Wen | Financial Street Lao Li

Xiaokang shares need to ask the market, while Huawei needs to ask the market more.

On August 12th, Huawei released its 2022 half-year report. For a company with trillion-level revenue like Huawei, there is hardly any big ups and downs. However, Huawei’s half-year report is not impressive, and even has hidden worries. Actually, it’s not just Huawei – in the first half of this year, major domestic groups weren’t performing well, and Tencent Holdings, which is a leader in everyone’s hearts, even saw its net profit halved in the first half.

Although Huawei’s half-year report is not eye-catching, the market has been continuously interested in it. The market value of Xiaokang, the cooperative partner, has been steadily increasing. Everyone knows that AITO has made significant achievements in Xiaokang, and the secondary market even cried out that when AITO’s monthly sales exceed 20,000 units, Xiaokang’s market value is expected to exceed 200 billion.

As the other party of the cooperation, what does AITO mean to Huawei? No one can explain it clearly since there is a lot of controversy about Huawei’s strategy within the industry. Today, Lao Li will discuss with everyone about the size of Huawei from a financial perspective before talking about AITO.

How big is Huawei’s size?

Before we talk about AITO, Lao Li will first talk about the business scale of Huawei with everyone. As a company with annual revenue of over 500 billion, Huawei’s business sectors are much more diversified than those of the whole car companies like Volkswagen and Toyota.

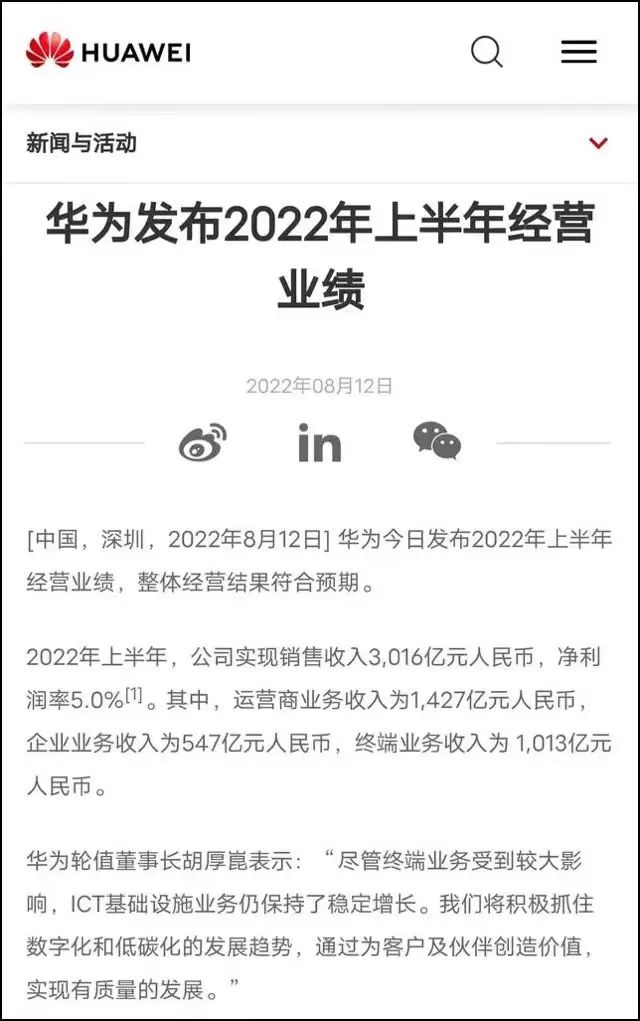

From a financial perspective, Huawei’s revenue is mainly derived from customers. According to Huawei’s financial reports, its revenue can be divided into operator services, enterprise services, and terminal business. Huawei’s sales revenue in the first half of the year was 301.6 billion yuan. Among them, the revenue of operator business was 142.7 billion yuan, accounting for 47.3%; the revenue of enterprise business was 54.7 billion yuan, accounting for 18.1%; and the revenue of terminal business was 101.3 billion yuan, accounting for 33.6%.

Looking at the growth rate, the revenue of the operator business and enterprise business of Huawei increased by 4% and 27% respectively in the first half of the year, but the most important terminal business not only had a 25% decline in revenue, but also a sharp decrease in the proportion of Huawei’s revenue.

Most friends are not familiar with Huawei’s business sectors. Lao Li will simply share with everyone that behind this seemingly stable revenue, there is a certain hidden worry: the foundation business such as operator services has stagnated, the innovation business such as enterprise services has small market space, and the terminal sector has been hit hard in the race.

The operator business has always been the revenue foundation of Huawei. After going through a setback in the first half of 2021, the operator business of Huawei in H1 2022 saw a growth of 4.2%. The main reason is that the three major domestic operators have increased their investment in 5G, and there is no room for growth in this sector.# Huawei’s performance in the first half of the year achieved stable growth in both China and overseas markets, with an overall growth of 27.5%. Earlier, Huawei laid out 20 enterprise service legions which had remarkable effects. The financial legion, digital power legion, intelligent expressway legion, and coal mine legion had a higher growth rate than the average growth rate of the enterprise business. However, this field has limited space for imagination and it is difficult to lift Huawei’s second growth curve.

Among Huawei’s three major businesses, the terminal business has relatively poor performance. In past years, the most well-known business of Huawei was the terminal business, but today, terminal business has become the worst-performing business. Let’s look at a revenue comparison: In the first half of 2020, the terminal business revenue was CNY 255.8 billion, while in the first half of this year, it was CNY 101.3 billion. The revenue proportion also decreased from 56% in 2020 to 33% this year. The main reason is that smartphone business has declined significantly due to the US sanctions – Kirin chips encountered obstacles, the Honor brand was divested, and Huawei’s smartphones faced significant supply-side challenges.

Even more seriously, Huawei’s net profit margin this year is only 5%, which means that Huawei’s products are not as profitable as before. Although we are unable to judge the reason for the decrease in net profit margin, the speculation in the secondary market is that, under the condition of restricted technology, Huawei products can no longer obtain additional premium through technological leadership, and the terminal business has the biggest impact.

Therefore, Huawei must find new terminal scenarios, from smartphones to printers to computers to watches and even cars. Among the many business scenarios, the automotive industry is most likely to lift Huawei’s second growth curve because of its large market.

Although Huawei has laid out much in the field of intelligent automobiles, the biggest imagination is Wanjie. Let’s make a hypothesis: if Wanjie achieves the same scale as Tesla, then Wanjie is expected to become another Huawei, but this road is not easy.

How big is the imagination of Wanjie?

In essence, the question about Wanjie is how big is the revenue imagination of a smart electric vehicle enterprise. Many friends often look at the sales volume of enterprises, but few are interested in the revenue of enterprises. As Mr. Li mentioned earlier, although everyone is talking about the future profits of car companies relying on “hardware + software + services,” so far, the majority of revenue of all car companies comes from hardware.

Therefore, Mr. Li and everyone will calculate the revenue of the enterprise. First, let’s take a look at the revenue size of the two private companies, Geely and Great Wall, in 2021.# Geely Auto sold 1.33 million new cars last year, with a revenue of 101.6 billion yuan; Great Wall Motor sold 1.28 million new cars, with a revenue of 136.4 billion yuan. However, under the sales volume of one million units per year, the revenue of Geely and Great Wall is only slightly more than 100 billion yuan, far less than one-fifth of Huawei’s.

Many friends say that the low ASPs of Geely and Great Wall cars cannot be fully referenced, so let’s take a look at the revenue of XPeng Motors and NIO:

XPeng Motors sold 98,000 new cars last year, with a revenue of 21 billion yuan; NIO sold 91,000 new cars, with a revenue of 33.17 billion yuan. The revenue of NIO and XPeng is even less than one-tenth that of Huawei.

Let’s take a look at Tesla’s revenue scale. Tesla delivered 936,000 vehicles in 2021, with automotive revenue of $47.232 billion, a year-on-year increase of 73%. Converted into RMB, it is more than 300 billion yuan. In terms of business volume, Tesla’s revenue is at the same level as a single business unit of Huawei.

Some time ago, many friends discussed about Xpeng Motors together. There are three possible ways for Xpeng to develop:

The first is for Xpeng to continue to maintain product pricing above 200,000 yuan. In this segment of the market, Xpeng faces triple competition from foreign-funded traditional automakers, foreign-funded new energy automakers, and domestic new energy automakers. From any perspective, Xpeng is hard to have an advantage.

In my personal judgment, in the current market competition, Xpeng is difficult to compete with NIO, Ideal, and XPeng in terms of brand and product strength. Therefore, Xpeng’s revenue scale in the short term is also difficult to be comparable to these three companies. The upper limit of revenue is around 50 billion yuan, still less than one-tenth of Huawei’s revenue.

The second is for Xpeng to explore the market below 200,000 yuan. In this segment of the market, Xpeng has obvious advantages and is expected to achieve rapid growth. However, the corresponding ASP of each unit will also decline, and enterprise revenue will be difficult to increase. We calculate based on an ASP of 150,000 yuan per unit and annual sales of 300,000 units. Xpeng’s annual revenue will not exceed 45 billion yuan, still less than one-tenth of Huawei’s.

Therefore, no matter from which perspective, Xpeng cannot become an important support for Huawei’s revenue in the short term, let alone become Huawei’s the second growth curve. Huawei values the strategic significance of Xpeng, that is, the third possible way of development-Xpeng is a testing ground for Huawei’s intelligent automotive development.# Does Huawei Need to Enter the Automotive Industry?

Huawei doesn’t seek to expand its market share in the auto industry, rather it values the strategic significance of the industry. So what does Huawei mean by “strategic significance”? Mr. Li believes that there are two sets of cards, one is to build a “Tesla-level” Huawei car brand through the industry, the other is to build a “platform-level” automobile ecosystem service provider. Whether either is a success, it will be a historic moment for Huawei.

Huawei has to get involved in the intelligent automotive industry, whether they want to or not. No one has a choice on this track because all of Huawei’s competitors have entered it. Following Baidu’s announcement to make cars, Apple and Xiaomi have also successively formed teams to enter the intelligent automotive industry. In the future, large ICT companies are likely to enter the intelligent automotive industry as well.

Huawei has gone through many major changes. In Huawei’s development history, there are two directions that are beyond dispute in Ren Zhengfei’s decision-making:

The first is to find the right opportunities. That is, Huawei found the wind of the intelligent smartphone industry. After deciding to enter the smartphone business, Huawei has experienced the explosive periods of 2G, 3G, and 4G, and gradually took the lead in the smartphone market through reshuffling, as is the case with today’s intelligent automotive industry.

The second is transitioning businesses. Huawei has been switching between G-end, B-end, and C-end businesses, breaking through one by one. Before entering the smartphone business, Huawei mainly focused on the B-end market. With the smartphone business, Huawei smoothly transitioned to the C-end market, which is the basis for companies to grow and become stronger. The point here is that the automobile industry is not just the C-end business but also the B-end and G-end businesses.

Therefore, from the perspective of historical strategic decision-making, Huawei attaches great importance to the significance of the auto industry. That’s why Mr. Li and we will discuss Huawei’s two major strategic directions:

The first is to build a “Tesla-level” Huawei car brand. People have been focusing on whether Huawei is going to make cars, but Mr. Li thinks that it’s not important. What is important is what identity Huawei is going to take when making cars. Starting as an ICT provider and then a three-way joint venture with Avita, and now strategic cooperation with Xiaokang Stock, Huawei has become more and more involved in the car-making industry.

Huawei has the ability to build a “Tesla-level” car brand, and Huawei’s plan to build cars will be the focus of the entire terminal business turnaround, as well as one of the key projects for the turnaround of the entire Huawei Group. Looking back at the birth of Wanjie, Mr. Li affirms this. It’s not just the influence of Yu Chengdong, but also the influence of Huawei.

When the M5 was first launched, it almost had no industry or market attention, and there weren’t even any media willing to make review videos. In such an environment, Wanjie M5 took one step at a time and gained everyone’s recognition.When Huawei released the Wanjie M7 in July, there was tremendous attention from the industry, capital, and users. Many friends say that Wei Xiaoli’s popularity was also high at the time. However, Mr. Li would like to say that Huawei has unlimited funding to support the development of Wanjie, and even if it is not a explosive product, it has the ability to create one.

The second strategic significance is the development strategy of “Platform + Ecology” proposed by Huawei, focusing on ICT technology, and building an ecology around the three major platforms of iDVP, MDC, and HarmonyOS smart cockpit. Together with partners, they help automakers make good cars.

This strategy is a perennial topic in the automobile ecology issue, and most familiar corporate ecosystems are mesh structures without a central point. However, Huawei’s ecology revolves around a central point and multiple ecological lines, and Huawei is the connecting point of different ecological lines and the decisive link. The faster this ecology advances, the more important Huawei’s role will be.

Regardless of which strategy is deployed, Huawei will ultimately be the winner.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.