Author: Zhu Yulong

At the 2022 Global New Energy and Intelligent Automobile Supply Chain Innovation Conference hosted by the Electric Vehicle 100 People’s Association, Miao Wei, Vice Chairman of the Economic Committee of the National Committee of the Chinese People’s Political Consultative Conference and former Minister of Industry and Information Technology, called for attention to the “more urgent supply chain issue of an operating system compared to a chip”.

Today, let’s talk about the topic of automobile operating systems, which involves several key issues:

-

In accordance with the evolution of the EE architecture, there are actually several types of operating systems of all sizes in the car. The ones that can be seen intuitively are a set of cockpit interactions, ADAS & advanced autonomous driving software systems, as well as the OS of the vehicle body system, and the reserved zonal controller and classic ECU, which are evolving forward along Autosar.

-

Around the cockpit operating system, we can see clearly that there may be only three paths abroad: Tesla, Android Automotive Operating System (AAOS), and the upcoming Apple OS. Currently, only Toyota and Hyundai-Kia are still throwing themselves into developing their own OS, and it is highly likely that a part of their vehicle models will switch to AAOS in the future.

-

Around the cloud AI chip operating system, on the one hand, it handles the intelligent interaction assistant in the cockpit, and on the other hand, it handles autonomous driving data.

In this hidden corner, an approach like Volkswagen’s money-burning model may be unsustainable, and it may also be difficult for our industry policies to find a way to intervene. So I think Minister Miao has raised a very good topic this time, which is also something we need to focus on in the future.

Lessons from the Mobile Industry

Talking about operating systems for cars, it’s easy to think of operating systems for mobile phones. In the process of transitioning from feature phones to smartphones, companies like Apple created the closed, proprietary and non-open source iOS operating system, while Google saw the opportunity and launched the open source, open and free Android operating system for everyone to use. Although at that time Samsung had a smartphone operating system, and Nokia had its own Symbian smartphone operating system, but under the trend of open, transparent, and free Android, except for Apple’s 10%-20% market share, almost all smartphone manufacturers in the world chose Android as their operating system.

The open and free operating system seemed to be a non-issue until the Huawei case showed us the problem – in addition to stopping the supply of chips, the use of Android operating system was also restricted. Huawei was not limited to using the Android operating system, but was restricted from using the APP software running on Android. This forced Huawei to temporarily switch from their previous industrial-use operating system to the full ecosystem of HarmonyOS, which enabled the continuation of upgrades for old customers and maintained the relationship. Otherwise, even Chinese Huawei customers would be difficult to retain. But it was a pity for Huawei to lose the market overseas. We could see the importance of the ecosystem – people do not buy phones for hardware but for the ecosystem. This case of missing an operating system in the industrial chain of smartphone operating systems demonstrates the importance of the operating system in the transformation from functional products to intelligent products. In the future 3-5 years, there might be a change in the automotive industry where people are buying cars for its software.

The open and free operating system seemed to be a non-issue until the Huawei case showed us the problem – in addition to stopping the supply of chips, the use of Android operating system was also restricted. Huawei was not limited to using the Android operating system, but was restricted from using the APP software running on Android. This forced Huawei to temporarily switch from their previous industrial-use operating system to the full ecosystem of HarmonyOS, which enabled the continuation of upgrades for old customers and maintained the relationship. Otherwise, even Chinese Huawei customers would be difficult to retain. But it was a pity for Huawei to lose the market overseas. We could see the importance of the ecosystem – people do not buy phones for hardware but for the ecosystem. This case of missing an operating system in the industrial chain of smartphone operating systems demonstrates the importance of the operating system in the transformation from functional products to intelligent products. In the future 3-5 years, there might be a change in the automotive industry where people are buying cars for its software.

Now, Android has entered the car enterprise through the car system, and will further penetrate the cabin system. Cars cannot repeat the mistakes that mobile phones have made.

Will we see a situation like mobile phones in the future where all smart cars in the world use an open and free operating system? Once this ecosystem is formed, it will be a jungle where the winner takes all. The case of smartphone operating systems shows that there are only first and second places in the world, not third. I believe that the same will be true for the global automotive market in the future. Tesla started with Linux and created a closed, non-open operating system just like Apple did back then. Prior to Tesla, Volkswagen, BMW and Mercedes-Benz attempted this path. For this kind of closed-loop system, there must be a large production and sales volume, otherwise there won’t be any app developers willing to do an adaptation with their operating system. If they do not start off well, the entire consumer will not accept it.Currently, Volkswagen, Mercedes-Benz and BMW are adopting the Android Automotive system, as General Motors, Ford, Stellantis, Honda and Renault are also introducing the Android Automotive system for their mid-range vehicles. This will eventually lead to the formation of an in-car Android ecosystem worldwide, where more and more developers will adapt their software to the operating system with the most users, which is simply an ecological development that cannot be avoided.

According to the estimation in Figure 4, by 2027, the market share of Android and Automotive Android will reach 50%, while Linux and Automotive-grade Linux will account for more than 40%, and other systems will be less than 10%. This basically ends the matter.

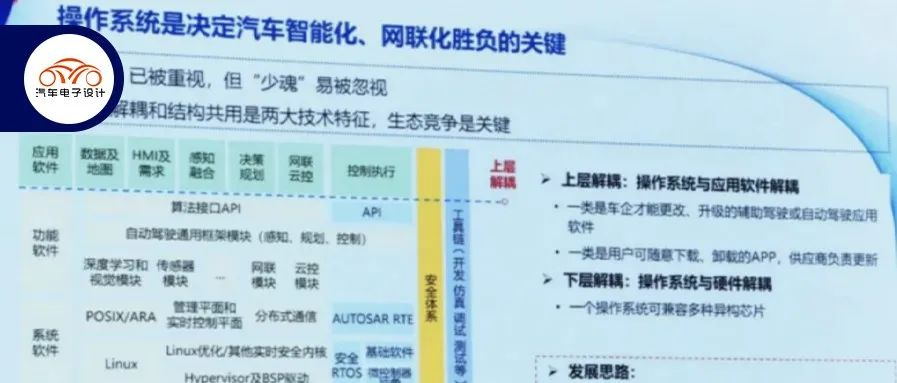

The importance of creating a self-developed car operating system lies in the separation of hardware and software, where one operating system can adapt to multiple heterogeneous chips, and can adapt to chips from different manufacturers of the same type. This is not a problem with the decoupling of the operating system at the bottom layer. In addition, the future chips will be like peripherals of a computer and can also achieve plug-and-play.

Starting in 2022, the global intelligent automobile development pattern has begun to upgrade towards the in-car Android system, leaving Chinese manufacturers a window of about three to five years. China can create a self-controlled, open source, and preferably free operating system through three years of effort, forming an industry development ecosystem in the Chinese market. China’s automobile production accounts for around 30% of the global total, with smart new energy vehicles accounting for over half of the global production and sales.

In conclusion, with the global automobile industry beginning to revolve around Qualcomm’s cockpit chips and the Android Automotive system, how can China break through in this field? This is an open-ended question.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.