Author: Mu Min

Key Points from NIO’s 2022 Q2 Financial Conference Q&A

-

Due to supplier issues, the good product rate of the integrated die-casting parts has affected the delivery volume in the third quarter to a certain extent. We are currently working to improve the good product rate and expect to solve the issue thoroughly by October.

-

Regarding the chip problem, NIO is currently meeting NIO’s training computing power demand and is also evaluating domestic chip solutions. In the core technical field, including chips, NIO’s goal is to establish full independent research and development capabilities.

-

Concerning new products, more models including upgraded versions and the entire series of models including the 866 will be switched to NT2.0 will be released next year. NIO will accelerate the introduction of new products next year.

-

As for new brands, Li Bin stated that he hopes NIO’s products and technology will be used by more people. They are also actively considering the benefits of smart car technology for users in different price ranges who have different understanding of the brand.

-

Regarding production capacity, there is significant pressure on the supply chain in the fourth quarter, and two factories will be producing simultaneously. Currently, full preparation is underway, and a record delivery is expected in the fourth quarter.

-

Concerning orders, there is an adequate supply of orders for the ET7 and ES7 models, with the ES7 exceeding expectations. The main issue at present is the supply chain, and the gross profit margin is expected to increase slightly in the third quarter. The internal monthly delivery target for the ET5 is higher than the expected 10,000, and it will continue to climb each month over the next three months.

-

Regarding the 150-degree solid-liquid mixed battery, it is currently in preparation and needs to be fully verified. Progress will be delayed for several months.

-

The Volkswagen brand will be equipped with the NT3.0 platform and launched together. This is NIO’s consideration for the Volkswagen brand.

-

Regarding rumors of NIO’s third brand, Li Bin stated: “In the past year or two, NIO has realized that accelerating the transformation from oil cars to electric vehicles does require introducing a more extensive range of users. We have also seen rapid growth in demand for China’s Volkswagen market over the past year and have seen many opportunities for innovation. NIO is also skilled in combining user experience with innovation.”

Financial Details: Low gross margin, high R&D investment

In terms of financial results, NIO is expected to generate revenue of RMB 12.85 billion to 13.6 billion in the third quarter, compared to market expectations of RMB 16.23 billion.

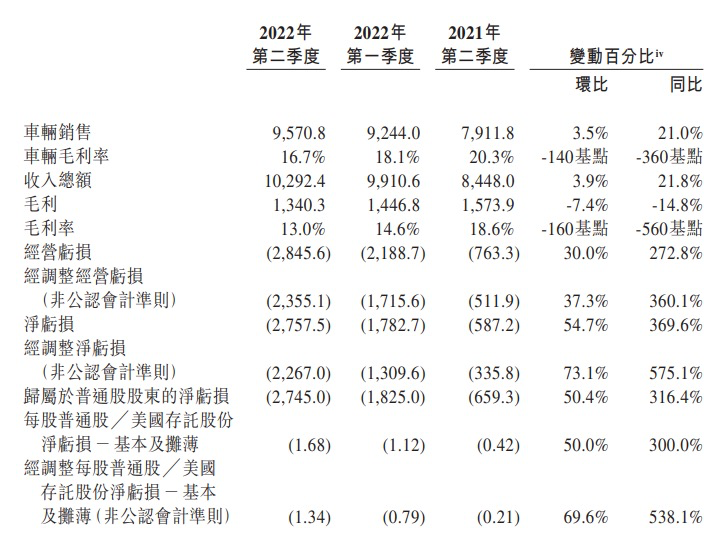

NIO’s Q2 revenue exceeded expectations, but the company’s quarterly gross profit margin continued to decline, and net losses widened significantly to RMB 2.7 billion, reversing the trend of narrowing losses in the previous quarter. The Q3 financial results guidance was significantly lower than the market’s expectations.On September 7th, before the US stock market opened, NIO released their 2022 Q2 earnings report. According to financial data, NIO’s Q2 revenue was ¥10.29 billion, exceeding market expectations of ¥9.67 billion, with a YoY growth rate of 21.8% and a QoQ growth rate of 3.9%, showing nine consecutive quarters of YoY growth.

Revenue from vehicle sales was ¥9.57 billion, with a YoY growth rate of 21% and a QoQ growth rate of 3.5%. Gross profit was ¥1.34 billion, with a YoY decrease of 14.8% and a QoQ decrease of 7.4%. The net loss attributable to ordinary shareholders of the company was ¥2.74 billion, with a YoY growth rate of 316.4% and a QoQ growth rate of 50.4%.

In terms of vehicle deliveries:

- Q2 deliveries totaled 25,059 vehicles, including:

- 3,681 ES8s

- 9,914 ES6s

- 4,715 EC6s

- 6,749 ET7s

These figures represent a growth rate of 14.4% compared to Q2 2021, and a decrease of 2.8% compared to Q1 2022.

Monthly deliveries are as follows:

- 10,052 vehicles delivered in July 2022

- 10,677 vehicles delivered in August 2022

As of August 31st, 2022, the company had delivered a total of 238,626 vehicles.

It is worth noting that NIO’s gross profit margin has continued to decline this quarter, with a Q2 gross profit margin of 16.7%, far lower than the 18.1% of the previous quarter and the 20.3% of the same period last year.

The company attributed the decline in gross profit margin to a decrease in vehicle gross profit margin and an expansion of investment in energy and service networks. Consider the following data:

NIO currently has 381 NIO Centers and NIO Spaces covering 152 cities around the world. The company also has 247 service centers and delivery centers covering 149 cities globally.

In the charging and swapping network, NIO has built over 960 battery swap stations and covered 197 cities around the world. Additionally, the company has deployed 829 supercharging stations and over 4,140 destination charging poles.

A detail worth mentioning is that NIO currently has the largest number of self-built supercharging stations among Chinese automakers, far more than XPENG.

NIO’s R&D expenses also increased significantly this quarter. Q2 R&D expenses were ¥2.15 billion, representing a YoY increase of 143.2% and a QoQ increase of 22.0%. The company stated that the growth was mainly due to an increase in personnel costs for R&D functions and the design and development costs of new products and technologies.

Regarding the Q2 revenue performance, NIO’s founder, chairman, and CEO, William Li, stated:> The second half of 2022 is a crucial period for NIO to expand production and deliver multiple new products. We have witnessed the strong influx of orders for the ES7, and began bulk delivery in August. We also anticipate the mass production and delivery of the ET5 starting at the end of September.

Financial Performance

Currently, NIO expects revenue for the third quarter to be between RMB 12.85 billion and RMB 13.6 billion, while market expectations are RMB 16.23 billion. The estimated delivery volume for the third quarter is between 31,000 and 33,000 vehicles.

Conference call on financial performance, Li Bin answers investors and journalists’ questions

Li Bin, Chairman and CEO of NIO:

In the first quarter of 2022, NIO’s vehicle deliveries reached a new high, with a total of 25,768 high-end intelligent electric vehicles delivered, a year-on-year increase of 37.6%.

In mid to late March, due to a new round of COVID-19 outbreaks in some parts of China, the company’s vehicle production and delivery was affected.

In April and May 2022, NIO delivered 5,074 and 7,024 new vehicles respectively. Since June, the supply chain and vehicle production have basically returned to normal. The delivery work in many important markets, including Shanghai, has also resumed. Starting in June, we will accelerate vehicle production and delivery work, and expect a total delivery volume of 23,000 to 25,000 vehicles in the second quarter of 2022.

Despite the challenges posed by the pandemic, the demand for NIO products remains strong, and the May order growth set a new historical record. Particularly, the performance of ET7 orders remains strong, and we believe that the launch of new products will drive sustained demand growth.

Gross Margin

The industry is facing rising prices for batteries, raw materials, and chips, and our vehicle gross margin has also been affected:

The gross margin of NIO vehicles in Q1 is 18.1%. In Q2, the cost of batteries continued to rise significantly and reached a high point in April, which presented a great challenge to the gross margin of the entire vehicle in the second quarter.

To alleviate cost pressures, we have implemented a series of measures such as adjusting product prices. With the delivery of new products, increased single-vehicle revenue, and production ramp-up, we expect the gross margin to rebound starting from the third quarter.

Next, I will talk with you about some key work on R&D and operations.

R&D: ET7, ET5, ES7, NT 2.0, Battery Technology

The R&D of new products and core technologies has always been one of NIO’s long-term development strategies, and all work is currently progressing as planned.

On March 28th, the ET7 was officially launched, and since then, we have continued to improve and introduce more intelligent experiences through FOTA upgrades.

The NT 2.0 technology platform has launched more than 200 new capabilities, based on the new generation of voice interaction and contextual intelligence engine, NOMI has achieved a comprehensive evolution of interaction experience, and its assisted driving system based on full-stack self-developed algorithms has performed well in external evaluations and testing data.In the third quarter, we will launch the NOP+ enhanced navigation assist function based on the self-developed high-precision map jointly developed with our partners.

With a powerful software and hardware platform, full-stack self-developed algorithm, end-to-end data loop, and operational capabilities, NT 2.0 has achieved the ability of rapid iteration and upgrade, laying a solid foundation for the subsequent opening of NAD services covering more scenarios and achieving a beyond-expectation autonomous driving experience.

On April 29th, the first batch of fully-crafted trial production line vehicles of ET5 officially rolled off the F2 factory in NeoPark Xinqiao Intelligent Electric Vehicle Industrial Park. The team is actively pushing forward the final mass production and will start delivery as planned in September.

Battery technology

Currently, NIO has a battery-related team of over 400 people who are deeply involved in research and development of materials, cells and pack design, battery management systems, manufacturing processes, etc., comprehensively establishing and enhancing the systematic research and development and industrialization capabilities of batteries. We believe that these investment will enhance NIO’s long-term competitiveness and profitability of products.

Production capacity

The Jianghuai NIO F1 factory has now fully recovered to the production capacity level before the epidemic and will gradually increase actual output in cooperation with the mass production of new products and ramping.

The F2 factory in NeoPark has achieved full-line connection of the production line and entered the stage of car-making verification. It will be officially put into production in the third quarter of this year as planned. The F2 factory took only 12 months from the groundbreaking to the first batch of fully-crafted trial production line vehicles rolling off.

New brand

The product research and development and production of the new brand in the mass market is steadily progressing.

On May 10th, NIO signed a strategic cooperation agreement with Hefei City on NeoPark’s second-phase vehicle and key core component supporting projects. According to the agreement, NIO will begin planning and preparing for the production capacity construction of new brand products.

In other words, NIO’s new brand is not only advancing the development of the vehicle end, but also has made practical progress in the supply chain of vehicle models.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.