Author: Zhu Yulong

After explaining new energy in graphics, I want to try explaining automotive electronics through sorting out various aspects of automotive electronics, tracking from chips and components.

Currently:

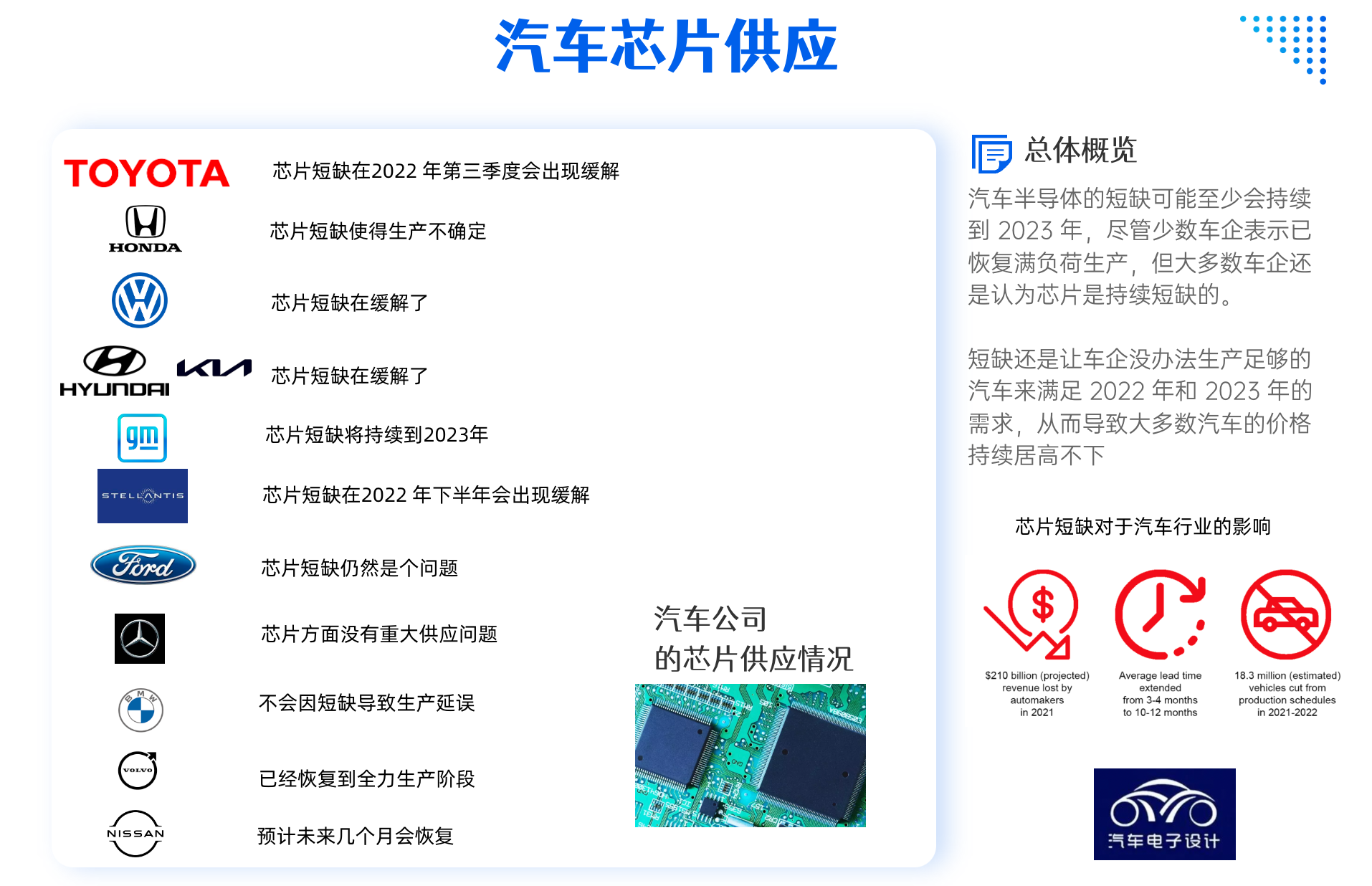

1) There is a link in the global supply of automotive chips; a few automakers have resumed full production, but the majority of automotive companies face structural shortages.

2) From the perspective of chip companies, the supply side will enter a relief period in 2022, but chip production capacity has basically been locked in for 2023.

3) Looking at consumer electronic chips, the supply of MCUs has already begun to exceed demand. This wave of domestic replacement in China is quite fierce.

As automotive chips are a branch of the entire chip industry or a relatively stable part, the entire process towards domestic substitution can be tracked.

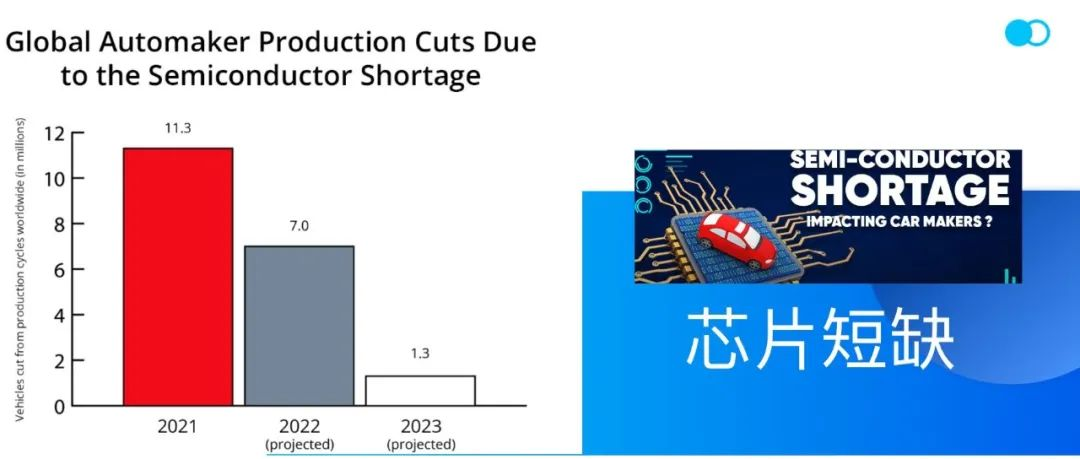

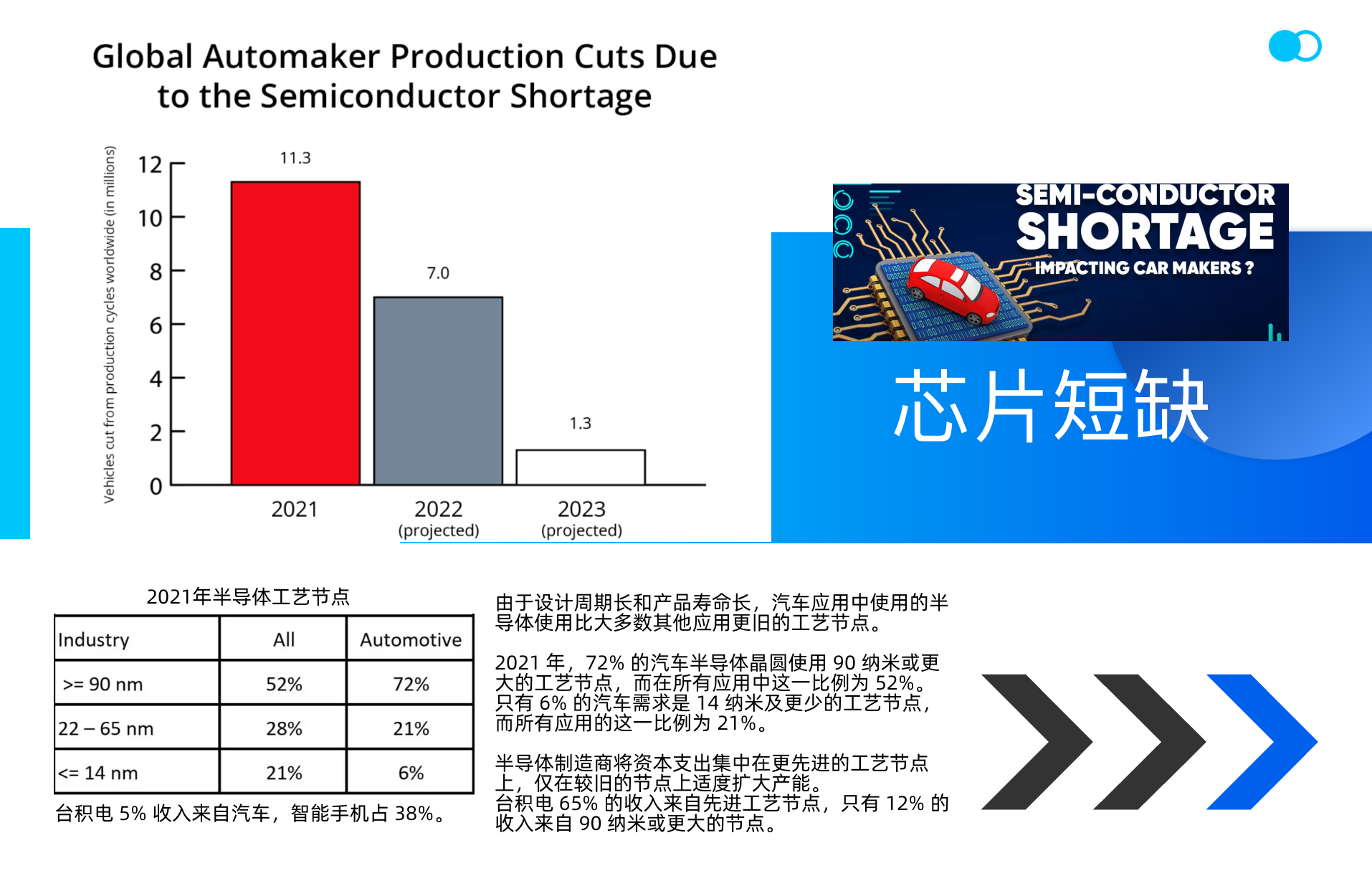

Shortage of Automotive Electronic Chips

At present, the shortage of automotive semiconductors is likely to last at least until 2023. Although a few automakers have stated that they have resumed full production, most automakers still believe that chips are in constant shortage. The shortage still prevents automakers from producing enough cars to meet demand in 2022 and 2023, resulting in the sustained high prices of most cars. The shortage of automotive chips is more harmful to the profit of automotive Tier1 and Tier2 than to that of automotive companies, as the latter can adjust profits through car supply prices, while parts suppliers have difficulty increasing prices.

Automotive chip companies are the big winners of this cycle, but the challenge it brings is that global automotive companies realize that controllability in the field of automotive chips is very important.

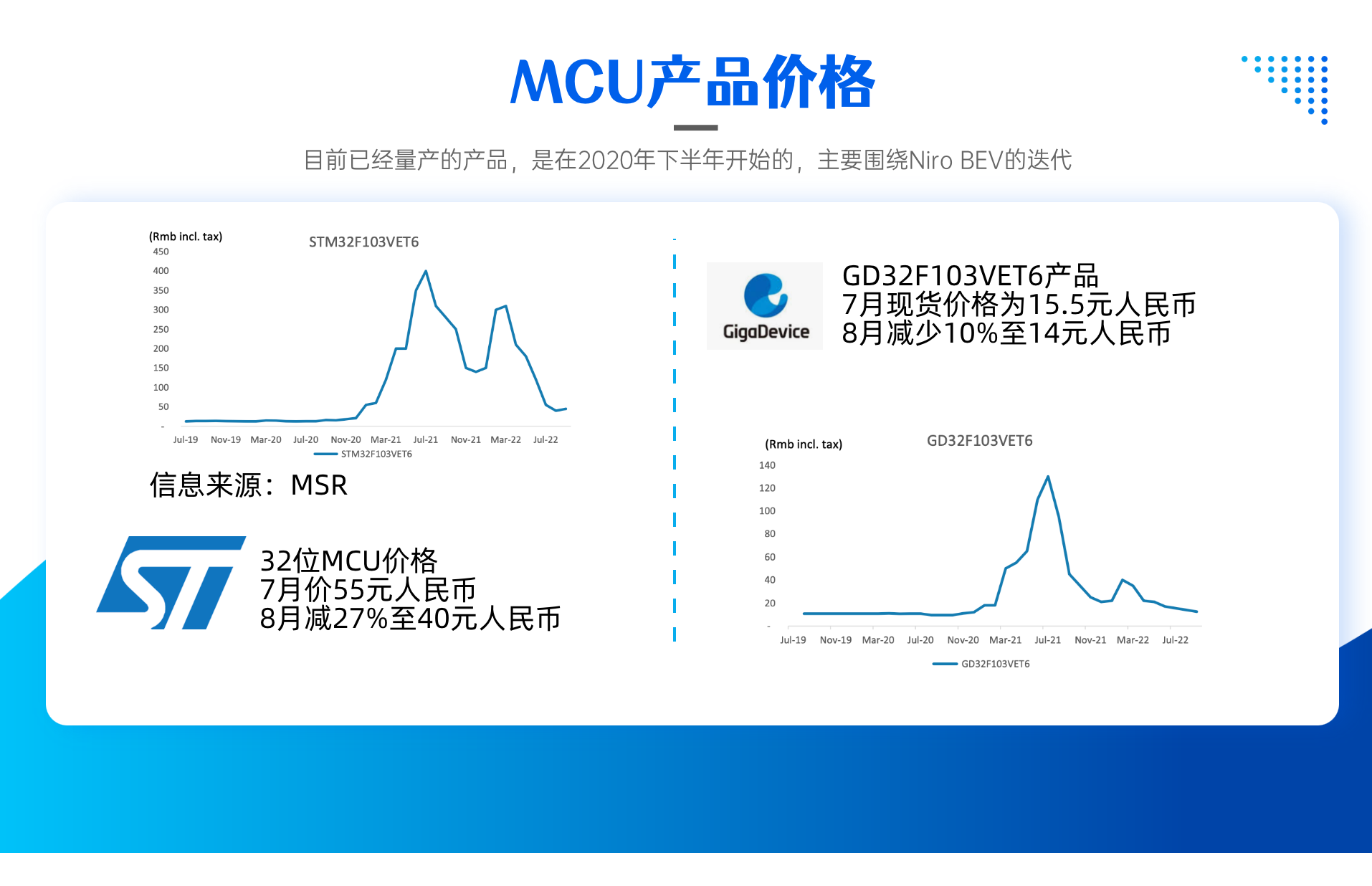

The Situation of MCUs.According to a Morgan Stanley report, demand for MCUs worsened in September, but MCU supply continues to increase and Chinese MCU manufacturers have not reduced their orders. Due to increasing inventory, price cuts are imminent, and if demand does not recover, inventory digestion may continue until the first half of 2023.

In September, the price of STMicroelectronics’ 32-bit MCUs rose by 13% to 45 yuan (compared to 40 yuan in August) for China’s MCU channel price data, after a sharp drop in August, and the current spot price is declining to 30-40 yuan RMB, which means that spot prices in September may continue to fall.

GigaDevice’s GD32F103VET6 spot price fell by 11% to 12.5 yuan compared to August, which was 14 yuan, and 15.5 yuan in July.

The biggest problem currently is the lack of seasonal demand recovery in September. Seasonal demand usually rebounds in September due to the inventory of components sold during China’s Singles’ Day, Black Friday, and Christmas sales in Europe and the United States. Demand in the first week of September was interrupted due to sporadic incidents, and future demand is expected to further weaken while supply continues to increase.

-

Global chip companies are keeping contract prices steady, and the tense supply dynamics are gradually easing.

-

Chinese suppliers lowered contract prices in the third quarter, but failed to boost demand.

The current problem is that dealers are reluctant to stockpile products due to macroeconomic uncertainty.

In this cycle, unlike factories in Taiwan, China’s domestic manufacturers are still purchasing wafers. As more supply enters the market and companies compete for market share, Chinese MCU suppliers’ profitability is under enormous pressure.

The current spot price of MCUs from some Chinese manufacturers is already lower than the contractual price; weak spot prices may further force local suppliers to lower contract prices in the fourth quarter.

The average inventory of Chinese manufacturers’ MCU channels increased by 4-6 months.

This MCU downward cycle will continue until the first half of 2023, with an expected duration of three quarters. Spot pricing is a good indicator of sentiment, and this round of domestic substitution will quickly lead to a price war in the automotive electronics industry.

Summary: I think that automotive electronics is actually a branch of electronics (with specific requirements), and the path that has been taken in consumer and industrial electronics will be repeated in automotive electronics.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.