Editor’s Note: “New Variables” is a column launched by Autohome to share insights from frontline practitioners in the smart car industry. From the perspective of insiders, it takes you to foresee the key variables in the development of smart cars.

Special Contributor / Huang Yuanchao, founder of WeChat public account “Lidar Veteran”

Editor / Autohome

“Please don’t speak if you don’t have at least 4.”

With a shout from Salon Automobile, a new energy vehicle brand under Great Wall Motors, the first model of Salon Automobile, Mechdragon, made its debut at the Guangzhou Auto Show in November 2021, claiming to be the “world’s first model equipped with 4 LiDARs”.

Mechdragon uses Huawei’s 96-line hybrid solid-state LiDAR solution, and the detection range of a single LiDAR can cover a horizontal range of 120° and a vertical range of 25°. Four LiDARs used simultaneously can achieve 360° full coverage without visual dead zones.

On August 19, the world’s first SAR Space urban exhibition hall of Salon Automobile opened at the In99 in Chengdu Yintai Center. Mechdragon also made its debut simultaneously.

At this exhibition hall, we were able to get a glimpse of Mechdragon in its entirety.

Let’s take a look at some actual photos:

From the exterior, Mechdragon has a bold and unique design, with sleek lines and large, thick-walled tires that echo the rear and front of the car, making for an eye-catching appearance.

Among them, the most attractive feature of the vehicle is undoubtedly the 4 Huawei 96-line LiDARs it is equipped with.

It can be seen that four LiDARs are distributed in the middle position of the front grille, the middle position of the rear end, and the front fender of the side body. This layout directly achieves 360-degree panoramic coverage, and it is no exaggeration to say that it is the world’s first model to cover its surroundings with LiDAR.

It can be seen that Great Wall has invested heavily in this series of vehicles. Moreover, the installation method that is completely embedded in the body structure also maximizes the aesthetics, which can be attributed to Huawei’s efforts in miniaturizing LiDAR.

What needs to be particularly noted is the cost of maintenance and repair of LiDAR in the later stage, after all, the probability of scratching or collision in these installation positions is much higher than that of the roof installation method.

As shown by the price list of the replacement cost of the LiDAR for the small Peng P5 exposed recently, the repair cost for a single LiDAR of the small Peng P5 after a scratch accident was as high as 8916 yuan. If the corresponding replacement and labor costs are added, the total cost will exceed 9000 yuan.

The Secret of Huawei’s 96-line LiDAR Technology Roadmap

The research and development of Huawei’s LiDAR products started in 2016. Unlike other LiDAR companies, Huawei chose a high difficulty position from the beginning: high performance, vehicle-level, capable of large-scale mass production, instead of starting from traditional mechanical LiDAR.

With ambitious goals and clear targets, Huawei’s LiDAR aims at the entire smart car and autonomous driving race.

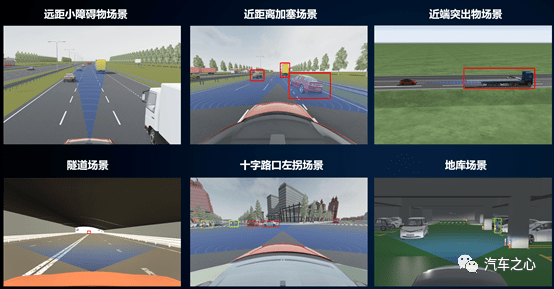

From the previous press conference, it can be seen that Huawei’s LiDAR first needs to solve the main difficult scenarios in actual driving, such as:

1) Cutting in close range. Due to its accurate angle measurement ability and contour measurement ability, LiDAR can confirm cutting in 2-3 frames within hundreds of milliseconds. The angle resolution of millimeter-wave radar is not enough, and cameras usually need to accumulate multiple frames, which requires several hundred milliseconds to confirm cutting in.

2) Nearby protrusions. LiDAR can also make quick judgments, while millimeter-wave radar and cameras have a little trouble.

3) Left turn at the intersection. This tests the LiDAR’s large-angle panoramic measurement ability, which needs to simultaneously meet large field of view and long-distance measurement ability.4) Tunnel scenario. Without further ado, the shortcomings of cameras at the tunnel exit are obvious, while lidar can perfectly solve the problem.

5) Underground parking scenario. Due to poor multipath reflection performance of millimeter-wave radar and the impact of light intensity changes on camera performance, the unique advantages of lidar can make up for it.

In addition, lidar is more accurate in identifying stationary objects.

In the recent collision accident of XPeng P7, neither camera nor millimeter-wave radar recognized the stationary vehicle ahead, let alone timely intervention to make evasive actions. If the vehicle had been equipped with lidar, the tragedy could have been avoided.

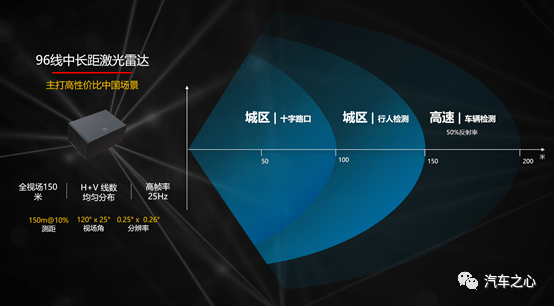

Take a look at the core parameters and key technologies of Huawei’s 96-line lidar:

- “See Far“: Huawei’s lidar can achieve a range of 150m @ 10%;

- “See Wide“: The horizontal FOV (field of view) of this lidar is 120°;

- “See Accurately“: The vertical FOV is 25°;

- “See Clearly“: The resolution can be up to 0.25°×0.26°.

The above parameter configuration can basically achieve detection coverage of pedestrians and vehicles in urban areas, and has the ability to detect high-speed vehicles, which is suitable for China’s complex road conditions.

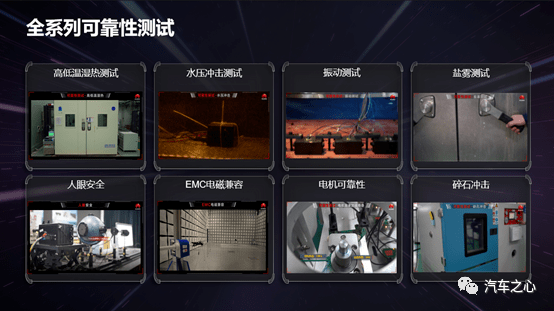

In terms of reliability, Huawei has also made great efforts, after all, reliability is the top priority for passing vehicle regulations.

With Huawei’s 20 years of deep accumulation in mechanical and electrical capabilities and experience in 2.5 billion motor reliability tests, it has enough confidence to climb Mount Everest.

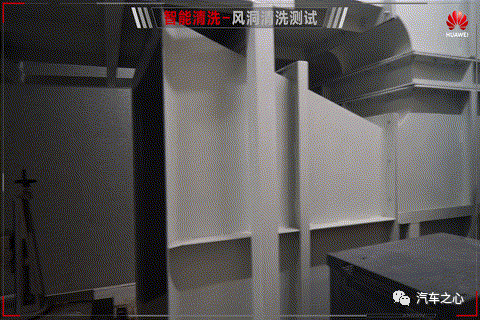

Not only that, there are also two functions to consider: cleaning and heating.

In the scenario where lidar is covered by dirt and pollution, an intelligent cleaning system is needed. In order to cope with cleaning during driving, Huawei has independently designed an intelligent cleaning wind tunnel system to simulate the cleaning ability at 130km/h, then tested the effect of different nozzles and pressures on cleaning, continuously accumulating valuable first-hand data, and adjusting and optimizing the corresponding functions accordingly.

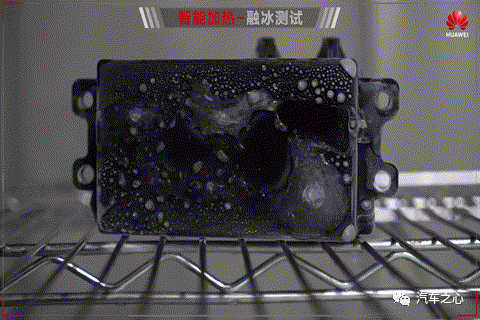

In scenarios covered by frost, fog, dew, and thin ice, Huawei is equipped with an intelligent heating system that automatically triggers the start-up.

From the above introduction, we can see that Huawei’s production of laser radar for cars is not mere talk, but it is determined.

As for the scanning scheme used by the laser radar of this car model, there is currently no clear public information disclosure. However, by combining internal and industry-related interviews with external public information, we can make a rough judgement.

We speculate that the laser radar loaded on the Mechdragon car model by Huawei is likely to use MEMS micro-mirror technology, and the reasons are as follows:

1) The turning mirror scheme has internal mechanical rotation mechanism, which has a shorter service life and is more difficult to carry out car regulation. Especially because Huawei’s laser radar has just started, it is difficult to make breakthroughs in core technology in a short period of time.

2) From the publicly available patents, Huawei’s laser radar has both turning mirror and MEMS micro-mirror schemes in the scan device related patents, while the MEMS laser radar patent is more complete, and the turning mirror scheme is relatively weak.

3) XPeng Motors’ first car model carrying laser radar, the XPeng P5, chose the Livox laser radar from DJI, which uses a dual wedge prism scheme. This scheme is more difficult than one-dimensional and two-dimensional turning mirror schemes, but it has been abandoned in its latest car model, the XPeng G9, and replaced by the RS-LiDAR M1 laser radar from SureStar Juchuang, which uses MEMS micro-mirror technology.

MEMS semi-solid-state laser radar is currently the most mature semi-solid-state laser radar and the preferred choice for mass-produced products.

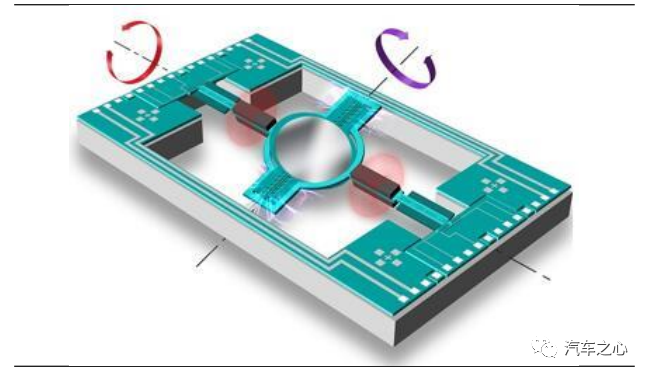

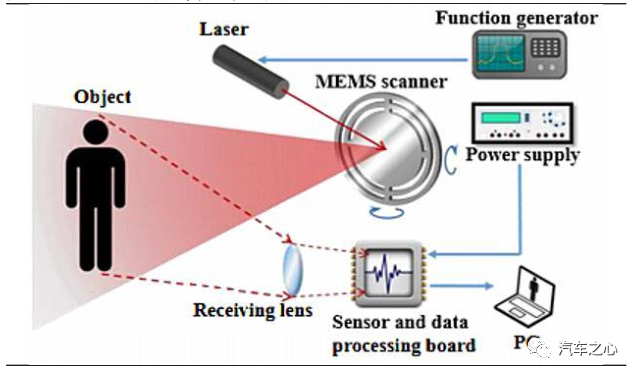

MEMS micro-mirror is essentially a silicon-based semiconductor component. Its characteristic is that the “movable” micro-mirror surface is integrated internally, and the static or electromagnetic driving mode is used. To put it simply, the scanning system driven by MEMS replaces the motor scanning system.

As a more mature semiconductor component, MEMS has the characteristic of cost reduction after large-scale production. Its advantages are:

1) The structure is delicate, and the volume and size are greatly reduced.

2) MEMS micro-mirror is not a device born for laser radar, it has been used in commercial projection display for many years, and the supply chain is relatively mature.

The disadvantages are also obvious, mainly that the size of the MEMS micro-mirror is small, and the corresponding laser radar’s optical aperture, scanning angle, and field of view angle will also become smaller.

How to solve the problem of small field of view and detection range of MEMS LiDAR?

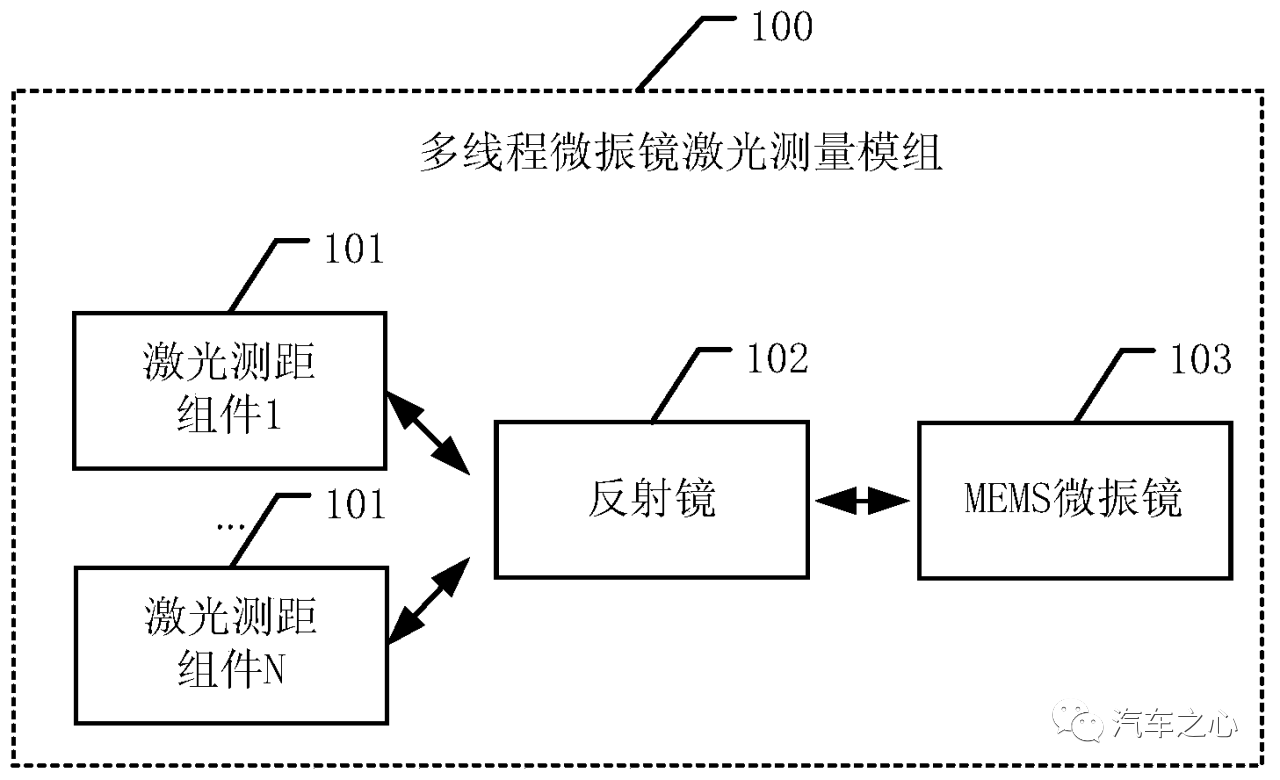

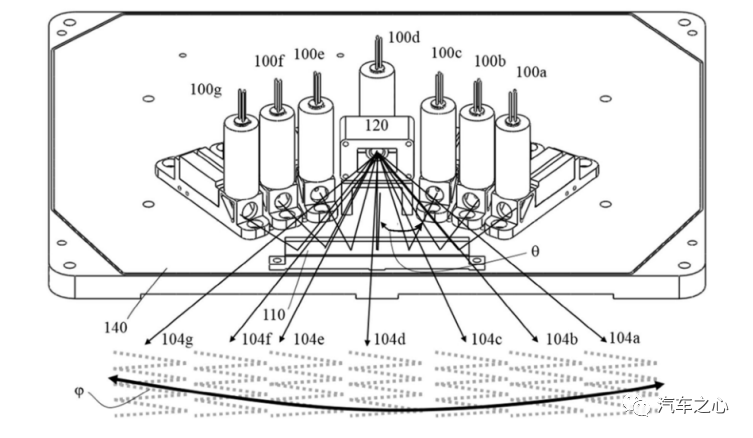

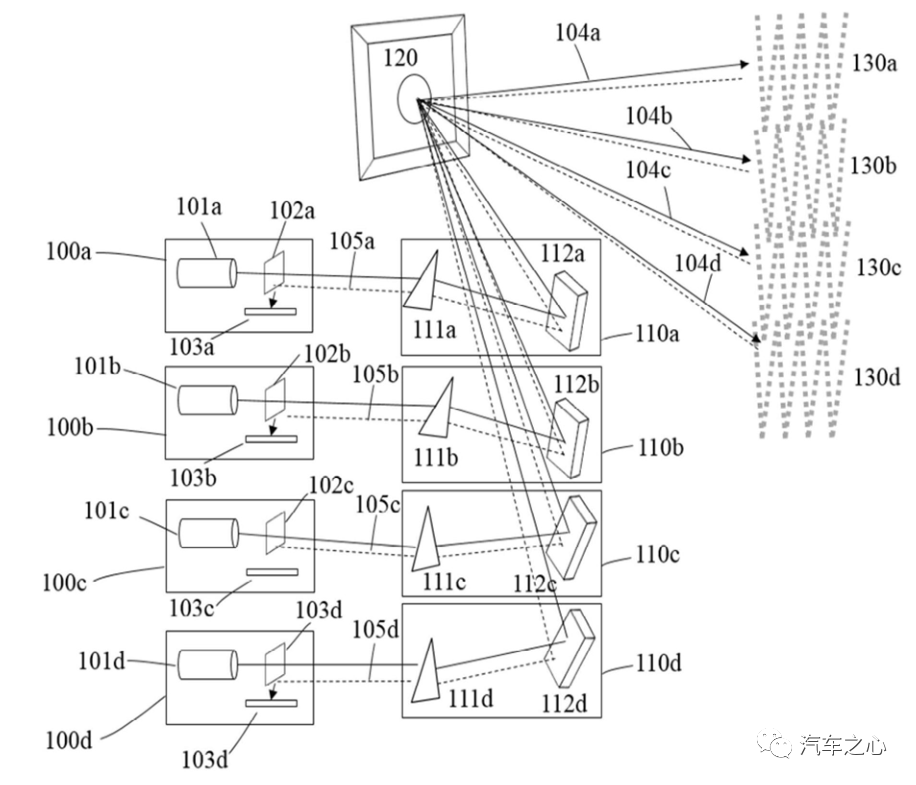

Huawei uses multi-threading technology. Multiple LiDAR ranging components share the same MEMS micro-mirror, and each or multiple LiDAR ranging components correspond to a reflective mirror group. The reflective mirror group is used to link the optical path between the LiDAR ranging component and the MEMS micro-mirror.

N emitting beams of the multiple LiDAR ranging components can be incident on the MEMS micro-mirror through the reflective mirror. The MEMS micro-mirror changes the direction of the emitted beam to achieve two-dimensional scanning.

It can be seen that multi-threading technology can effectively improve the performance of detection range and FOV, but the use of multiple LiDAR ranging components will also increase the volume and cost.

Regarding the price, Huawei officially announced that the cost of the 96-line LiDAR should be within 200 US dollars.

We believe that no matter whether the mirror-type or MEMS micro-mirror technology scheme is adopted, it is difficult to achieve a cost of less than 200 US dollars in the short term based on the current cost of lasers, detectors, and driving circuits.

Huawei LiDAR Patent Progress

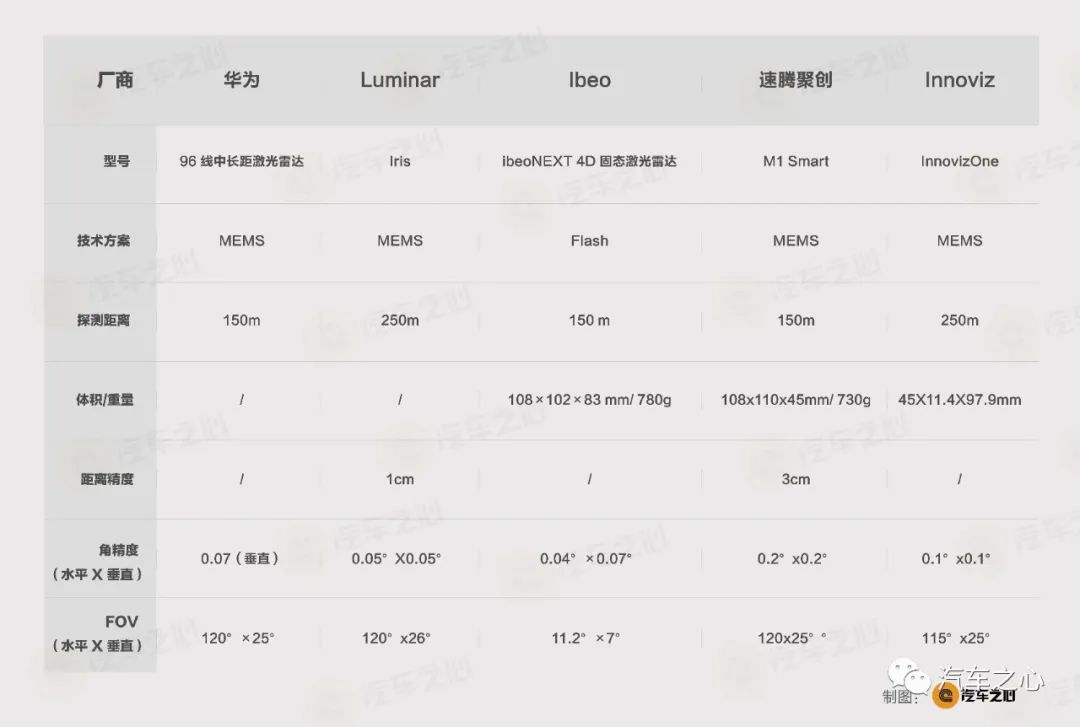

What is the level of Huawei’s LiDAR in the industry?

From the main parameters including detection range, accuracy, and field of view, it can basically reach the middle and upper levels.

Thanks to the characteristics of an equivalent 96-line LiDAR, the vertical angle accuracy can reach 0.07°, leading the industry in this performance and the product is still competitive.

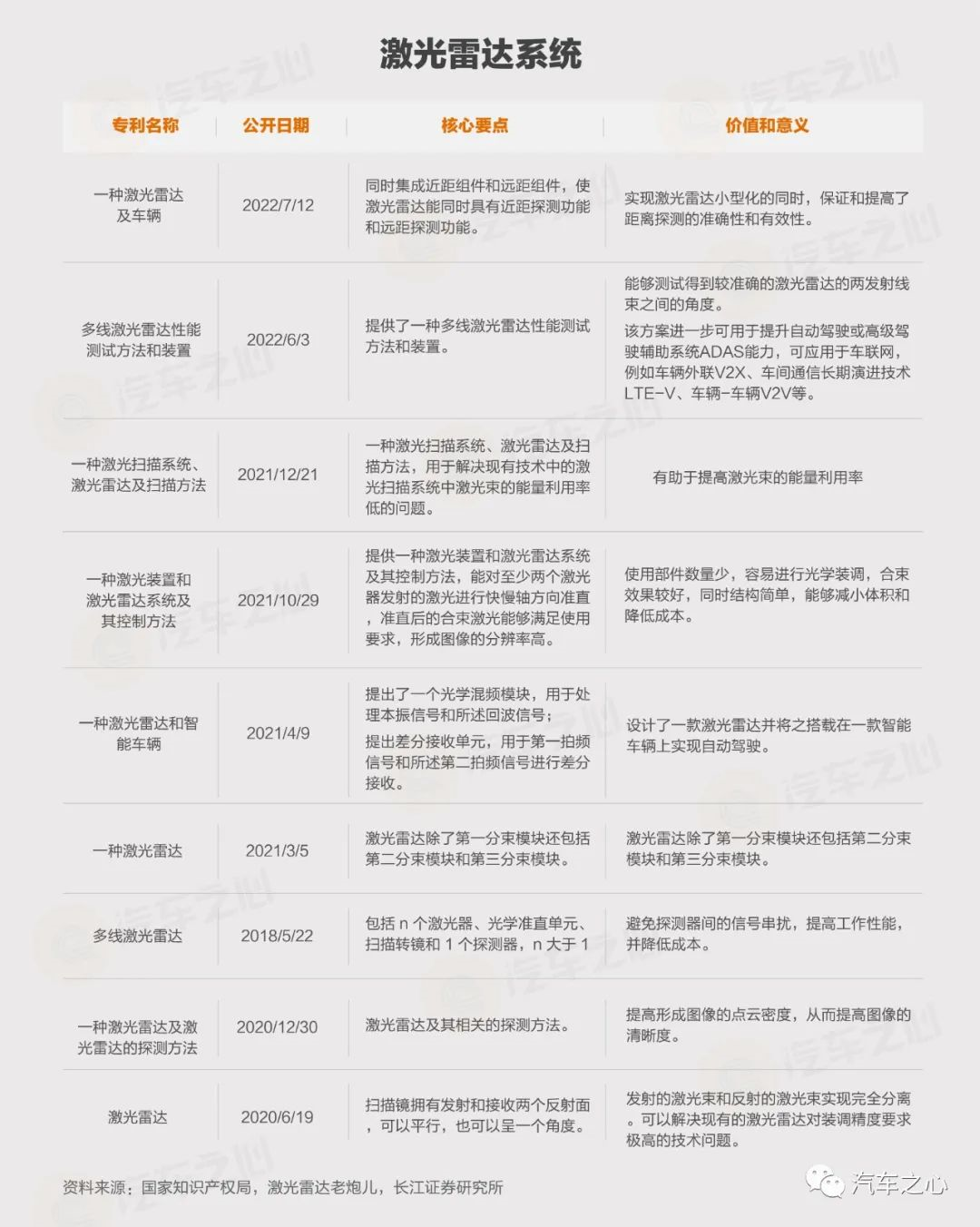

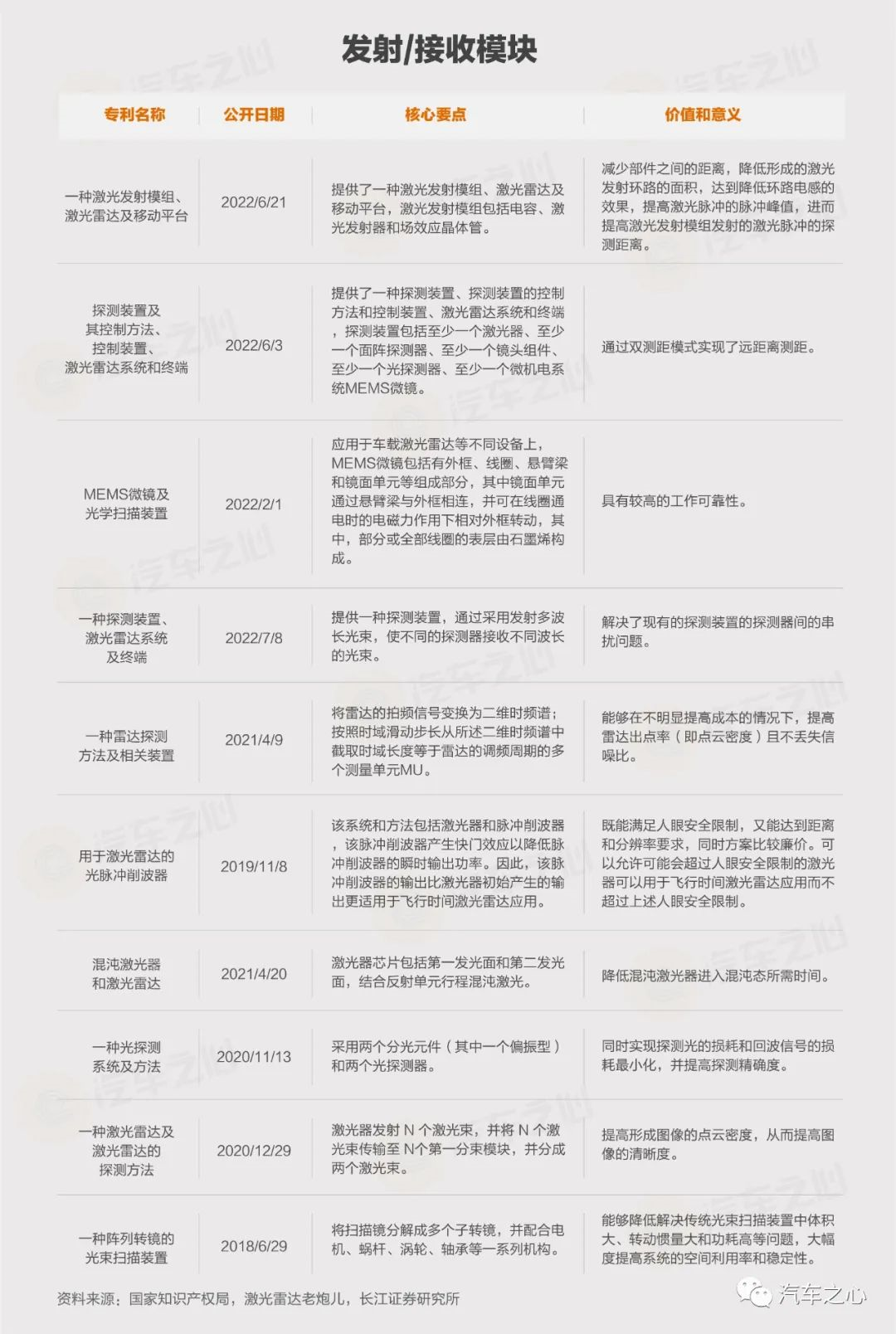

As for the current progress of Huawei’s LiDAR, little public disclosure has been made.The latest data shows that Huawei has been applying for relevant patents since 2016. So far, Huawei has accumulated 87 patents related to LiDAR (including those in the application process), with a signal processing proportion of more than 60%, followed by LiDAR systems, transmission and reception, and scanning systems.

Huawei has the ability to provide a complete set of autonomous driving solutions, with a large number of patents in the application layer.

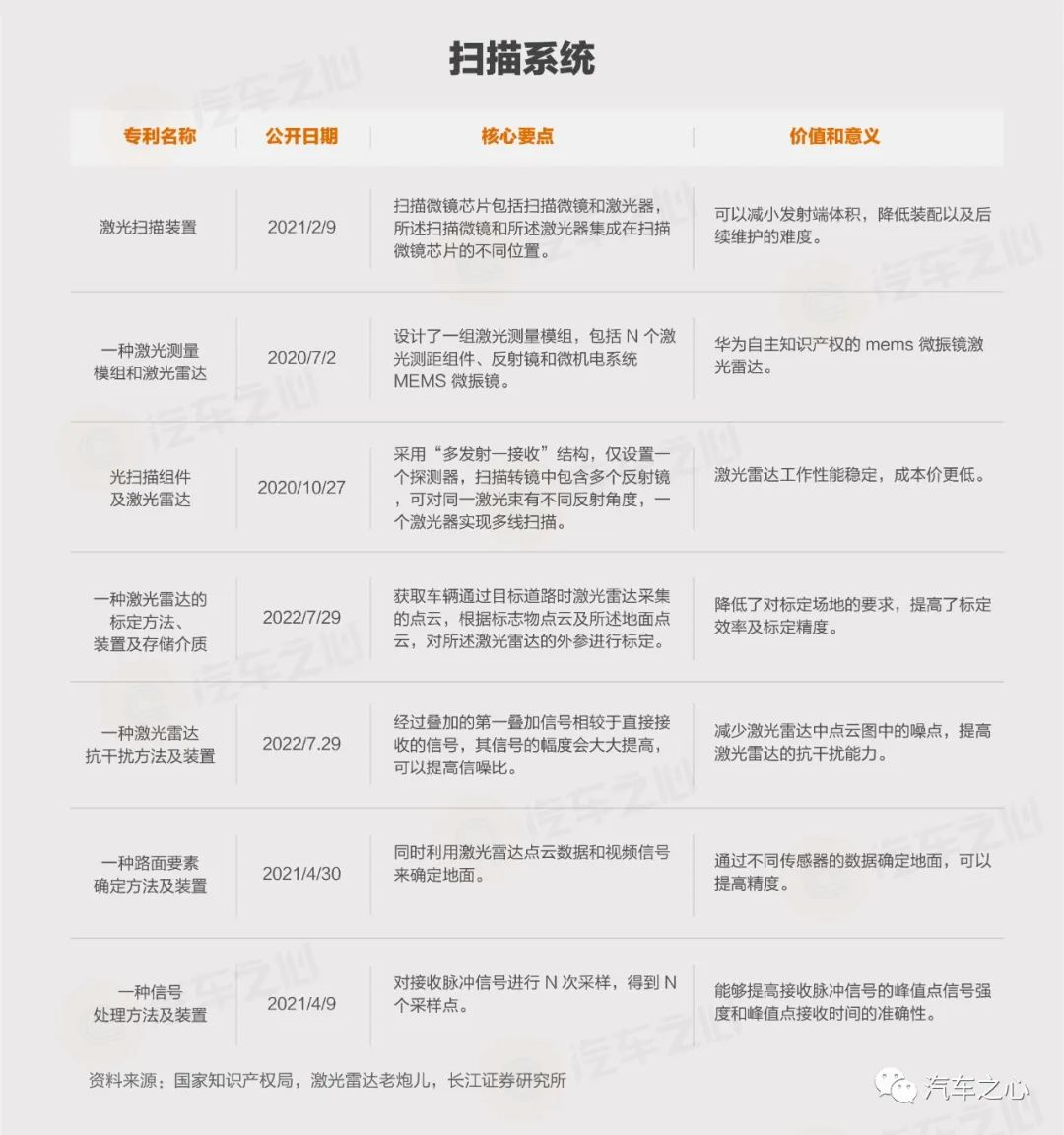

Huawei’s core patents related to LiDAR are mainly divided into three categories: LiDAR systems, transmission/reception modules, and scanning systems:

After a simple review, it was found that Huawei’s core patents are mainly in the optimization of scanning systems and the improvement of point cloud quality at the transmission and reception end.

1) In terms of transmission and reception, Huawei is simultaneously developing pulsed lasers and chaotic lasers. It has designed chaotic laser diodes and used different emitting surfaces to reduce the time required for chaotic laser diodes to enter a chaotic state. It has also developed pulsed lasers and pulse choppers for LiDAR that can meet human safety limitations and distance and resolution requirements while being relatively inexpensive. Huawei has also proposed various radar detection methods that can improve the radar point density without significantly increasing costs while maintaining signal-to-noise ratio.

2) In terms of scanning systems, Huawei is simultaneously developing MEMS micro-mirrors and multi-sub-mirror scanning schemes. The multi-sub-mirror scanning scheme can solve the problems of large volume, high moment of inertia, and high power consumption in traditional beam scanning devices and greatly improve system space utilization and stability. The MEMS micro-mirror scanning scheme uses a multi-threaded MEMS micro-mirror laser measurement module design to effectively improve LiDAR performance, increase the effective detection distance and field of view.

3) In terms of information processing, Huawei has proposed environmental detection methods, signal processing methods, road feature determination methods, ranging methods, vehicle positioning methods, and algorithms for processing point cloud data, covering all aspects of autonomous driving.

Compared with leading LiDAR companies, Huawei’s total number of patents is not yet high.

According to the latest data, Huawei has accumulated 87 patents related to LiDAR, which is still somewhat less than Luminar (228) and Velodyne (354) overseas and Hesai Technology (231) in China (all total numbers include patent applications).As a leading enterprise in the MEMS LiDAR industry, Luminar has relatively balanced patent distribution and uses multiple unique technologies in its MEMS LiDAR, including:

1) Biaxial scanning mirror technology, which reduces the number of lasers and increases the field of view;

2) 1550nm high-power optical fiber laser, which improves detection distance and resolution;

3) Highly sensitive InGaAs indium gallium arsenide material detector, which supports optical fiber lasers;

4) Self-developed ASIC chip, which reduces dependence on front-end hardware.

In addition, Luminar’s patents also include layout of cutting-edge technologies such as solid-state lasers. At the algorithm level, it also possesses core technologies such as fusion with vision and signal optimization of LiDAR.

It’s worth mentioning that Huawei announced a patent called “Lidar and Vehicle” on July 12, which innovates on the structure of lidar, can integrate the characteristics of two types of lidar, and has both short-range and long-range capabilities while reducing the volume of the lidar.

From the structural diagram, it can be seen that the lidar integrates short-range and long-range components:

- The short-range component can detect targets that suddenly appear within a large field of view in a short period of time, and is suitable for short-range detection;

- The long-range component has high resolution, and can detect the size, direction of travel, and speed of targets within a relatively small field of view in front of the lidar, and is suitable for long-range detection, so that the lidar can have both short-range and long-range capabilities.

When the angle alpha between the first optical axis of the short-range emission module and the second optical axis of the long-range emission module satisfies 10° ≤ α ≤ 40°, the reflection of the laser emitted by the short-range component and the long-range component will not obstruct each other, thereby realizing miniaturization of the lidar while ensuring and improving the accuracy and effectiveness of distance detection.

The difficulty of simultaneously achieving short-range and long-range detection capabilities is one of the many key issues facing current LiDAR technology. Huawei’s lidar patent provides a good solution to this problem if it can achieve miniaturization of the lidar while ensuring the accuracy and effectiveness of distance detection, the volume increase problem brought by multi-threading technology can also be resolved.

Huawei’s Investment Map for LiDAR

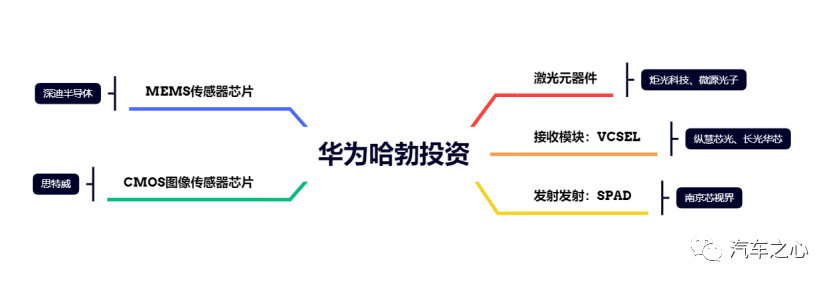

Through investigation, we discovered that Huawei Hubble Investments has actively invested in the laser radar industry chain, particularly in next-generation technology innovation, involving laser components, transceiver modules, MEMS sensor chips, CMOS image sensor chips, and more specifically:

Through investigation, we discovered that Huawei Hubble Investments has actively invested in the laser radar industry chain, particularly in next-generation technology innovation, involving laser components, transceiver modules, MEMS sensor chips, CMOS image sensor chips, and more specifically:

(1) In the layout of the next-generation laser emission (VCSEL) and reception (SPAD) architecture, Huawei Hubble invested in Zonghui Xin Guang (mainly producing VCSEL chips L), Changguang Huaxin (VCSEL), and Nanjing Xin Shijie (SPAD).

-Zonghui Xin Guang:X is an innovative optoelectronic semiconductor enterprise. Its mass-produced VCSEL chips are light sources for laser radar, and VCSEL is widely used in intelligent phones, data communication, laser radar, etc. Zonghui chip is also the main supplier of Huawei mobile phone ToF light source, with its own 6-inch epitaxial production line.

-Changguang Huaxin:Also a company that develops VCSEL, it has launched three categories of products: Distance Sensors, Structured Light (SL), and Time of Flight (ToF). The standard products include wavelengths such as 808 nm, 850 nm, and 940 nm. It is one of the few companies in the world that research and develop and mass-produce high-power semiconductor laser chips.

-Nanjing Xin Shijie:In September 2020, Nanjing Xin Shijie added Hubble Technology Investment Co., Ltd. and other shareholders. Nanjing Xin Shijie is mainly engaged in solid-state laser radar chips, high-speed optoelectronic interconnect chips, and system solutions for large data centers. Its products have single-photon avalanche diodes SPAD (receivers), and SPAD has high sensitivity to light. Laser radar equipped with SPAD can accurately detect objects with low reflectivity, such as pedestrians wearing dark clothing.

(2) In the development of more powerful laser components, Huawei Hubble invested in Juguang Technology (high-power semiconductor laser components, laser optical components, and particularly industry-leading technology in the “generation of photons” + “control of photons” field) in 2020 and Wei Yuan Photonics (high-performance laser chip and supporting optoelectronic module).

-Juguang Technology:Mainly engaged in the research and development, production, and sales of high-power semiconductor laser devices and laser optical devices in the upstream of the laser industry, with core capabilities in automotive-level applications (laser radar) and is expanding its core capabilities towards innovative automotive applications such as intelligent driving laser radar (LiDAR), and intelligent cabin driver monitoring systems (DMS).

-Weiyuan Photonics:It focuses on the research and development and production of high-performance laser chips and supporting optoelectronic modules, with core technologies having independent intellectual property rights and products having unique technology in China. According to data from SmartSprout, Wei Yuan Photonics mainly focuses on technology areas such as laser emitters, narrow linewidth, gain chips, photonic chips, and laser radar.

(3) In terms of advanced engineering and manufacturing capabilities, it invested in DeepTech Semiconductor in 2021 to layout MEMS sensor chips.DeepTech Semiconductor: A company that produces MEMS gyro series inertial sensor chips. It provides MEMS gyro chip solutions for consumer electronics and automotive electronics markets, as well as comprehensive application solutions.

In terms of more powerful image perception capabilities, it invested in SITRI as early as 20 years ago, extending to the field of CMOS image sensor chips.

SITRI: A high-performance CMOS image sensor chip design company. Its products are widely used in fields such as security monitoring, car imaging, machine vision, and consumer electronic products. Although the company has not been established for a long time, its market areas are avoiding the mobile phone market and opting for security monitoring. With excellent product design, it ranks among the top in the security field and is well-deserved as an “invisible champion”.

With new cars such as the Polestar, Avita, and Mechdragon equipped with Huawei LIDAR gradually being launched, the real performance of Huawei LIDAR will be verified in the market, as for now, the biggest obstacle of installing LIDAR on a car is the cost issue.

We believe that as Huawei continues to overcome the technical challenges and bring mass-produced cars to the market, the cost issue will be resolved.

Looking towards the future, we remain highly optimistic. Once the core technology of LIDAR is broken through by Huawei and the prices continue to drop, it may deal a blow to Tesla in the field of autonomous driving.

P.S. For readers interested in LIDAR and autonomous driving, please follow the author’s official WeChat account.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.