NIO announced its Q2 2022 financial results this afternoon. In this quarter, which marked the shift from old to new product lines, Nio delivered 25,059 vehicles, which remained stable since Q3 2021. This is mainly due to the end-of-lifecycle of the ES8, ES6, and EC6 models, which are no longer competitive in the market and cannot bring additional growth to Nio.

On the other hand, of the three new vehicles released on the NIO NT2.0 platform, only the ET7 was delivered in Q2 2022 and is still in the supply-demand ramp-up period, while the other two models are still in the preparation stage. Therefore, Nio’s Q2 2022 financial data reflects the stage of transition. The following is a summary of financial information.

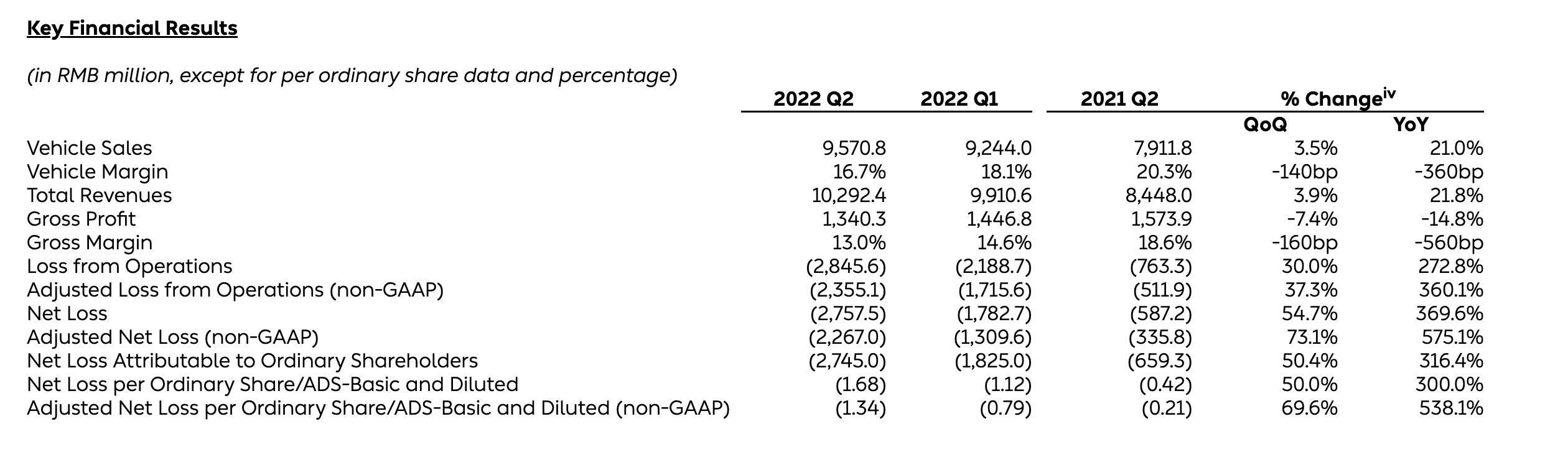

Nio Q2 2022 Financial Information Summary

Nio’s delivery volume increased by 14.4% YoY and decreased by 2.8% MoM in Q2 2022. Model sales volumes are as follows:

-

ES8: 3,681 units

-

ES6: 9,914 units

-

EC6: 4,715 units

-

ET7: 6,749 units

Regarding finance:

-

Total revenue was RMB 10.29 billion, up 21.8% YoY and 3.9% QoQ.

-

Automotive sales revenue was RMB 9.57 billion, up 21% YoY and 3.5% QoQ.

-

Sales expenses were RMB 8.95 billion, up 30.2% YoY and 5.8% QoQ.

-

Total gross profit was RMB 1.34 billion, down 14.8% YoY and 7.4% QoQ.

-

Gross margin was 13%, compared to 18% in Q2 2021 and 14.6% in Q1 2022.

-

Gross profit per vehicle was 16.7%, compared to 20.3% in Q2 2021 and 18.1% in Q1 2022.

-

Net loss was RMB 2.76 billion, up 369.6% YoY and 54.7% QoQ.

-

Net loss attributable to Nio’s ordinary shareholders was RMB 2.74 billion, up 316.4% YoY and 50.4% QoQ.

-

R&D expenses were RMB 2.15 billion, up 142.3% YoY and 22% QoQ.

-

General and administrative expenses were RMB 2.29 billion, up 52.4% YoY and 13.3% QoQ.+ Cash and cash equivalents reserve of 54.4 billion yuan.

Supplementary Financial Information

According to the financial report, NIO was affected by a variety of adverse factors in Q2 and needed to make various preparations for the upcoming delivery of new cars. The decline in NIO’s single-car gross profit was mainly due to the increase in single-car battery costs, but the good sales performance of ET7 compensated for this to a certain extent. However, the decline in single-car gross profit also led to a decline in overall gross profit.

The increase in sales costs in Q2 was mainly due to the increase in vehicle raw material costs, and the significant increase in R&D investment was due to personnel expenses, incremental design, and R&D expenses for multiple new models.

The increase in general sales and administrative expenses was also due to the increase in personnel expenses, as well as the increase in market and promotion expenses, including the release and promotion of the new car ES7.

Summary of Conference Call Information

-

R&D progress is proceeding as planned. NT3 technology will be used in future mass-market brands, and will be introduced to the market together with NT3 products;

-

ET5 will be delivered in large quantities in December, with all aspects well prepared. The internal target is higher than 10,000. Q4 will break records month by month, and will peak in December without a doubt. Whether it’s ET7 or ES7 in October, the supply chain and production capacity situation will improve greatly, and ET5 will start to climb. Specific production capacity is difficult to predict, and there are many uncontrollable limiting factors. Nevertheless, the company knows how to produce more in such an environment. We are confident in the production capacity in Q4;

-

The popularity of ET5 continues to rise, with very high user expectations, and it will be a very popular product. There will be more new models next year, including replacement models. The existing 866 models will switch to the NT2 platform next year;

-

Although the supply chain and delivery pressure is very high in the fourth quarter, NIO has actively prepared in the third quarter, and there are two factories in the fourth quarter. The new factory in Xinqiao began debugging in Q3 and will only manufacture ET5 at the beginning, with much lower complexity;

-

NIO has not released order numbers for a long time. Whether it is ET7 or ES7, orders are very abundant, and the performance of ES7 exceeded expectations. It will undoubtedly take a relatively long time for ET5. The main issue in the near future is the supply chain and production capacity. Overall, we are confident in demand;

-

The U.S. policy on exporting chips to China will not have much impact on NIO’s operations in the short term, and it has not involved chips related to vehicles. The current computing power of chips already can support AD training, and NIO is still cooperating with NVIDIA. NIO will also further evaluate solutions to various technical issues and collaborate with more chip companies. Chip policy will not have an actual impact on the company’s long-term strategy. In core technology areas, including chips, NIO aims to establish full-stack self-developed capabilities. Core R&D capabilities can help address risks of changes in industry policies and can also improve gross profit margins and technological competitiveness.- The US market has been thinking about it for a long time, and has been fully certified in all aspects, including products, user experience, and business models over the past five years. Now it is becoming clearer and preparations are underway.

Final Thoughts

The rapid increase in the penetration rate of the epidemic and new energy has brought many phased effects to the market. The cost of automotive parts and batteries is a relatively important factor. The shortage of car-standard MCUs has become a key factor restricting delivery in the past period of time, and the fluctuation of battery raw material costs has become a major factor in the unsightly profits of downstream new energy manufacturers in the past few quarters.

NIO is precisely in the painful period of new and old transitions during this period. The 866 three old models, which have already become weak in product competitiveness, still contributed valuable delivery volumes to NIO this year. On the one hand, it can be seen that NIO’s brand and service system, as well as financial models, have actually become the user attraction of NIO in the luxury pure electric vehicle market. On the other hand, it also reflects the insufficient competition in the domestic luxury pure electric vehicle market in the past period of time.

With the launch of more and more competitive models at the same price, NIO’s competition and market pressure are also increasing. Similarly, in the new energy market environment with a year-on-year growth rate of three digits, NIO’s performance in the first half of this year has shown signs of insufficient growth compared to last year. However, with the delivery of ET7, ES7, and ET5 all starting in September, NIO is about to enter a new stage of growth in the second half of the year.

Regarding the business expectations for Q3, NIO has given a delivery guidance of 31,000-33,000, and it is important to emphasize that the delivery time of ET5 is September 30th, so this “NIO’s highest expected quarter in delivery history” is likely to be greatly refreshed in the following Q4.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.