Author: Zhu Yulong

Nowadays, every battery company has to have its own Battery Day.

Currently, Jeve Power is mainly managed by the major shareholder. Let’s take a look at the overall situation of the company:

-

Customer Representatives: Chery, Daimler, SAIC, Dongfeng, Great Wall, Hezhong, Dayun, Youpao, JAC.

-

Supply Chain Circle: Many suppliers have signed strategic cooperation agreements, including Nantong Ruixiang, Guangdong Kaijin, Dangsheng Technology, Saiwei Electronics, Hubei Wanrun, Baijiada, Xingyuan Materials, Tiannai Technology, Xinlun New Energy, Xingheng New Materials.

-

Aim to achieve a production capacity of 100 GWh of power batteries by 2025.

-

Battery cell products: LFP battery with energy density of 220Wh/kg, the LMFP battery, which is under validation and has completed basic development verification, and the next generation of 360Wh/kg semi-solid state batteries.

-

Soft pack products have two series corresponding with standard modules and customized modules. The standard module includes VDA355/390, MEB590; custom module series includes building block batteries, HEV modules and 48V module series. Hard-shell products include pole-out series and pole-side-out series.

Battery Cell Product Status

Jeve’s current products mainly include soft pack series, with a production volume of 1.07GWh in 2022, ranked 12th in China.

Jeve’s production bases mainly include Tianjin, Yancheng, Jiaxing, Changxing, Chuzhou, Wuhan, etc. By 2025, Jeve Power will have 100GWh production capacity.

-

Tianjin Base: 1GWh. This factory mainly produces old standard soft-package products, with relatively low cost performance due to equipment issues.

-

Yancheng Base: Phase I with a capacity of 2.5GWh was put into operation in mid-2019, and Phase II with a capacity of 3GWh should gradually land. The production line was initially planned for standard soft-pack battery cells.

-

Jiaxing Base: Engineering experiment line has been put into production, with Phase I of 8GWh and Phase II of 20GWh.

The original cell products were mainly soft packs, with 65Ah, 70Ah, and 78Ah in the BEV product line, and 28Ah in the PHEV battery.

Soft pack battery products include two series: standard modules (VDA355/390, MEB590) and customized modules, such as building block batteries, HEV modules, and 48V modules. The size restrictions are clear: length ranges from 300mm to 750mm, thickness from 7mm to 18mm, and height is limited to 100mm due to the pack height.

Currently, there is no good solution for soft pack batteries. To maintain the original battery structure, the highly coiled design requires the batteries to be assembled together, as shown in the figure below, with the soft pack wires designed as a long module to achieve a 1.8-meter structure. Alternatively, the batteries can be arranged similarly to blade batteries in width.

Square-shaped batteries include pole-top and pole-side series, and the design of long and short blades is also interesting. The 200Ah product shown below is an LFP product with a hard shell based on the original soft pack, and the same logic applies to the 100Ah product. Given that CTP design is now available, the disadvantages of soft pack batteries have been fully reflected, so switching to hard shell batteries sooner is preferable.

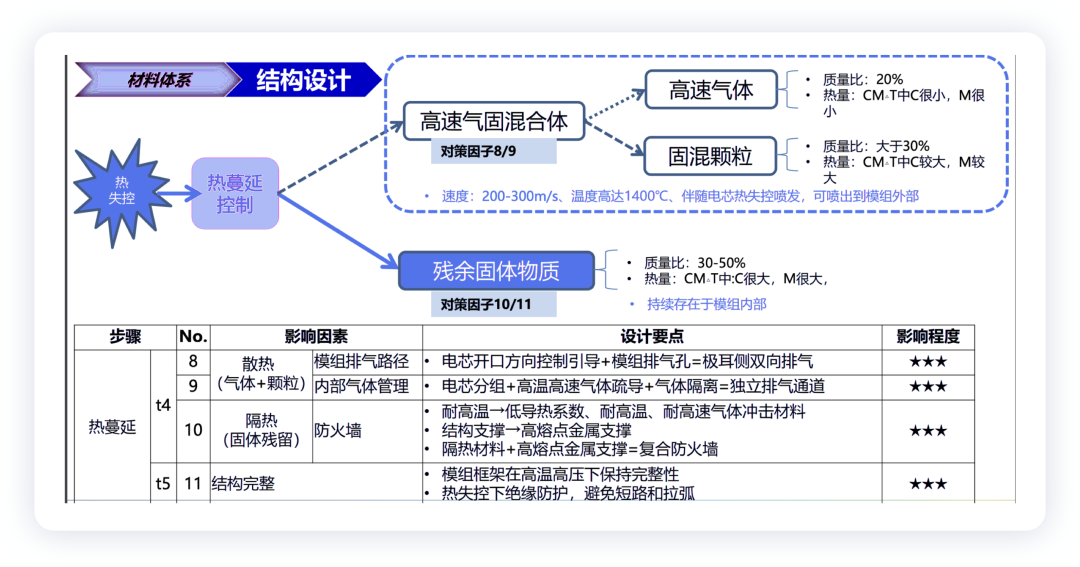

Thermal Runaway Protection for Soft Pack Design

In this area, JEVE has some experience because it has taken the route of ternary soft packs, but the large size of soft pack batteries makes it difficult to design thermal insulation. In particular, Mercedes-Benz’s requirements include meeting energy and weight limitations, fast charging, and thermal runaway prevention within the given dimensions, which is a challenging design task.

Conclusion: I am eager to see the development path of JEVE under capital control. This strategy is risky since the competition in the power battery industry is so fierce. Moreover, it involves the transition from soft pack to shell stack (blade) structure and the management of customers and supply chain.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.