Author: Zhu Yulong

As Nvidia and Qualcomm dominate the intelligent cockpit and advanced assisted driving SOC market with their strategic advantage in big computing power, what can automotive chip companies do in this war from small to big computing power? From current observation, the manufacturers upgrading their original MCU chips and participating in the AI-in-MCU competition also include NXP, Renesas, ST, and Infineon. In this sense, as automotive companies begin to accept processors with a unit price of over 100 dollars, the original automotive electronic MCU companies can also meet the demands of automotive companies by upgrading their products: software-defined cars, zonal/domain controllers, end-to-end secure communications, secure multi-ECU integration, and so on.

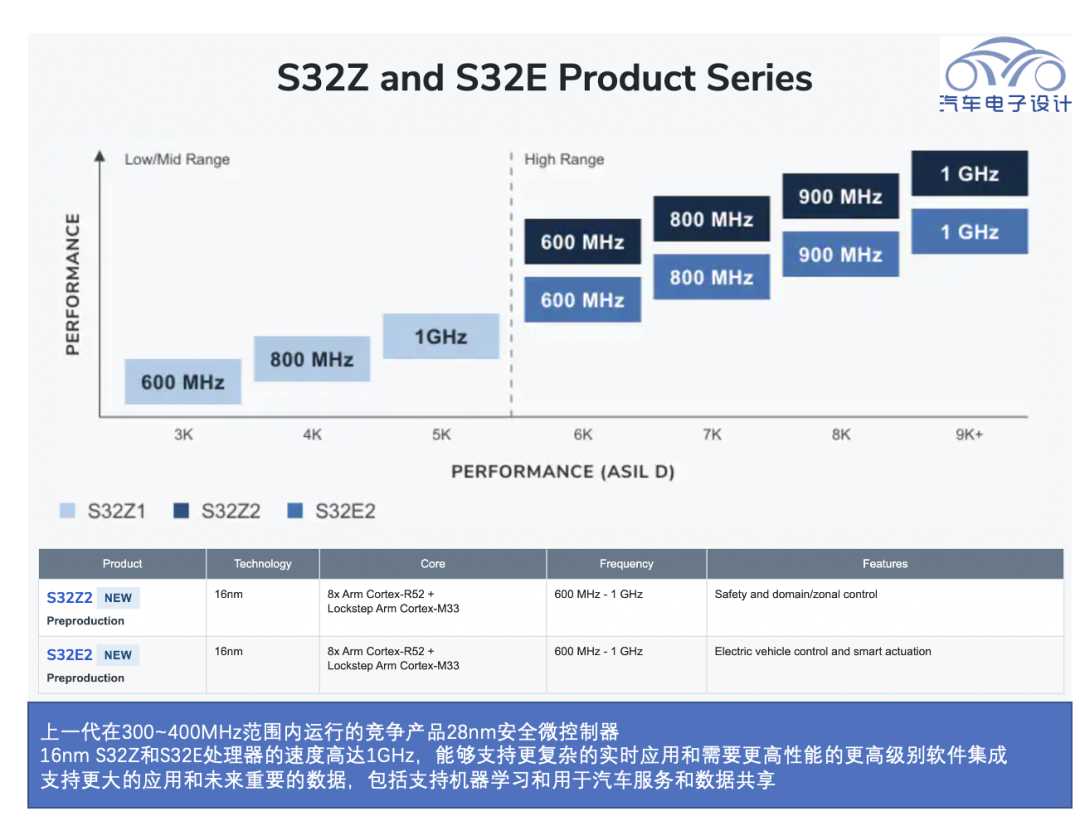

NXP recently launched two new real-time MCU processors that meet the different needs of automakers for the next generation automotive architecture, belonging to the NXP S32 automotive platform. S32Z is responsible for secure processing and domain/zonal control, while S32E is responsible for electric vehicle control and intelligent driving.

Shift in Concept

In the global competition of the automotive industry, the next-generation automotive architecture is still evolving. Automotive chip suppliers are divided into two camps:

-

Enterprises with big computing power GPU/CPU and AI/ML capabilities (Nvidia, Qualcomm, Intel/Mobileye).

-

Traditional automotive chip companies evolving from MCU (NXP, Infineon, Renesas, TI).

Now the key point of competition for designing new automotive platforms is about software rather than hardware. Of course, even for Tesla, the biggest problem we see is whether it can really gain advantages by integrating all the software and turn the investment in the software suite into a return. Before Tesla introduced big computing power chips, traditional automotive companies believed that a 100-dollar processor was unacceptable. Currently, automotive companies focusing on technology and luxury cars have all started to accept the trend of central brain processing controllers in vehicles. Car manufacturers hope to design and develop a computing platform that can continuously increase ADAS functions, even if they do not plan to develop fully autonomous driving at level L4/L5.Due to this trend, traditional MCU automotive chip enterprises who had some illusions and hoped that car companies would awaken and abandon expensive GPU/CPU solutions and return to traditional automotive chip design architectures, can no longer turn back. But now that car companies are familiar with Nvidia’s solutions, they have developed their own software.

The new generation of MCUs are positioned as “adjacent to high computing brains” supporting chips. On one hand, they can serve as safety processors (Co-Pilot) or perform redundant decision-making and execution. On the other hand, they can also share some functions from the high computing SOC central chip, reducing the burden on central computing. The distribution here is as follows: S32G (central gateway) and S32R (perception radar), S32E (vehicle control and battery management) and S32Z (domain/zonal control).

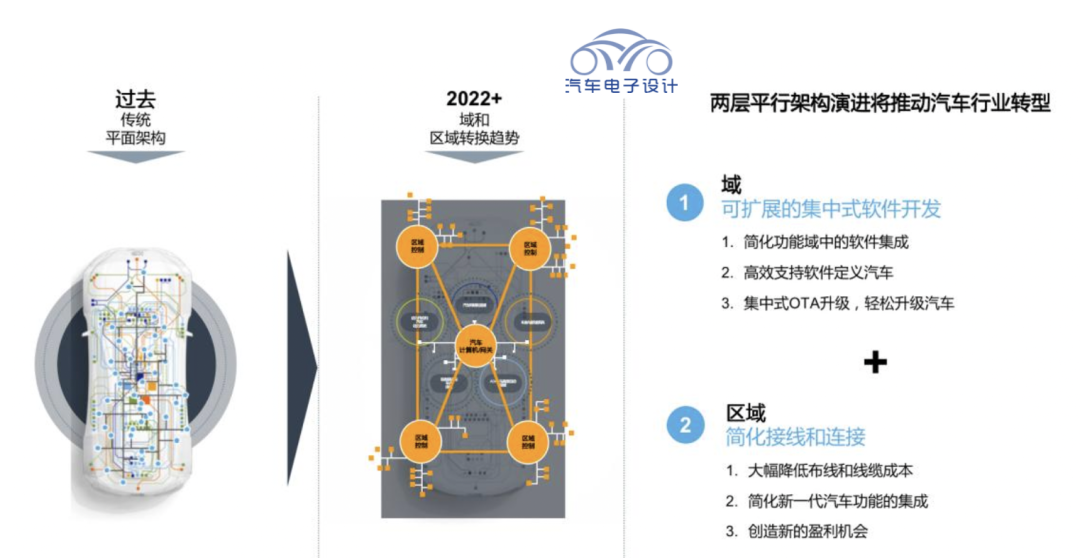

The automotive industry hopes to merge independent ECUs into fewer ECUs. Different car manufacturers have different integration schedules and paths. Some companies hope to start with domain architecture (integrating logic software of the same functional block together, putting the foundation in general software, and implementing OTA centrally), while others directly start with zonal integration (simplifying wiring and implementing cross-domain design). There are also other companies that adopt a mixed architecture of domain and zonal. For chip enterprises, it is necessary to meet the needs of these different car companies, regardless of development to architecture (EEA1.0=EEA2.0 to EEA3.0, one-generation architecture for one Chinese car).

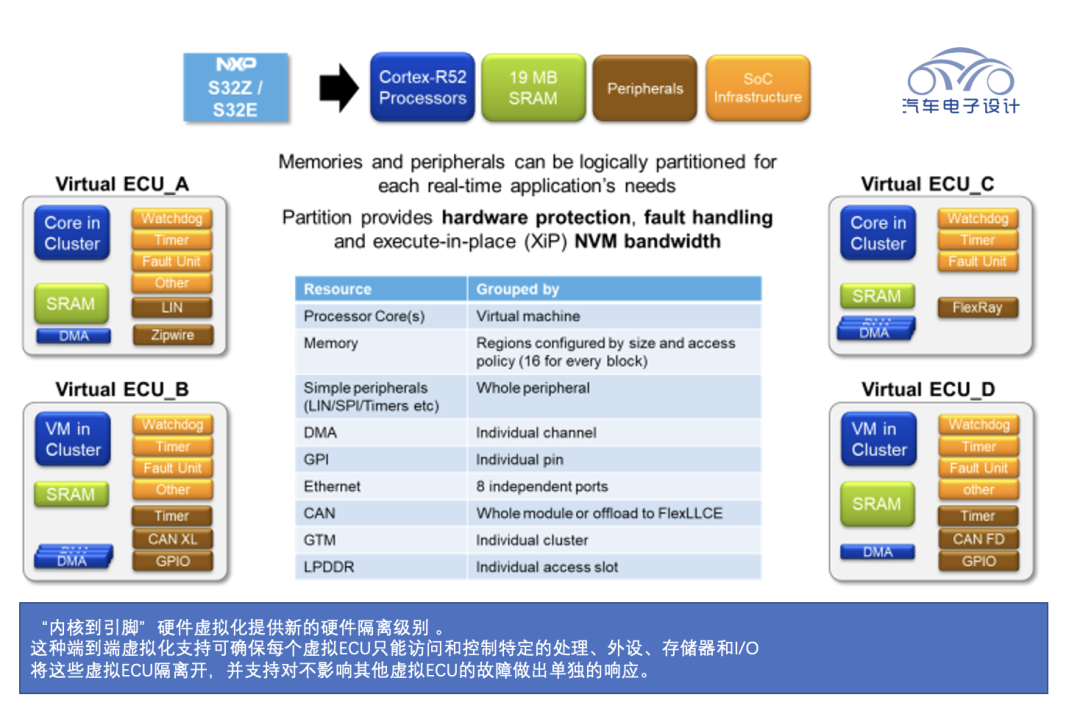

Hardware isolation from core-to-pin is an important design feature in the new design. This is very important for car companies to integrate different ECU functionalities on new processor platforms. From the processor to the chip pin, I/O, task, functionality, and control can be completely virtualized in the hardware. The hardware virtualization capability of “processor core-to-pin” allows “multiple real-time applications to be developed and run on the device simultaneously”. Hardware virtualization assigns relevant memory, peripheral devices, memory bandwidth, and device (I/O) pins to processor tasks. Tasks appear as separate and isolated functions, just like in independent ECUs.

Development of MCU in other fields

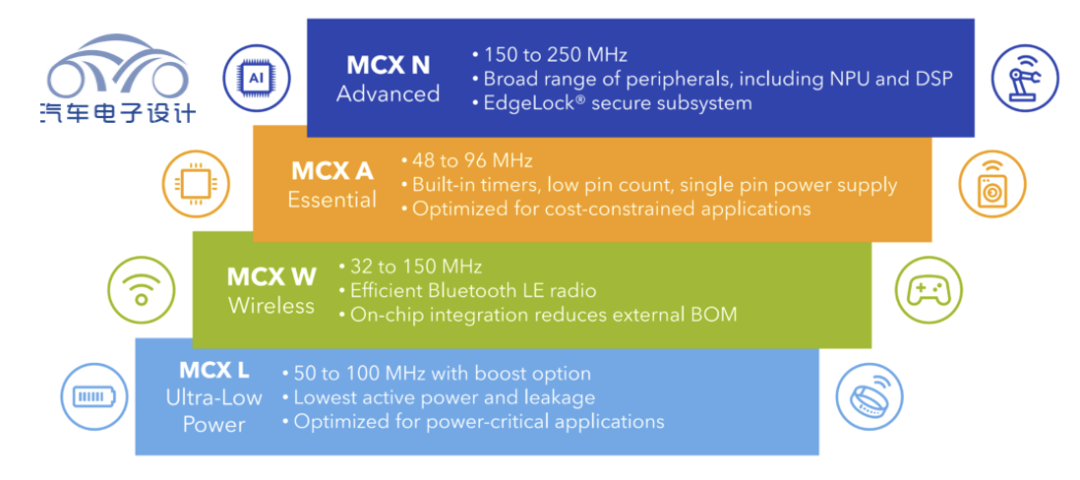

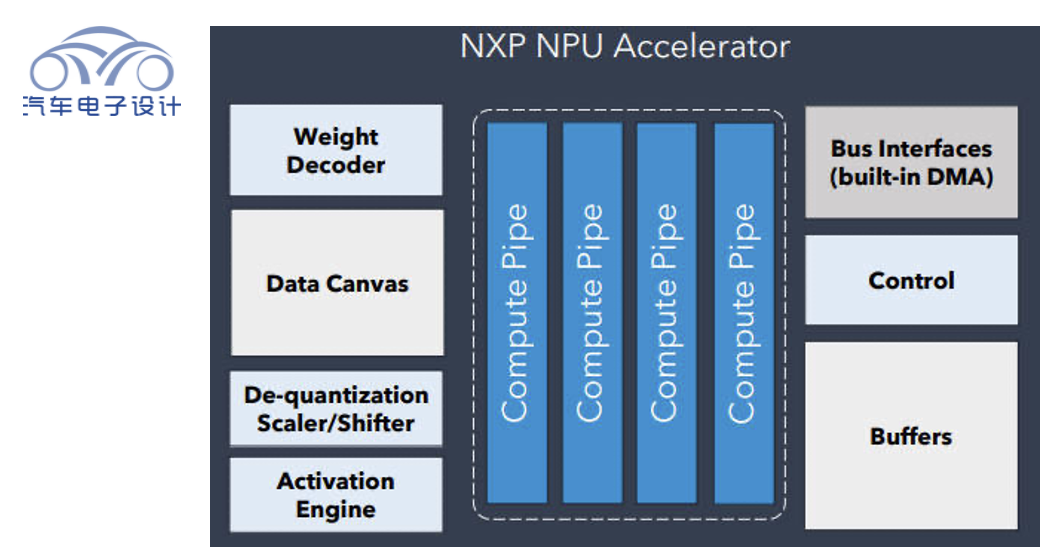

Outside of the automotive industry, MCU is also facing the demand for AIoT (AI Internet of Things). Edge AI is “limited economically, just as it is physically.” NXP has also launched its self-developed NPU, which will enter its MCX N series, the high-end version of NXP’s new microcontroller series, by accelerating edge inference. NXP has developed MCX series, which includes MCU devices from four different series, namely N, A, W, and L, to address a wide range of networked edge devices, including industrial and IoT edge applications.

The popularity of MCX MCUs and sensors in the embedded market is gaining momentum, and people have high hopes for the coming era of edge AI. For traditional chip companies, the key issue is the fundamental mismatch between MCU and AI, with MCU requiring the longevity of embedded systems, while AI continues to iterate and develop. In addition to NXP, Renesas, ST, and Infineon will release MCUs using Arm Cortex-M85, M55, or similar AI architectures.

-

ST has created a platform that uses STM32Cube-AI to apply ML to 32-bit MCUs.

-

Infineon has already introduced the Aurix TC4x platform for AI acceleration.The more popular trend of solving edge AI in MCUs lies in the development of algorithms. ML algorithms can be developed using smaller tools, such as TinyML and TensorFlow Lite, enabling the development of AI applications in MCUs and other constrained hardware. Some AI startups, like Brainchip, Hailo, and Alif, have aimed at AI accelerators that can be used for MCU applications. NXP’s collaboration with Hailo in the automotive field combines NXP’s automotive processors, including NXP’s S32G series and Layerscape, with Hailo-8 to provide scalable and efficient DL processing for automotive electronic control units.

Summary: Currently, Chinese startups are breaking into the automotive MCU track, while traditional automotive MCU enterprises need to raise the bar and find a big logic for survival in the shadow of high computing power SOC in the automotive and industrial fields.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.