Author: Zhu Yulong

Unconsciously, the summer vacation is over, and September (the eagerly anticipated start of school) is coming. Here’s a systematic review of the market for electric drive systems, power electronics, and battery management systems in August.

-

The cumulative number of passenger car electric motors is 479,000 sets, an increase of 98.6% year-on-year. The combined three-in-one and multi-in-one electric drive systems for new energy passenger cars had a total installed capacity of 288,000 sets, an increase of 136.1% year-on-year, accounting for 60.1% of the total matching volume. Silicon carbide products have gradually begun to increase in volume.

-

The installed capacity of BMS in passenger cars is 439,454 sets, an increase of 105.77% year-on-year. The trend of vehicle manufacturers outsourcing BMS is becoming more apparent, and cloud-based BMS management is becoming a standard product for vehicle manufacturers.

-

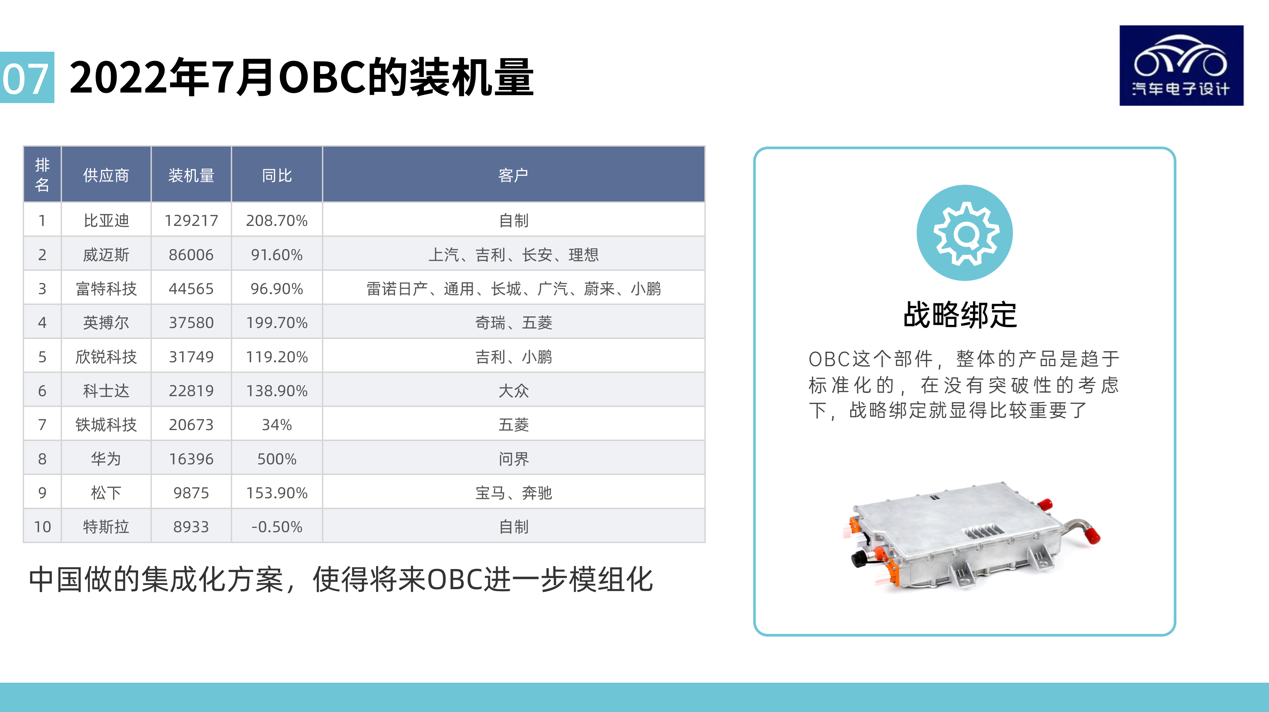

The installed capacity of OBC in the market is 436,210 sets, an increase of 104.25% year-on-year. The product value is relatively low, and the value of doing it yourself is not obvious, which leads to more third-party suppliers and a scattered distribution. Vehicle manufacturers are choosing strategic suppliers to bind.

Battery Management System

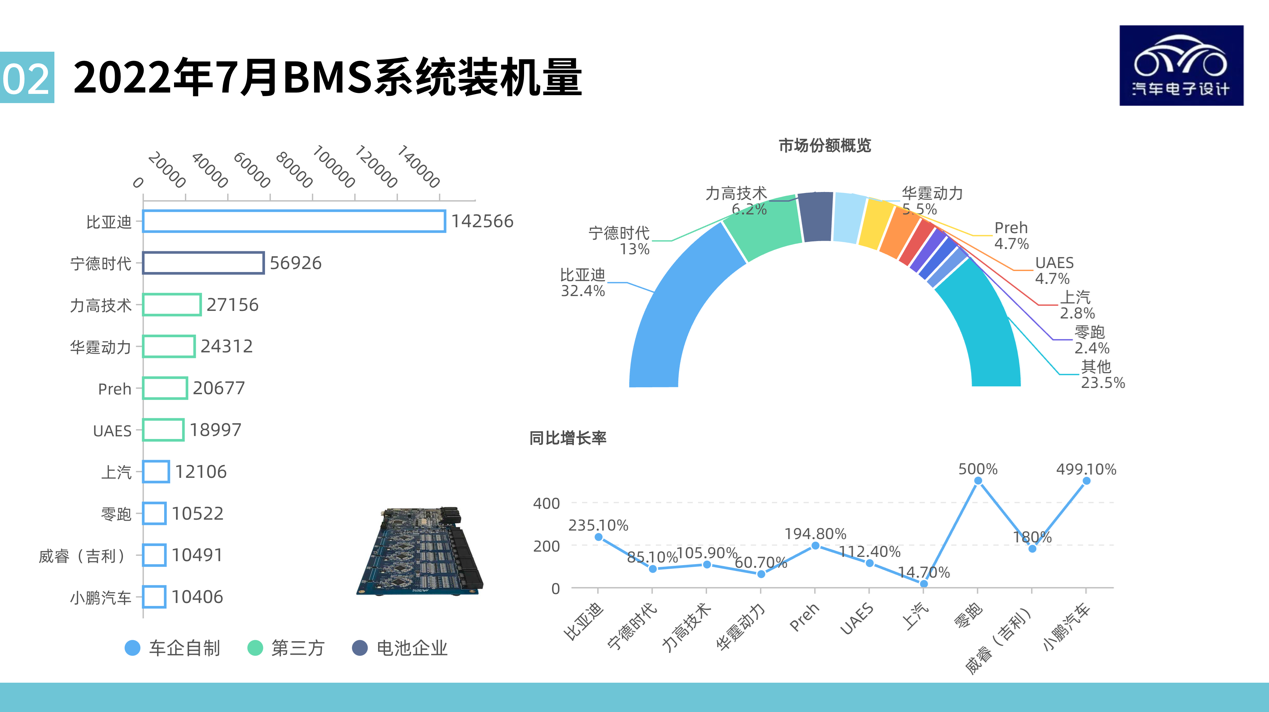

In Figure 2 below, the number of BMS installations is relatively clear: Ligo and Huating are pushing for the installation of vehicles in close partnership with battery companies. In addition, Preh and UAES are among the top 10, with no position for component companies.

As the battery management system is directly connected to subsequent cloud data management, we find that from the overall design and manufacturing of A-class vehicles, the electronics outsourcing method has been adopted except for Class A00 vehicles.

There are no particularly surprising developments in this field.

Electric Drive System

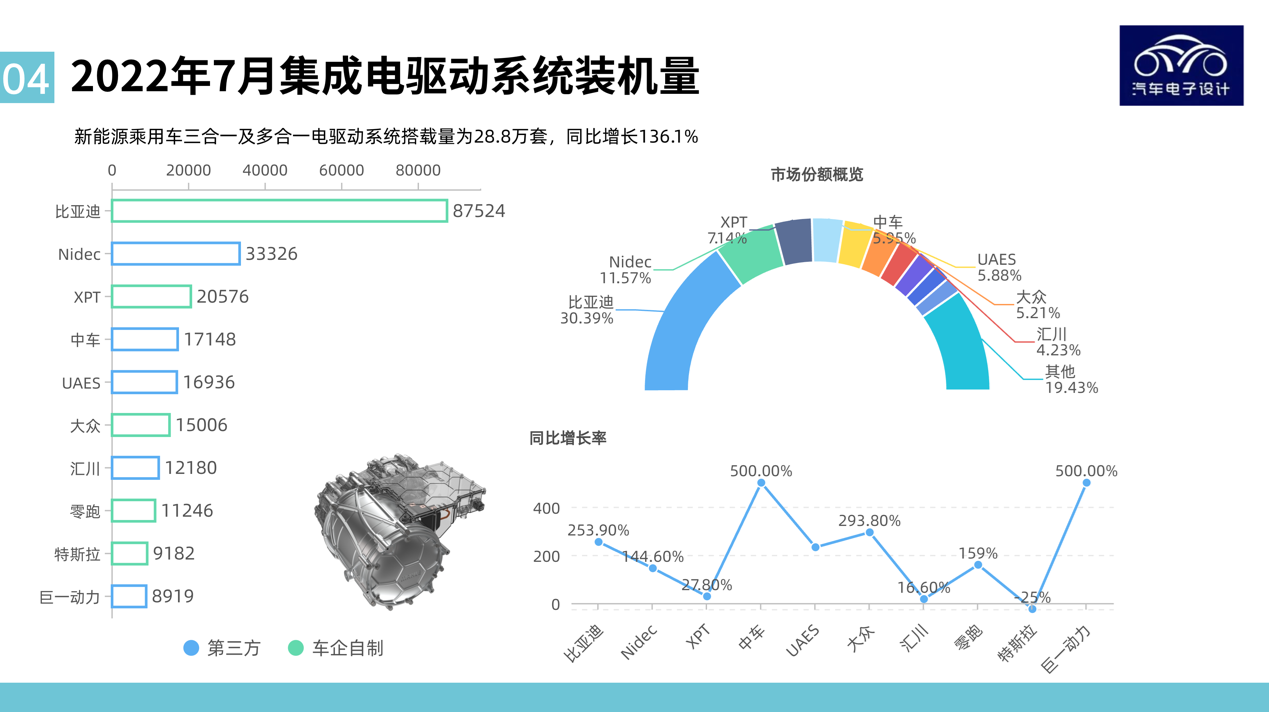

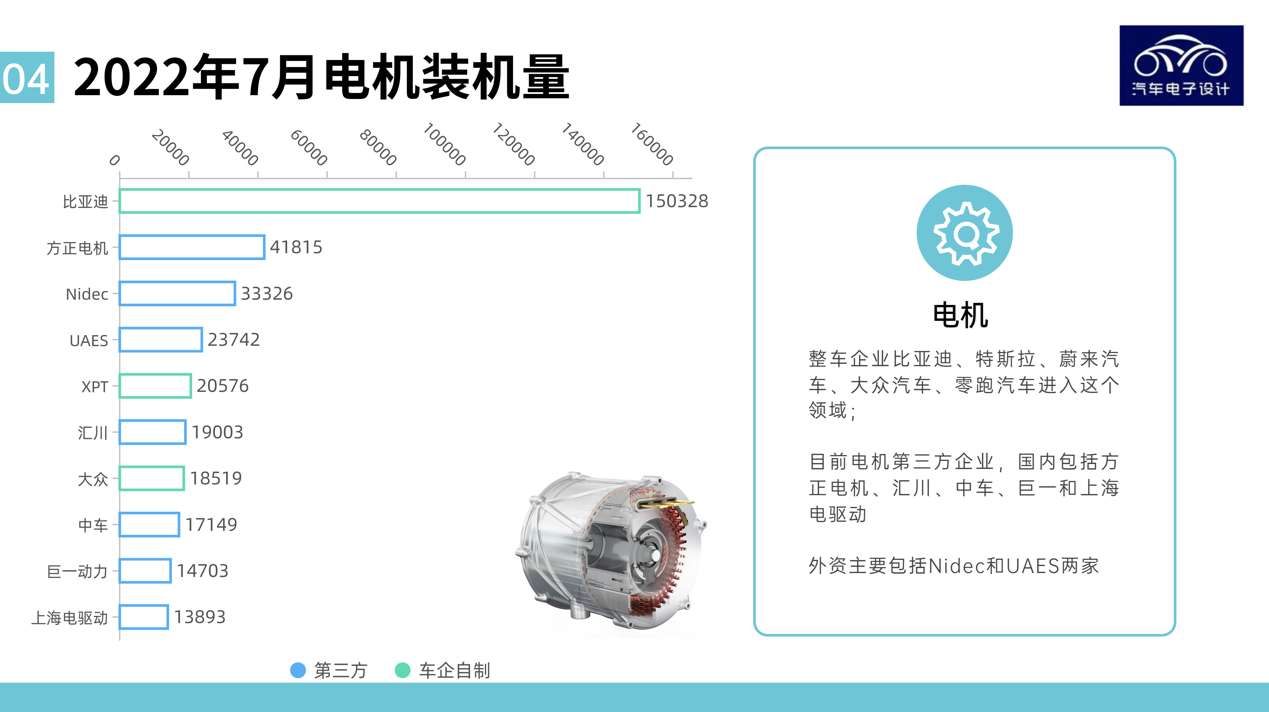

As previously mentioned, vehicle manufacturers are still capturing the manufacturing links of three-in-one and multi-in-one, and completing the entire assembly themselves; the trend of motor manufacturing is also relatively clear (Figure 4).

The motor is relatively easy to make, and the next step is mainly to focus on the increment based on HEV dual motor, which will be faster than 3 in 1 due to the popularity of flat wire technology and oil cooling design (see Figure 5).

As for the inverter, due to certain manufacturing requirements, there are not many domestic car companies that truly design and manufacture inverters (see Figure 6).

OBC System

The OBC market is progressing rapidly due to standardization. Currently, except for BYD, WM Motor, Futurus Technology, and Xinyikang Technology are leading the way, and low-cost strategies like Envision AESC are effective in many cars. We’ll see if Huawei has room to expand in this field.

Conclusion: With the development of SiC devices, car companies may become more determined to pursue power electronics and inverter integration in the future. These companies in various subdivisions will compete in combination rather than individually, and it is indeed more appropriate to put them together for comparison.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.