Article by: Leng Zelin

Edited by: Wang Pan

In 2015, Geely proposed the “Blue Geely Plan”, aiming to achieve a 90% share of new energy vehicles by 2020. The ambition was so big that the gap between expectations and reality was huge when the time came.

In 2020, Geely sold a total of 1.32 million vehicles, with new energy vehicles accounting for only about 5% of the total.

However, people only saw Li Shufu’s failure in new energy vehicles, but did not see Geely’s success in overall sales. In fact, since 2017, with the launch of fuel-powered models such as Borui, Boyue, and Binrui, Geely has been the top-selling Chinese domestic brand for five years. In 2018, it sold a staggering 1.5 million vehicles to reach its peak.

After the peak, Geely’s total sales in 2019 and 2020 experienced two consecutive declines along with fluctuations in the domestic automotive market. In 2021, with the explosive growth of new energy vehicle sales, Geely stabilized its position in the domestic automotive market with a score of 1.328 million vehicles.

Although Geely’s new energy and electrification sales exceeded 100,000 units in 2021 (note: Geely’s “new energy and electrification” includes BEV, PHEV, HEV, and MHEV. This statistical caliber did not start to change until 2022), its true flagship products, JiKe and LeiShen Hybrid, only had mass-produced models officially launched in the fourth quarter of last year and the first quarter of this year, respectively.

Therefore, no matter how Geely promoted its commitment to new energy vehicles before, perhaps this year is the year it truly exerts its strength in the new energy field.

The BYD DM-i model was gradually launched in 2021, driving BYD’s new energy vehicle sales from 160,000 in the previous year to about 600,000. Now Geely has come to this crossroad, whether to turn around or continue to be criticized, the test is not only on technology and products, but also on the company’s determination and perseverance.

Transformation is Internal, Not External

In terms of sales, Geely sold a total of 613,845 vehicles in the first half of this year, a year-on-year decline of 3%, with the biggest drop of about -28% in April. Considering the influence of local epidemics in some cities in the first half of the year, the sales are still quite stable.

However, analyzing the composition of sales in detail, the difference from last year is huge.

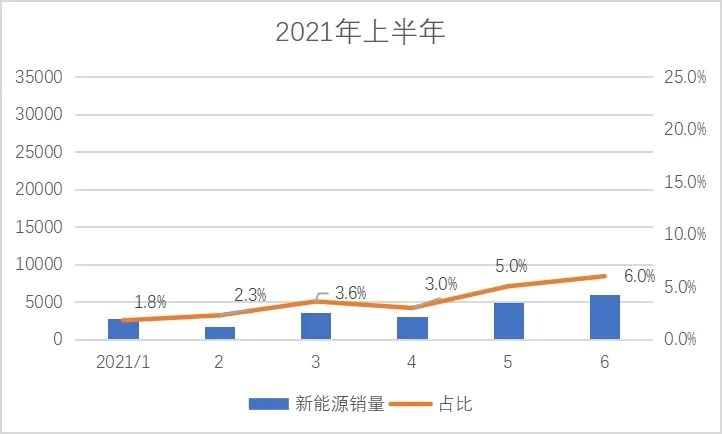

In the first half of this year, the sales proportion of Geely’s new energy sector (BEV+PHEV) increased by 14.4 percentage points to 17.9%, and the monthly proportion in July has reached 26.1%, while the highest proportion in the first half of last year was only 6%.

The rapid growth of BEV has contributed the most to the increase of Geely’s proportion of new energy, with BEV sales in the first half of this year of about 86,000 vehicles, a year-on-year increase of 519.7%; and PHEV sales of about 24,000 vehicles, a year-on-year increase of 191.9%.

The rapid growth of BEV is mainly due to several factors. One is that several modified/new models of Geometry have been launched from last year to this year. At present, there are already four products on sale: Geometry A Pro, Geometry C, Geometry E, and EX3 Kung Fu, although they have a close relationship with their sibling products Dorsett and Yujing, the brand’s overall selling price is lower, and it has achieved sales over 10,000 units for three months from January to July.

Secondly, Geely’s mid-to-high-end pure electric vehicle brand, Zeeker, launched its first model for delivery last October. At the beginning of this year, Geely formed a joint venture with Lifan Technology to establish Rui Lan Automobile, which mainly focuses on battery-swapping mode. Currently, the brand has three models for sale: X3 PRO, Maple Leaf 80V, and Maple Leaf 60S.

In the latest sales data of July, both new brands have also surpassed the threshold of 5,000 units sold per month.

This year, Zeeker also planned an MPV that will continue to boost the brand’s overall sales. At the same time, a few months ago, the behavior of “spending a lot of money” on upgrading 8155 has also recovered one percent of Zeeker’s brand image; on the other hand, Geometry will also release two new models, G6 and M6, in the second half of the year, which will be equipped with Huawei’s Harmony OS, and Rui Lan brand also has new vehicle plans.

In the short term, the combination of brand image, number of models, and Huawei’s heat will further increase Geely’s pure electric vehicle sales in the second half of the year. However, from a long-term perspective, the problem still lies with Zeeker in terms of the “oil-to-electricity” issue and Rui Lan’s reliance on the B-side attributes, which may not be able to sustain Geely’s vehicle sales in the long-term fierce competition in the market.

The rapid growth of the new energy sector will naturally be reflected in financial data as well.

In the first half of 2022, although Geely’s sales had fallen, the total revenue still achieved a year-on-year growth of 29%, reaching RMB 58.2 billion (excluding joint ventures, LYNK& CO and Rui Lan).

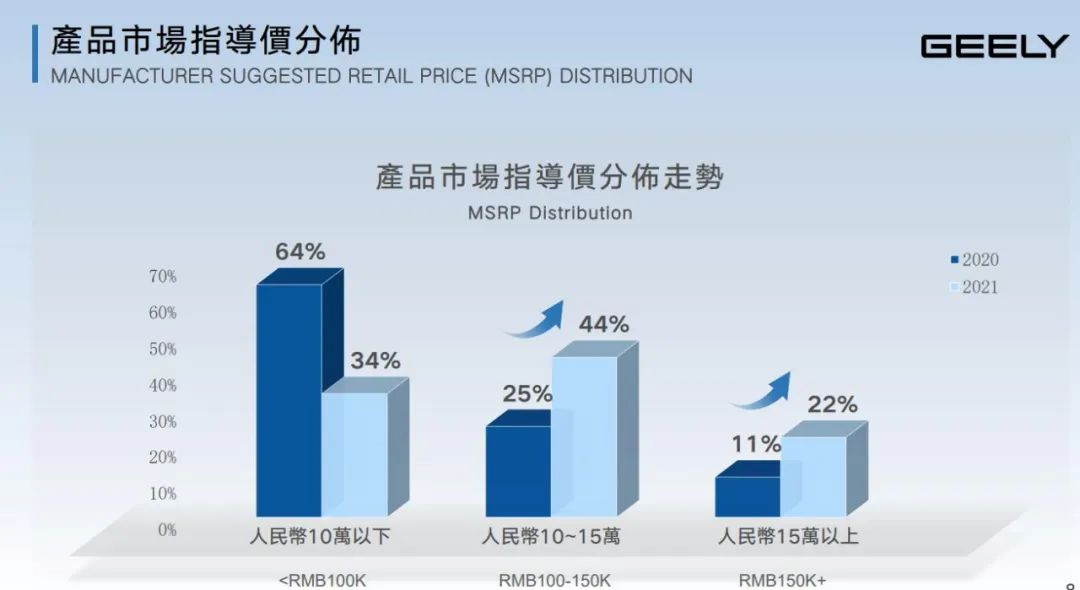

Similar to most traditional automakers, Geely is also raising overall prices through different product combinations. According to the 2021 annual report data, its product market guidance price range has shifted from below 100,000 yuan in 2020 to 100,000 to 150,000 yuan.

In the first half of 2021, Geely Automobile’s average gross profit per vehicle reached 16,000 yuan, a year-on-year increase of 9.9%; the total average single-vehicle sales income increased by 21.1% year-on-year, reaching 102,000 yuan.

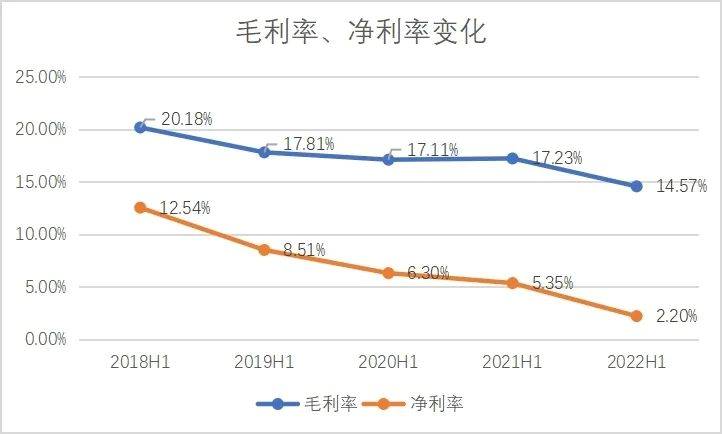

However, during the reporting period, the net profit attributable to equity holders of Geely Automobile decreased by 35% year-on-year, reaching only 1.55 billion yuan, with gross profit margin and net profit margin reaching the lowest levels in the past five years.

The main reason for this is the rise in sales costs, distribution and sales expenses.

Due to the large increase in battery raw material prices in the first half of the year, and the rapid increase in Geely’s new energy vehicle sales, sales costs increased by 33.4% year-on-year to 49.71 billion yuan; at the same time, Geely’s investment in 66 extremely cool brand direct sales stores resulted in a 29% year-on-year increase in distribution and sales expenses; in addition, the development of multiple car models also led to an increase in administrative costs.

In short, the profitability of Geely’s single vehicles is gradually improving, but due to the slow start of the new energy strategy, the demand for group profits in the short term must give way to the demand for transformation.

Transformation “Deep Water Area”

During the transformation period, in addition to the forced slowdown of short-term profits, for traditional automakers with rich product types and number of brands like Geely, the simultaneous adoption of multiple technological routes and the overlap of old and new product cycles have led to a relatively chaotic product line, which is also one of the problems of the “awkward period”.

Geely Automobile Group’s sales statistics include Geely (including Geometry), Lynk & Co, Zeekr, and Lynk & Co Blue, with most of the sales still contributed by the Geely brand. Geely brand sales from January to July this year were 597,468 units, accounting for approximately 81.1% of Geely Automobile’s total sales, and this is also closely related to its huge product matrix.

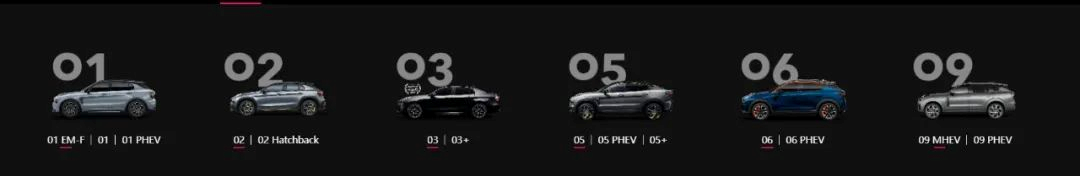

Photon Mobility has sorted out the currently available Geely brand models, totaling 30 models and 9 series, with starting prices ranging from 50,000 to 170,000 yuan.

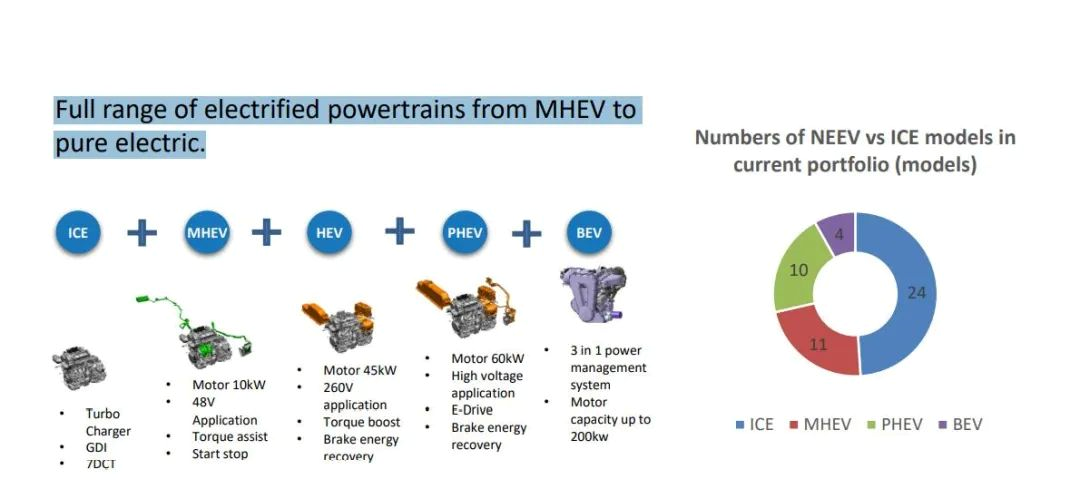

Unlike Great Wall Motor’s focus on SUVs and pickups or BYD’s tight grasp of hybrids and pure electric vehicles, Geely’s vehicle models and power types are much more complex.Apart from various sizes of saloons, SUVs, and MPVs, the power mode is also divided into fuel, HEV, PHEV, BEV, methanol-electric hybrid, and methanol cars, among which hybrids include two generations of systems with different ideas: ePro (P2.5 single motor + 7DCTH) and Thunder Intelligent Power Hi・X (dual motor + planetary gear set), the former is a fixed-axis mechatronic coupling system, and the latter is a planetary gear mechatronic coupling system.

If further split, Thunder Intelligent Power can also be divided into Hi・F hybrid (HEV) and Hi・P plug-in hybrid (PHEV). This leads to the result that the suffix of various Geely models is very complicated.

In addition to the car model suffix, the Chinese characters still have a lot of “learning”.

Among them, “Rui” represents saloon cars, “Yue” represents SUVs, “Bo” emphasizes leadership and mainstream, “Xing” is geared towards high-end, “Bin” is aimed at the young market, and “Emgrand” is aimed at the medium and low-end markets. After combining them in pairs with suffixes, different names are formed, as we see today.

For example, “Xingrui” can be translated as “high-end saloon car,” while “Xingyue L Thunder Hi・F” should be translated as “high-end hybrid SUV.”

Of course, just like language learning in general, rules are only a reference, and there are still many irregular grammar conventions that have been formed in historical evolution. For example, words like S, L, Pro, PRO, COOL, new, brand new, Xth generation, etc.

The advantage of having many cars is that smaller price ranges can introduce more models that can cover more specific markets, and the overall sales are naturally good. But the disadvantage is also very obvious, it makes it difficult for consumers to grasp the key points for a moment, and it raises the threshold for consumers to choose, making it more difficult to match the appropriate models at the first time.

Similarly, this situation also appears on Lynk & Co.

As a mid-to-high-end brand under Geely, Lynk & Co is a major player in the group’s overall average selling price growth. But the sales volume of its plug-in hybrid models using the GHS1.0 (P2.5 structure) system has been lukewarm. Therefore, in June of this year, Lynk & Co developed the Lynk E-Motive hybrid system based on the Thunder hybrid platform, and expects to achieve full electrification of all models by 2025.

To distinguish from the previous PHEV, Lynk & Co also used another set of naming rules, where EM-F represents HEV, and EM-P represents PHEV.Currently, based on the Thunder Hybrid System, Geely and Lynk & Co have launched the following models: the Star Bow L Thunder Hi・F, the Emgrand L Thunder Hi・X, the Lynk & Co 01 EM-F, and the recently released Borui GE L (Thunder Hi・F version). In 2022, Geely will launch a total of 8 thunder hybrid models.

As mentioned earlier, in addition to the existence of two different structured hybrid systems, one can also see Geely’s layout in multiple fields such as methanol, alcohol-electric hybrid, and pure electric vehicles. Among them, the other main player, the pure electric vehicle, can also be divided into three directions: Oil-to-Electric, Battery Exchange, and High-Voltage Fast Charging.

This diversified approach and multi-market layout also expose Geely’s ambition, which is not only aimed at a certain market, but rather a net that is cast wide.

It is worth noting that the Borui GE L mentioned above will be built on the CMA architecture. The CMA architecture was first used in the Lynk & Co brand, then downgraded to Geely’s “China Star” series, and now it has been used on the Borui series models.

In fact, this is another mainline for Geely this year: modular car manufacturing.

In 2022, Geely claims to fully enter the 4.0 era, which is the era of architecture-based car manufacturing. The proportion of modular architecture models will increase to 70%, and the sales of the “China Star” series, which mainly focuses on the mid-to-high-end market, will also increase to 30%.

Thus, we can also summarize the two main lines of Geely’s huge layout. One is the CMA architecture + Thunder Hybrid + popular models, and the other is the Ji Ke based on the SEA vast architecture. The rest of the routes are more like “investment” behavior.

In fact, if we look at the entire Geely Holding Group, it is a similar path.

In addition to the brands mentioned earlier in the passenger car field, Geely Holding also has Bao Teng and Polestar focusing on overseas markets, Lotus and Volvo in the high-end market, and off-road new energy brand LYNK & CO; in the commercial vehicle field, there are long-distance commercial vehicles, London electric vehicles, and Cao Cao travel.

Furthermore, Geely Holding has also laid out in the fields of flying cars, satellites, automotive chips, and intelligent cabins.

It is not difficult to see that some of the internal technology exchanges within Geely are accelerating. For example, this year, Geely and Volvo have merged and cooperated in some businesses, sharing/co-developing powertrains, electric vehicle modular structures, intelligent technologies, and even sales channels, in order to reduce costs and improve efficiency.

This is also likely to be the ultimate goal of Geely’s wide net.

However, it should also be noted whether there will be infighting before forming a joint force in each module business, and whether it can operate independently without dragging the group. Therefore, when observing Geely Automobile, it is necessary to look beyond the clouds and focus on the main lines.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.