Once mocked as a “money-losing game”, NIO’s bold investment in battery swapping stations took a turn when the four ministries jointly released the “Notice on Improving the Fiscal Subsidy Policy for the Promotion and Application of New Energy Vehicles”, strengthening subsidies for the construction of battery swapping stations and swapping EV models. With support from the government, the battery swapping industry has undergone tremendous changes. Not only NIO, but also many other companies such as Guangqi Aion, CATL, Tesla, and Volkswagen have invested in the battery swapping industry. As a result, the battery swapping model has triggered rapid discussions in the industry, even causing Electric Drive’s fan community to ask if “battery swapping can really work?”

Unremitting Exploration

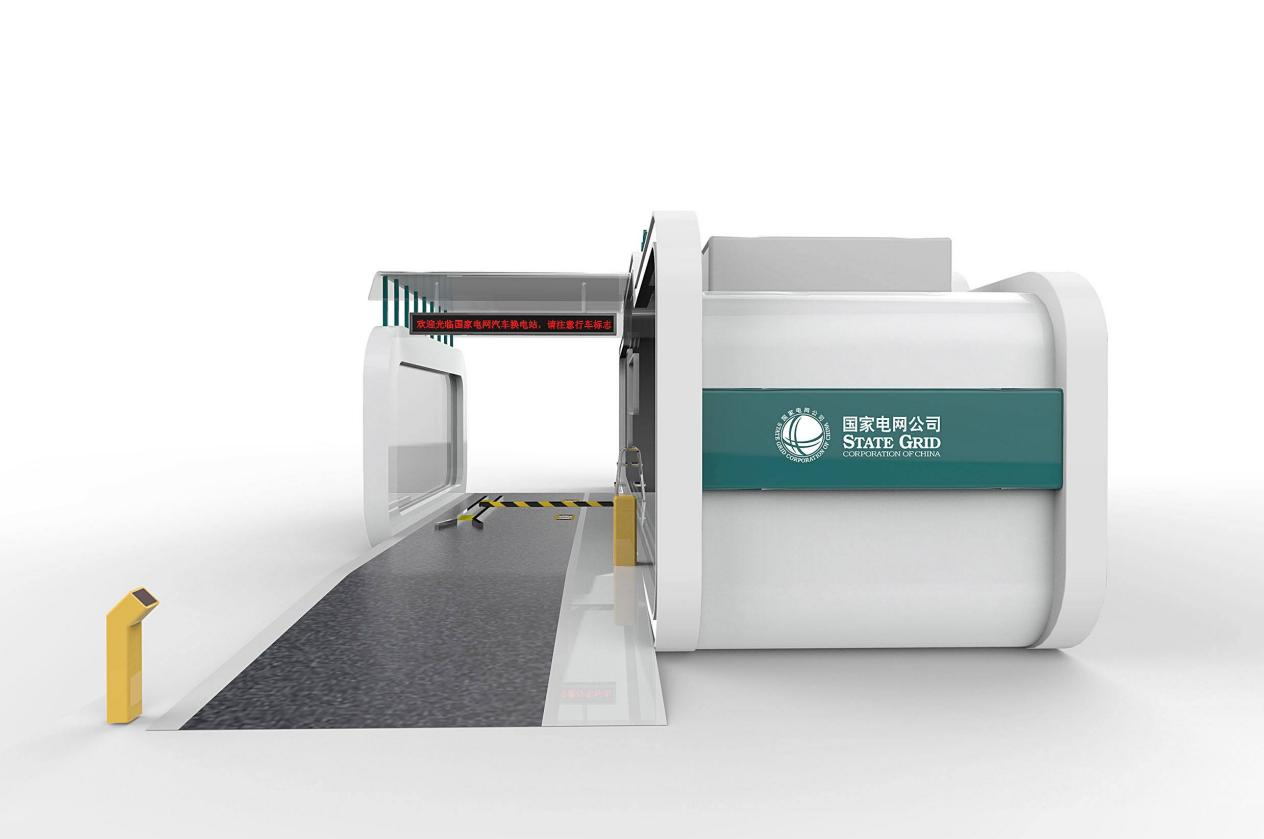

In fact, China began exploring battery swapping more than 20 years ago. In 2000, the electric bus company China Dynamics Energy was founded. In 2005, the world’s first large-scale bus battery swapping station was established in Lanzhou, laying the foundation for Octopus New Energy. From 2010 to 2015, State Grid and XJ Electric entered the battery swapping field, but their investment did not achieve the desired results.

The real turning point for battery swapping came in 2016 with Beijing Auto New Energy and Octopus New Energy’s cooperation, launching the “Ten Cities and Thousand Stations Column Plan” for EVs in the taxi market. Thereafter, mainstream car companies in China, such as NIO, Guangqi Aion, First Auto Works Hongqi, and Geely, joined the “battery swapping technology for electric vehicle chassis” for some models, promoting the development of battery swapping.

This year is especially significant for the battery swapping industry, as many companies showcase their achievements.

On January 18th, battery giant Contemporary Amperex Technology (CATL) launched the swapping service brand EVOGO. On June 18th, CATL launched the EVOGO swapping service in Hefei, Anhui Province.

On January 24th, Lifan Technology and Geely Auto jointly established a joint venture-Ruicheng Auto, entering the new energy vehicle market with “battery swapping travel new forces”, based on the self-developed swapping platform and developing new products (GBRC swapping platform) covering sedans, SUVs, MPVs, and even logistics vehicles, catering to both B-end and C-end swapping needs.

On April 27th, CATL and Aiways signed a framework agreement for the EVOGO swapping project. With Aiways U5 as the carrier, they will jointly develop a combination-swapping version and plan to launch it in the fourth quarter of this year. Aiways owners with the combination-swapping version can enjoy electricity separation, on-demand power delivery, and the EVOGO swapping service.

On May 6th, Changan Shenlan announced the configuration information of its sedan C385, which supports various powers, including the swapping mode. The new car will be launched in August.On June 2nd, the first electric exchange taxi (NIO U Pro) landed in Nanning, Guangxi and officially started operation. Supported by Audong New Energy and 16 main engine factories including FAW, Chang’an, Dongfeng, BAIC, GAC, SAIC, Dongfeng Qichen, Hezhong, and Chery, together they built a shared power exchange service network in Nanning, driven by the power exchange policy. Together with Audong New Energy, Beifang Taxi Company and other companies, Hezhong NIO promotes the application and development of power exchange dynamics in the Nanning market.

On June 13th, MG MULAN officially released its new technical highlights, which support the exchange of SAIC “Cube” batteries for the first time.

On July 6th, NIO announced that the nationwide cumulative construction of power exchange stations has reached 1,011 units, and Rui Blue Automobiles plans to expand to cities nationwide, with Chongqing as the construction camp, planning to build more than 5,000 power exchange stations by 2025, covering more than 100 cities.

The frequent actions in the power exchange market of new energy vehicle brands such as SAIC, Chang’an, and NIO are both driven by user needs and policies.

It is understood that the penetration rate of new energy vehicles is expected to exceed 30% by 2025, greatly increasing the user’s demand for power replenishment. In addition, in 2020, charging facilities were included in the seven major new infrastructure areas; since 2021, related policies have been continuously introduced. The government’s work report specifically proposes to increase the construction of charging piles and power exchange stations.

Advantages and Disadvantages of Power Exchange

At present, electric vehicles rely on two methods to supplement energy: power exchange and charging. However, the question of “Will power exchange replace charging?” and “Which is better, power exchange or charging?” has always been controversial. Some car companies and even industry experts believe that they compete with each other.

Previously, Tong Zongqi, director of the information department of the China Electric Vehicle Charging Infrastructure Promotion Alliance, said, “At present, the power exchange model is mainly concentrated in the operation and heavy truck fields. In the private sector, new energy vehicles are still mainly supplemented by slow charging, and fast charging is supplementary. Power exchange as a way of supplementing energy will not become mainstream.”

Some experts also believe that fast charging has a greater impact on power batteries and the power grid. Especially when a large number of electric vehicles use fast charging at the same time, the pressure on the local power grid is immense, while power exchange has a small impact on batteries and can also use peak-valley electricity to improve energy utilization.

Li Shufu, chairman of Geely Holding Group and a national people’s congress representative, proposed at this year’s Two Sessions to increase the construction of the power exchange system. He believes that the power exchange mode of electric separation has two advantages of efficient power supplement and cost reduction over the charging mode.In terms of energy replenishment efficiency, electric vehicles on the market can replenish the battery from 30% to 80% within about 30 minutes (usually more than 30 minutes) when using fast charging mode, while passenger cars only need about 1-5 minutes to exchange batteries. It is reported that ODA New Energy’s latest fourth-generation battery-swapping station has achieved the whole process in 1 minute and the battery-swapping process only takes 20 seconds, which is comparable to refueling stations, achieving the goal of “just exchange and go”.

In terms of cost, the power battery accounts for about 40% of the entire vehicle, and the “vehicle and power integration” charging mode greatly increases the cost of the entire vehicle. Under the “vehicle and power separation” mode, the purchase price of electric vehicles can be reduced by half at the highest. Therefore, the battery-swapping mode not only shortens the charging time, but also alleviates the pressure on the power grid and reduces prices, which naturally becomes the focus of corporate attention.

Essentially, the battery-swapping mode is very simple. It is the adaptation of the chassis or lateral power battery pack used by new energy vehicles for battery-swapping technology. The battery pack can be disassembled and replaced at the battery-swapping station to achieve the goal of replenishing energy.

Many companies pay attention to the battery-swapping mode because it is suitable for “rechargeable, replaceable, and upgradable” under different scenarios, and has diversified, efficient, convenient, and safe characteristics. In addition to the high-efficiency energy supplement mentioned above, the advantages of battery-swapping mode also include the following four points:

-

Extend battery life. Under the battery-swapping mode, the battery is uniformly and quickly charged in a constant temperature and humidity charging cabin, which protects the SOH (health) and SOC (driving range) of the battery. Even in cold weather, the vehicle can be provided with a fully charged battery quickly, without worrying about being unable to charge the battery.

-

Improve battery safety. When using battery-swapping mode, the background of the swapping station will timely analyze the battery status and eliminate battery faults and other safety management measures, thereby reducing the risk of vehicle combustion and safety losses caused by thermal runaway of the power battery.

-

Reduce the threshold for purchasing cars. Compared with the “vehicle and power integration” charging mode, the “vehicle and power separation” battery-swapping mode is suitable for different travel scenarios and can rent power batteries of different specifications, which not only reduces the user’s purchasing cost, but also can achieve long-endurance driving scenes.

-

Conducive to recycling and utilization. For example, the cascaded utilization of lithium batteries can effectively improve the comprehensive economic benefits of the entire society.

Of course, the battery-swapping mode has advantages and disadvantages. It belongs to a heavy asset industry, and the cost burden on investors is relatively high. The investment payback period is longer, and there is a certain risk in frequently plugging and unplugging the power battery. At the same time, some experts have indicated that the ratio of battery-swapping vehicles to reserve batteries should be 1:1.3 to be reasonable, but the reality is not the case.Using NIO as an example, currently the ratio of car sales to battery swapping services is about 1:1.04. Due to the disproportionate ratio of car sales to battery swapping services, NIO has been making efforts to establish battery swapping stations over the past two years, and the Baas purchase plan launched by NIO has become a promotional sale for new car sales.

On June 28th, NIO announced that it has provided more than 9.7 million battery swapping services at 997 swapping stations worldwide, completed the construction of 4,795 supercharging stations and 4,391 destination charging stations. Nevertheless, the company is still operating at a loss.

The reason why some automakers do not have confidence in the battery swapping model is that it has a single target audience and a lack of standards. The energy density and size of power batteries vary due to differences in design, materials, and technology, making it difficult for swapping stations to service multiple vehicle models, leading to idle resources and low operational efficiency of battery swapping stations, which in turn increase the operating costs as well as the scale of applications.

In fact, the fundamental logic of battery swapping lies in separating the vehicle and the battery, standardizing batteries, and realizing energy independence. However, it is indeed difficult to standardize batteries, as there are currently up to 145 types of power batteries on the market, and there are various battery swapping methods, such as lateral battery swapping, box swapping, and chassis swapping. For various reasons, it is challenging to change the design concepts and standards of power batteries for new energy vehicle manufacturers. Therefore, to achieve the standard of “universal battery swapping”, a huge gap needs to be bridged.

Furthermore, due to the competitive relationships between new energy vehicle manufacturers, the design and swapping methods of power batteries have differentiation, and nobody is willing to disclose their own solution or adopt their competitors’ solution.

Currently, many companies have started the universal design of battery packs, but it will take time to form combat capability.

However, the greatest challenge to the battery swapping model is not the lack of a unified standard for power batteries, but how to increase the utilization rate of single stations to achieve profitability. According to a calculation model by CITIC Securities Research Institute, the construction cost for a single passenger car battery swapping station is about RMB 4.9 million, while the construction cost for a commercial vehicle battery swapping station is about RMB 10 million. For the former, the breakeven point corresponds to a utilization rate of 20%, which means serving approximately 60 vehicles per day; for the latter, the breakeven point is 10%, which means serving approximately 24 vehicles per day. From the current number of battery swapping stations, it is impossible to reach the breakeven point.The data always reflects the most authentic situation. Taking the third-party battery-swapping operator Oudong New Energy as an example, their total revenue from 2018 to 2020 was RMB 82.47 million, RMB 212 million and RMB 190 million respectively. The net losses were RMB 186 million, RMB 162 million and RMB 249 million respectively. The cumulative losses for the past three years were RMB 597 million.

Therefore, facing the relatively small market of ride-hailing vehicles and the incomplete layout of battery-swapping stations, the non-uniformity of battery standards affects the interests, gains and losses, and development paths of all parties involved. This is quite challenging for the overall vehicle enterprises such as taxi and ride-hailing operators.

Lastly:

Undeniably, compared to charging, battery-swapping has overwhelming advantages in energy supplement efficiency.

Leaving aside whether battery-swapping will replace charging mode in the future, at least from the participation of numerous vehicle enterprises in battery-swapping mode, the battery-swapping solution is feasible. It has more effective battery management, taking into account energy storage and minor impact on the power grid, which cannot be achieved by fast charging.

From the perspective of the industry, standardized and unified power battery can realize unified recycling, unified market services and other businesses, driving the development of the new energy vehicle industry chain from upstream to downstream.

Perhaps for a long time in the future, slow charging will still be the main way for new energy vehicles with fast charging and battery-swapping as supplementary charging modes. If the national power battery standardization cannot be resolved, we believe that as long as there is a demand in the market, the traceability system is further improved, and the adaptability optimization for the separation of the vehicle and the battery is improved, battery-swapping mode will be recognized by people. Then, several vehicle enterprises can form a group and achieve 2-3 power battery standards, providing more space for battery-swapping mode to survive and develop.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.