The Situation of China’s Charging Infrastructure

Author: Zhu Yulong

At the end of June 2022, the total number of motor vehicles in China reached 406 million, including 310 million cars and 10.01 million new energy vehicles. With the increasing number of new energy vehicles, the bottleneck that limits the development of China’s new energy vehicles is still infrastructure. Therefore, I plan to conduct a data review of the infrastructure on a regular basis (bi-monthly) in the future.

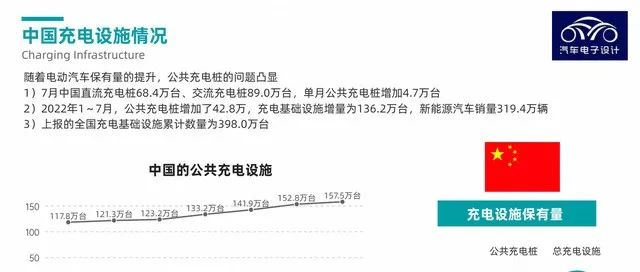

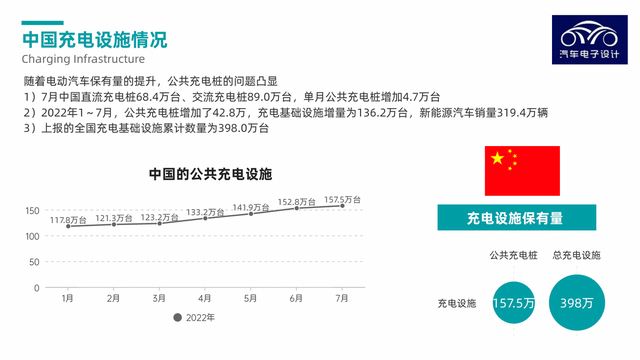

- Number of Charging Piles

In July, there were 684,000 DC charging piles and 890,000 AC charging piles in China. The monthly increase in public charging piles was 47,000, and the reported national cumulative number of charging infrastructure was 3.98 million.

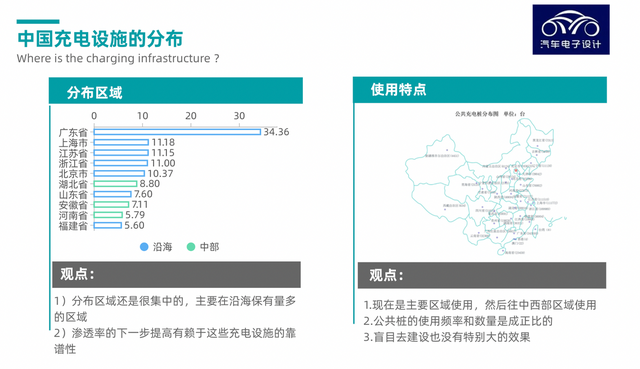

- Distribution of Charging Piles

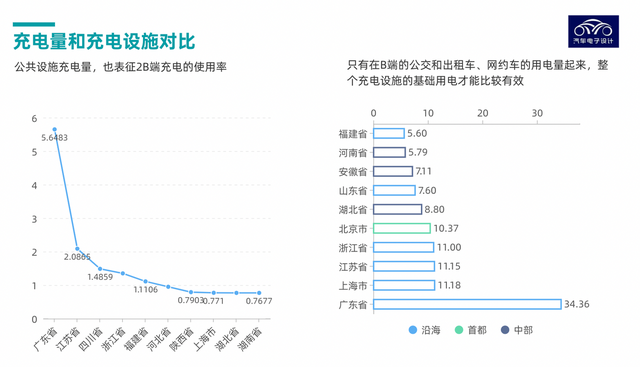

71.7% of the charging piles in China are distributed in ten regions: Guangdong, Shanghai, Jiangsu, Zhejiang, Beijing, Hubei, Shandong, Anhui, Henan, and Fujian. The charging quantity is also concentrated in these regions. Currently, the use of public charging mainly revolves around buses and passenger cars. In July, the total charging power in China was about 2.19 billion kWh, which equals to 219 kWh per vehicle per month, or about 7 kWh per day.

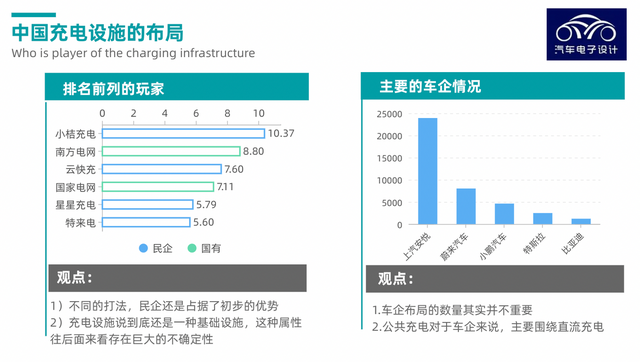

- Charging Operators

In July, among the charging pile operators, TELD operated 295,000 piles, Star Charge operated 293,000 piles, and State Grid operated 196,000 piles, mainly these three companies. Among them, Star Charge also operated about 72,200 private charging piles, but the most important thing is the DC charging piles.

Deployment of DC Charging Piles and Battery Swap Infrastructure

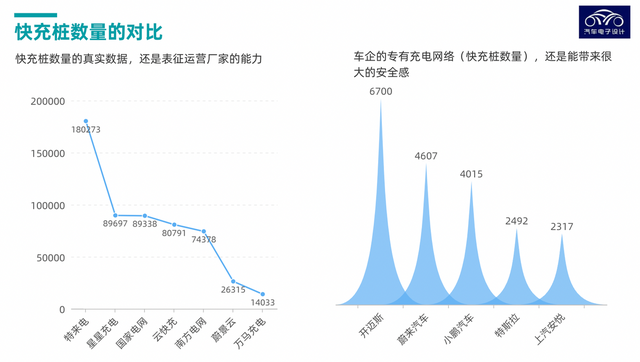

Compared with June, the number of public charging piles increased by 47,000 in July, an increase of 65.7% compared to the same period last year. As of the end of July 2022, there were 1.575 million public charging piles, including 684,000 DC charging piles and 890,000 AC charging piles. In the layout of charging piles, the importance of DC piles is the highest. At the same time, with the power of DC piles increasing, a new wave of investment efficiency will replace 60-100kW. Also, it is necessary to consider the relationship between charging power and electrical load, which may involve a new wave of energy storage investment.In DC charging stations, the effect of the 180,000 whole units brought by TELD is still very good, followed by Xingxing charging’s 89,700 units and State Grid’s 89,300 units. In the automotive industry, the network of 6,700 fast charging stations invested by Volkswagen-backed CAMS ranks first, followed by NIO’s 4,607, XPeng’s 4,015, and Tesla, which started well but now has been fully surpassed, with only 2,492 units currently.

In fact, the charging of electric vehicles is also achieved through DC fast charging stations. The national charging power is mainly concentrated in provinces such as Guangdong, Jiangsu, Sichuan, Zhejiang, Fujian, Hebei, Shaanxi, Shanghai, Hubei, and Hunan. The flow of electricity is mainly for buses and passenger cars, while the proportion of environmental sanitation logistics vehicles, taxis, and other types of vehicles is relatively small. In July 2022, the total national charging power was about 2.19 billion kWh, an increase of 125.2% year-on-year and an increase of 13.7% month-on-month.

- Operational efficiency of charging operators

To assess operational efficiency, a comparison can be made between charging volume and the number of charging stations.

As of July 2022, the top 15 charging operators in China accounted for 92.5% of the total number of charging stations: TELD operated 295,000 stations, Xingxing Charging operated 293,000 stations, State Grid operated 196,000 stations, Yun Fast Charging operated 196,000 stations, Southern Power Grid operated 95,000 stations, and Xiaojuchongdian operated 80,000 stations.

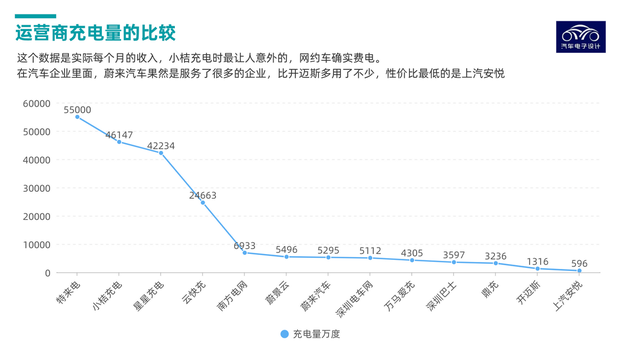

Each charging operator’s charging volume data represents their actual monthly revenue (Figure 6). Xiaojuchongdian is the most surprising, as ride-hailing services indeed consume a lot of electricity. In the automotive industry, NIO has indeed served many companies, and has used more charging stations than CAMS. SAIC Anyue is the one with the lowest cost performance.

Currently, from January to July 2022, the increment of charging infrastructure was 1.362 million units, and the increment of public charging piles increased by 199.2% year-on-year, while the increment of privately-built charging piles continued to rise, up 390.1% year-on-year. The growth of private charging piles is still impressive. The increment of charging infrastructure was 1.362 million units, and the sales volume of new energy vehicles was 3.194 million units. So far this year, the ratio of piles to cars has been 1 to 2.3.## Battery Swapping Facilities

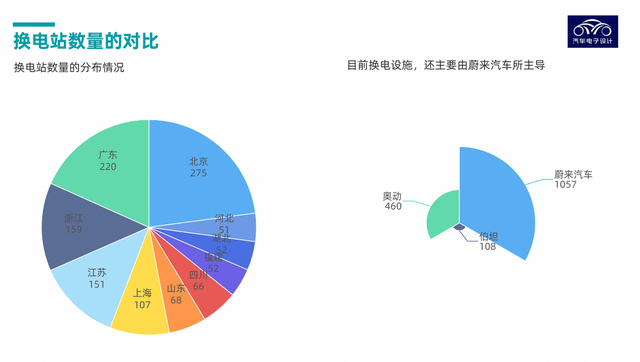

Compared with the overall abundance of charging facilities, there are currently more than 1600 battery swapping stations nationwide, of which NIO accounts for over 1000 and Orsted nearly 500. In terms of regional distribution, they are mainly located in Beijing (275), Guangdong (220), Zhejiang (159), Jiangsu (151), and Shanghai (107).

However, it still needs time to prove that the overall solution is valuable for car companies.

Conclusion: There will be many problems encountered in the future as the number of new energy vehicles increases. On the one hand, we face a new car market of over 20 million and a total ownership of 400 million. Therefore, careful consideration should be given to how to build the overall infrastructure.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.