Author: Zhu Yulong

Recently, our three-person team, consisting of GreenCore, Kangan, and myself, has prepared a program discussing sales volume. Looking at the overall market structure from 2021 to 2022, with the continuous growth of new energy vehicle sales, there is a significant change.

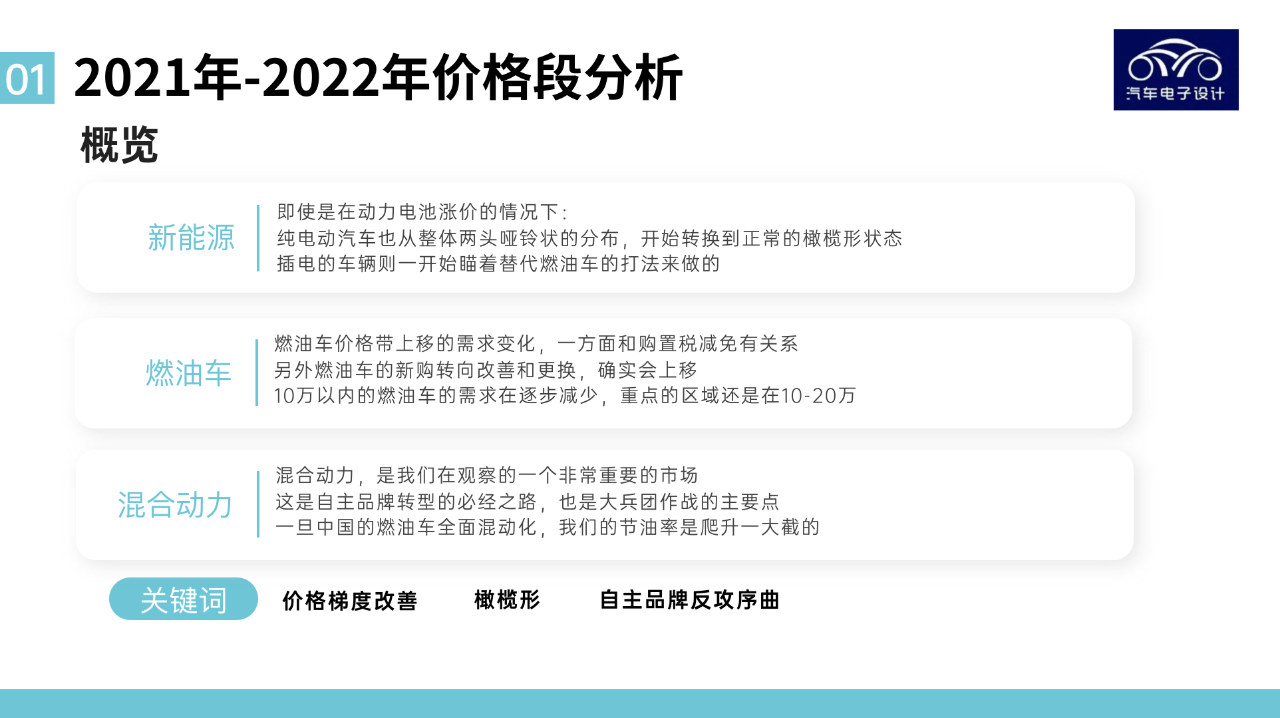

New Energy Vehicles

Despite the rising cost of power batteries, pure electric vehicles have transitioned from a dumbbell-shaped distribution to a normal olive shape. Plug-in vehicles were initially designed as a replacement for traditional fuel vehicles.

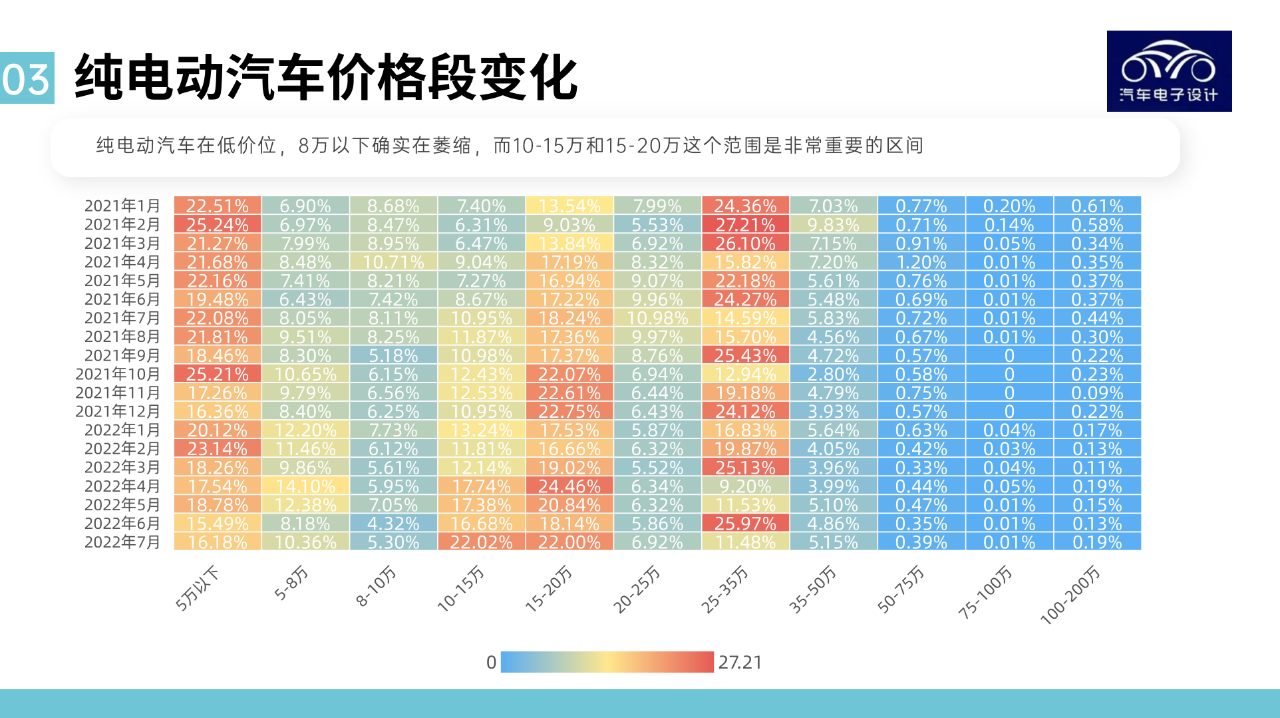

Traditional Fuel Vehicles

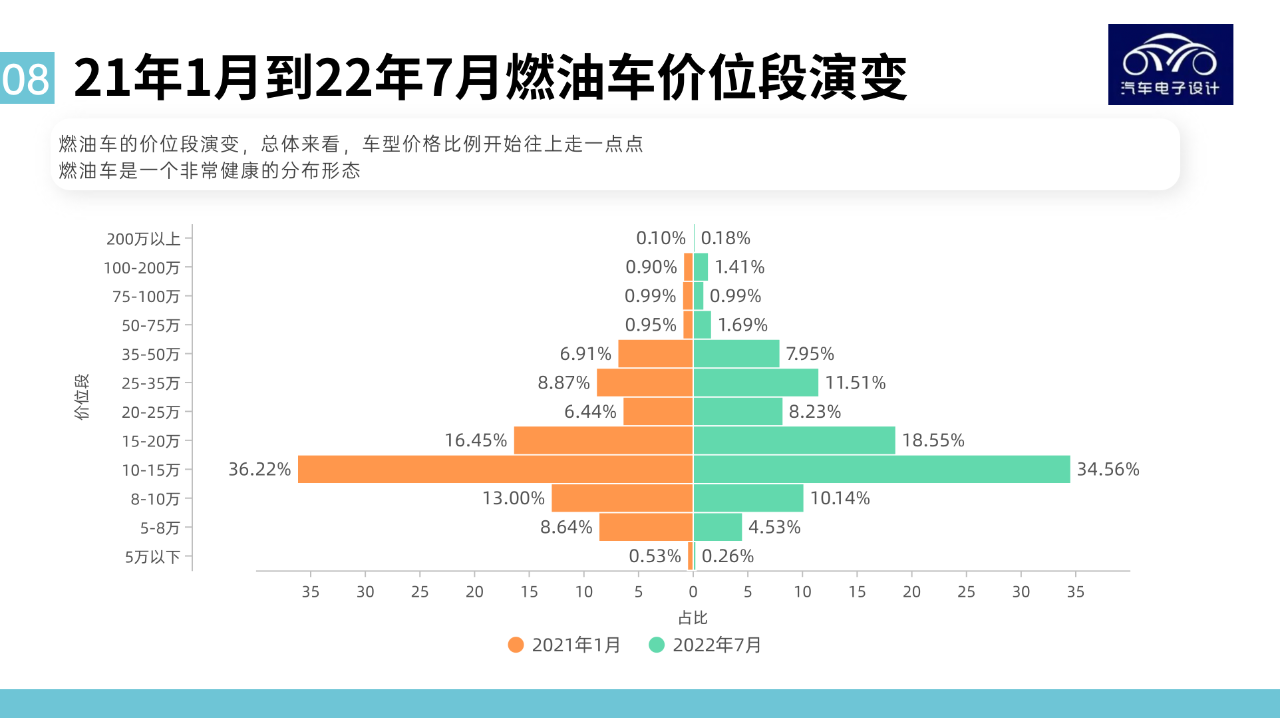

As the price range of traditional fuel vehicles has shifted upwards, the demand has also changed. One aspect of this shift is related to the reduction of purchase tax. The demand for traditional fuel vehicles priced under 100,000 yuan is gradually decreasing. The important range still remains at 100,000 to 200,000 yuan.

Hybrid Vehicles

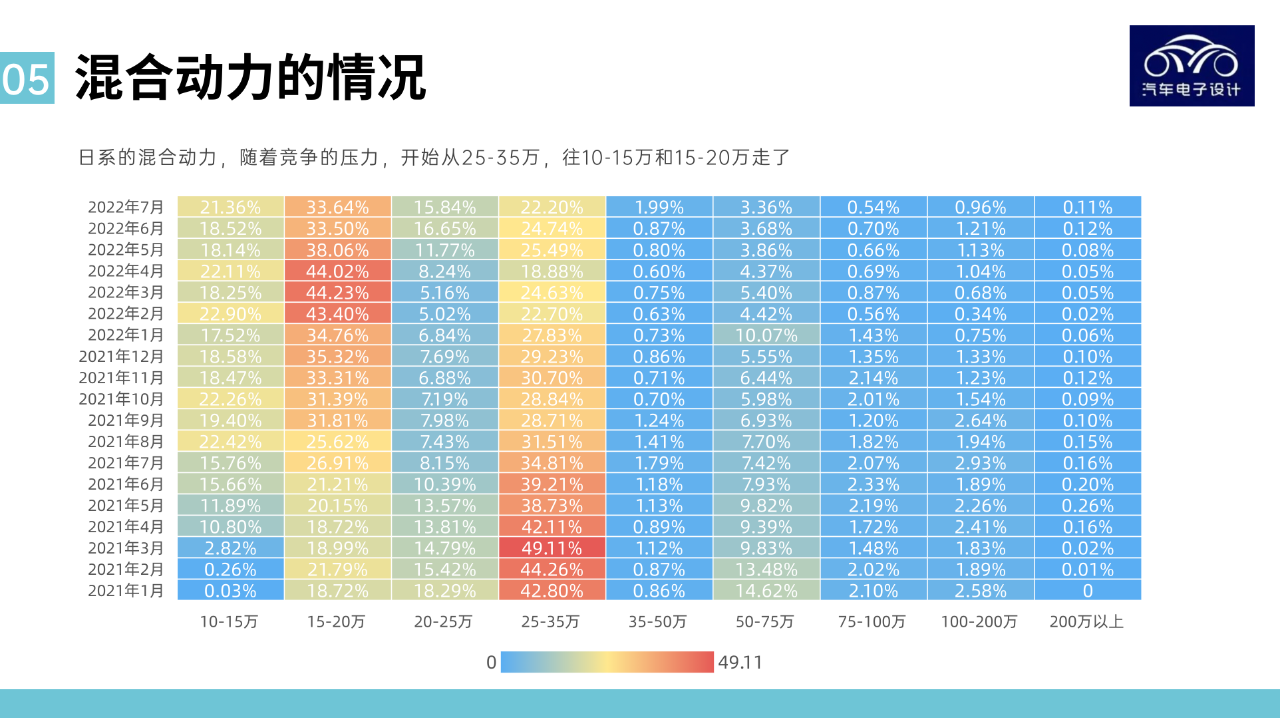

Hybrid vehicles are a very important market to observe. It is a necessary step for self-owned brands and a critical component of our main operations. Once China’s traditional fuel vehicles are fully hybridized, our fuel economy will improve dramatically.

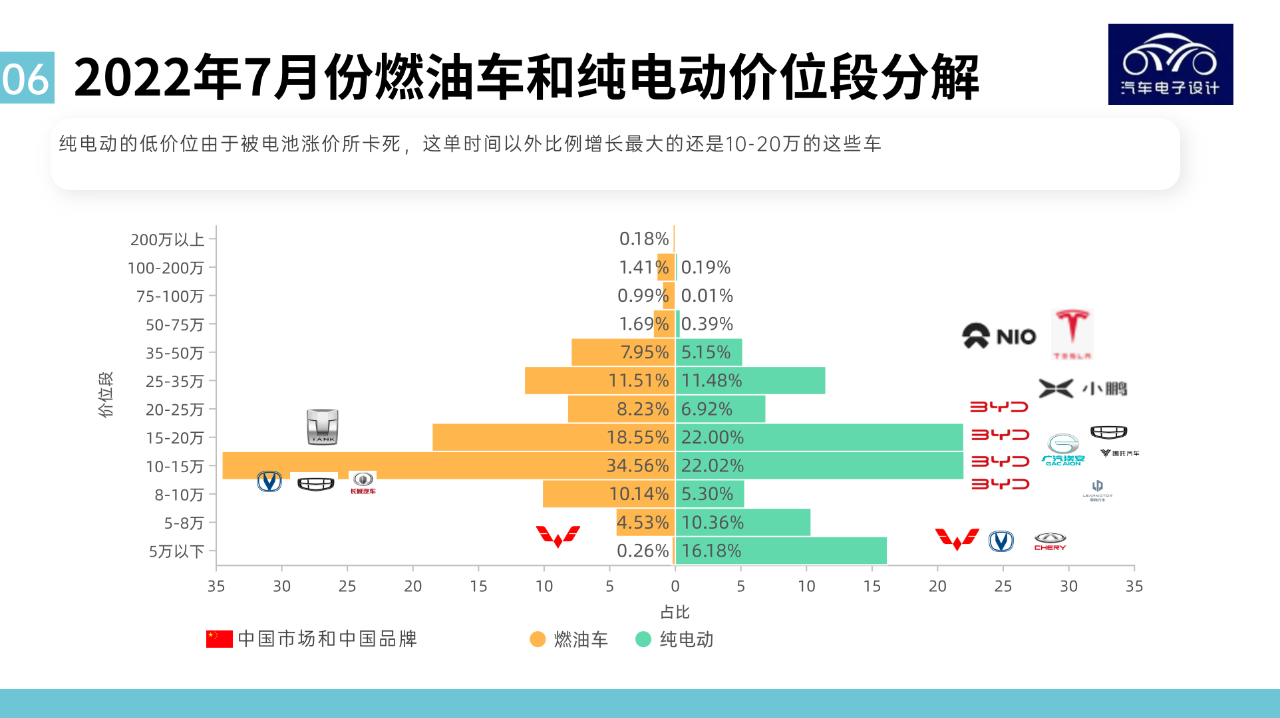

Pure Electric and Traditional Fuel Vehicles

First, let’s take a look at the two heat maps, one for pure electric vehicles and one for traditional fuel vehicles.

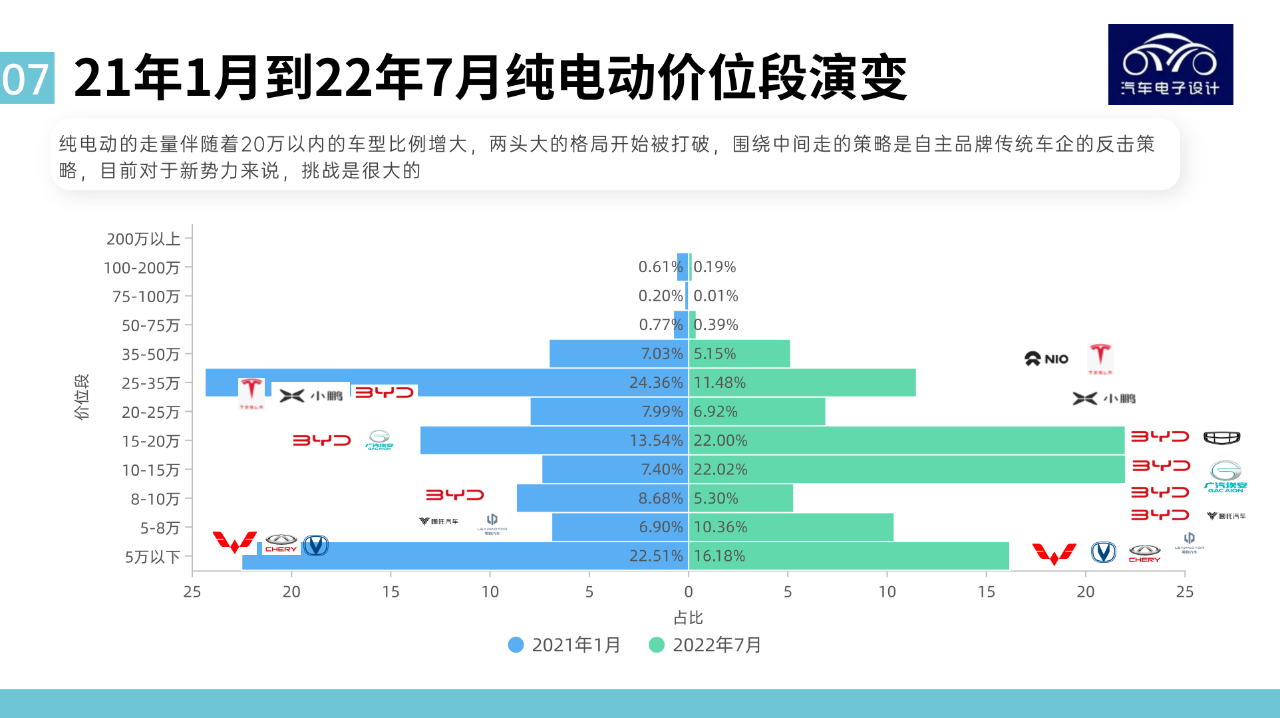

1) Pure Electric Vehicles

In January 2021, the pure electric vehicle market was bifurcated. Vehicles priced below 50,000 yuan increased by over 20%, while the Tesla range priced between 250,000 and 350,000 yuan also increased by over 20%.

2) Traditional Fuel Vehicles

Traditional fuel vehicles are mainly concentrated in the 100,000 to 150,000 yuan range, with a slight improvement in the 150,000 to 200,000 yuan range and affordable vehicles priced between 80,000 and 100,000 yuan for daily commutes.

By comparing companies producing these two vehicle types with dominant Chinese automakers, we can understand where the core driving force of this year’s growth is. By positioning first, new forces have taken the lead in 2021. However, with fluctuations in battery prices in 2022, it presents significant challenges in terms of cost control. By focusing on the crucial 100,000 to 200,000 yuan range for household vehicles, the companies experiencing rapid growth this year are BYD, EAON, and Changan.

With the rise in prices of Tesla and other new energy vehicles, traditional car companies have gained more market share. The market structure has transformed from a dumbbell shape to a more reasonable olive shape. However, the price war for market share has led to a decrease in overall profits. The question is whether to focus on expanding the market scale or stabilizing the direction of company development.

The price trend of gasoline vehicles is characterized by a decline in total volume while the overall distribution structure remains the same. As a result, car companies have to rethink how to survive in this market. Therefore, in 2022, companies such as Haval, Wuling, and Geely will transition their gasoline cars, following a very aggressive timeline.

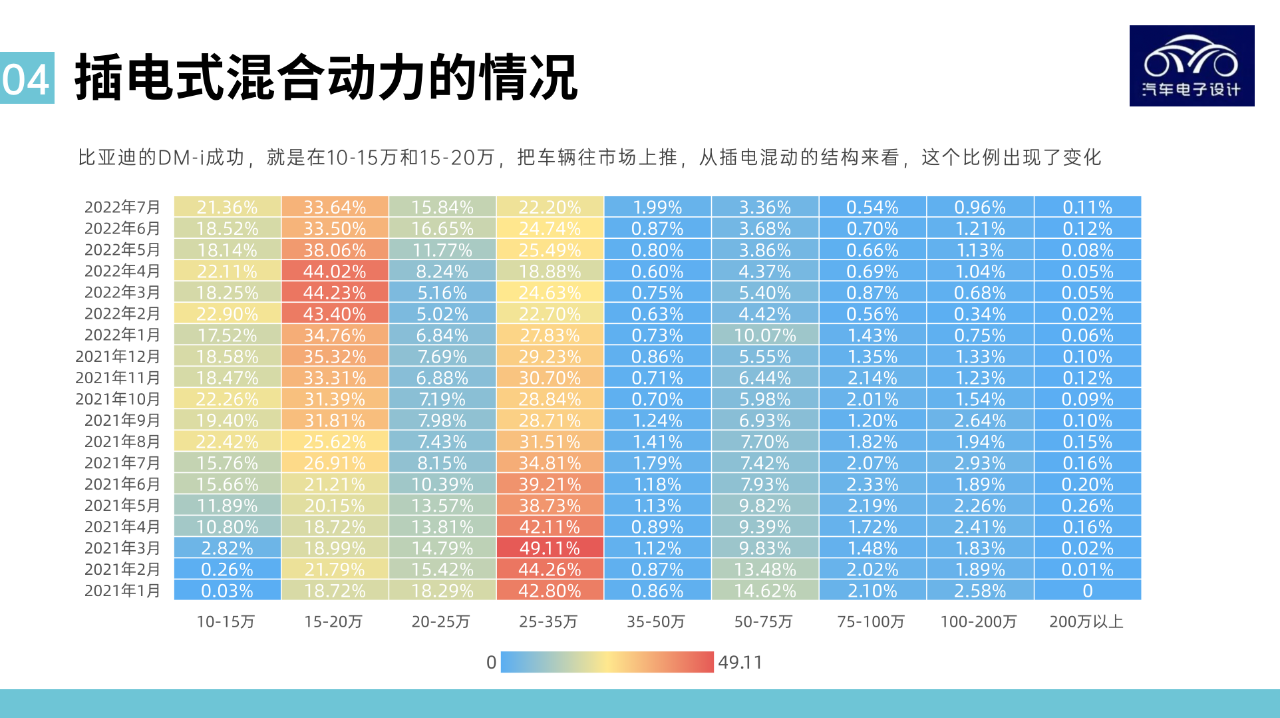

Plug-in Hybrid Electric Vehicles and Hybrid Electric Vehicles

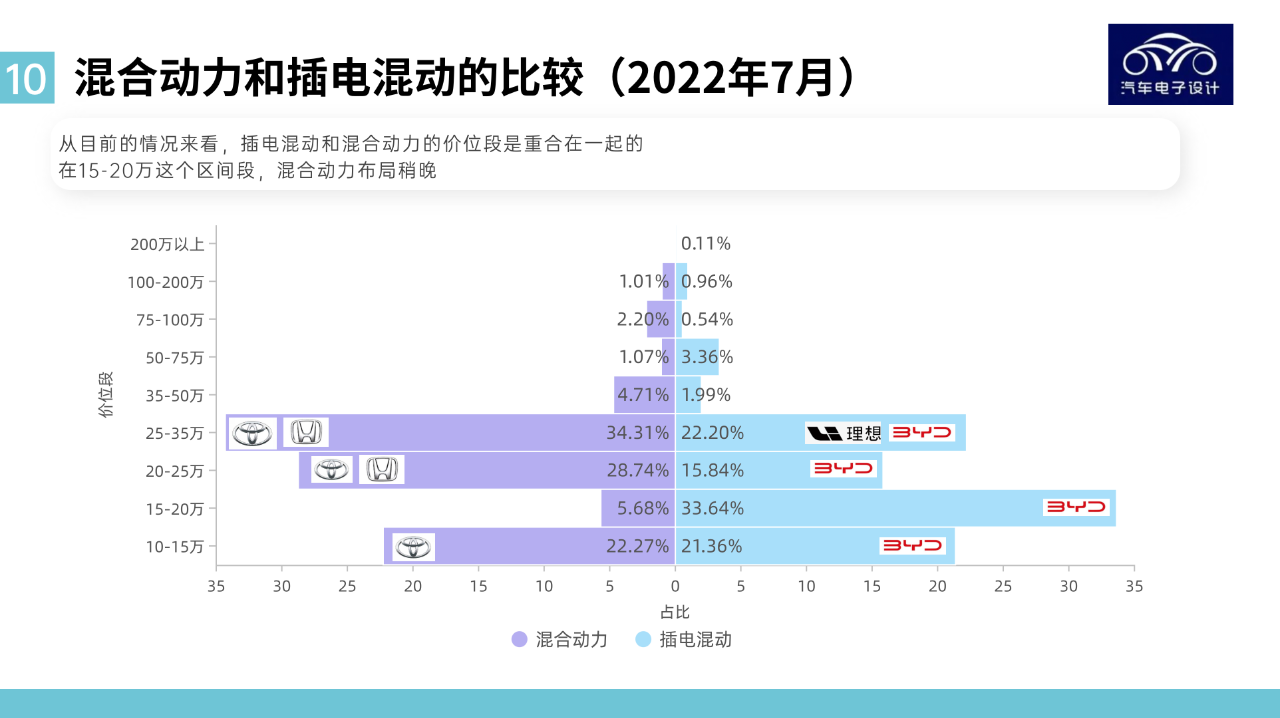

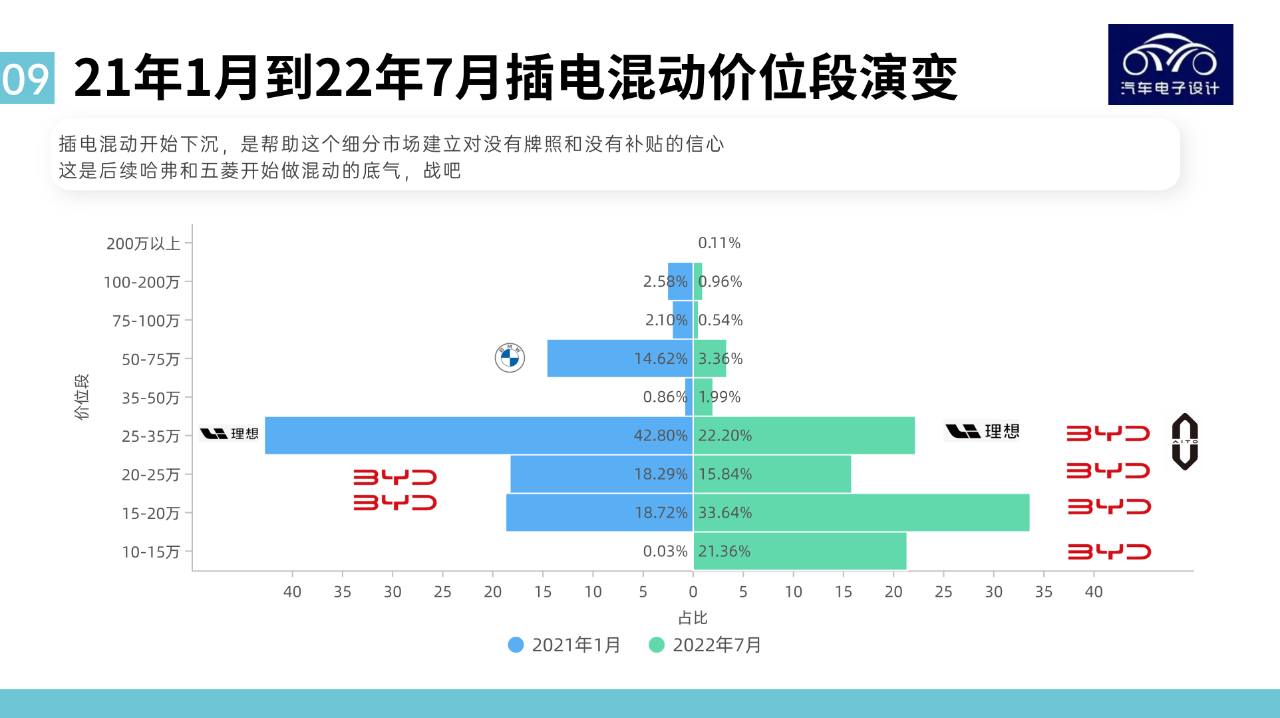

There are also changes in the structure of plug-in hybrid electric vehicles and hybrid electric vehicles. A successful example is BYD’s DM-i, which has pushed vehicles to market in the 100,000-150,000 and 150,000-200,000 price ranges. The proportion of these vehicles has changed significantly, especially in March and April 2022, where the latter price range has seen a very high proportion.

The Japanese-led hybrid electric vehicle market is also expanding. Honda and Toyota continue to expand their hybrid electric vehicle product lineup, lowering prices to substitute family cars from gasoline to hybrid electric ones. The Japanese strategy is steady and sure.

BYD’s “Super Hybrid” strategy targets the current price range that overlaps with the Japanese models in the SUV segment of 150,000-200,000 RMB. The effect has been successful.

Therefore, with most domestic brands importing the DHT hybrid architecture and promoting hybridization around the three different modes of HEV, PHEV, and EREV, this market will become the main market. From 2023 onwards, this will be the main driving force for market growth.

Summary: Looking ahead to 2022, the original “siege-hammer” new forces failed to tap into the market pulse in the intelligentization stage, and the overall growth rate was lower than expected. The main theme in 2022 will be the price reduction of pure electric and plug-in hybrid vehicles, which will drive market growth, especially in the case where the A00 market is estimated to be only 1 million.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.