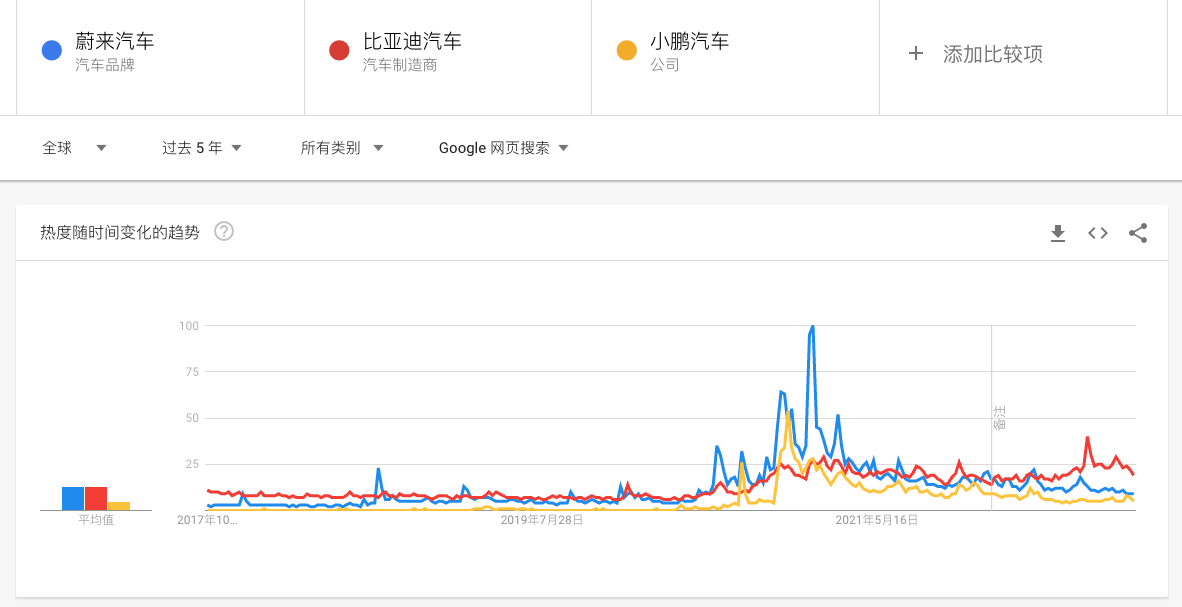

Do you think that the peak of NIO’s recorded search volume on Google Trends is its 2018 IPO?

The answer is no. Based on Google’s statistics over the past five years, the peak of web search traffic for the NIO brand actually occurred after the release of the ET7 in 2021. Even in Australia, a market not associated with the NIO brand, there was a peak in search engine traffic for “NIO” in mid-January 2021.

We must admit that Chinese automotive brands are still not comparable to traditional brands such as BBA, Volkswagen, and Toyota in the eyes of many Western consumers. However, the disadvantage of Chinese automotive brands is not product technology, but rather the lack of localized brand stories.

Throughout history, regardless of luxury or ordinary cars, as long as there is a story associated with the brand, a well-crafted story will make consumers more receptive to the product, and they will recommend it to others. Furthermore, it’s best if the story has some local flavor.

Consider the Honda Fit GK5, a car that is not particularly impressive, but can still be used to tell the story of Honda’s athletic genes. If the GK5 were replaced with the logo of Baojun, it may have already been unsellable and could only be exported to third world countries to clear inventory. And without so many rich modification options in China, it would be difficult for consumers to long for a domestically made GK5 just by looking at Japanese and Thai modification examples.

If this is the case for ordinary cars, high-end products require brand stories to support their premium pricing, so that consumers are willing to pay more. Since Koreans cannot blame Chinese consumers for giving up on Genesis due to a lack of 4S stores and brand foundation, Chinese companies cannot attribute their poor sales overseas to foreign markets and must find the reason within themselves.

An elaboration on NIO has been provided in thousands of words so far. It is not intended to solely focus on NIO, but rather to showcase the typical example of a Chinese car company’s brand image establishment from scratch in foreign markets. Additionally, it serves as a foundation for the story of selling cars overseas. Although the NIO Berlin announcement only revealed rental plans for the ET7, ET5, and ES7 in the European market, without a complete launch, I believe NIO will select a more appropriate time to begin selling cars to European consumers after appropriate preparation has been carried out.

An elaboration on NIO has been provided in thousands of words so far. It is not intended to solely focus on NIO, but rather to showcase the typical example of a Chinese car company’s brand image establishment from scratch in foreign markets. Additionally, it serves as a foundation for the story of selling cars overseas. Although the NIO Berlin announcement only revealed rental plans for the ET7, ET5, and ES7 in the European market, without a complete launch, I believe NIO will select a more appropriate time to begin selling cars to European consumers after appropriate preparation has been carried out.

Let’s wait and see.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.