Author: Rezz

Under the new energy wave, China’s domestic brands have encountered an unprecedented opportunity for a come-from-behind victory. In just the first half of 2022, the market share of new energy vehicles has reached 21.6%.

However, Great Wall Motors seems at a loss: its move to embrace the new energy wave cannot outcompete its rival BYD, which has occupied the champion of monthly sales for 98 consecutive months with the first-generation SUV Haval H6. Haval H6 may have fallen in sales ranking partially due to its not being upgraded with the DHT technology.

Mocha, latte and macchiato, these “coffee brothers,” even with the support of DHT technology, have been greatly affected by high prices and naming confusion. They have had to sit by and watch the sales of AITO WENJIE M5 soar, even occupying a portion of the SUV market of Haval and WEY.

Therefore, Great Wall Motors has come to a realization that the leading DHT technology must be applied to Haval H6, a sales representative, and has launched two models, Haval H6 DHT HEV and Haval H6 DHT PHEV.

Although this decision comes at a great cost and the price of the hybrid version is much higher than that of the fuel version, it may not necessarily win over consumers. Nonetheless, Great Wall Motors has taken a solid step forward.

At the same time, Great Wall Motors announced a major move: to stop producing fuel-powered cars in 2030. This move by Great Wall Motors, which started with its own multi-point direct injection engine, seems to be fighting a last-ditch battle with the strong competitive opponents in today’s market.

The Battle Between Extended Range and Intelligent DHT

In the past month, many people on Weibo have been comparing the extended range and DHT hybrid technologies, and even the topic has burned under the Weibo of Great Wall WEY CEO Li Ruifeng and Huawei Terminal CEO Yu Chengdong. Their sharp exchange of words has sparked a heated debate about DHT and extended range hybrid.

Previously, many people simply compared them in terms of economy, believing that the extended range hybrid is a backward technology that is a consensus in the industry. However, I think this phenomenon is more limited to the technical capabilities of certain brands of range extenders, hence the impression that “extended range equals more fuel consumption” is given to more consumers. With the emergence of more and more extended range models and the continuous breakthroughs in technology, this perception will gradually be broken.

Therefore, it is a little shortsighted to merely compare their economic efficiency, and it is necessary to study the difference between them from a technical perspective.The biggest difference between range extender and DHT hybrid technology is whether the engine participates in power output. The Lemons DHT hybrid has 4 working modes, including pure electric, engine direct drive, engine and motor series and parallel connection. In addition, the Lemons DHT hybrid also includes two dedicated gearboxes, and the engine direct drive also has two power modes.

There are only two situations for range extender: the range extender works or not, and the final power output depends on the motor. In terms of energy loss, range extender models usually generate some loss when energy is transmitted, for example: range extender-battery-motor, which is what most people mention.

However, it should be noted that most range extender technologies now also support the range extender to directly output electricity to the motor, or output to the battery and motor at the same time, reducing the transfer link.

The most important thing, I think, is that the so-called technological advancement of DHT should be reflected in the parallel connection of the engine and motor. This mode can bring users the greatest value.

-

Economic advantages: Under this mode, both DHT and range extender are only the problem of electricity loss. Currently, the efficiency of these modes is not much different. The key is to look at the driver’s throttle technique. Many car owners buy hybrid models but don’t understand the concept of plug-in hybrid. They don’t charge for commuting in the city, and they run in pure EV mode on the highway when fully charged, which is “going the wrong way.”

-

In terms of power output, there is a big difference between the two. To achieve the same power, range extender needs enough cost on the motor, while DHT can reduce the overall cost through superposition. If the same motor is used, DHT can provide additional power from the engine, and the power performance will be stronger.

In terms of cost, DHT is more similar to DM-i. The traditional mechanical parts are relatively more, and the cost can be squeezed a little, making it more convenient to push the price to tens of thousands of dollars for mass production. Therefore, the Song Plus DM-i has become the sales champion of SUVs in this price range.

Range extender is more electrified and has higher costs. It is used by new forces such as Ideal, and their dependence on the supply chain is relatively strong.

To sum up, I think the advantage of DHT will be more in terms of performance and cost, especially in terms of cost, which is why the price of range extender cars generally starts from 200,000 or 300,000 yuan.

At the same time, it should be noted that in terms of performance advantages, because the motor has a natural advantage in power output, the difficulty of power improvement of 100 to 200 horsepower for motors and engines is vastly different. Therefore, this gap will continue to decrease as motor power technology advances. Of course, DHT hybrid technology will also benefit from this progress.I personally think that the DHT hybrid technology solution used in Great Wall Motors’ (GWM) Lemon Hybrid model is very impressive. It solves many problems such as receiving government subsidies, allowing for short-range pure electric usage and long-distance travel, engine output for high-speed driving, and dynamic output in the engine’s sweet spot. The only concern is whether its reliability and higher purchasing costs as a new technology will be accepted by the market, which remains to be seen.

Battle Between DM-i and DHT

Overall, DM-i and DHT are the flagship technologies for BYD and GWM, respectively. DM-i emphasizes overall fuel economy while DHT focuses on the adaptability to a variety of driving conditions. Both are the superheroes of their respective brands, with DHT having better high-speed performance and DM-i having better economy for household use.

The Lemon Hybrid developed by GWM has a 2-speed gearbox which provides stronger performance at high speed compared to BYD’s DM-i, as the engine can engage at around 30 km/h. DM-i only has one gear, and the engine only engages at around 70 km/h. DM-i generally cannot operate well beyond 160 to 170 km/h, while DHT can theoretically run at 180 to 190 km/h, including Changan’s IDD.

However, DM-i has better smoothness at low speeds because it operates solely on electric power. What is smoother than DM-i is the range extender. This system is an excellent solution for grocery shopping or almost all household practical needs, generally being a well-rounded solution with no real weaknesses. However, its limits are low, making it suitable only for short-distance commuting. Lemon Hybrid, GWM’s model, can offer slightly more powerful performance.

The main reason why DHT is more expensive than DM-i is not so much the two-speed gearbox or the E-CVT gearbox but the batteries. Lithium iron phosphate batteries cost at least 300-500 yuan less per kWh than ternary lithium batteries. A 10 kWh difference is 3-5 thousand yuan, a 40 kWh battery equipped in the Mocha PHEV and Tang DM-P level would have a price difference of over 20 thousand yuan.

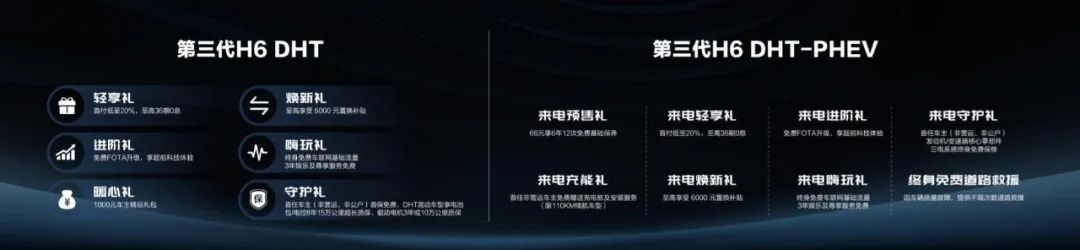

The HEV and PHEV from GWM are rivals to BYD’s DM-P, new energy hybrids, and joint ventures, while H6 DHT PHEV officially launched and priced today competes with BYD Song Plus DM-i, which is currently the best-selling SUV in the market today.The current average price of Haval’s Chitu, H6S, and Divine Beast HEV is around 130,000 to 160,000 yuan. Lemon’s hybrid DHT technology was previously used on Great Wall’s own high-end brand, the NIO Coffee series Three Musketeers, with a starting price of 230,000 yuan. However, today Great Wall has spared no effort to equip the entire Haval series with hybrid DHT, and the price of the Haval H6 DHT PHEV is RMB 168,800 to 176,800, directly targeting the DM-i models of Song Pro and Song Plus.

The Battle Between HEV and PHEV Fast-charging

Previously, hybrid-specific transmissions simply used two or more electric motors to replace the functions of the original mechanical transmission. As for how to achieve this double-motor series-parallel technology, each automobile manufacturer has its own methods. DHT-based hybrid vehicles that do not include large battery packs and rely solely on burning fuel are known as HEVs, while those that include large battery packs, can be charged, and have pure electric driving capabilities are known as PHEVs.

Technically speaking, the battery voltage of a plug-in hybrid PHEV is actually similar to that of a pure electric EV, but without the rectifier circuit, a DC-DC voltage reduction circuit is likely to be required, and most of them use the same supplier products, at around 350V.

Of course, there are exceptions, but they are few and far between, such as the 500V plug-in hybrids of BYD DM-i, and the current trend led by Porsche and XPeng, the 800V system pure electric supercharging network.

The DC charging station itself will provide the required charging voltage according to the handshake protocol. Of course, the premise is that it must be matched. The 500V system and the 750V system are no different for most pure electric vehicles, but there are also awkward situations, such as the high-voltage Tang DM-i in the BYD DM-i plug-in hybrid, which needs to use a new 750V charging station, while the old 500V charging station cannot be used.

Even if such high-power DC-DC converters are really needed, the mainstream direction now is integration and reuse, integrated with the drive motor/motor controller, such as BYD’s electric boost.

Of course, some are unique, such as Porsche’s 400V to 800V DC-OBC, where OBC refers to the on-board power electronic device that charges the vehicle’s power battery, which is also known as the on-board charger. It can safely and reliably manage the charging of the power battery, but the cost of this is very high, so even Porsche, which is backed by the Volkswagen Group, thinks it is a losing proposition.# Highlights of Haval H6 “Twin Stars”

Most charging stations in the market offer boost charging but few offer step-down charging, as the charging stations themselves can already provide lower voltage and step down at the end of the charging process.

DC-DC step-down may not be needed for 400V, but for hybrid models, such as Geely and Great Wall, without an option of quick charging, the battery thermal control may not be able to sustain the charging process, hence battery life should be considered first. In general, adding direct current quick charging is not expensive, costing several hundred yuan at most, similar to the option price of fast charging for Changan’s Blue Whale SL03, which is only CNY2,000.

Moreover, the product managers may bear some responsibility, as fast charging at a temperature of over ten degrees Celcius is embarrassing for small batteries, because fast charging requires high charging rates, which may compromise battery life. On the other hand, low rates translate into limited charging power, hence the 1C rate of tens of kilowatts is very slow compared to the concept of quick charging.

However, many car manufacturers’ product managers may not be aware that, even if the charging is slow, it is necessary to have a fast charging port that can be used, otherwise the DC pile group cannot be used. Comparing better versus whether it exists, the latter is more important.

Similarly, the cost of improving the reverse power supply function, such as V2G, is limited after spending a lot of money on the OBC power electronics. The option can still be limited by power, but the difference between having and not having will still be noticeable.

In the end, the maturity and ease of use of technology rely on the perspective of the product. The key to Haval H6’s sales success has been to make the consumer’s life easier. The addition of DHT technology to Haval H6 not only improves fuel economy and energy efficiency, but also compensates for the model’s only shortcoming.

With years of experience in power battery technology, Haval H6 DHT has three major advantages of high economic efficiency, long endurance, and strong performance. The power battery with multiple chemical systems can include lithium iron phosphate, cobalt-free batteries, ternary lithium batteries, and solid-state batteries. Great Wall’s independent research and development of the Dayu battery technology features high stability and safety with no fire and explosion risk.

Great Wall’s hybrid motor electric drive technology also features integration, efficiency, speed, and high voltage performance. It can achieve power versions ranging from 100 kW to 220 kW, including T-type bridge and dual-motor vector bridge.

Parallel multi-architecture, horizontal and vertical placement is Great Wall’s hybrid technology route, and the Lemon hybrid DHT with two dual-motor systems is applied to every hybrid model. The future Tank brand will also be equipped with off-road vertical P2 parallel architecture and independent research and development of 3.0T efficient engine, 129 kW efficient electric motor system, and 9HAT hybrid gearbox; the maximum power can reach 394 kW, and the maximum torque is 750 N·m. The ambition is self-evident.

In terms of intelligent driving assistance, thanks to the IDC 3.0 third-generation automatic driving computing platform, Haval has the highest production-capable computing power in the world, with the world’s first Qualcomm 7nm chip automatic driving computing platform, with a single-board computing power of 360TOPS. When cascaded between boards, it can be upgraded to 1440TOPS.

In terms of intelligent driving assistance, thanks to the IDC 3.0 third-generation automatic driving computing platform, Haval has the highest production-capable computing power in the world, with the world’s first Qualcomm 7nm chip automatic driving computing platform, with a single-board computing power of 360TOPS. When cascaded between boards, it can be upgraded to 1440TOPS.

Great Wall Motors’ full electrification began with the “Coffee Three Musketeers” under the WEY brand, equipped with DHT innovation. In addition, with the layout of the Euler brand’s pure electric dual cars, Ballet Cat and Good Cat, the pure electric high-end and high-performance market is also represented by the salon brand Mecha Dragon, which marks Haval’s H6, which carries the banner of Great Wall Motors’ total sales volume, joining the ranks of hybrid vehicles, declaring the determination and courage of Great Wall Motors’ comprehensive electrification.

Therefore, the group also predicted that the proportion of new energy sales would reach 80% by 2025, and traditional fuel vehicles would be officially discontinued in 2030.

Finally: Great Wall’s Past and Future

Great enterprises have never been afraid of competition because opportunities and challenges always accompany them in the era, and the entrepreneurship of Chinese private entrepreneurs is often a difficult and tortuous road.

In 1990, Wei Jianjun, then 26 years old, took the initiative to contract what was then the Great Wall Motor Company, a small factory with only 60 employees specializing in refitting vans and box trucks.

But Wei Jianjun was obviously not satisfied with this. In order to find a way out for the enterprise, Wei Jianjun demonstrated the toughness of an entrepreneur who is not afraid of hard work and traveled across major cities in China and even went to the United States to conduct research, finally discovering a new automotive hot spot business opportunity – that pickups were a type of vehicle previously untapped in China but hugely popular in the United States and perhaps Great Wall could find success in this area.

After establishing a foothold, Great Wall was not satisfied with the single model of assembling and selling raw materials, and “anxiety” about independent R&D technology has always been on Wei Jianjun’s mind, who is passionate about automobile technology. By purchasing advanced production equipment from Europe and America, and relying on classic engine technology whose patents had expired, the Great Wall’s internal combustion engine company, born in 2000, gradually began to produce electronically controlled fuel injection engines, becoming the first domestic brand to have engine technology.

Each step in this process seemed to be a turn for the worse, not staying in the comfortable zone before but constantly exploring new areas.

A similar development and transformation also occurred with Great Wall’s good brother, Geely. Many readers may not know the poor sales performance of Geely’s Emgrand in its early years, but relying on continuous product upgrades and iterations that have kept pace with the times, it has finally become a hot-selling car.

Over the past three years, Lynk & Co. has also been hurt by the market’s clustering effect in the economic downturn, with sales continuing to decline, but Geely Group has never stopped giving resources to Lynk & Co., investing heavily in research and development, and now we can see that the Lynk & Co. 02 Hatchback and Lynk & Co. 03 are officially competing with East Asia’s superb Honda Civic and German Volkswagen’s Sagitar.If we compare the strategies of Great Wall Motors and Geely, the difference may lie in that Great Wall Motors does not have the resources for global deployment like Geely does. In my previous articles, I have also analyzed Geely’s strategy of “Nine Dragons Breed Different”. However, even if financing, consortium and integration are done well, there are still historical lessons of being unable to help the weak.

I have always believed that the three biggest resources of an enterprise are: “the first is the market, which is the customer; the second is the technology research and development accumulated by the enterprise; and the third is the decision-making of the car company’s boss“.

Being market and customer-oriented seems to be Geely’s style; BYD and Huawei are leaders in their respective fields and have always been at the forefront of investment in the research and development field, with Great Wall Motors following closely behind; and the best representative of the last decision-making resource should be Mr. Wei Jianjun, the helmsman of Great Wall Motors.

In fact, Great Wall Motors does not lack resources, and its biggest resource is the bold and daring style, tenacious personality, and love for automotive technology of Mr. Wei Jianjun.

Great Wall Motors’ sales and reputation accumulation has always been a good card. Since the first generation of Haval H6 was launched in response to market demand in 2011, it has gone through three generations and has a total global sales of over 3.8 million units, occupying the top spot on the domestic SUV monthly sales chart for eight consecutive years and nearly 100 months, and has even set a record of more than 80,000 monthly sales of domestic SUVs, bringing a value-for-money driving experience to more than 7.5 million users at home and abroad.

Now, the brand has completely turned to embrace new energy with the Great Wall Haval, and with the perfect combination of its accumulated quality reputation and the lemon hybrid DHT PHEV, it is bound to spark.

Great Wall Motors’ “going all out”, the bet still has to be placed on the prince, the first-generation legendary car Haval H6.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.