Challenges Faced by Europe’s Electric Vehicle Industry in 2022

Author: Zhu Yulong

In 2022, Europe encountered many unexpected challenges, ranging from the Russo-Ukrainian conflict, natural gas and energy issues, industrial and financial problems. The dilemma for Europe’s electric vehicle (EV) industry is:

-

The subsidy for new energy vehicles in major countries is beginning to decrease, and the budget is limited.

-

The challenge of increasing energy prices, as well as constraints on electricity supply.

In other words, Europe is facing the same electricity problem as Japan did before. Previously, Akio Toyoda, the President of Toyota, stated that developing EVs in Japan requires increasing electricity supply. This issue of energy development is a comprehensive game. Switching from oil to electricity has aggravated Japan’s electricity problem.

Note: This scene was re-staged in Europe in 2021, fulfilling Akio Toyoda’s prediction.

Therefore, from the perspective of the overall environment, Europe’s development of new energy vehicles in 2023-2024 has shifted from pursuing carbon emissions to energy security, energy supply, and industrial balance.

Note: Due to our country’s reserves of coal and natural gas, the availability of electricity depends on how much green electricity we want. The coordination between new energy vehicles and renewable power generation is being adjusted in the context of balancing overall energy development.

Reduction of Subsidies for New Energy Vehicles in Major European Markets

First, let’s take a look at the countries with relatively developed new energy vehicle industries:

We focus on the changes in the new energy vehicle market in several major countries.

Germany

In July, the German Federal Ministry for Economic Affairs announced that after the ruling coalition reached an agreement, electric vehicle subsidies will be reduced next year. The reason given was that penetration is constantly increasing, and “electric cars are becoming increasingly popular, and government subsidies will no longer be needed in the foreseeable future.” Germany currently has the following plan:

- Pure electric vehicles priced below €40,000 will receive a subsidy of €6,000 in 2022, €4,500 in 2023, and €3,000 in 2024.- Electric cars above €40,000 will receive a subsidy of €5,000 in 2022, and will decrease to €3,000 at the beginning of 2023.

- Electric cars above €65,000 will not receive any subsidies, and cars above €45,000 will also not receive subsidies from 2024 in Germany.

The rapid development of electric vehicle subsidies in Germany is beyond expectations, and the budget of €3.4 billion allocated for the next two years has been used up.

France

July 2022 is a dividing line in France.

- Consumers who purchase pure electric cars under €45,000 will receive a subsidy of €6,000, while business customers will receive a subsidy of €4,000. The subsidies will decrease to €5,000 for individuals and €3,000 for business customers after the reduction.

- If the vehicle price is between €45,000 and €60,000, the subsidy amount will be €2,000.

Plug-in hybrid cars can receive a subsidy of €1,000, which will be completely cancelled.

UK

The UK government’s plug-in hybrid car subsidy policy was officially cancelled on June 14, 2022.

The current subsidy of £3,000 for pure electric cars also needs to be tracked for duration.

The growth of new energy vehicles in Europe was mainly driven by the start of subsidies, and this round of subsidy contraction is similar to China’s rollback from 2017 to 2020. We have also experienced this process. Of course, we have come up with some popular products from the B end to the C end from 2020 to 2022.

The problem of electricity fees and electricity supply

The issue mainly involves consumer usage. Figure 3 shows the residential electricity prices of major states in Germany, which have surged to €469.35 per 1000 kWh, equivalent to €0.469 per kWh.

Let’s calculate the cost:

- For gasoline consumption per 100 km, let us estimate it as 7L, and at €1.99 as of September 5, the cost is €14 per 100 km.

- For electricity consumption per 100 km, let us estimate it as 15 kWh per 100 km, and €0.460 per kWh, the cost is €6.9 per 100 km.

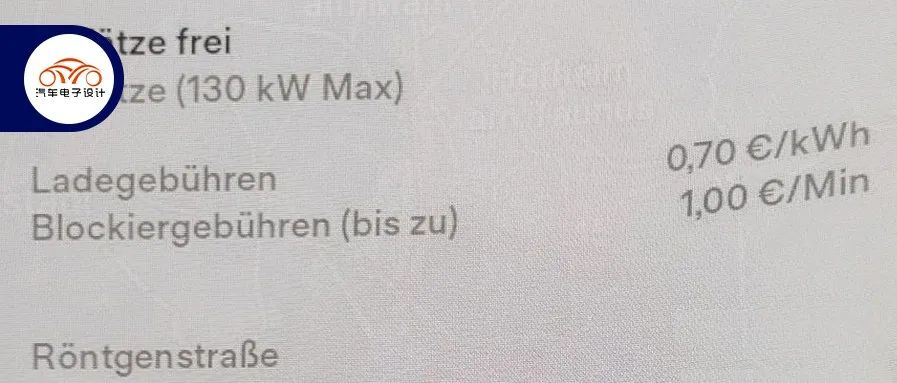

As we can see, the difference between the two is not particularly large.Tesla’s public operating network, if we calculate the charging cost per hundred kilometers under the public charging network based on this price. Tesla has sent emails to European car owners warning that the charging prices at their Supercharger stations will rise significantly again. In this email, Tesla blamed the price hike on the rising energy prices in Europe. According to the media, the charging price has increased by an average of 0.12 euros per kilowatt-hour, currently at 0.7 euros per kilowatt-hour.

In the process of promoting new energy vehicles, the concept of green is still based on the relatively acceptable purchase cost and not outrageous usage cost. This year’s winter in Europe will be particularly cold, so the prospects for new energy vehicles in Europe are uncertain.

In fact, the development of new energy vehicles has had a significant impact on various links of Europe’s automotive industry chain, and the impact on the competitiveness of enterprises has been reflected in the profit margins of European component companies. In order to continue operations, efforts must be made to control costs and reduce expenses, which will lead to other problems, ultimately making this issue particularly sensitive.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.