Author: Xizi Tian

The competition among autonomous truck companies has officially entered the mass production stage.

Today (August 23), DeepWay, a new force in intelligent new energy truck manufacturing jointly created by Baidu and Shiquan, announced the successful completion of a 460 million yuan A-round financing, led by Qiming Venture Partners, with participation from Lenovo Capital, Guangyue Investment, Jianxin Trust, Mu Hua Kai Chuang, China Power Fund, China CITIC International, and Huagai Capital. This is also DeepWay’s first external financing and sets the record for the largest financing scale for intelligent new energy truck manufacturing new forces.

According to the plan, DeepWay will start mass production in June 2023.

Not long ago, on August 16, ZhiJia Technology and Zhitu Technology jointly completed the first batch delivery of 100 autonomous heavy-duty truck orders for Rongqing Logistics.

Earlier, Winning Intelligence announced the delivery of the world’s first mass-produced L3 level autonomous heavy-duty truck at the end of 2021.

Many other players have also put mass production on their agendas. On July 28, Xiaoma Zhixing and Sany Heavy Industry established a joint venture company and plan to start small-scale production and delivery of autonomous driving trucks in 2022. The first self-driving car stock TuSimple announced earlier that it plans to launch L4 autonomous driving trucks in the North American market by 2024…

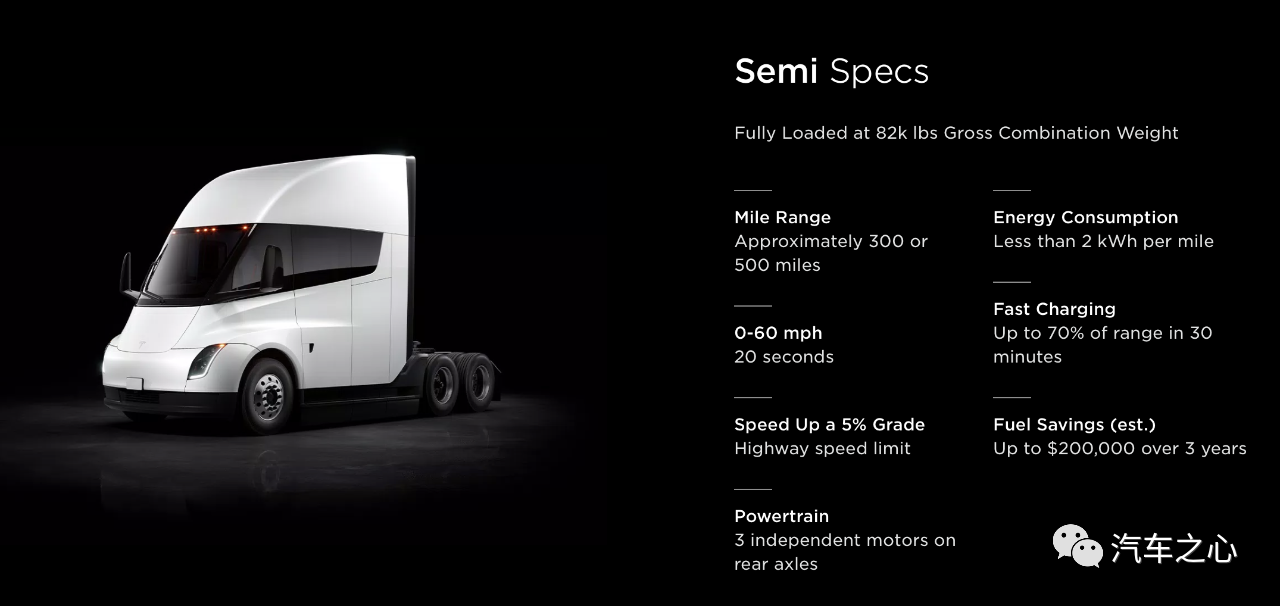

It is surprising that Tesla’s Semi Truck, which “disappeared” for 5 years, recently came out with news of mass production. Musk revealed rare news on Twitter that Semi Truck will start delivery at the end of this year.

Why have autonomous truck companies pressed the mass production button almost at the same time? How can players with different backgrounds achieve mass production? Does mass production mean that the commercialization of autonomous driving in long-haul logistics has been successful?

These questions hide in the undulating sea level of autonomous driving and turn into giant waves, hitting the people standing on the shore who are watching this industry.

To achieve L4, L3 must go on the road first

In the view of ZhiJia Technology, mass production means that autonomous driving technology has been fully validated on road testing, and artificial intelligence is applied to make truck drivers drive more efficiently while ensuring safety during the autonomous driving process.

It should be noted that unlike passenger cars, autonomous driving trucks have higher requirements for perception, planning, control, and other technologies due to their large payload and non-rigid body.The braking distance of a truck is about 100 meters, while a general passenger car is only 40 meters, which requires the detection distance of autonomous driving trucks to reach several hundred to thousands of meters.

In addition, the front and rear parts of the truck are not rigidly connected. To ensure that the front and body of the truck are within the lane lines in sharp turns, special power models and algorithms are required to achieve this.

Rong Qing Logistics China’s General Manager, revealed that before delivering the first batch of autonomous heavy-duty trucks to Rongqing Logistics, it had operated for 93 days on two busy lines of Jinghu and Shenhai highways with large freight volumes, with a total mileage of 91,616 kilometers, of which the proportion of autonomous driving was as high as 96.7%, and achieved zero accidents under various adverse weather conditions.

XiaoMa Zhixing also prepared well before mass production.

Li Hengyu, Vice President and Head of Autonomous Driving Truck Business of XiaoMa ZhiXing, stated that the development of autonomous driving trucks is divided into three stages: technology research and development, productization, and commercialization. With the continuous expansion of the XiaoMa ZhiXing fleet and the increasing range of tests, the technology has matured and can now enter the productization stage.

According to a domestic high-speed live test video released by XiaoMa ZhiXing in April this year, L4-level autonomous driving trucks can easily cope with driving scenarios such as rainy and foggy weather, night driving, tunnel passage, large curvature ramp, disabled vehicle occupying the lane, and slow car ahead on roads with a mileage of more than 400 kilometers, without intervention.

“When technology reaches a certain level, mass production is a natural thing”, said an industry insider. At present, there are still a large number of corner cases on trunk roads that require autonomous driving companies to collect various data by “brushing scenes” to improve algorithms. To complete these tasks, a few test vehicles are far from enough, and autonomous driving functions must be mass-produced on trucks to achieve true unmanned driving.

“No company doing commercial vehicle autonomous driving has accumulated as much data as those doing passenger vehicle autonomous driving. Even if they do, it is still far from enough for trucks”, the industry insider added.

Although the total amount of data collected cannot be compared with passenger cars, the efficiency of collecting data per truck is higher. Wan Jun, CEO of DeepWay, once calculated that a passenger car only travels 20,000 kilometers a year, while a commercial vehicle is almost on the road every day and can travel more than 200,000 kilometers a year, which is 10 times more than the former.”More autonomous trucks on the road mean more deliveries and more real-world road data,” said Wan Jun. He also stated that DeepWay hopes to iterate on their autonomous driving technology through the operation of more production trucks in real-world scenarios.

Ma Zheren, founder and CEO of Winning Intelligent Technology, expressed a similar opinion. Despite the company’s successful production of autonomous heavy trucks, ramping up production is dependent on time to accumulate mileage, train algorithms, and learn from long-tail scenarios in order to achieve truly unmanned driving. “Once the vehicles are on the road, we continuously upgrade the algorithms and software for L3 and aim to achieve L4 as soon as possible.”

Who Will Make the Production Vehicles?

After achieving production-ready technology, the next question is, how can we achieve mass production?

In response, players in the autonomous driving truck industry are divided into two camps: supplier-oriented and vehicle manufacturing-oriented.

The latter includes companies such as Pony.ai, DeepWay, and Tesla.

In Jun’s view, the traditional truck industry is outdated and heavy, lacking vehicles designed specifically for autonomous driving. This inspired them to develop a new breed of long-haul logistics autonomous driving vehicles through positive design and research and development.

On September 17, 2021, DeepWay’s first intelligent new energy heavy truck concept – the Deeptruck Star Path I – made its debut, with a brand new electronic and electrical architecture, unique front-end design, and exaggerated space layout that stunned the industry. The shockwave effect was comparable to that of Tesla Semi Truck, which first appeared in 2017 and received orders for hundreds of vehicles from Pride Group Enterprise, United Parcel Service, Pepsi, and other major companies.

Apart from being the “first ones to eat the crab,” Jun also stated in an interview with 36 Kr that another reason for car manufacturing was even more important: the willingness of host factories / Tier1 and Tier2 to help autonomous driving companies produce a self-driving heavy truck was limited.

“Automotive Tier1 and Tier2 (first- and second-tier suppliers of auto parts) are more responsible for the host factory. Their willingness and investment to cooperate with autonomous driving companies’ requirements are limited. Similarly, although the host factory also vigorously advocates for intelligent transformation of trucks, the intensity and speed of technological investment may not meet the needs of autonomous driving companies.”

In fact, this is also why Chen Mo, the former chairman of TuSimple, found Beiqi Foton in November 2021 to jointly develop L4 level self-driving heavy trucks.

Previously, TuSimple partnered with Navistar, the third-largest truck manufacturer in the United States, to mass-produce L4 autonomous trucks.

However, over time, Navistar has continually postponed the progress of TuSimple’s L4 autonomous truck manufacturing process, from its original target in Q3 2024 to 2025, 2026, and beyond.

“Now Navistar’s progress in autonomous driving mass production is too slow, especially in the European and American markets. Our promise to investors was that TuSimple would achieve mass production in Q3 2024. If our partners cannot support mass production in Q3 2024, I must do it myself,” TuSimple CEO Chen Mo said in a media interview, revealing his helplessness.

In June 2022, Chen Mo announced his own car company, Hydron, and emphasized that it had no equity relationship with TuSimple. The main reason for its establishment was to achieve large-scale commercialization of autonomous driving technology as soon as possible.

Pony.ai also entered the car manufacturing industry, but with a slightly different approach: it teamed up with Sany Heavy Industry’s Sany Truck, a heavyweight automobile manufacturer, to jointly develop, produce, and sell L4 autonomous heavy-duty truck products.

Sany Truck is the 2021 domestic new energy heavy-duty truck sales champion. In the opinion of Pony.ai co-founder and CEO Peng Jun, joining forces with such a heavyweight automobile manufacturer will help accelerate the production and commercialization of high-end autonomous driving heavy-duty trucks.

In this collaboration, Pony.ai provides corresponding autonomous driving truck technology and hardware, while Sany Truck is responsible for vehicle production, manufacturing, and sales. The two sides plan to start small-scale production and delivery within 2022, mass production by 2024, and the annual output will hopefully exceed 10,000 units in a few years.

Of course, not all autonomous driving companies have the resources or energy to enter the car market.

Firstly, according to the forward truck design process, autonomous driving companies need to invest at least hundreds of millions of dollars to complete the overall mass production design, which poses a significant challenge to their already not-so-robust cash flow.

Secondly, heavy-duty truck manufacturing is different from passenger car manufacturing. Both wired chassis and automatic steering gearbox engines face greater engineering challenges, which are not the strengths of autonomous driving companies, and are difficult to bridge the gap in the short term.

Finally, Ruan Likang also added that in the traditional heavy-duty truck market, FAW Jiefang, China National Heavy Duty Truck, Dongfeng Commercial Vehicles, Shaanxi Heavy-duty Motor, and Foton Daimler Automobile account for nearly 90% of the market share, making it challenging for autonomous driving companies to break through OEM self-manufacturing.

Zhi Jia Technology’s strategy is to become an autonomous driving technology supplier, and its J7 super truck delivered to Rongqing Logistics is the result of a joint effort with Zhitu Technology to help FAW Jiefang build the vehicle, electronic and electrical, and wired chassis systems, while Zhi Jia Technology and Zhitu Technology are responsible for the software and hardware system development of the autonomous driving system.

Yingchi Technology also believes that it is unlikely to build its own cars at this stage, so it has teamed up with two major domestic truck manufacturers, Dongfeng Commercial Vehicle and China National Heavy Duty Truck Group, to develop mass-produced autonomous heavy-duty trucks.

In addition, Yingchi Technology also pays attention to establishing cooperative relationships with Tier1 companies and utilizing their resources and capabilities to implement their autonomous driving technologies.

According to Mazhe Ren, over 100 intelligent heavy-duty trucks equipped with Yingchi Xuan Yuan autonomous driving system have been mass-produced, and the market demand is strong. “We are coordinating the supply chain in full force, striving to ensure that the annual production plan is not affected by the epidemic.”

In 2021, FAW Jiefang signed an agreement with PlusAI to officially establish PlusAI as the supplier of the L3 autonomous driving system for FAW Jiefang. FAW Jiefang ordered 1,000 sets of L3 systems from PlusAI at one time, which were used for the assembly of the J7 L3 super truck.

Waymo is also representative of “not building cars”, choosing to cooperate with OEMs to integrate its technology into mass-produced autonomous trucks.

Waymo bought some Peterbilt heavy-duty trucks and remodeled them extensively for autonomous truck testing. Later, Waymo announced a joint venture with Daimler, the parent company of Mercedes-Benz, to develop a fully autonomous Level 4 truck system.

What kind of mass-produced trucks are needed for long-haul logistics

After mass production, whether commercialization can be achieved becomes a question that autonomous truck companies cannot avoid.

It is well known that the mission of autonomous trucks is to reduce costs and increase efficiency in the logistics and freight industries. In this industry, there is a measure of commercial value called TCO (Total Cost of Ownership), which includes acquisition costs, energy consumption costs, labor costs, maintenance and operation costs, among which the first three items are the main costs.

First of all, from the perspective of labor costs, the consensus in the industry is that autonomous driving technology can currently only achieve “labor saving”, that is, replacing traditional two-person driving with single-person driving, and cannot achieve “unmanned” driving.

In fact, from the perspective of domestic regulations, unmanned autonomous trucks have not been approved to operate on the road. Even in the United States, where regulations are relatively lax, autonomous trucks cannot operate “unmanned” on all roads because the technology does not meet safety requirements.# Waymo’s Charlie Jatt: Autopilot Trucks Will Be Driver-and-Machine Co-Driving

Charlie Jatt, commercialization lead for Waymo Trucking, said that the operation of self-driving trucks with human drivers will still be maintained for a long time in the future. The reason behind this is not only the technical feasibility and safety issues but also the ability to handle a series of emergencies, such as how to deal with a truck that breaks down in the middle of the road. “In the coming decades, the transition to L4 automated driving trucks may be a progressive, industry-chain collaborative transformation.”

Therefore, although self-driving technology can partially reduce labor costs, the cost of one driver cannot be removed, which also means that self-driving companies have the same starting point in the commercial value of this field.

According to capacity calculations, assuming a truck driver’s monthly salary is 15,000 RMB, reducing the number of drivers from two to one can save logistics companies a budget of 180,000 RMB annually, and the effect is still considerable.

Purchase costs and energy consumption costs can be understood as two sides of the same category of costs, which stem from two different carrier options for achieving automatic driving in long-haul logistics: fuel heavy trucks and electric heavy trucks.

Enterprises represented by Winwell Technology and IMa Technology advocate achieving automatic driving on existing fuel heavy trucks, while Pony.ai, DeepWay, and Tesla believe that electric heavy trucks are the best carrier for automatic driving.

In DeepWay’s view, accurate definitions of deceleration, steering angle, and other instructions for automatic driving cannot be achieved without a wired control chassis, which can only be realized on electric trucks. Traditional fuel-heavy trucks mostly use non-wired control chassis, and are not superior in vehicle control efficiency and redundancy backup, and cannot guarantee safety.

In addition, Wan Jun pointed out in an interview with 36Kr that traditional heavy-duty trucks driven by internal combustion engines basically do not have so-called electronic and electrical architectures, which makes it almost impossible for various controllers in the vehicle to communicate and connect. “It means that there is no way to control the components through a certain area platform, let alone intelligent driving.”

However, electric trucks also have fatal flaws: it is difficult to solve the energy supplement problem for long-distance transportation in long-haul logistics.

For most people, the first thing that comes to mind is to charge through a charging pile. Take the Semi-Truck mentioned recently by Musk for example. The truck uses a dedicated ultra-fast-charging pile, which can charge up to 70% in 30 minutes. The long-life version can travel around 500 miles (805 km) with a single charge. The actual performance may be discounted according to road conditions and weather.

More importantly, even if this data is achieved, it is not enough for heavy-duty trucks. It is worth noting that currently, most fuel-heavy trucks on the market can have a range of over 2000 km with an 800-liter fuel tank.

In addition, an easily overlooked point is that electric heavy trucks represent larger volume and weight of the battery pack.

The Semi Truck uses a 4680 battery pack with a capacity of 878 kWh in the 500-mile range version, weighing a total of 4192 kilograms. This means the truck needs to pull tons of weight while driving on the road. In comparison, using diesel as fuel would only require an additional 250 kilograms of weight. It is easy to see which solution is more suitable for freight transportation scenarios.

The Semi Truck uses a 4680 battery pack with a capacity of 878 kWh in the 500-mile range version, weighing a total of 4192 kilograms. This means the truck needs to pull tons of weight while driving on the road. In comparison, using diesel as fuel would only require an additional 250 kilograms of weight. It is easy to see which solution is more suitable for freight transportation scenarios.

However, there are also innovators in the electric truck industry. DeepWay proposed a battery-swapping mode, claiming that the process could be completed in 6 minutes, which solves the problem of range anxiety but does not address the issue of the battery pack being too large and heavy.

At the same time, many questions remain unanswered, such as how often heavy-duty trucks need to change their batteries, whether battery-swapping is feasible when fully loaded, where to build battery-swapping stations, whether the highway network is sufficiently covered, and how the inputs and outputs compare, etc.

Some have even suggested using hydrogen fuel cell technology to supplement the energy supply. DeepWay has adopted a hydrogen fuel cell platform in its trucks, and Hydron, founded by the former chairman of TuSimple, Chen Mo, is also a startup that focuses on hydrogen fuel cell trucks.

However, hydrogen fuel cell technology is mainly designed for the future. The technology for hydrogen production and storage is still not mature, safety issues exist, and supporting infrastructure such as hydrogen refueling stations is not yet complete.

Even TuSimple’s CEO admits that hydrogen fuel is not as mature as pure electric technology but believes that hydrogen fuel will inevitably become the mainstream driving force for long-haul logistics in the future.

The discussion has mainly revolved around energy supply solutions but is, in fact, related to acquisition costs and energy consumption costs. In terms of acquisition costs, electric trucks are generally more expensive than diesel trucks.

According to public information, the 300-mile range Semi Truck is priced at 150,000 US dollars (approximately RMB 1.02 million), while the 500-mile range version is priced at 180,000 US dollars (approximately RMB 1.22 million). In comparison, the domestic diesel trucks are priced at around RMB 400,000, and even with the additional cost of autonomous driving equipment, they are still far from reaching one million yuan.

Among electric truck manufacturers, the first generation of DeepWay’s Shenxiang Xingtuo has a relative competitive edge, reportedly priced at around 400,000 yuan, which is basically on par with the prices of heavy-duty trucks in the market.

In terms of energy consumption costs, electric trucks clearly have an advantage. In an interview with 36 Kr, TuSimple’s CEO calculated an example stating that with an electricity consumption of 150 kWh per 100 km at a cost of 1.3 yuan/kWh, the cost of Shenxiang Xingtuo’s first-generation vehicle was RMB 195 per 100 km. In comparison, a general fuel-driven truck consumes 35 liters of fuel per 100 km, which costs about 6 yuan per liter, equating to a cost of 210 yuan per 100 km. This means that DeepWay’s new energy heavy-duty trucks can save 7%-8% in energy costs.Tesla has done the math and determined that its SemiTruck costs $1.26 per mile to operate, compared to an average of $1.51 per mile for a diesel truck, a cost savings of 20%. The high initial cost of the electric truck can be offset by the lower operating and maintenance costs.

In China, companies working on autonomous driving for fuel-powered trucks are also reducing energy consumption costs. Yun Che Technology has developed a fuel-saving algorithm that uses big data analysis to learn driving strategies, which can reduce fuel consumption by 5% compared to experienced drivers.

ZhiJia Technology uses artificial intelligence to learn from experienced drivers and employs intelligent technologies such as vehicle-road collaboration to achieve triple fuel savings. The actual operating data of the intelligent heavy truck in mass production with front loading shows that it is 10% more fuel efficient than conventional manual driving.

Cangzhou TRMT, a Chinese logistics company, claims that from the perspective of saving fuel costs, an efficient fleet running regular long-distance logistics routes could recoup the cost of an autonomous driving system within two years.

There are different commercial paths for autonomous driving trucks to increase cost savings and efficiency in the logistics industry. TuSimple’s prospectus mentioned two business models: “selling trucks + software kits” and selling software services. Most companies such as TuSimple, Xiaoma Zhixin, DeepWay, and Tesla are involved in the former model, with Tesla’s Semi Truck receiving over a hundred orders, including from PepsiCo.

The high-end autonomous driving heavy truck jointly produced by Xiaoma Zhixin and Sany Heavy Industry Co., Ltd. may be sold to the joint venture between Xiaoma Zhixin and China Overseas Shipping Group Co., Ltd. to create an intelligent logistics power platform. DeepWay reports that the first-generation DeepWay Star Trail has already reached the commercialization inflection point of vehicle sales. Cooperation partner logistics platform Shiqiao will become DeepWay’s first batch of seed users.

The business model of selling software services can be divided into two types:

1) serving as an autonomous driving technology supplier for automakers/Tier 1 companies charging a one-time fee based on the number of vehicles produced, as in the case of ZhiJia Technology and Zhitu Technology;

2) providing autonomous driving truck services to shipping companies and major retailers, such as Waymo, TuSimple, and Aurora Innovation, who hope to sell autonomous driving truck services to logistics companies and charge customers based on the distance traveled.In China, the representative of this business model is Yunzhou Intelligence. The founder, Zhe Ma, claims that his company is not just a provider of technology, but also an autonomous driving asset operation company, which is exactly the “technology + operation” business model that Yunzhou Intelligence proposed at the beginning.

After the mass production of L3-level autonomous driving trucks, Yunzhou Intelligence will purchase these trucks and cooperate with logistics companies to provide standardized intercity heavy-duty truck transportation services based on a pay-per-kilometer system.

It seems that many autonomous driving companies have already figured out their commercialization routes after mass production, but whether they can really work is disputed by industry insiders.

Wan Jun, in an interview with “36Kr”, stated that under the conditions of L3-level autonomous driving, autonomous driving technology only reduces the workload of the driver but still cannot achieve complete automation and remove labor costs. In this case, it seems unlikely to ask drivers or logistics fleets to pay for autonomous driving software.

On the contrary, some industry insiders believe that companies that choose a gradual route may be the first to achieve commercialization.

For example, IMa Technology, which has set China’s largest mass production order for autonomous driving heavy-duty trucks, used the L4 technology to accumulate scenarios and collect data through landing fuel-efficient trucks. This helped reduce the cost and increase efficiency of freight logistics while also feeding back to the autonomous driving technology, laying the foundation for achieving true unmanned commercial operations in the next step.

Geely Group acquires Torc Robotics China, and there is a boom in entrepreneurial activities in the field of autonomous driving heavy-duty trucks.

In fact, the debate over mass production and commercialization of autonomous driving trucks has never stopped, which also reflects the fact that the industry is still in the early stage of development.

In this situation, some startup companies and cross-border players have seized the opportunity to enter the autonomous driving truck market.

For example, in the second half of 2021, three companies with the same background suddenly entered the field of autonomous driving trucks. They were founded by 3 teams who left Pony.ai: Qiangua Technology, Xingxing Technology, and Qingtian Zhika. Among them, Xingxing Technology chose to build cars within half a year of its establishment and was the first to release an L4-level autonomous driving pure electric box-type heavy-duty truck logistics vehicle called “Apebot I”.

There are also players who cross over from “harbor autonomous driving”. Zhang Tianlei, CEO of Mainline Technology, said, “the harbor is just a ‘starting point’, and the real goal is to build a logistics transportation network that covers the whole country.” According to the report of “Yunlian Think Tank,” in the scenario of high-speed mainline, the cooperation model between Mainline and Jiefang will be delivered in large quantities at the end of this year, and the vehicle has already had the function of L4.Also, automated driving companies that cover multiple scenarios such as passenger vehicles, public transportation, and mining vehicles are entering the mainstream logistics market, for example, HongjingIMa and Jianghuai Commercial Vehicles’ joint effort to create the L3-level HyperTruck One, a digitized intelligent heavy-duty truck for the mainstream logistics market that is expected to begin mass production in 2022.

It is also worth paying attention to the latest developments of some “old players” in the field of truck automated driving.

In October 2021, Huang Zehua, co-founder of TuSimple, left the company to establish a car manufacturing company named “010 ZhiKa”.

Han Wen, CFO of IMa Technology, serves as the legal representative of a startup named “Weidu Technology”, which currently focuses on the research and development of a new generation of new energy heavy-duty trucks and has recently announced the completion of angel round financing worth hundreds of millions of yuan.

Traditional car companies are also beginning to enter the field of automated driving for trucks.

In February 2021, Great Wall Motor secretly established “RuGuo Technology.” This is a brand new company that specializes in new energy automated driving for trucks, which includes several other companies within the Great Wall system, such as FengChao Energy, WeiShi Energy, XianDou Intelligence, HaoMoZhiXing, and ShanLongZhiXing, indicating a strong stance.

More recently, the news that Geely Holdings Group intends to acquire all shares of TuSimple’s Asia-Pacific regional business has caused quite a stir. They have issued a purchase offer to TuSimple’s US headquarters. If this transaction is successful, it means that Geely’s automotive empire will officially expand into the field of automated driving for heavy-duty trucks.

Prior to this, Geely had launched a new energy commercial vehicle brand named Yuan Reng Shi Qi in 2016. It covered logistics heavy-duty trucks with pure electric drive as its core, powered by liquid hydrogen energy and methanol technology, and equipped with battery swapping technology. It is estimated that the “new energy + automated driving” heavy-duty truck model will enable Geely to achieve another major business success in terms of sales growth, following its acquisition of Volvo.

It can be seen that as the commercial value of automated driving for mainstream logistics gradually emerges, there will be another wave of entrepreneurial explosion in the field of heavy-duty trucks.

Currently, except for a few companies that have achieved mass production and are leading the industry, other players are relatively evenly matched in the progress of automated driving. The outcome remains uncertain, as all are dark horses, and there are still many variables. However, it can be affirmed that the participation of more players will greatly enhance market vitality.

In the future, there will also be more new industry ideas emerging from the ongoing debates and explorations, leading to the arrival of an era of unmanned driving for trucks.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.