Author: Zheng Senhong

Round and round, the story of the Great Wall can only be told by the Haval H6.

As the first model in China to break the sales record of 3 million vehicles and named the SUV sales champion for 10 consecutive years by the China Association of Automobile Manufacturers, SUVs are undoubtedly the most popular market in the Chinese automobile industry in the past decade. The Honda CR-V, Nissan Qashqai, and Volkswagen Touareg have become the fastest-growing models in this segment.

As the pioneer of SUVs, Honda CR-V has accumulated more than 2.2 million users in 16 years since it entered China. Then, the Qashqai and Touareg entered the Chinese market in 2008 and 2009 respectively, with cumulative sales of 1.4 million and 2 million vehicles.

In the face of these popular joint venture SUVs, only the independent Haval H6 has emerged as a popular model, achieving a sales volume of over 3.8 million within 11 years. This accomplishment has not only made Great Wall Motors successful but also has triumphed the Chinese brand.

However, the one to end the Haval H6’s sales crown is not the domestic independent brands who have been fighting with Great Wall Motors for years, such as Geely, Changan, and BYD, nor is it the joint venture brands such as Honda and Toyota. It is not even a fuel-powered vehicle.

In September 2021, the Tesla Model Y sold 33,000 vehicles, crushing the Haval H6’s monthly sales of 23,000 vehicles. This also means that the myth of the Haval H6 being the top-selling SUV for 99 consecutive months has come to an end.

As the core sales pillar of Great Wall Motors, the company is well aware that the battlefield of new energy vehicles will soon head to the front line.

Intelligence, the reserve force of Great Wall Motors in the second half

In the first half of this year, Great Wall Motors achieved a sales volume of 518,525 vehicles, a year-on-year decrease of 16.12%.

In comparison, Geely’s sales volume for the first half of the year was 613,800 vehicles, Changan Automobile sold 600,000 vehicles, while Chery Automobile nearly reached 500,000 vehicles. BYD, which has been growing rapidly, achieved a cumulative sales volume of 641,400 vehicles, a year-on-year growth of 314.90%, surpassing last year’s full-year sales of 603,800 vehicles.

Looking at the sales data from last month, BYD ranked first with a performance of 158,900 vehicles. Great Wall Motors, which had always been at the forefront, fell to 10th place behind Changan and Geely.

Obviously, the sustained decline in sales performance indicates that Great Wall Motors has already encountered growth bottlenecks. Especially in the SUV market, which Great Wall Motors has been cultivating deeply, there has been a phenomenon of weak sales, which undoubtedly brings a significant challenge to the company.The market trend of continuous negative growth for three consecutive years indicates that the traditional SUV market in China has entered the stock market stage, and is gradually being replaced by the accelerating new energy vehicles.

Data shows that the total size of China’s SUV market exploded from 3 million vehicles in 2013 to 10 million vehicles in 2017, and then fell into stagnation. The total size in 2021 is still around 10 million vehicles.

In contrast, in the first half of 2022, the sales of new energy vehicles in China continued to climb, and the market share had reached 21.6%.

In the face of the continuously suppressed gasoline vehicle market, Great Wall Motors proposed the 2025 strategy, transforming from a traditional automaker to a global technology travel company, achieving annual sales of 4 million vehicles in 2025, of which 80% were new energy vehicles.

Taking EV Volumes’ prediction that global new energy vehicle sales will reach 20 million vehicles in 2025 as an example, the market share of Great Wall’s new energy in 2025 will reach 16%, one percentage point higher than Tesla’s global new energy market share in 2021.

How can Great Wall Motors achieve this goal? From the new energy core structure of power battery to electronic and electrical architecture, to the smart level of cabin and driving, it must realize the ability of self-research on both software and hardware.

For example, regarding the power battery, Great Wall’s technology integration has three main features: economic efficiency, long endurance, and high performance.

Among them, the lithium iron phosphate is mainly used for entry-level and operational versions, and the medium-to-long-range versions mainly adopt high-cost-effective cobalt-free batteries, with energy density similar to that of the high-nickel 811 system.

High-performance models adopt long-thin stacking technology battery cells and high-performance ternary systems, to ensure long endurance and be able to charge for 10 minutes while continuing to travel for 400km.

It is understood that Great Wall Motors has invested a total of 1 billion yuan in power battery research and development, and has established Honeycomb Energy to focus on technical development of battery cells, modules, pack, and BMS. It has even acquired upstream raw material suppliers, Australian lithium mining company shares, to obtain lithium mining resources.In September last year, Great Wall Motors released Dah Yu battery technology, establishing the core advantage of no fire and no explosion when triggered by excessive heat in any location of the high-capacity nickel-based electrode and battery pack.

The birth of the Great Wall Dah Yu battery is actually in line with BYD blade battery, GAC Aian cartridge battery, and SAIC Cube battery directions, firmly grasping power battery technology in their own hands and not wanting to be controlled by others.

Currently, Great Wall Motors has built two major platforms, M and L, with a series of products ranging from 100 kW to 220 kW, covering A to D class models, and able to meet the power needs of users in different scenarios.

In addition, Great Wall Motors has also developed the “GEEP” fifth-generation electronic and electrical architecture, a newly developed central control unit that integrates power, chassis, body, intelligent assistant driving, and vehicle control functions, along with intelligent cabins, advanced intelligent assisted driving, forming three major brains.

Therefore, Great Wall Motors proposed the industry’s first “Three Wisdom Integration” product concept, which promotes full-stack self-developed capabilities for intelligent cabins, intelligent driving, and intelligent services from multiple dimensions such as perception, data, delivery, and service.

Mu Feng, the president of Great Wall Motors, believes that intelligence is a complete reshaping of automotive hardware and software.

At the critical period when intelligent driving enters the second half of the competition, automobile companies are starting to upgrade their electronic and electrical architecture to cope with the development of automotive intelligence and networking.

Great Wall Motors independently developed the new-generation EE architecture of central computing + regional control, realizing software architecture that can be upgraded, expanded, and reused by opening standard communication interfaces and software modules, and then supporting the growth of functions and the integration of vehicle and cloud.

From the overall development design of intelligent cabins, Great Wall Motors is currently focusing on two core tasks: a scalable computing central hub and a growing ecosystem.

- At the hardware level, Great Wall Motors uses the Qualcomm 8155 chip as a scalable large computing central hub, providing power for the growth of smart cars.

- At the software level, Great Wall Motors has formed full-link software self-developed capabilities such as cabin OS, self-developed voice, self-developed maps/navigation, and self-developed visual algorithms, providing comprehensive software support for smart car development.Mu Feng stated that the system software undergoes a major FOTA upgrade on average every three months, while functional software can be updated in real-time via OTA to meet users’ needs.

Regarding intelligent driving, Great Wall Motors will build a passenger car autonomous driving solution with comprehensive scene coverage and scalable mass production, based on the intelligent cockpit. Equipped with the world’s first ICU3.0 autonomous driving computing platform using a Qualcomm 7nm chip, its single-board computing power reaches 360T, which can be continuously upgraded to 1440T through board-level cascading.

In fact, the core chip of ICU 3.0 platform is a combination of Qualcomm 8540+9000, with a computing power of 360TOPS, which has already reached the absolute forefront of the autonomous driving chip field.

Based on this, Great Wall Motors has self-developed the entire software stack from the bottom BSP to the upper application layer for ICU 3.0 platform, and uses a strong fusion perception algorithm of multi-vision, multi-millimeter wave, and multi-lidar to create all-encompassing autonomous driving functions from high speed to city scenarios.

Finally, in terms of intelligent services, Great Wall Motors will achieve seamless integration of end-to-cloud for future intelligent connected vehicles and independently develop cloud platforms by 2023.

In the 30th anniversary celebration of Great Wall Motors in 2020, Wei Jianjun raised a soulful question: “Can Great Wall Motors make it next year?” And he even gave the answer – “I see, we are hanging by a thread.”

Two years later, enterprises under Great Wall Motors’ subsidiaries, such as Haohuai Zhixing, Technology Center, Jinge Automotive, Nobo Automotive, and Nochuang Technology, focusing on the intelligent track, possess the full-stack self-developed capabilities of core technologies in the fields of intelligent driving, intelligent cockpit, and intelligent services, including electronic and electrical architecture, autonomous driving, intelligent line control chassis, and intelligent cockpit.

The powerful R&D system and full-stack self-developed capabilities are the foundation for Great Wall Motors to continuously lead in technology and brand, and even its self-developed achievements have begun to transform intelligent driving assistance systems into commercial value.

As planned, the Wei brand Mocha DHT-PHEV will become the first domestic landing model to achieve urban NOH production, which has already been launched in two cities, Beijing and Baoding, with plans to expand coverage to over 10 cities before 2022.In 2021, Great Wall Motors had a research and development investment of 10 billion yuan, with a planned total investment of 100 billion yuan by 2025.

In addition to their own research and development layout, Great Wall Motors has also engaged in deep cooperation with enterprises such as Horizon, Qualcomm, and Huawei in the field of autonomous driving. For example, the first model of their salon brand, the Mecha Dragon, is equipped with Huawei’s 96-line hybrid solid-state lidar solution.

In the era of intelligentization, software development capabilities are essential. Suppliers, manufacturers, and even internet companies unrelated to car manufacturing all have the opportunity to share in the automotive industry. With a dual strategy of self-development and cooperation, Great Wall Motors clearly wants to occupy more dominant and authoritative positions.

The hybrid market is a crucial battlefield for Great Wall Motors

If Great Wall Motors’ layout for intelligentization is just to build new walls to compete in the second half of the new energy vehicle market, then their solution to run multiple power systems in parallel is more about accelerating their electrification transformation.

According to the plan, Great Wall’s new energy mainly includes pure electric, hybrid and hydrogen energy technologies. Euler specializes in pure electric, the salon brand specializes in hydrogen + pure electric, and the Haval, WEY, and Tank brands specialize in hybrid technology.

The pure electric route naturally follows the development trend of new energy, while the layout of hydrogen energy routes is that Great Wall Motors believes that the energy form of electric-hydrogen combination is the future energy form. Great Wall Motors will lay out on the upstream and downstream of energy and gradually create an energy ecology based on electric-hydrogen society.

For the positioning of hybrid technology routes, Great Wall Motors believes that it is not only the most direct and effective way for traditional car enterprises to save energy and reduce emissions, but also the only way for electric vehicles to have complementary uses.

Since 2020, domestic hybrid technology has experienced a collective outbreak. Models such as BYD DM-i, Great Wall citrus DHT, Geely Leixing Hi-X, Chery KUNPENG DHT, Chang’an iDD, GAC GMC 2.0, and Dongfeng Mach MHD have successively joined the market, and the competition in the hybrid market has escalated.

From this list, it can also be seen that the current hybrid market is almost dominated by domestic independent brands. In 2021, China’s share of the world’s plug-in hybrid market was 32%, and it is expected to rise to 48% in the first half of 2022.

Independent brands are strong in the field of hybrids due to their experience advantages in the era of fuel vehicles, and they cannot do without the outbreak period of the hybrid market.According to the data, the retail sales of new energy vehicles in 2021 reached 2.989 million, including 2.444 million pure electric vehicles, a YoY increase of 168.6%; the sales of plug-in hybrid vehicles, including extended-range electric vehicles, reached 545,000, a YoY increase of 171.2%, slightly higher than that of pure electric vehicles.

As of July this year, the cumulative sales of plug-in hybrid electric vehicles in China reached 674,000, a YoY increase of 1.7 times, higher than the growth rate of pure electric vehicles.

The rise of hybrid vehicles actually fills the gap of pure electric vehicle models and targets a larger consumer group, inheriting the market share of traditional fuel vehicles.

At present, the domestic pure electric vehicle market is still polarized; on one end, represented by brands such as NIO, Tesla, and XPeng, are high-end models priced above CNY 200,000, on the other end, represented by the Hongguang MINI at around CNY 50,000.

In the middle of these two price points, although there are pure electric brands such as NETA and GAC Aion, the overall product performance makes it difficult for consumers to abandon fuel vehicles that “require no worries about range.”

However, this price range of CNY 50,000 to 200,000 is precisely the largest market for fuel vehicles, which means that pure electric vehicles have not completely touched the core users of traditional fuel vehicles, leaving opportunities for the hybrid market.

Sales figures prove that last year, BYD Qin DM-i sold 83,400 units, Song DM-i sold 63,700 units, Tang DM-i sold 46,100 units, and Han PHEV sold 30,000 units. Sorted from high to low prices, the higher the number of units sold.

In other words, for this price range, high-end electric vehicle brands are not interested, and the competitiveness of mid-to-low-end electric vehicles is not strong, thus creating favorable conditions for the outbreak of cost-effective hybrid models.

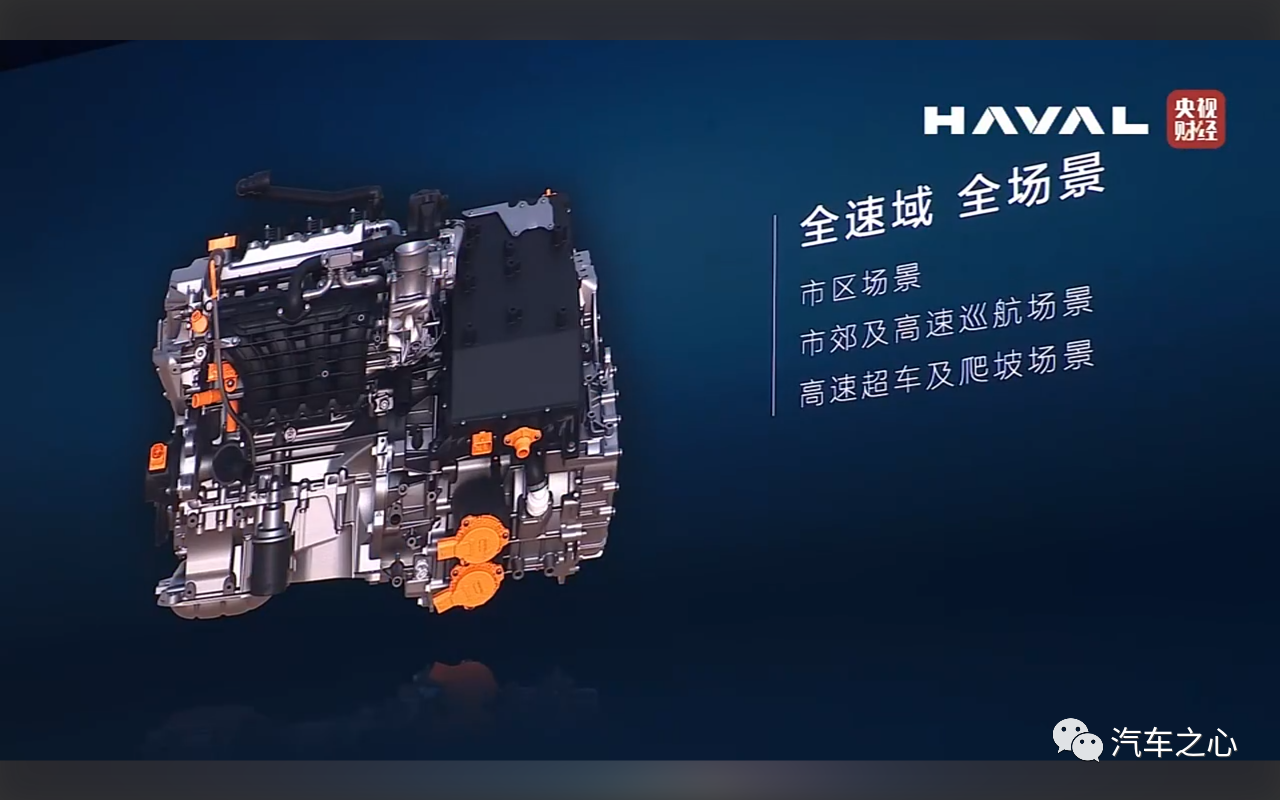

Returning to Great Wall Motors, Lemon Hybrid DHT is Great Wall’s self-developed high-efficiency, high-performance hybrid technology solution that showcases Great Wall’s expertise.

Compared with Japanese HEV, Great Wall Motors’ Lemon Hybrid achieves overwhelming leadership and surpassing, and has obvious advantages in different working conditions and usage scenarios with its “two-gear DHT” compared to benchmarking other independent brands.

According to Li Wenbin, CTO of Haval, under high-speed conditions, the two-gear DHT is more efficient than single-speed hybrid and extended-range technology, with an efficiency increase of roughly 15%. In terms of performance, the acceleration of a vehicle equipped with Lemon Hybrid DHT can enter the 5-second interval, the fuel consumption per hundred kilometers is less than 5 liters, and the comprehensive efficiency is over 50%, which is absolutely leading in the new energy vehicle market.

“`markdown

“`markdown

Compared to the single-speed hybrid system of BYD DM-i, Lemon’s hybrid DHT not only achieves lower fuel consumption under medium and low-speed conditions, but also achieves two-speed direct drive of the engine under high-speed conditions, providing better power performance while consuming less fuel,” Lv Wenbin added.

However, reflecting on the products, only some models of the Wei brand under Great Wall Motors currently have hybrid technology, which has less influence, sales and consumer recognition than its competitors.

Taking the highest-selling Latte DHT as an example, as of July this year, cumulative sales approached 8,000 vehicles, with a monthly sales of just over 1,000. On the other hand, the Macciatto DHT, with the lowest sales volume, has an average sales of less than 500.

For Great Wall Motors, it is currently relying only on Ora cars, which focuses on “her-economy,” in the pure electric market. Although their fluctuating sales are understandable, the company’s market situation, including its main force in hybrid technology, has been stuck in the “neither up nor down” dilemma.

On one hand, there is a continuously thriving competitor in the new energy field; on the other hand, there is the hybrid market in its outbreak stage. Great Wall Motors has no reason to maintain its core technology but difficult to make use of it.

When it comes to hybrid technology as applied to Great Wall’s competitive-product line, it is a natural choice of the current trend.

Take the competition trend between Haval H6 and BYD Song Plus new energy as an example:

Before the first half of 2021, there was a constant gap of about 20,000 vehicles sold per month between the two. From the second half of the year, the sales volume of new energy Song Plus began to grow rapidly, almost catching up with Haval H6.

In 2021, Song Plus was able to increase its market share to 1% in the SUV market, while the market share of Haval H6 fell from 4% in 2020 to 3.7%.

In July this year, the Song Plus emerged on top of the SUV sales charts with 32,266 vehicles sold, while the Haval H6 came in second place with 24,374 vehicles sold.

Clearly, whether in terms of the size of the whole market or the single SUV segment, new energy vehicles have rapidly seized market share from fuel cars. Fighting against fuel-powered vehicles will only leave a pathless way ahead.

Therefore, the 3.8 million users of Haval H6 have embarked on a transformation path, even the entire Haval brand is changing its logo and slogan to show its determination to achieve complete transition to new energy.

Li Xiaorui, CEO of Haval, said that in the new energy era, Haval is transitioning from China’s SUV global leader to a new energy SUV specialist, accelerating the brand’s strategic transformation.

“`

As for the reasons for choosing hybrid, Li Xiaorui agrees that this is the direction of the market. “This year, so far, in the SUV market, the strongest performing products are undoubtedly new energy products.”

Of course, this is not choosing the new energy route after seeing rapid growth in sales by competitors, but a genuine understanding of market demand.

Li Xiaorui said that in the era of fuel cars, the Haval brand was a leader. In the era of new energy, Haval’s goal is still to play a leading or popularizing role.

In recent years, the total volume of the domestic SUV market has remained at around 10 million vehicles, and the pure increment is minimal. Users who upgrade or purchase additional vehicles are gradually increasing their recognition of the value of the cars themselves. Only products that exceed user expectations can gain advantages in market competition.

Li Xiaorui believes that for the Haval brand, there is a good market accumulation and the highest user base for SUVs. Haval hopes to regain its king status in the new energy field once it transforms.

Leveraging Great Wall Motor’s Lemon hybrid technology, launching a star product as the first battle, means that Haval will launch a full-scale offensive towards a new energy strategy with greater ambition, stronger strength, and more resolute determination.

But entering the hybrid market also means that Haval’s hybrid models will be included in the transitional products.

Regarding the planning of the brand line, Li Xiaorui stated that Haval does not consider the large-scale development of the pure electric market in the short term because Great Wall Group has always adhered to the strategy of coordinated development of brands. “Currently, the group has the highest-end Salon brand, as well as the pure electric brand Ora, which focuses on women. There will be new brands launched in the future. It is not conducive to the synergy of the group’s established classification and brand to urgently seek to advance in the pure electric segment in the short term,” Li Xiaorui added.

As for the term “transitional technology,” no one has defined how long the entire transition period is, whether it will be 10 or 50 years in the future.

Indeed, without a time limit, the judgment of the so-called transitional period is actually meaningless. If we calculate it based on 50 years, will pure electric vehicles also be regarded as a transitional technology for hydrogen energy in the future?

Great Wall Motors previously stated that when the penetration rate of new energy reaches 30%, the proportion of various technologies in the market will tend to balance. Currently, the more common consensus in the industry is that hybrid may account for an increasing proportion before 2025.Li Xiaorui said that neither new forces, traditional car companies, nor traditional car companies that have pioneered transformation are fully prepared yet. They all have their own strengths and weaknesses. For example, new forces are stronger than traditional car companies in terms of intelligence, digitalization, and customer service. However, facing larger-scale production, they may face problems such as research and development capabilities, production processes, consistency and quality guarantee of products after mass production.

New energy is a marathon, where the rhythm is more critical than starting and capabilities. At this point, Haval Motors entering the new energy field still has great opportunities. After all, the market has not truly settled into a fixed pattern yet.

At least for now, the so-called “transition period” will be the “assistance period” for Haval Motors, and even the entire Great Wall Motors Group to complete the transformation.

Li Xiaorui said that he hopes that by the end of this year, the ratio of fuel and new energy vehicles in the Haval H6 model will be at least four to six. In the long run, Haval is the champion and king of SUVs in the era of fuel vehicles and aims to be a leader or popularizer in the new field.

Looking further ahead, Haval plans to achieve an 80% share of new energy vehicle sales by 2025, and to officially stop selling fuel vehicles by 2030.

Choosing the hybrid technology transformation path does not mean that Haval Motors is the only one fighting. At the press conference where Haval Motors announced the transformation, the president, growth officer, supply chain officer, technology officer, manufacturing officer, human resources officer, quality officer, and finance officer of Great Wall Motors gathered together and left the center stage to Li Xiaorui representing Haval Motors.

Can the legend of the fuel vehicle market be replicated in the new energy field? Can they live up to the trust of Great Wall Motors’ center stage?

In Li Xiaorui’s words, the last piece of the puzzle for Great Wall Motors’ new energy transformation is now complete.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.