Author: Zhu Shiyun

Editor: Qiu Kaijun

“We don’t make money from the 300,000-yuan Wei brand DHT hybrid model, nor the 150,000-yuan Haval H6 hybrid model,” said Lu Wenbin, CTO of the Haval brand, to the “EV Observer.”

Despite not making a profit now, it doesn’t hinder Great Wall Motors’ determination and effort in the new energy transformation.

On August 22, the Haval “God Car” H6 officially released three super hybrid DHT models: the DHT model priced at 149,800 yuan; DHT-PHEV models with 55 km and 110 km of pure electric range are pre-sold at 168,800 yuan and 176,800 yuan, respectively.

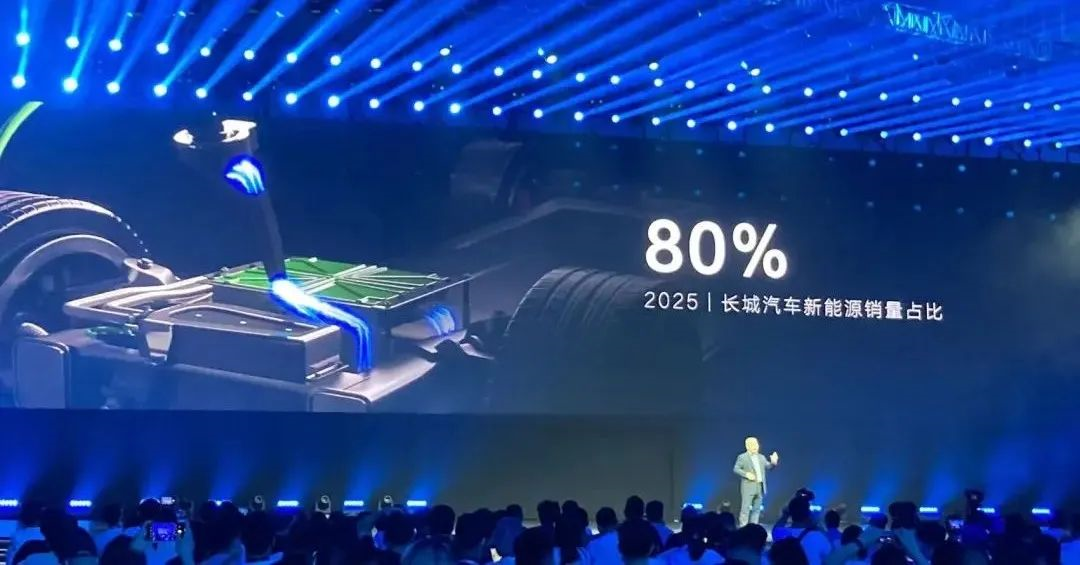

Starting with this, the Haval brand plans to achieve an 80% new energy product sales ratio by 2025 and to stop selling fuel vehicles by 2030.

At the end of the Haval H6 hybrid twin star listing ceremony, several key personnel from various Great Wall Group core departments, including technology, manufacturing, supply chain, quality, human resources, and finance, stood on the stage under the words “Partners protecting Haval new energy.”

Although Great Wall Group Chairman Wei Jianjun was absent, almost the entire Great Wall Group leadership team was present.

“This year, we hope that hybrid vehicles will account for 40% of Haval H6’s main vehicle sales by the end of the year,” said Haval brand CEO Li Xiaorui to the “EV Observer.” “Haval’s brand positioning remains unchanged. We are SUV experts and leaders, and we hope to regain our championship position in the new energy race once we transform.”

In the first half of this year, the Haval H6 was trailing the “new king” BYD Song in new energy vehicles by 20,000 units, expanding to 120,000 units when comparing new energy models.

How will Great Wall and Haval catch up on this “road to kingship”?

Unprecedented Market Changes

“This (new energy transformation) is a market-driven change, and everyone wants to seize new user demands after the change. Geely, Changan, Chery, and we all think like this,” said Li Xiaorui.

This “market change” refers to the rapid rise of BYD in the new energy field after 2021, verifying the fact that China’s automotive market is shifting to the center stage from the edge zone.In 2018, the market penetration rate of HEVs (hybrid electric vehicles) and NEVs (new energy vehicles) in the SUV market was only 1%. However, in the first half of this year, the market penetration rate of these two power structures has reached 28.4%. The overall scale of the Chinese SUV market is still around 9 million units, and during this period, the market share of fuel SUVs has dropped to 71.6%.

“The changes in the four years from 2018 to 2022 are catching any companies that were originally focused on fuel vehicles off guard,” said Li Xiaorui.

This includes Great Wall Motors. In the first half of the year, BYD’s cumulative sales volume, once mediocre, was 641,400 units, a year-on-year increase of 315%. Geely and Great Wall Motors sold 614,000 units and 520,000 units respectively, a year-on-year decrease of 3% and 16% respectively.

This imbalance is also reflected within Great Wall Motors. In the first half of the year, Haval, the main brand under Great Wall, continued its double-digit year-on-year decline for six consecutive months, with cumulative sales of 289,000 units, a year-on-year decrease of 26%, but still accounting for 56% of Great Wall Motors’ total sales.

In contrast, the pure electric brand Ora achieved continuous growth in monthly sales of nearly 20,000 units in the first half of the year with only two models, the Good Cat and the Good Cat GT. The other high-priced Tank brand achieved cumulative sales of 54,000 units, a year-on-year increase of 64%, competing with Ora for the top position.

While there may be factors such as a shortage of core components such as chips and disruptions caused by the epidemic affecting the launch of new vehicles, the trend of the rise of new energy vehicles is undeniable.

Great Wall Motors’ performance forecast shows that the company achieved a net profit of 5.3-5.9 billion yuan in the first half of the year, a year-on-year increase of 50%-67%. However, excluding non-recurring profits and losses brought about by exchange gains and losses, its net profit will decrease to 1.8-2.3 billion yuan, a year-on-year decrease of 19%-37%.

Despite this, with the sales growth of the two high-priced and high-margin brands Ora and Tank, “the unit selling price, gross profit, and gross profit margin of Great Wall Motors have increased” during the reporting period.

In this context, it is not difficult to understand the urgency of Great Wall Motors to release the Lemon Hybrid DHT at the 150,000 yuan level with the support of the flagship Haval H6.

This year, Haval has explicitly launched the God Beast DHT, H6 Lemon Hybrid DHT HEV and PHEV models, and two other new Haval models will also be launched.

“Now it’s about speed, R&D competition, new product releases, and terminal promotion speed. It’s about who can deliver better products to users,” Li Xiaorui said. “We truly see the market demand, and we have to act. We have to act as quickly as possible.”

Li Xiaorui’s speed theory coincides with the statement made by BYD Chairman Wang Chuanfu, “the faster fish eats the slower fish.” The question is, in the hybrid race, Haval is currently the “slow fish.”Long for technology route selection and landing aspect, Great Wall is not slow. In December 2020, Great Wall Motors released the Lemon Hybrid DHT platform; in April 2021, Chery DHT hybrid technology was released at the Shanghai International Auto Show; in November, the same technology system’s Geely Lynk & Co 02 Hybrid System was released.

However, when it comes to technology landing, Great Wall and its competitors have chosen different routes.

Great Wall chooses to maintain the technical premium of DHT. The first model equipped with Weipai Nacha Hybrid has a price range between RMB 180,000 and 270,000, and since then, only three models, Nacha, Mocha, and Machiato, have the lowest price of RMB 155,800. The HEV hybrid power configuration applied to Haval H6S and Chitu is 12% and 17% higher than the same configuration petrol vehicle pricing and is a trial supply.

BYD and Geely have chosen the scale route.

Nearly simultaneous releases of BYD Han, Tang, Qin, and Song DM-i models covered a wide range of RMB 100,000 to 300,000, including the sales of the main line of the Song PLUS DM-i model within the RMB 152,800-216,800 price range.

Geely launched the Geely Starway and Lynk & Co 01 Hybrid models this year, priced at RMB 129,800, 171,700, and 181,800, respectively.

Lower prices and broader models make Lemon DHT’s competitors slow to follow, and even help the emergence of “new kings” such as BYD.

In the first half of the year, BYD’s sales of the Song EV broke through 120,000, surpassing the 108,000 of the same level of Haval H6.

Geely Automobile sold 33,000 units of HEV and PHEV models. Geely Automobile executives told the Electric Vehicle Observer that the cumulative orders of the Emgrand L Super Electric Hybrid have also reached 30,000 units, and in July, the sales of the Lynk & Co 02 surpassed 10,000. The supply chain will climb steadily, and there will be a significant increase in September. In the fourth quarter, the Starway L will be equipped with a 200-kilometer long-life “Lynk & Co” Hybrid system on the market.

In contrast, Weipai’s sales mainly relying on hybrid power in the first half of the year were 22,000 units.

Obviously, neither the market nor competitors intends to give Great Wall the time and opportunity to digest the early technical research and development input of Lemon DHT, which is destined to be a fight for scale and profits.

How to fight Haval H6 PLUS and Lemon DHT?

Although they lost the initiative, it doesn’t mean that Great Wall has no chance of winning in this hybrid-dominated transformation battle. The Lemon DHT technology base, infiltrating the main market in various forms of power, will be the central tactic in the battle of Haval’s Hybrid version.Haval will enter into the HEV and PHEV markets, targeting SUV models priced between 100,000 and 200,000 RMB (~15,000 – 30,000 USD) and leveraging its 7 million users’ reputation. This move will help Haval compete against brands such as Toyota in the HEV market, and BYD, Idean, and Sylphy in the PHEV market.

Haval’s Foundation

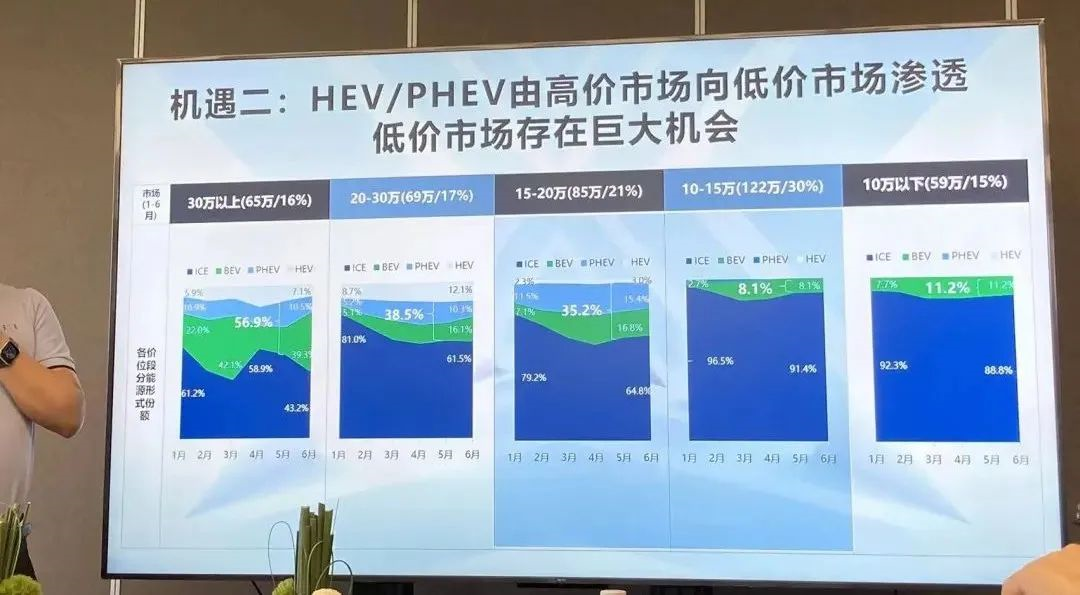

“We always look for the biggest opportunity when entering a market,” said Li Xiaorui. He added that PHEV and HEV models account for 16% of the SUV market for prices over 300,000 RMB, 17% for prices between 200,000 and 300,000 RMB, 21% for prices between 150,000 and 200,000 RMB, 30% for prices between 100,000 and 150,000 RMB, and 15% for prices below 100,000 RMB.

The 150,000 to 200,000 RMB and 100,000 to 150,000 RMB segments are the core markets for Chinese SUVs, with 850,000 and 1.22 million vehicles sold in the first half of the year, respectively, accounting for 52% of the overall market. “As more and more HEV/PHEV products are introduced, we believe there is enormous potential for these two segments. Haval is entering this market at precisely the right time,” Li said.

Haval has already established a strong network system covering hundreds of first- and second-tier retail dealerships in 1-5 tier cities, with a 96.8% coverage rate for prefecture-level cities. A batch of new energy exhibition halls will also be established this year. In Li’s view, Haval’s 7-million strong user base is also a huge advantage when entering the new energy field.

“Haval H6 has always represented the SUV segment and the Haval brand, and no one has ever been able to shake its position. (Our customers) expect H6 to be fuel-efficient,” he said.

“This time, when Haval enters the new energy market, we do not want to throw away our advantages or lose our customers’ trust. We only need to strengthen our strengths and bring customers new experiences in the new energy era.”

Speak with Technology

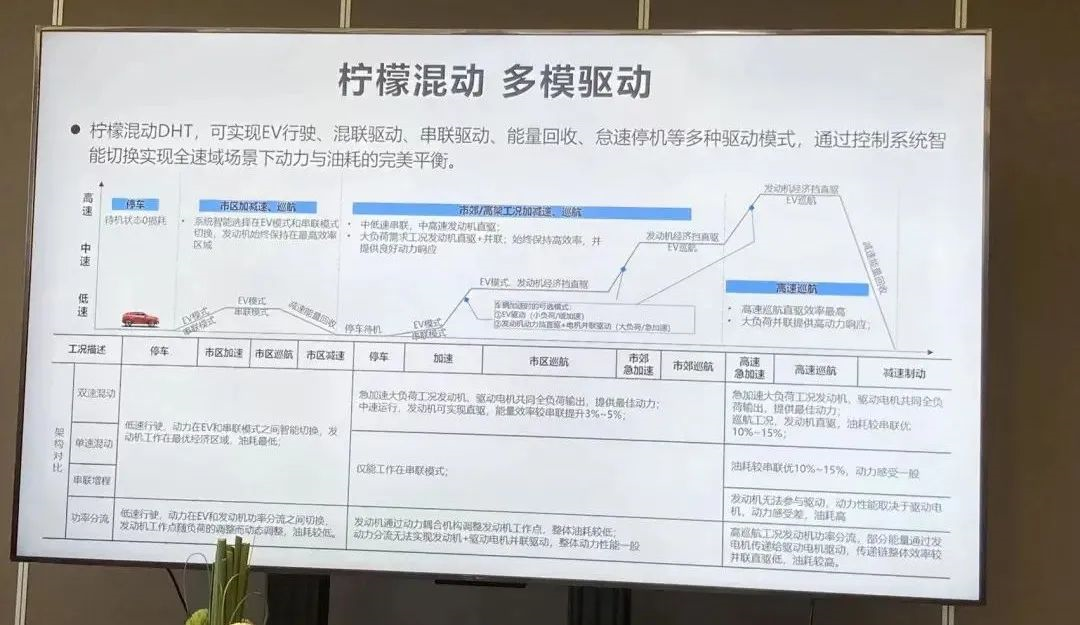

The Lemon Hybrid DHT is an exclusive highly integrated hybrid architecture that adopts two high-efficiency engines of 1.5L and 1.5T. It provides both HEV and PHEV power modes and offers P4 electric four-wheel drive capability.

The Lemon Hybrid DHT is an exclusive highly integrated hybrid architecture that adopts two high-efficiency engines of 1.5L and 1.5T. It provides both HEV and PHEV power modes and offers P4 electric four-wheel drive capability.

The Haval H6 DHT model will compete with Toyota, Honda’s HEV, BYD’s DM-i, as well as Ideal and Tesla’s extended-range electric vehicles.

According to Lv Wenbin, although DM-i, extended range electric vehicles, and mode splitting by Japanese automakers are more suitable for urban driving conditions and have slightly weaker power performance during city and highway cruising, Haval has strengthened the calibration of the series mode in the 0-35 km/h and 0-50 km/h speed range for the H6 hybrid model, “combining economic regions and also fully calibrating power output,” which can increase energy efficiency by 3-5% compared to the series mode during urban cruising;

In high-speed situations, Lemon DHT adopts the parallel mode, achieves direct engine drive, and outputs driving assist from the electric motor, which not only achieves high efficiency but also satisfies the power demand of high-speed scenarios. From the data, under high-speed cruising conditions, the Lemon DHT is 10-15% more fuel-efficient than the series mode and has better power performance than the mode splitting by Japanese automakers.

“In short, in terms of fuel efficiency, our two-speed DHT is basically comparable to DM-i and extended-range electric vehicles, as well as the mode splitting by Japanese automakers, but it has better power performance in urban areas and highways. Moreover, during the power switching process, two-speed DHT is smoother than single-speed and extended-range,” said Lv Wenbin.

In addition, to address the pain point of NVH for hybrid models, Lemon Hybrid DHT has carried out 31 NVH calibrations on wheels and proprietary hybrid engines to provide better comfort.

The Haval H6 PHEV, which is currently available for pre-sale, has a range of 50-110 km. In the future, Haval will launch a long-range version of 200 km.

Brutal Hybrid Battle

The Haval H6 wants to “win over” the Japanese HEV market, represented by Toyota and Honda, first.

“We will achieve a price parity between nearly 150,000 yuan for the third-generation Haval H6 Lemon Hybrid DHT HEV and traditional gasoline vehicles. We cannot allow all SUVs to be controlled by joint ventures, nor can we allow them to continue to sell at prices above 200,000 yuan,” said Li Xiaorui.

This will be relatively easy for today’s Chinese brands.Li Xiaorui said, “Although HEV is currently dominated by Japanese brands, Toyota HEV is the earliest and has the leading technology, while Honda HEV has its own differences. However, in the Chinese market, the self-developed system technology of domestic brands has already surpassed the Japanese models by a large margin. This will be Haval’s opportunity.”

In addition, domestic brands have formed a strong position in the field of new energy. In the first seven months of this year, domestic new energy vehicles accounted for 82.3% of the market share, while joint ventures and luxury brands accounted for 5.6% and 12.1% respectively. In the field of traditional fuel vehicles, domestic brands still have a market share of around 30%, while joint ventures and luxury brands occupy 50% and 18.6% respectively. “This means that the new energy market is the domestic brands’ biggest home field. Consumers have different mindsets, so we have different voices,” said Li Xiaorui.

In the first seven months of this year, Toyota HEV models sold a total of 403,000 units, accounting for 90% of the HEV market. For Haval, this is undoubtedly a tempting cake. “But on the other hand, the competition in the hybrid field is just as fierce as the pure electric field, and Chinese automakers are currently in a low-profit or even unprofitable stage in the new energy field,” said Lv Wenbin.

“Cost is a major issue for us,” said Lv Wenbin. Great Wall’s philosophy is to make the products the best they can be. On this basis, although we have carried out platform-based resource integration to reduce costs, the high technology costs and the upstream raw material price increases make it difficult to reduce the costs of new energy products. The only hope is future economies of scale.

“If you look at our competitors, they are also in a low-profit state,” Lv Wenbin told Electric Vehicle Observer.

BYD, which has fully devoted to new energy and achieved a certain degree of economies of scale, saw a 34% increase in revenue from Q1’s automotive and related business, with a gross profit margin of only 17%;

In the first half of the year, while Geely raised the unit price of new energy products, its gross profit margin fell by nearly 3 percentage points to 14.5% year-on-year;

Wu Kai, Chief Scientist of upstream industry chain Ningde Times, said, “Ningde Times has been struggling on the edge of slight profitability this year, which is very painful.”

Tianqi Lithium, which has mining reserves, may have a lot of profits on the surface, but is under pressure from the huge financial expenses caused by borrowing money to buy mines in 2018.

The battle has just begun. Industry insiders have learned that BYD Qin DM-i and Geely’s Raytheon hybrid models are currently being offered discounts ranging from thousands of yuan. Moreover, the production capacity window that BYD “left” for its competitors is rapidly shrinking.

Compared to the H6, the DHT model faces two major challenges – guaranteeing supply and ramping up production capacity – before it can achieve significant sales.

Li Xiaorui told “Electric Vehicle Observer” that Haval has detailed plans for production capacity of new energy products in the fourth quarter, “first of all, there will not be the low-end inventory situations of H6 and Big Dog like before. If we are going to lay out a new track, we must do a good job with all common type of material resources.”

“Haval has a relatively large market share in Great Wall and is also the brand most easily experienced by consumers,” Li Xiaorui said at the end of the previous communication meeting. “Haval’s successful transformation will also represent the successful transformation of Great Wall. We need the group’s brand endorsement and technical empowerment, and the success of the group also requires Haval to make this car a hot seller in the marketplace.”

Great Wall Group also announced that it will achieve a sales ratio of 80% for new energy vehicles by 2025.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.