Zhao Yuepeng

2000 TOPS computing power!

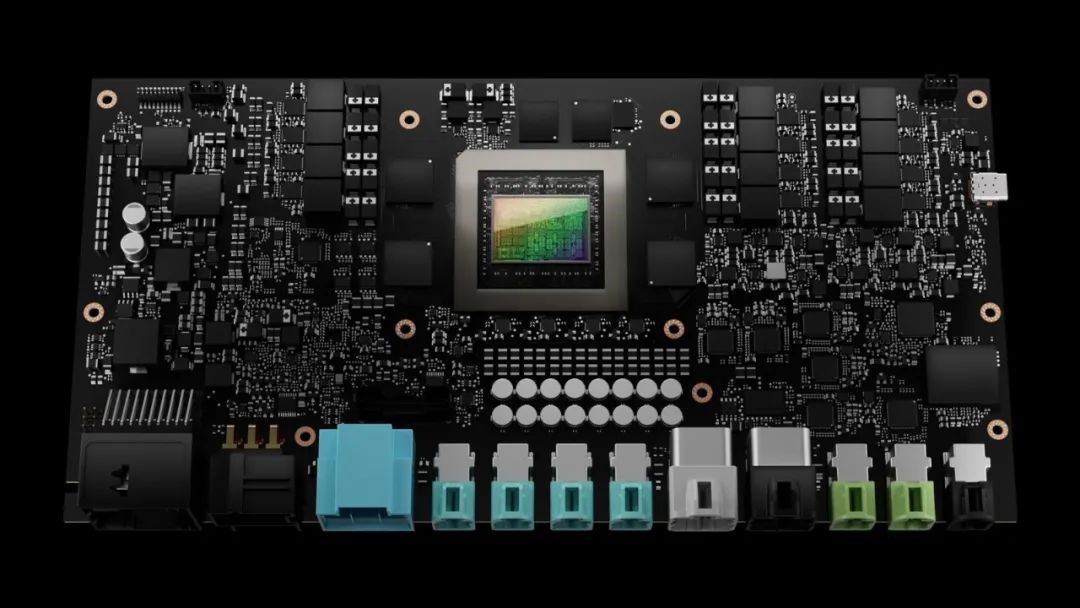

At this year’s NVIDIA GTC, NVIDIA set a new benchmark for autonomous driving computing power with its new generation autonomous driving chip, Thor.

Car companies usually have five evaluation dimensions when determining whether an autonomous driving chip is suitable for their vehicles: performance (i.e. computing power), cost, power consumption, ease of use (or ease of development), and homogeneity (the compatibility of the chip with other systems).

Computing power is at the forefront of determining whether a car is intelligent, and is the most easily perceived indicator by users.

In the industry, it is believed that the greater the computing power, the smarter the autonomous driving system becomes. This means that product managers and engineers can install more and higher-level functions into the system.

Starting from 2015, NVIDIA iteratively released autonomous driving chip platforms such as DRIVE PX, DRIVE PX2, Drive PX Xavier, DRIVE PX Pegasus, DRIVEAGX Orin, and DRIVE Thor at a rate of one generation per year.

Calculated over time, the computing power of NVIDIA chips is increasing at a rate of several times per year, some car companies and autonomous driving companies even demand more computing power from NVIDIA.

But the question arises: can chip companies dominate the autonomous driving chip market by having higher computing power?

Today we will discuss the current state of autonomous driving chips.

NVIDIA Orin: high computing power, perfect tool chain, and a consensus among new forces

“From the information obtained by communicating with many car companies, except for FAW, basically all are using and testing NVIDIA chips. NVIDIA is basically in a monopolistic position in the L2+ and L3 markets.” said a well-informed person familiar with the automotive industry supply chain.

According to incomplete statistics, in the field of electric passenger cars, NVIDIA has already taken orders from 20 of the top 30 mainstream car companies in the world, including Mercedes-Benz, Jaguar Land Rover, Volvo, NIO, IDEAL, XPeng, Zhi Qi, RisingAuto, and Zeekr.

In the field of autonomous driving trucks, NVIDIA won orders from 7 of the top 10 mainstream companies in the world, including Tusimple, IMa, Navistar, and more.

In the field of autonomous taxi (Robotaxi), major autonomous driving companies such as Didi Autonomous Driving, WeRide, Pony.ai, Enovate, and QCraft have all adopted Nvidia’s Orin platform for their next-generation flagship products with high computing requirements.

In the field of autonomous taxi (Robotaxi), major autonomous driving companies such as Didi Autonomous Driving, WeRide, Pony.ai, Enovate, and QCraft have all adopted Nvidia’s Orin platform for their next-generation flagship products with high computing requirements.

In fact, the “Pole-breaking Effect” created by Nvidia has been immense, as car manufacturers seeking massive computing power for intelligent vehicles have all pursued the Orin platform. Pandaily reported that smart EV startups, including NIO, XPeng, and Li Auto, have all adopted Nvidia’s Orin platform for their flagship products.

On September 20th, Nvidia released the next-generation autonomous driving chip, Thor, at the GTC conference, which boasts a computing power of up to 2,000 TOPS.

According to Huang Renxun, one Thor chip can integrate all the computing power required for intelligent vehicles, including advanced autonomous driving, in-car operating systems, intelligent cabins, and autonomous parking.

As Huang Renxun puts it, “One chip to rule them all!” The first automakers to adopt the Thor chip onboard are the most innovative ones in the industry.

Why is Nvidia’s chip solution so popular among these companies?

It all starts with Nvidia’s core competency in GPU visual image processing.

Compared to CPUs, GPUs are more suitable for neural algorithms in the AI era, capable of conducting large-scale algorithmic throughput parallel processing.

Nvidia offers more than just a chip in the field of intelligent vehicles; it provides a more flexible solution for automakers that revolves around hardware, algorithms, complete toolchains, and integration of multi-sensor ecosystems.

Firstly, Nvidia provides a comprehensive range of algorithms.

From relatively mature CNNs, RNNs to the latest popular algorithms, such as Transformers, GANs, RLs, and numerous new algorithms, Nvidia can provide a wide range of mature algorithms for developers to call upon.

Secondly, Nvidia offers the DRIVE Hyperion Developer Kit, which includes:

- The Drive AGX provides a hardware reference for on-board installation;

- The DGX series provides data processing and training; and

- Constellation provides virtual simulation hardware.

This is an intelligent driving car reference architecture that can accelerate the development, testing, and validation processes in production.Based on the Hyerion 8 development kit, many car companies have shown interest, including Mercedes-Benz and Jaguar Land Rover models that are scheduled to be launched in 2024 and 2025. Byton, Lucid, and other car companies are also looking into it.

Furthermore, Hyerion 9 will be released in 2026.

In terms of software, NVIDIA Drive OS provides a basic software stack which includes an embedded real-time operating system (RTOS), hypervisor, CUDA library, TensorRT, and other modules that have access to processing chips. Driveworks is a comprehensive middleware library that makes development and calling easier.

Compared to Mobileye’s “black box” delivery, NVIDIA’s open and flexible approach is preferred by car companies and autonomous driving companies.

Of course, NVIDIA’s GPU solution is not perfect. For example, the power consumption and utilization of NVIDIA chips have always been criticized in the industry. “Xavier and Orin’s utilization rate is basically 30%, and optimizing them remains at around 30%,” an industry insider revealed.

However, despite this, the industry insider stated that “in the short term, within three years, the most competitive computing platform is still NVIDIA. Although its power consumption is high and the utilization rate is not high, it has a very good operator library. If we give its operator library a score of 90, the best one domestically is only between 60-70, which is a pretty big gap.”

For some engineers who develop AI algorithms at the upper layer, the richness of this operator library is very valuable.

This is because, due to the different underlying architectures of each chip company, any model running on different chip and hardware platforms must be optimized. If the operator library is rich enough, it can link the autonomous driving model to the computing platform faster and more efficiently.

Texas Instruments’ TDA4: The most popular chip solution for mid- to low-end car models.

“The TDA4 chip was originally a cabin chip, but it gradually developed applications in driving domain control, with very good results. Although the computing power of TDA4 is only about 10T, the optimization, maturity, and development of the entire chip are still very good. Currently, the coverage rate of domestic car companies choosing TDA4 models is roughly between 40% and 50%, roughly estimated,” said an industry insider when talking about Texas Instruments’ TDA4 chip.

Texas Instruments’ TDA4 chip has several versions:

- TDA4 VL: computing power of 4 TOPS

- TDA4 VM: computing power of 8 TOPS

- TDA4 VH: computing power of 32 TOPS

Currently, TDA4 VM is in mass production. It is understood that Texas Instruments’ next-generation chip, TDA5, will have computing power exceeding 100 Tops.In January 2020, Texas Instruments released the Jacinto 7 processor platform. One of the first two automotive-grade chips in this platform is the TDA4VM chip, which is designed for ADAS applications.

The TDA4 series chip, aimed at next-generation intelligent driving applications, has significantly improved performance and power consumption, providing 8TOPS or even higher deep learning performance.

It has different types of processors including Cortex A72, Cortex R5F, DSP, and MMA, which are responsible for their respective tasks to improve computing platform efficiency.

It can be said that the two major features of the TDA4VM chip are its multilevel processing capability and low power consumption.

- Supports deep learning and real-time image processing

- 5-20W of power consumption and performance efficiency can perform high-performance ADAS operations without active cooling

- Targeted integration with a generic software platform can reduce system complexity and development costs

- Single-chip supports up to 4-6 3-megapixel cameras to improve vehicle perception and omnidirectional processing capabilities

TDA4VM integrates various accelerators, deep learning processors, and on-chip memory, which can achieve a fully programmable integrated platform. It can support 8-megapixel cameras on the processor, allowing the vehicle to see farther in rainy and foggy weather conditions.

As a veteran supplier of automotive-grade chips, TI can also offer a complete solution.

As the upgrade of electronic and electrical architecture (from distributed to centralized), the integration of parking and driving solutions has cost advantages.

Many autonomous driving solution companies, including Baidu, DJI, Nullmax, Yihang Intelligence, He Duo, and Zhuisui, have based their parking and driving solutions on the TDA4 chip.

It is understood that by integrating parking and driving functions and sharing sensors, L2+ enhanced perception capabilities can be achieved to improve safety and user experience. Compared with traditional 1V1R+APA technology solutions, cost savings can be as high as 20% to 30%.

In the past few years, the first-generation products often used Mobileye EyeQ4 chips as the dominant product, with mature perception algorithms, high cost-performance ratio, and easy scalability. However, due to Mobileye’s “black box” delivery, modifying algorithms was difficult.

On the other hand, the TDA4 chip-based parking and driving solution brings significant increases in computing power compared to Mobileye EyeQ4 and increases the development degree of perception and regulatory algorithms.

Secondly, under the trend of designing parking and driving domains, the system places a higher demand for computing power on the platform.

At the same time, automakers need a stable, large, influential, and extremely secure chip supplier.In the words of industry insiders, Texas Instruments’ TDA4 has become “more reliable.”

There is also something worth mentioning:

In November 2021, Desay SV and Texas Instruments signed a memorandum of cooperation to carry out joint R&D and deep cooperation, and jointly released a new intelligent driving solution―the IPU02 intelligent driving domain controller.

IPU02 is the third intelligent driving domain controller created by Desay SV based on the TI TDA4 chip, and it is also the world’s first TDA4 mass-produced project that has landed in advanced driver assistance systems.

According to Li Lele, the general manager of Desay SV’s Intelligent Driving Business Department, IPU02 has entered the supporting system of automakers such as SAIC, Great Wall, GAC, GM, and new car-making forces. Most of the projects will be mass-produced in 2022, and the peak of project landing may be in 2023.

Qualcomm Snapdragon Ride: The Dark Horse of Autonomous Driving Chips

In January 2020, Qualcomm released a new autonomous driving platform―Snapdragon Ride.

This platform adopts scalable and modular high-performance heterogeneous multi-core CPU, high-efficiency AI and computer vision engine, and GPU.

It also includes the Snapdragon Ride security system-level chip, Snapdragon Ride security accelerator and Snapdragon Ride autonomous driving software stack.

Currently, Qualcomm has reached cooperation agreements with automakers such as GM, Great Wall, BMW, and Volkswagen to equip their next-generation vehicles with the Ride platform.

Snapdragon Ride has two major advantages:

One is scalability.

-

L1/L2 active safety ADAS―aimed at vehicles equipped with automatic emergency braking, traffic sign recognition, and lane keeping assistance functions;

-

L2+ ADAS―aimed at vehicles that perform automatic driving on highways, support self-parking, and can drive in urban traffic environments with frequent stops;

-

L4/L5 fully autonomous driving―aimed at autonomous driving in urban traffic environments, autonomous taxis, and robot logistics.For L1-L3 autonomous driving, Snapdragon Ride can provide a complete hardware + software stack system-level solution, which can meet the scalability requirements of automakers for different levels of autonomous driving.

Second, economic and high energy efficiency.

Energy efficiency is the most important issue for car manufacturers and car owners.

Snapdragon Ride can support up to 30 TOPS of computing power required for L1 level applications, to 700 TOPS of computing power required for L4/L5 level driving, and the highest power consumption of multiple SoCs, accelerators, and software/hardware solutions on the top platform is only 130 watts.

Compared with autonomous driving platforms using X86 architecture, which consume up to 700 watts of power, Snapdragon Ride platform based on ARM architecture has huge energy efficiency advantages.

Industry insiders commented:

“As things stand, the maturity of Qualcomm’s entire driving chip is lower than that of Nvidia. In the long term, including Qualcomm, Huawei, Mobileye, and other domestic chip startups, they are taking the ASIC route. In terms of key metrics such as utilization rate and power consumption, Qualcomm may take a big market share after three years, i.e. between 2024 and 2025.”

The Rise of Domestic High Computational Power Autonomous Driving Chips

The substitution of domestic products and more flexible and open delivery solutions compared to Mobileye have provided new opportunities for the development of domestic autonomous driving chips.

“We have learned that some decision-makers in large automotive companies have made it clear that they will not use Mobileye chips from the fourth quarter of 2021, nor will they test Nvidia. The new platforms are basically still domestic, including companies such as Huawei, Horizon Robotics, and Black Sesame Technologies.”

It can be said that the substitution of domestic products has provided great help to domestic start-up companies and domain control industries.

According to sources close to the supply chain, there will be mass production of mainstream models equipped with domestic chips in the fourth quarter of this year.

In 2023, the year of domestic chip adoption will be significant as domestic chip companies will achieve remarkable results.

On the other hand, ADAS giant Mobileye is “loved and hated” by automakers:

-Mobileye’s optimization of chip utilization is almost perfect, and is even rated as a “divine” existence by some engineers.

-But at the same time, Mobileye is criticized for being not open, which brings the problem of slow development efficiency. If automakers submit feedback to Mobileye, the entire cycle is basically calculated yearly based on Mobileye’s internal R&D speed.

Horizon Robotics’ roadmap is very similar to Nvidia’s model, servicing first-tier suppliers, automakers, and mobility service providers, providing them with chip, hardware reference design, and toolchain and algorithm solutions.

As of August this year, Horizon has collaborated with more than 20 automakers, providing over 70 installed base models. The current shipment volume of its Journey series chips has exceeded 1 million.

Horizon has reached mass production cooperation intentions for Journey 5 chips with automakers such as SAIC, Great Wall, JAC, Changan, BYD, Naza, and Lantone.

Therefore, there is a voice in the industry that says Horizon’s chips are a “cost-effective substitute” for NVIDIA.

Another player is Heizhima.

Heizhima provides perception system solutions for automakers through its neural network visual perception algorithm, vehicle-grade ADAS/autonomous driving chips, supporting implementation systems, and reference designs.

Currently, Heizhima’s SoC chip products include Huawei Mountain One A500, Huawei Mountain Two A1000, and A1000L.

Heizhima’s Huawei Mountain Two A1000 series chips have completed all vehicle-grade certifications and have reached mass production cooperation with several automakers including SAIC-GM-Wuling and JAC.

In the strongest chip of Heizhima, the Huawei Mountain Two A1000 Pro, it is equipped with Heizhima’s self-developed image processor and neural network accelerator.

Among them, the neural network accelerator can make the INT8 computational power of the A1000 Pro chip reach 106TOPS, and the INT4 computational power reach 196TOPS.

Another heavyweight player that cannot be ignored is Huawei.

However, Huawei is more presented through Huawei MDC.

The Ascend series chips used by Huawei MDC mainly include Ascend 310 and the upgraded version Ascend 910.

From the official Logic Architecture of the MDC610 platform of Huawei, we can see that the AI module, ISP module, and CPU module are integrated in a SoC and communicate with the outside world. It is also a heterogeneous architecture SoC.

Huawei MDC810, based on the underlying construction of MDC610, has a computational power of over 400 TOPS and can be applied to L4-L5 auxiliary autonomous driving.

However, for the MDC810, whether it uses Ascend 310 or the upgraded version Ascend 910, Huawei has not disclosed too much. But it is certain that the Ascend series AI chips are self-developed products of HiSilicon.

Huawei’s ADS solution based on the Huawei MDC computing platform has been installed in the Fox Alpha S Huawei HI version and Avita 11.

The Huawei MDC610 is also installed in new car models such as Guangqi Aion LX and Naza S.

To some extent, NVIDIA’s attack this time has raised the threshold of large computational power chips.Thor is the strongest self-driving chip ever with a computing power of up to 2000 TOPS, eight times more powerful than Nvidia’s previous generation Orin chip and 14 times more powerful than Tesla’s FSD chip.

However, this does not mean that Nvidia is the absolute leader in the self-driving chip market.

The trend towards intelligent automobiles has attracted players from various fields, gradually forming the emerging camps of new chip technology companies, traditional automotive chip manufacturers, consumer electronics chip giants, and carmakers with self-developed chips.

One camp is controlled by traditional chip manufacturers such as TI, NXP, and Renesas.

Another camp is led by Nvidia and Mobileye, backed by Intel. Qualcomm, Huawei, and Horizon Robotics are close behind, showing strong catch-up potential.

In the fiercely competitive Chinese market for intelligent automobiles, domestic chip companies such as Huawei, Horizon Robotics, Black Sesame Technologies, Cambricon Technologies, and Deeproute have also demonstrated strong competitiveness.

Leading carmakers such as Tesla, NIO, and XPeng have embarked on the journey of self-developed self-driving chips.

Looking at the choices of car manufacturers for intelligent driving chips, new forces tend to choose Nvidia, while traditional car manufacturers choose multiple chips for multi-level layout.

New players like NIO, Ideal, and Xpeng initially chose to use Mobileye chips to achieve basic intelligent driving functions on their first-generation models, and then switched to fully self-developed systems with Nvidia’s powerful Orin chips.

Some traditional carmakers, due to their large number of models, will mainly use Mobileye in their current ADAS solutions, while also deploying the TI TDA4 and Horizon J2/J3 solutions for autonomous parking, as well as Nvidia’s Orin chip for greater computing power.

It can be said that the oligopoly pattern in the self-driving chip industry has not yet formed, and the market landscape is still being reshaped.

What is even more promising is that there is not a large gap between domestic leaders in large computing chip research and giant companies such as Mobileye, Nvidia, and Qualcomm.

In this great evolution that is synchronous with the intelligent automobile industry, a battery giant like CATL has emerged with a market value of trillions. Against the backdrop of domestic self-reliance and substitution, Chinese self-driving chip companies also have a chance to rise and become the next “king”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.