Author: Zhu Yulong

In the new strategy outlined in the Mercedes-Benz half-year report, there are many topics worth discussing: in the face of competition from new-generation automakers such as Tesla, NIO, and Li Auto, Mercedes-Benz is beginning to contract its strategy and refocus on the higher-end market.

Current combination strategies include:

-

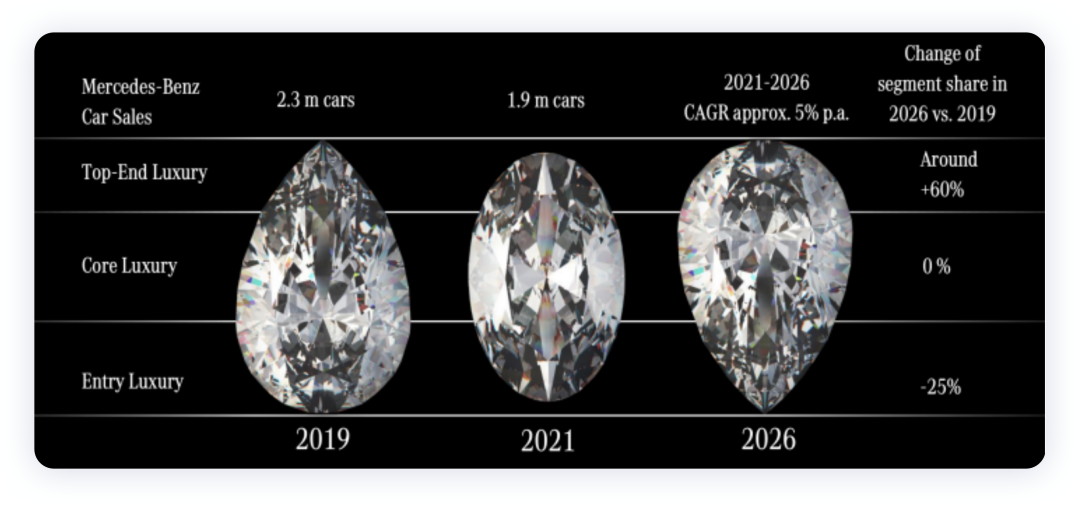

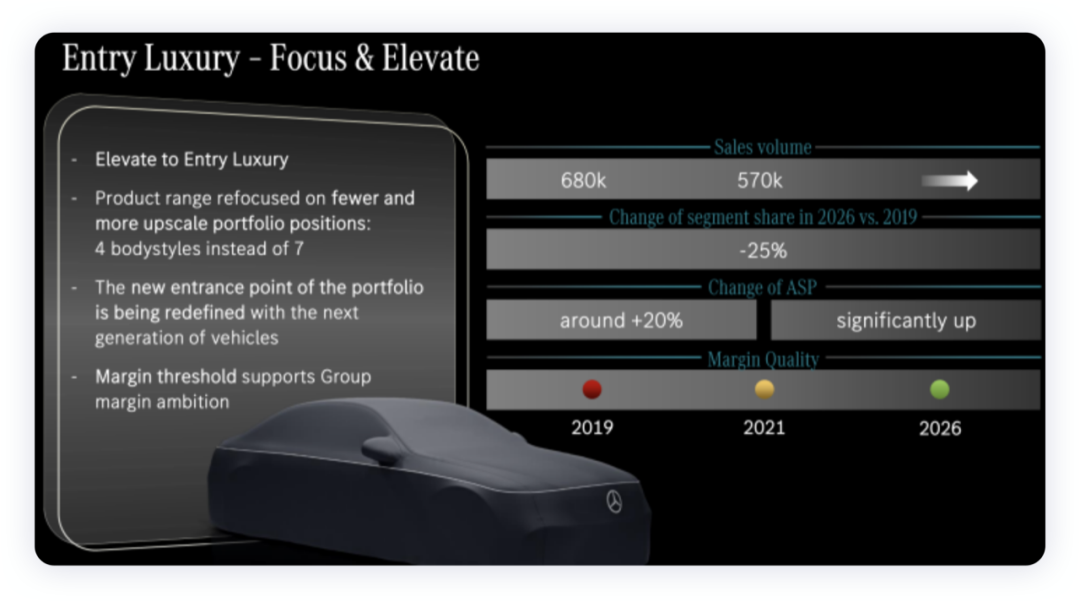

Reshaping the brand’s product matrix, with over 75% of investments focused on developing the most profitable (high-end) subsegments. By 2026, sales of high-end models are projected to increase by approximately 60% from 2019 levels, while the value of entry-level models will decrease by 25%.

-

Achieving full electrification by 2030 where market conditions permit, with carbon neutrality for new vehicle product lineups to be achieved by 2039. Battery-related investment will be limited to ACC and next-generation batteries, with overall batteries still relying on procurement.

-

Development of electric vehicles will center around the EVA2 platform for medium-to-large pure electric vehicle architectures (including the all-new EQE and EQE pure electric SUV) and the subsequent MB.EA vehicle architecture platform.

In the face of constant pressure from Tesla, particularly if Tesla continues to strive towards 1.5 million units this year, the three major German luxury brands will be the most affected. Therefore, the overall strategy is moving towards a model of shrinking production to preserve profits, which is both unexpected and logical.

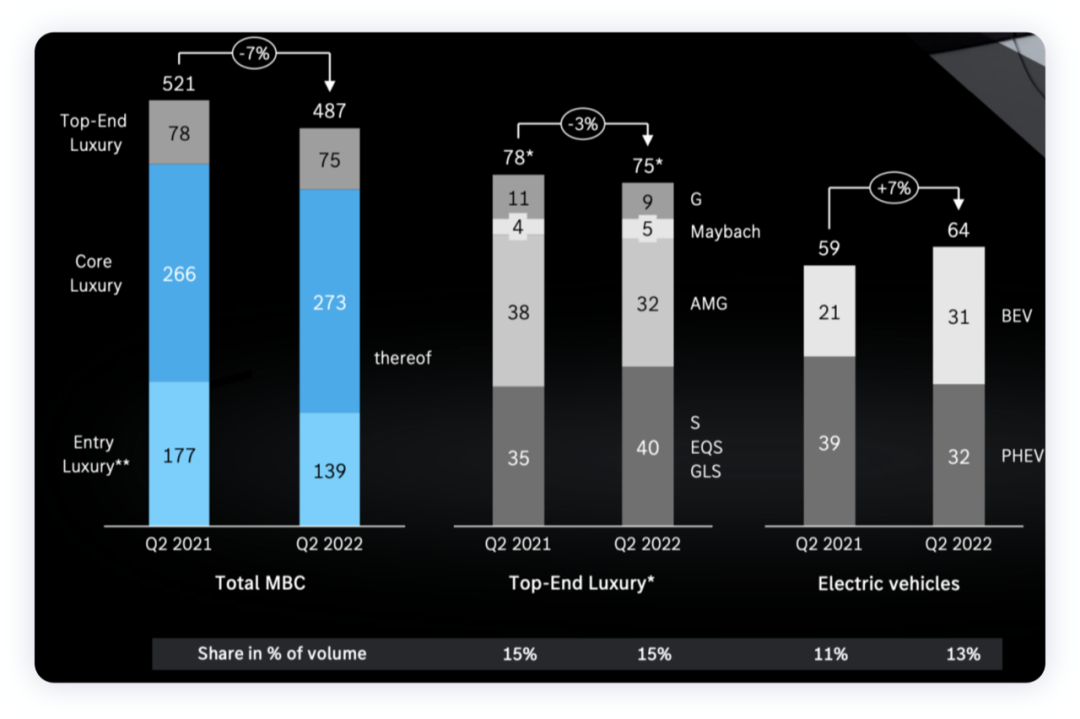

In Q2 2022, with supply chains still constrained, Mercedes-Benz’s entry-level models dropped from RMB 177,000 to RMB 139,000, while its core models rose from RMB 266,000 to RMB 273,000. Profitable models decreased from RMB 78,000 to RMB 75,000 (the S series was RMB 40,000, AMG was RMB 32,000, and 5,000 Maybach and 9,000 big G were sold). Total sales for the quarter dropped from 521,000 to 487,000 units. New energy vehicles increased from RMB 59,000 to RMB 64,000, with pure electric vehicles rising from 21,000 to 31,000 units and plug-in hybrids decreasing from 39,000 to 32,000 units.

Advancing the Product Matrix# Mercedes-Benz’s Latest Strategy Plan

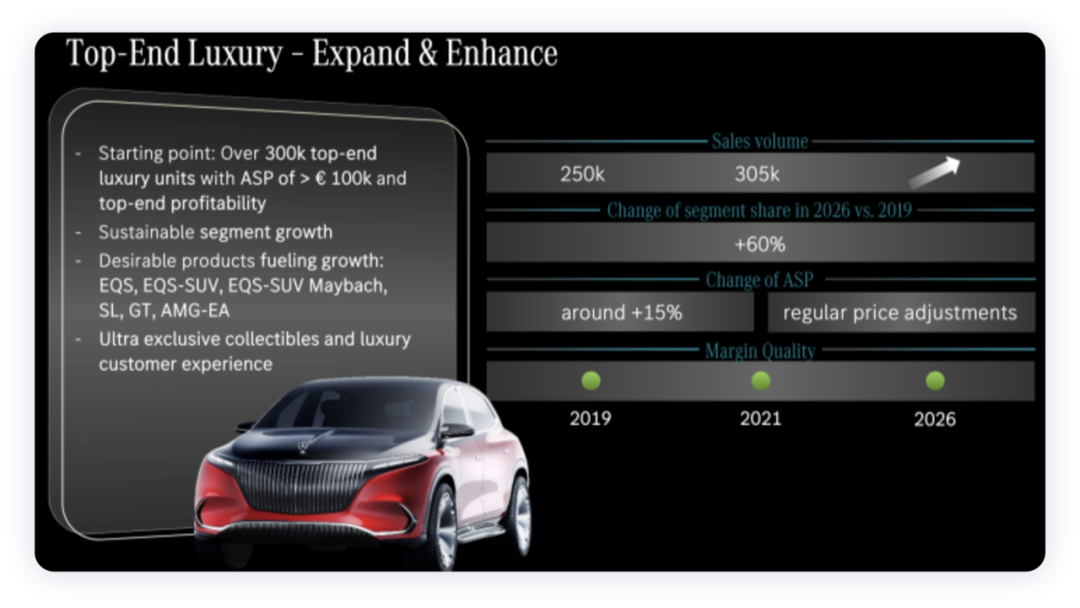

Mercedes-Benz’s latest strategy plan will further focus on luxury, upgrade its product line, accelerate its journey toward “comprehensive electrification,” and commit to structurally enhancing its profitability. Its high-end luxury product lineup includes all models of the Mercedes-AMG and Mercedes-Maybach brands, high-end models of the Mercedes-EQ brand, the Mercedes-Benz S-Class sedan, G-Class vehicles, full-size luxury GLS SUVs, and other limited-edition and selected crossover models. The number of high-end cars priced above 100,000 euros has increased from 250,000 in 2019 to 305,000 in 2021. Mercedes-Benz aims to increase this number to 400,000.

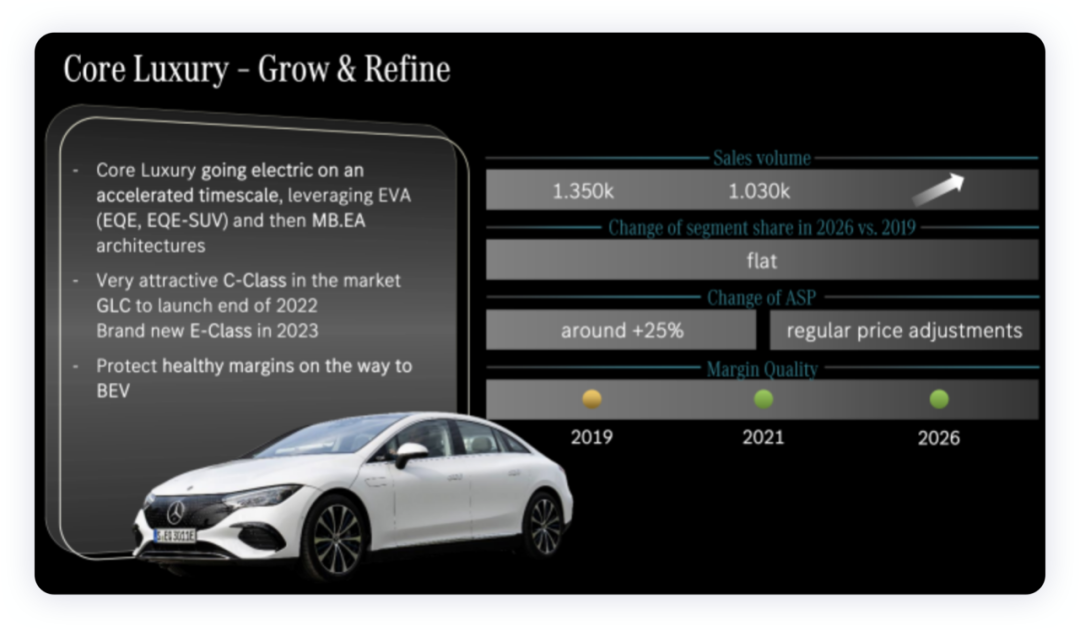

“Core luxury” is the backbone of Mercedes-Benz’s product lineup and the market it most wants to stabilize amid competition from Tesla and new forces in China. This includes the Mercedes-Benz C-Class and E-Class families and their derivative models, which make up the majority of Mercedes-Benz’s sales. In 2019, 1.35 million of these cars were sold, but in 2021 this number declined to 1.03 million. Mercedes-Benz hopes to maintain its sales at 1.35 million and accelerate its electrification process to counter Tesla’s impact. This requires the introduction of a new model designed specifically for the Chinese market, based on the EVA2 platform for medium and large pure electric vehicles.

Mercedes-Benz’s entry-level luxury cars (light luxury approach) cannot attract young people and the new generation’s attention. To address this, Mercedes-Benz will streamline its 7 models down to 4, with a focus on developing products based on the modular architecture (MMA) platform for the next generation of cars. However, this market segment will be limited to around 500,000 cars, shrinking to one-fourth of its previous size. In this segment, the Model 3 and Model Y have significant impact.

Overall, Mercedes-Benz’s sales will be redistributed, with an overall market size of 2.25 million:

-

400,000 high-end luxury cars

-

1.35 million core luxury cars

-

500,000 entry-level luxury cars

Battery SupplyIn light of this, Mercedes-Benz estimates that it will need 200 GWh of electricity for electrification by 2030, which is equivalent to 100 kWh per 2 million vehicles. However, this estimate may include commercial vehicles and it seems that not as many batteries will be needed. In terms of battery allocation, CATL has become the main supplier of the next generation batteries for Mercedes-Benz, followed by ACC. Farasis supplies some batteries in China, while AESC supplies some batteries in the United States. Mercedes-Benz has announced an expanded partnership with lithium-ion battery manufacturer CATL to supply batteries, becoming the first partnership to receive batteries from its Hungarian factory with the largest initial order. In early August 2020, CATL announced that it had become the leading supplier of batteries for Mercedes-Benz passenger car products, providing cells and modules for its light commercial vehicle products.

It is precisely because of its focus on high-performance cars that Mercedes-Benz’s current partnership with ACC is for its high-performance batteries, while 1.85 million mid-to-low-end vehicles are still in production. From a chemical perspective, Mercedes-Benz’s strategy is modular and compatible, from LFP to high-nickel batteries.

The next generation of batteries is focused on high-silicon fast-charging batteries, solid-state batteries, and more, with Mercedes-Benz tracking these developments through small-scale strategic investments. Following its cooperation with NVIDIA, Mercedes-Benz is now a leader in this field.Summary: On the whole, the strategy of Mercedes-Benz, which focuses on selling high-end products, means that it is returning to the road before expansion, and the market is indeed impacted. They want to achieve good financial performance through transformation. However, whether this strategy can work in the current market, especially for expensive pure electric vehicles, is difficult to be accepted in the current Chinese market at least.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.