Author: Zhu Yulong

When I looked at the sales of new energy vehicles for four weeks in August, I noticed that the sales of Changan’s new energy vehicles have been rising, which puzzled me.

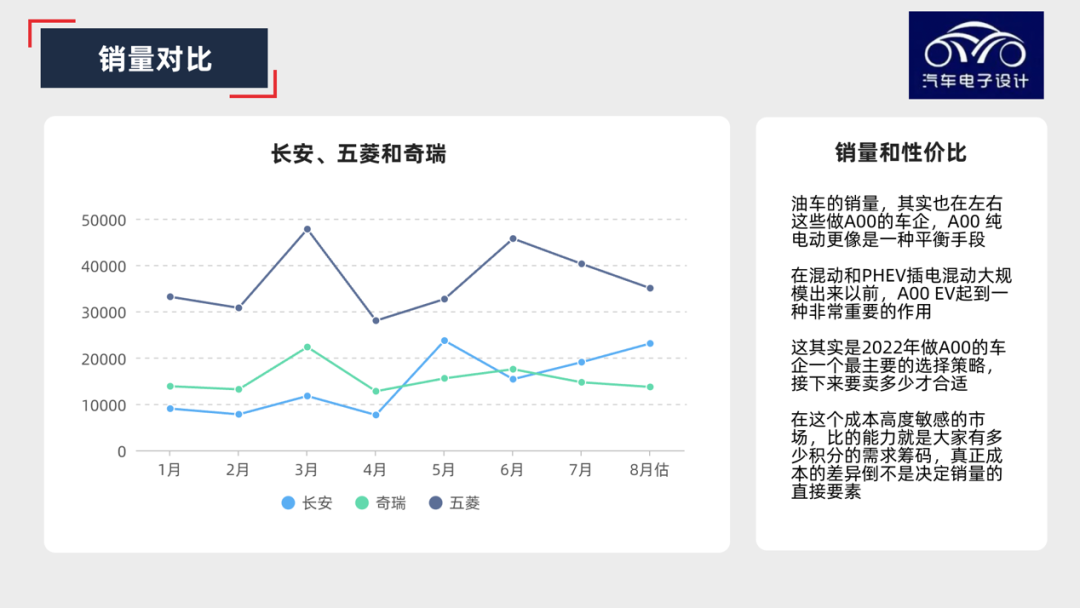

As I understand it, the A00 segment strategy is related to the overall positioning of conventional vehicles. The biggest players in this market are Wuling, Chery, and Changan. Before Changan made significant progress in the blue ocean, they launched a wave of A00 cars. This is something I don’t quite understand. The sales of conventional vehicles are also influenced by these A00 car manufacturers, and A00 pure electric vehicles are more like a balancing tool. Before hybrid and PHEV plug-in hybrids became widespread, A00 EV played a very important role. This is actually the most important strategic choice for A00 car manufacturers in 2022: how much to sell is appropriate- in this cost-sensitive market, the ability to compete depends on how many points people need, and the true cost difference is not the deciding factor in sales.

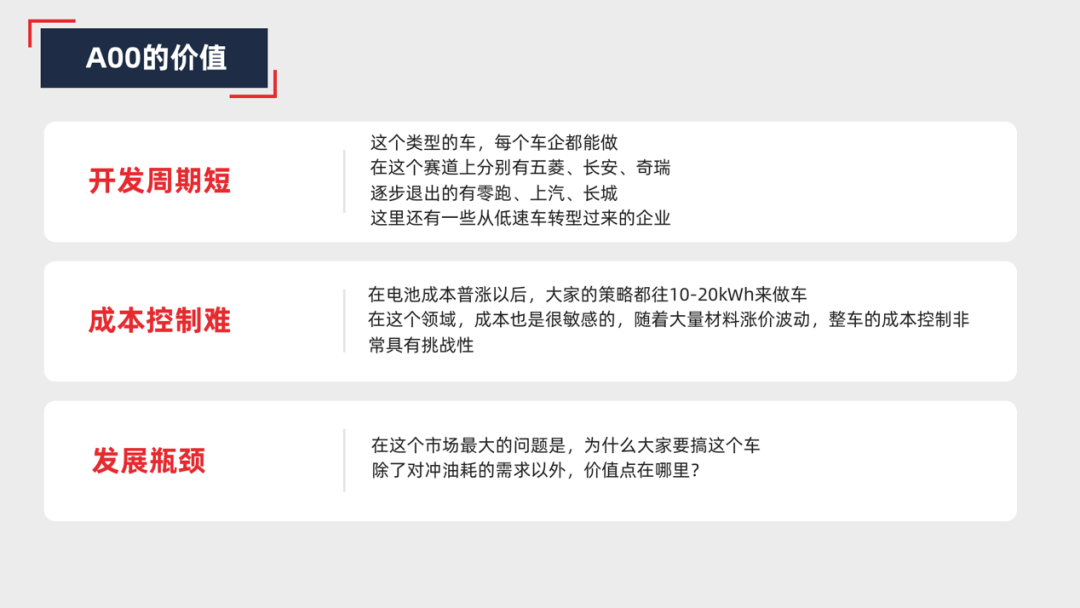

The value of A00 and the entire competitive landscape is as follows:

-

Short development cycle: Every car manufacturer can build this type of car. There are zero run, SAIC, and Great Wall that gradually withdrew from the track with Wuling, Chang’an, and Chery. There are also some companies that have transformed from low-speed vehicles.

-

Difficult cost control: After the cost of batteries rose, everyone’s strategy shifted towards making cars with 10-20 kWh. Cost is also very sensitive in this field, and with the fluctuation of a large number of materials price increases, it is very challenging to control the overall cost of the vehicle.

-

Obvious development bottleneck: The biggest problem in this market is, aside from the demand to offset fuel consumption, where is the value point for everyone to develop this car?

Overall Overview of the A00 Car Market

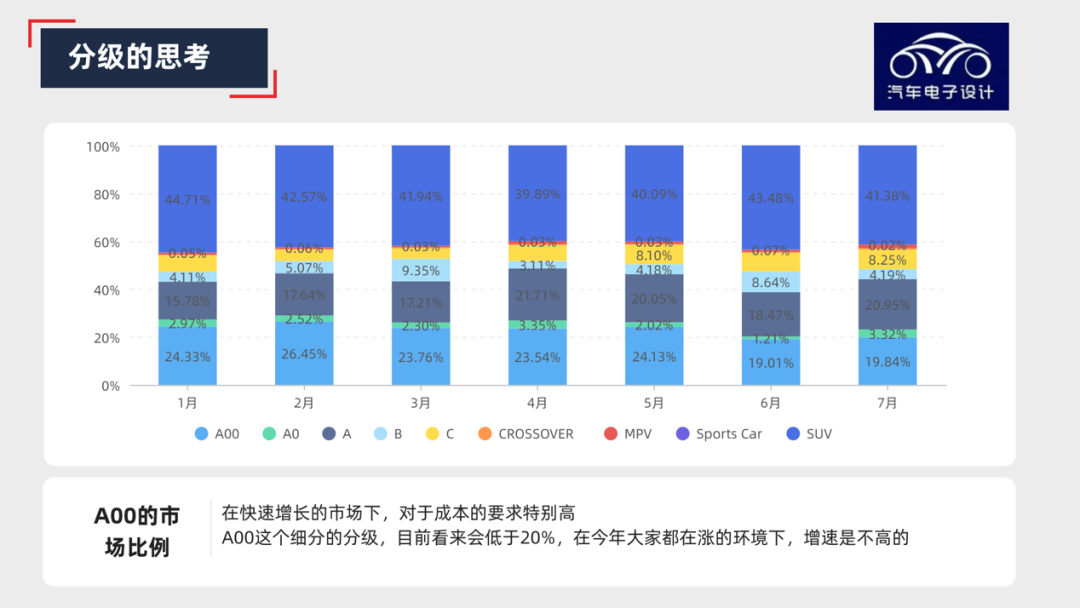

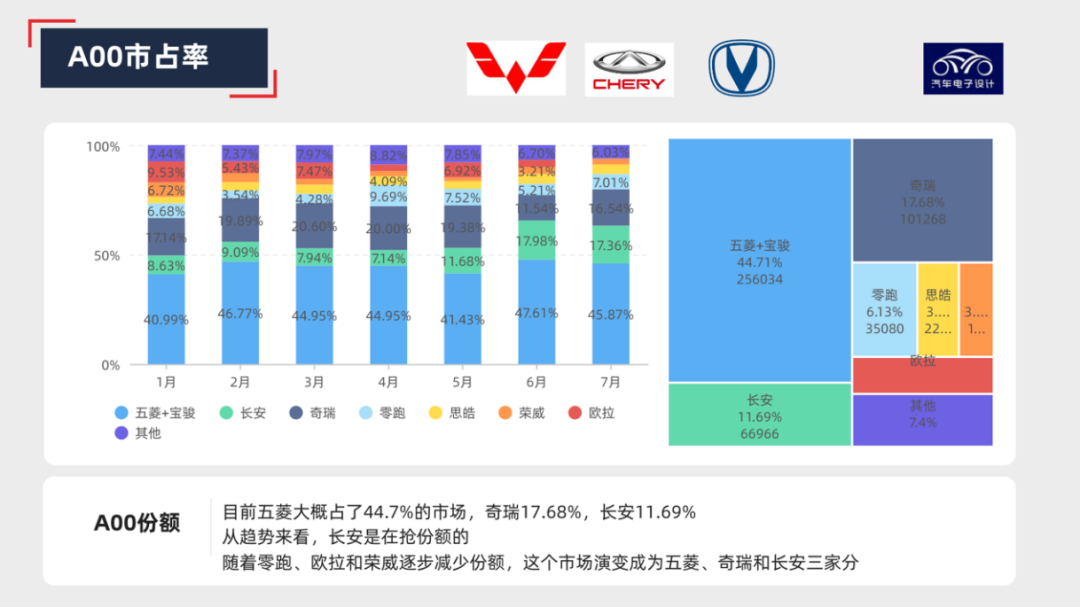

This year, the sales of A00 cars in the first seven months amounted to 572,600 units, accounting for 22.5% of the overall market. However, this proportion has fallen below 20% dynamically.

The main issue here is that the major companies lack the drive to continuously invest resources in this market. Currently, Wuling accounts for about 44.7% of the market, followed by Chery at 17.68% and Changan at 11.69%. Looking at the trend, Changan is trying to increase its market share. With the gradual reduction in market share of Zero and Euler, this market has evolved into three major players- Wuling, Chery, and Changan.

The main issue here is that the major companies lack the drive to continuously invest resources in this market. Currently, Wuling accounts for about 44.7% of the market, followed by Chery at 17.68% and Changan at 11.69%. Looking at the trend, Changan is trying to increase its market share. With the gradual reduction in market share of Zero and Euler, this market has evolved into three major players- Wuling, Chery, and Changan.

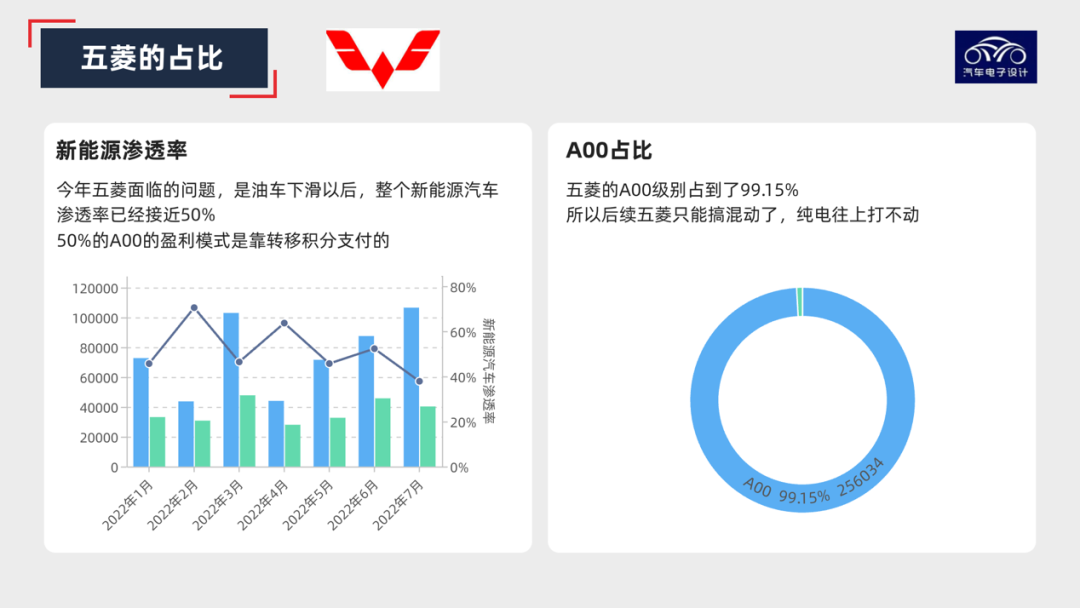

Wuling

This year, Wuling is facing the problem that after the decline of fuel vehicles, the penetration rate of new energy vehicles has reached nearly 50%. The profit model of the A00 level mainly depends on the transfer of integral payment. In the field of new energy vehicles, Wuling’s A00 level accounts for 99.15%. So in the future, Wuling can only focus on hybrid vehicles, and pure electric vehicles are not feasible for them.

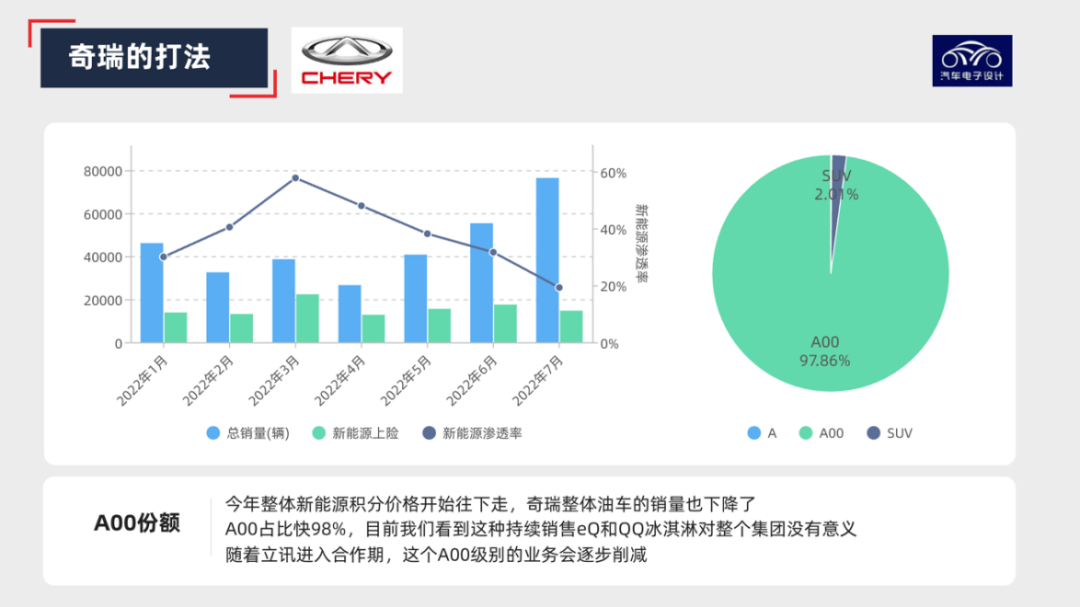

While Chery is a bit unclear. This year, the overall price of new energy credits has begun to decline, and the overall sales of Chery’s fuel vehicles have also dropped. The A00 level accounts for nearly 98%, and we see that the sustained sales of eQ and QQ ice cream do not make sense to the entire group. As Lixun enters the cooperation period, the A00-level business will gradually be reduced (compared to the previous increase).

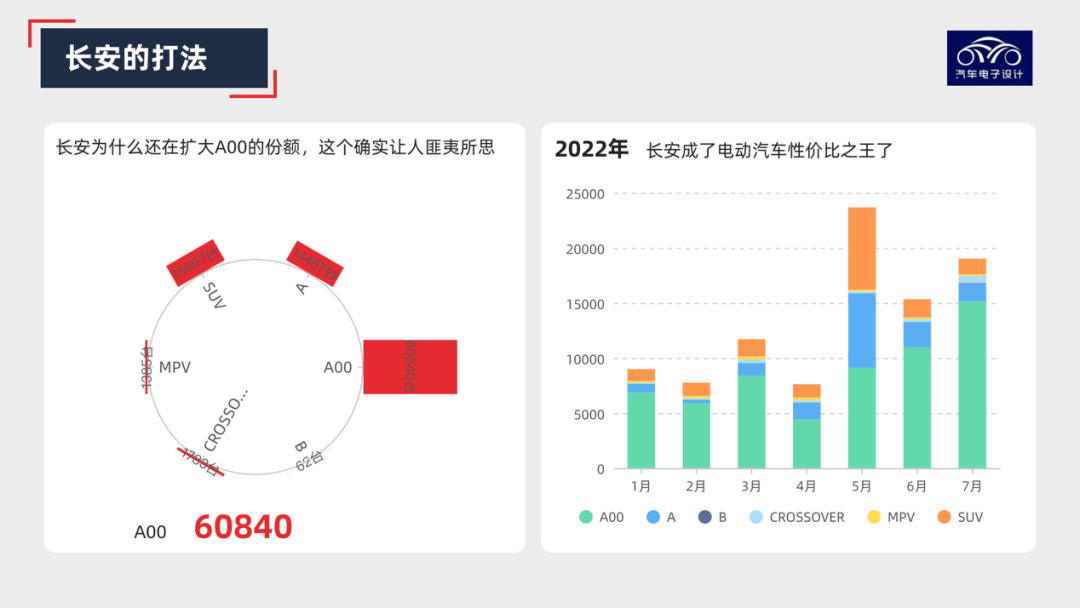

What I don’t understand is Changan’s current push to increase the market share of A00 pure electric vehicles.

Pricing strategy issues

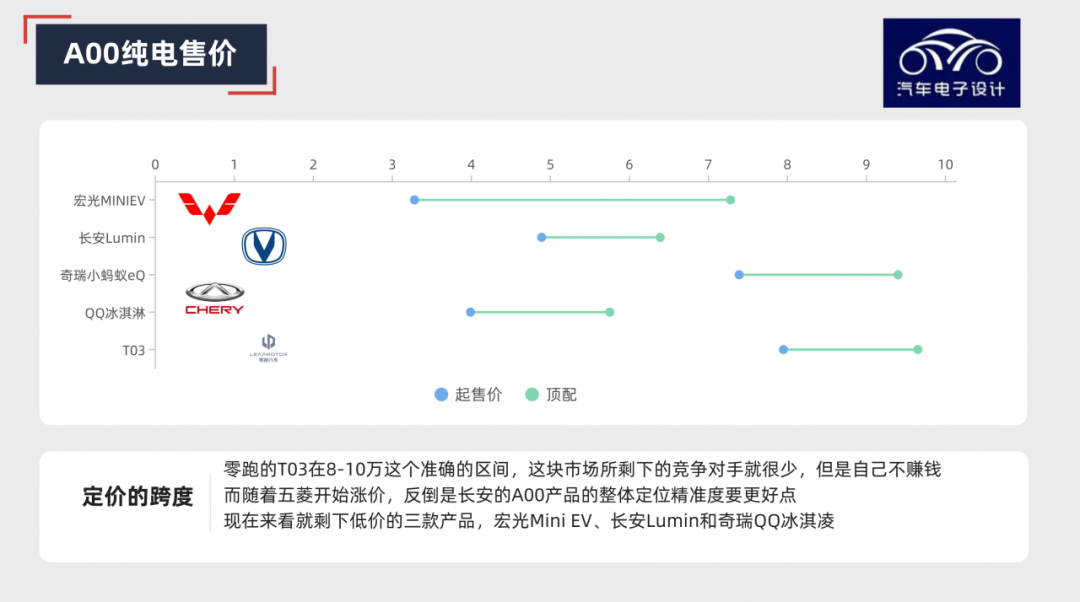

The price range for Zero’s T03 is accurately between 80,000 to 100,000, and there are very few competitors left in this market. However, Zero is not making any money. As Wuling starts to raise prices, Changan’s A00 product’s overall positioning becomes more accurate. Currently, there are only three low-priced products left on the market, Hongguang Mini EV, Changan Lumin, and Chery QQ ice cream.

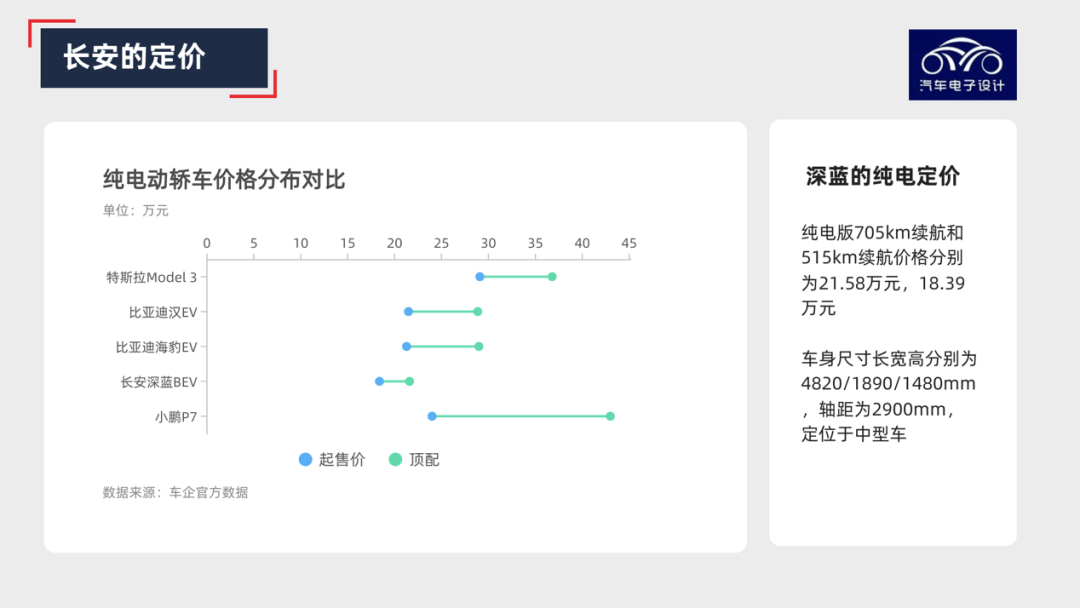

Therefore, let’s go back to the fundamental of Changan’s main Deep Blue platform. In my understanding, Deep Blue is unlikely to increase its production volume this year based on its current situation, its cost-effective performance is not remarkable, and its A00 will continue to run. The structural transformation will take place in 2023 when the delivery is gradually completed.

Therefore, let’s go back to the fundamental of Changan’s main Deep Blue platform. In my understanding, Deep Blue is unlikely to increase its production volume this year based on its current situation, its cost-effective performance is not remarkable, and its A00 will continue to run. The structural transformation will take place in 2023 when the delivery is gradually completed.

So in my understanding, this wave of A00 is to solve practical problems. Deep Blue’s pricing aims to promote its brand and reputation. Avita’s pricing is a bit high and needs to rely on Deep Blue’s cost-effective performance to be launched, and then adjust it in 2023.

In summary, I still think that this year’s A00 pure electric vehicle trend is to control the volume, and it is reasonable to have a monthly price of about 80-90 thousand yuan. By the end of the year, it will probably fluctuate around 400-450 thousand yuan, and gradually retreat to a supporting role position at about 1 million yuan.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.