Author: Zhu Yulong

The European automotive industry and market faced many challenges in the current environment, but it did not prevent Porsche’s stock price from rising on its first day of trading. After being priced at 82.50 euros, it rose to 82.72 euros with a market value of 75 billion euros (or 72 billion U.S. dollars, as the euro and the dollar are currently inverted). Porsche has 911 million outstanding shares, and the IPO was the largest in Germany in more than 25 years, raising approximately 19.5 billion euros.

-

Volkswagen has listed 12.5% of Porsche’s shares to raise the several billion euros required to invest in electric vehicles. The IPO raised 19.5 billion euros, and approximately half will be used by Volkswagen.

-

Porsche itself can follow the business model of the Italian luxury brand, Ferrari, to attract luxury fashion brands’ valuation methods (being a small enterprise).

From a big-picture perspective, the European automotive industry is facing significant challenges in this transition to electrification and intelligence. The previously profitable and sustainable gasoline car business is declining, and continuous investment in electric vehicles is necessary, particularly as Volkswagen needs to invest in six battery factories in Europe. Switching from the MEB, PPE to the SSP series of electric platforms also requires resources and time.

Porsche’s Electrification Strategy

While Tesla was developing around the Model S and Model X, Porsche was the first to feel the pressure. In 2017, as Tesla’s development center shifted towards the Model 3, Volkswagen Group’s Volkswagen and Audi brands faced significant pressure, particularly because Audi currently has a weaker presence in pure electric vehicles. However, Taycan’s delivery data for Porsche has been quite good over the past two years, which is due in part to Tesla’s brand sinking and Porsche’s complete disconnection.

But it was precisely under the pressure from 2013-2016 that Porsche remained firm in the pure electric field, basically making plug-in hybrid vehicles (PHEV) as supplementary. From my point of view, for this type of positioning with prices above 500,000 yuan, it is better to focus resources on high-performance batteries rather than PHEVs (less than 20kWh) and extended-range electric vehicles (EREV) (less than 40kWh). The overall arrangement space is limited, and rigid constraints on vehicle acceleration characteristics and handling performance make it difficult for Porsche to have too many products in the hybrid field.

Currently, Porsche is developing around two electric platforms, PPE and SSP. The sport version of SSP is being led by Porsche and will also develop its own independent modules. At present, such sports car companies are mainly developing their own three electric systems.

Currently, Porsche is developing around two electric platforms, PPE and SSP. The sport version of SSP is being led by Porsche and will also develop its own independent modules. At present, such sports car companies are mainly developing their own three electric systems.

When it comes to independent development of the three electric systems, many readers will inevitably mention BYD. From my understanding, in the auto industry, it follows the path of Toyota toward electrification, with the aim of controlling the cost of the three electric systems, controlling fuel consumption rates and providing some handling performance. Therefore, pricing Han EV at 500,000 RMB in Germany is not about pursuing sales volume, but it can only be regarded as an effort.

Porsche’s development of three electric systems values the high efficiency oil-cooling of the electric motor, oil cooling and 800V efficiency of the battery, and fast charging design. I understand that this performance-oriented design is only pursued by Tesla’s Model S Plaid.

Currently, in the European market, NIO wants to output luxury and battery swapping services – but when it comes to the path of charging and swapping, we need to observe it when it arrives in Europe; XPeng wants to output the XP series of driver assists, which seems quite difficult. At present, the only one that is doing well is MG, which on the one hand, uses cooperation with Volkswagen to sell carbon credits, and on the other hand, sells a slightly higher price than domestic prices, which still needs some breakthroughs in Europe. On the other hand, Polestar is currently moving forward with its Nordic design.

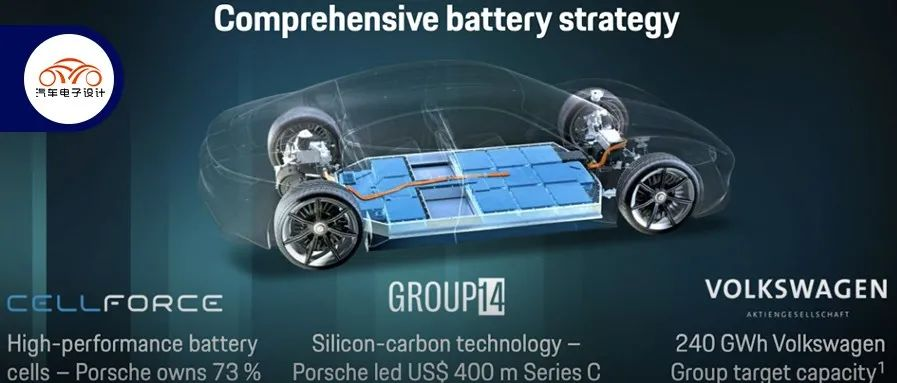

Currently, Volkswagen’s investment of 240GWh in Europe is indeed very helpful for the entire group brand, otherwise there would be no breakthroughs in front-end battery investments. With the foundation of battery factories, all investments in front-end batteries can be used as a guarantee by patents or retained teams. This is the bottom line for industrial investment in the automotive industry.

It seems that all car companies that make 800V cars need to build their own charging network, using existing systems on the one hand, and building a whole new set on the other. Porsche has also connected fast-charging channels through Shell in Thailand. In terms of supercar characteristics, RIMAC’s cylindrical battery is promising if iterated into a large cylindrical battery.The English Markdown text with preserved HTML tags and only corrected/improved parts is:

Porsche’s weaknesses and long-term competition

At present, Porsche’s relatively weak points still lie in software and intelligent functionalities. As a company that originally centers around powertrains, this area can only rely on its Volkswagen parent company. This is beyond Porsche’s expertise, whether it is the entire EE architecture or independent system modules. It can only be said that Porsche follows in Volkswagen’s footsteps.

In summary: In my personal opinion, in this round, the world’s automobile industry is considering partial contraction in a turbulent economic environment, focusing on things that are of long-term value. This round of contraction also makes our exports possible, but each enterprise has boundaries. Deciding whether to contract or expand in different environments is a matter of decision-making. If it goes wrong, we may be in for a roller coaster ride.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.