Author: Zhu Yulong

In July, the Chairman of Guangzhou Automobile Group (GAC), Mr. Zeng, mentioned at the 2022 World Power Battery Conference that the power battery accounts for 40-60% of the total vehicle cost, and the cost is still increasing. He jokingly said that the company was working for the battery factory, and revealed that GAC had already started working on battery production. On August 25th, with the announcement of several important proposals, GAC took another step forward in the vertical integration of automotive and battery manufacturers.

-

Established Green Engine Battery Company to carry out independent battery industrialization construction, with a total investment of RMB 10.9 billion.

-

Participated in Guangzhou Juwan Technology Research Company to build a battery production base, producing the core of fast-charging power batteries, with a total investment of RMB 3.69 billion.

GAC is no longer a “worker” for battery factories because they have started to make their own batteries. They are following BYD’s vertical integration strategy to control the entire battery cost. This strategic direction is based on the foundation of Times Electric, and from a macro perspective, GAC does have some unique ideas.

GAC’s Determination

Let’s rewind a bit: In October 2021, GAC passed the “Proposal on the Construction of the Self-developed Battery Trial Production Line Project” to accelerate the industrialization of self-developed battery technology, verify battery process maturity, product consistency, and product cost, reserve mass production process technology, agree to implement the plan of the wholly-owned subsidiary GAC Aion’s self-developed battery trial production line project with a total planned investment of RMB 336 million.

In March of this year, GAC’s new energy brand, GAC Aion, officially started construction of the self-developed power battery trial production line. The self-developed battery trial production line project covers an overall area of approximately 10,500 square meters, including the entire process of battery production from slurry preparation to battery pack, as well as laboratory operations such as material research and development, physical and chemical testing, and electrical performance. The project is expected to be completed and put into operation by the end of 2022 (including Si anode battery). The core of the power battery technology strategy, “Neutron Star strategy,” is to promote technology advancement in three areas: battery cells, battery management systems (BMS), and battery packs. Self-developed power battery cells must be scaled and applied within three years, with the aim of achieving self-developed and produced power batteries in the medium to long term.

In August, GAC Group will establish GAC Green Engine Battery Co. as the main entity to implement the self-owned battery project. The initial registered capital is 1 billion yuan, with GAC Aion, GAC Passenger Vehicle, and GAC Trading investing 510 million yuan, 400 million yuan, and 90 million yuan, respectively, according to their respective shareholding ratios of 51%, 40%, and 9%. The funds will be managed by GAC Group. The independent battery industrialization will start construction at the end of this year and will be completed by 2025, with a production capacity of 26.8 GWh, which can cover the demand for pure electric and hybrid vehicle markets.

From the perspective of battery use, it will mainly serve GAC Aion and the companies within GAC Group in the early stage, steadily increasing market share of batteries, and in the future, expand to external markets and conduct market-oriented operations.

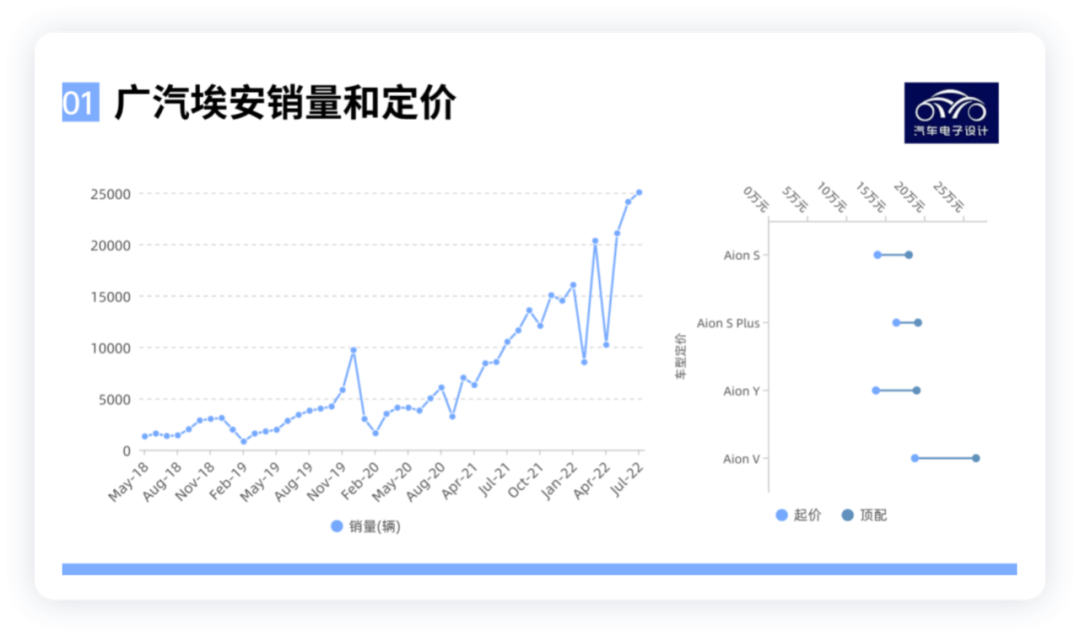

From the perspective of production capacity planning, the current standard production capacity of GAC Aion is 200,000 vehicles per year, and the second factory is expected to be put into operation at the end of 2022, with an overall capacity of 400,000 vehicles per year. This means there will be a demand for around 25-30 GWh of batteries, mostly based on lithium iron phosphate battery cores.

GAC’s Battery Technology Roadmap

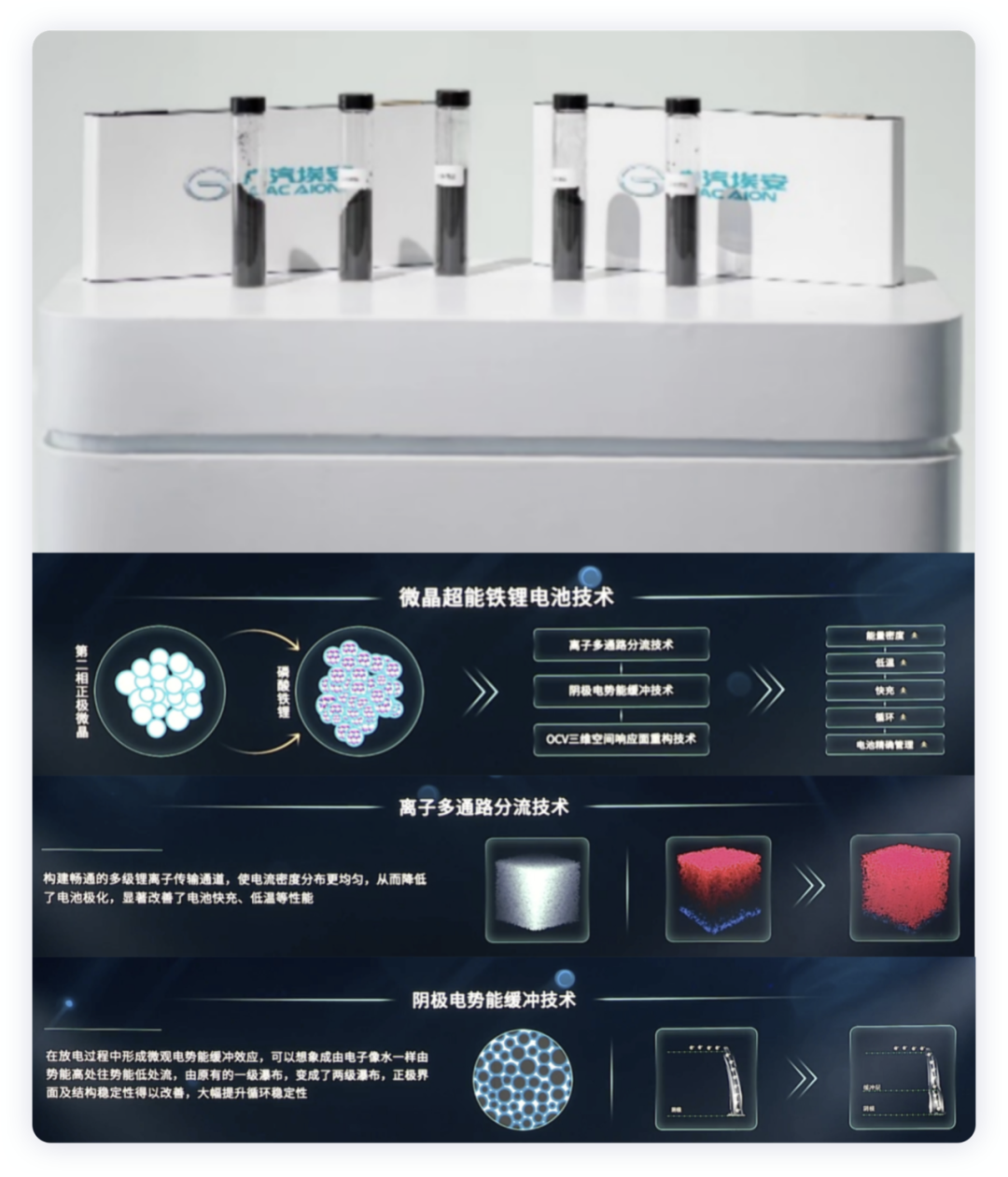

On GAC Technology Day on June 28 this year, GAC Group released a new generation of super energy lithium iron phosphate battery technology (SmLFP) based on microcrystalline technology. Compared with commercially available lithium iron phosphate batteries, the energy density of the former was increased by 13.5%, and the volume energy density was increased by 20%. The energy density increased from 185 Wh/kg to 210 Wh/kg and the volume energy density increased from 400 Wh/L to 480 Wh/L.

Note: How to achieve 480 Wh/L and whether it can be achieved in production are currently unknown.

In this sense, Geely also invested in lithium iron phosphate battery cores. With everyone returning to lithium iron batteries, vertical integration of battery cores by automakers became reachable.

Conclusion: After a series of automakers layout battery industry, whoever does not independently develop battery technology will gradually become the exception. However, no matter what, in the end, it still needs to compete with BYD on price – whether or not you can sit at the table depends on your current level of enthusiasm.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.