Author: Tian Xi

The arena of autonomous driving seems to have reached the cloud.

On August 2, XPeng Motors announced the establishment of the largest autonomous driving smart computing center in China, “Fu Yao”, dedicated to autonomous driving model training.

According to He XPeng, “Fu Yao” is designed to handle the increasing amount of data in autonomous driving, with a floating-point operation capacity of 6 billion billion times.

Prior to this, Tesla also released Dojo, a supercomputer for training neural networks, with a floating-point operation capacity of exaflops, or hundreds of billions of billions of operations per second, which was referred to by Musk as “like a beast”.

For the time being, accessing cloud services has become the common choice of autonomous driving leaders in both China and the United States. However, for more participants, the answers to questions such as why car companies should go to the cloud, what benefits can be gained from cloud, and how to go to the cloud are not yet clear, but urgently need to be answered.

At this juncture, the “Intelligent Automobile Cloud Service White Paper” jointly written by Ernst & Young (China) Enterprise Consulting Co., Ltd. (hereinafter referred to as “Ernst & Young”) and Huawei Intelligent Automotive Solutions BU was released. It analyzes the data and business enabling capabilities of cloud in-depth, and discusses how car companies and cloud service providers should cooperate and assist in the development and continuous upgrading of autonomous driving according to industry pain points and enterprise development stages.

In the era of massive data, “going to the cloud” is a must

In 2022, after continuous breakthroughs in technology and policies and regulations, autonomous driving has truly begun to move from small-scale experimental fields to large-scale commercialization.

Now, whether it is a rising new energy vehicle startup, an L4-level autonomous driving company with high aspirations, or a traditional car company vigorously transforming into intelligent, they are all racing against time to add autonomous driving functions to their vehicles in order to achieve mass production.

At the same time, challenges follow. In the era of autonomous driving, the amount of vehicle data rises exponentially. Because various sensors such as Lidar and cameras need to “observe” the road, according to estimates by Garner, each autonomous driving vehicle connected to the network generates at least 4TB of data per day, and when car companies sell hundreds of thousands or even millions of autonomous vehicles, the data volume will grow from PB-level to ZB-level, which greatly consumes car companies’ resources in data acquisition, storage, and computation.

In the past during the R&D stage, autonomous driving companies relied on data centers to support their storage and computational needs.

Due to the small scale of the testing vehicles, traditional data centers were sufficient. In some Robotaxi companies, they even used the most primitive “hard drive copy” method to transmit all data and then conduct data mining.

However, in the mass production stage, the number of vehicles being connected and the amount of data being generated has greatly increased, and the requirements for GPU computing power for training and parallel simulation have grown rapidly. Traditional data centers are struggling to cope with the demand.

Some industry insiders have revealed that during the development stage of training their autonomous driving models, the company often encountered unexpected computational demands beyond their local computing capabilities. As a result, they had to purchase new servers through the usual procurement process, which led to significant delays in their development progress due to the lengthy approval process.

In response, some automakers have started seeking change. Rumor has it that a foreign start-up automaker has built its own supercomputer center to mine massive redundant data. However, the cost is not to be underestimated, with hardware costs alone amounting to as much as $140 million.

“This is clearly not something that ordinary automakers can afford.” The operations director of an intelligent technology company under an automotive group said that building a supercomputer center is just one part of the cost, and when taking into account operating and maintenance costs, as well as value mining and other human expenses, costs will continue to rise.

Even more importantly, in the future, as the demand for data storage increases, enterprises will undoubtedly need to invest more funds. However, autonomous driving companies have already been struggling with cash flow and may not be able to sustain this model.

“Moving to the cloud is an essential step for autonomous driving from development to commercialization.” In the “Smart Car Cloud Service White Paper” co-written by EY and Huawei’s Intelligent Automotive Solution BU, this view is clearly stated.

The white paper divides the auto industry’s demand for autonomous driving data into four parts: cost efficiency, market efficiency, scalability, and safety and reliability. According to the three stages of autonomous driving development: R&D Test Period, Early Scale-Up, and Intense Competition, the white paper discusses the changing trends of different stages of demand.

For example, in the Early Scale-Up stage, automakers gradually increase their demands for cost and scalability, and at the same time, since they are already in the commercialization stage, they will also increase their demands for data security and market efficiency. In the booming competition stage, as the market becomes saturated, automakers’ demands for cost control and scalability gradually reach their peak, and their demands for product updates and iterations gradually decrease.

Revolved around the demands of different stages, Automotive Cloud Services can play the role of a controlled “external support”, becoming an indispensable part of automakers’ journey towards commercializing autonomous driving.According to reports, cloud-based services coupled with support for multiple computing units can satisfy the ultrahigh computing power and elastic business demands of the massive infrastructure resources needed for model training and parallel simulation during the development of self-driving cars. Compared to traditional data centers, this approach effectively improves operational efficiency by more than 60%, and reduces TCO by 30% to 60%.

What’s more, the significance goes beyond efficiency tools; it’s a self-driving revolution. Cloud services not only improve efficiency for automakers but also accelerate the development of self-driving.

A complete self-driving system has three parts: perception, planning, and decision-making. Perception and planning are the primary parts of data generation, including data collection, cleaning, labeling, and simulation testing.

Cloud services can do more than provide massive storage and computing power; they can also integrate intelligent strategies that overturn traditional data processing methods. It’s important to note that self-driving systems collect various types of data, including videos, images, laser point clouds, radar point clouds, etc. In addition to the large data volume, the most significant characteristic is that the value data ratio is low, and irrelevant and valueless information takes up immense storage space.

In response to this, some cloud service providers can offer features that extract difficult scenario situations through label-based and image-based searches, build high-quality databases and scenario sets, and provide timely feedback to algorithm training, optimizing the storage space and accelerating self-driving algorithm iterations.

“In scenarios that require cloud accumulation of learning data actively, such as tunnels and encountering electric two-wheelers, developers can upload images they need the vehicle to retrieve, and cloud instructions will send the car to ‘search for images based on images.’ This avoids uploading entire data sets and only uploads ‘value’ data with labeled tags to the cloud, significantly improving the efficiency of Corner Case mining,” explained an insider from a car cloud service provider to Automotive News.

After discovering valuable data, the next step is cleaning and labeling the data. Simply put, data cleaning involves erasing sensitive data collected by the car, including geographic location, faces, license plates, and other information related to national security and privacy. It must undergo desensitization and compliance processing, and uniform formatting. Data labeling further processes the cleaned data, roughly divided into 2D and 3D object labeling, joint labeling, lane marking, and semantic segmentation.No matter it’s data cleaning or data labeling, it requires a large amount of human labor. Data processed in this way can be of varying quality and have a high rate of rework, while being highly inefficient. Even with the later introduction of local AI training data processing by automakers, the improvements over manual processing have not been significant.

A leading technology company in China discovered that a team of over 100 people was needed for labeling work and that the amount of manual labeling required for machine learning was extremely high, time-consuming, and inefficient.

This problem is not uncommon in autonomous driving companies, to the point where some have said, “Whoever can efficiently and cost-effectively extract the value of data will become the king of competition in the autonomous driving industry.”

If the data labeling work is delegated to a car cloud service provider, there will be significant changes. Based on cloud-based training of complex neural network models, the car cloud service combines deep learning to improve automatic labeling capabilities, optimize labeling algorithm efficiency and accuracy, and reduce data processing costs.

The white paper mentions that the car cloud’s high computing power combined with intelligent strategies can increase overall data processing efficiency by more than 10 times and reduce data processing costs by 50% in comparison to manual labor.

If the perception process based on data is the foundation, then simulation training is the housing construction process. The former determines the success or failure of autonomous driving technology development, and the latter directly affects the progress of the entire development process.

According to industry consensus, autonomous driving systems need at least 10 billion miles of test drive data to mature. This is an impossible task for any automaker to complete with only physical road tests, so simulation testing has become a necessary step.

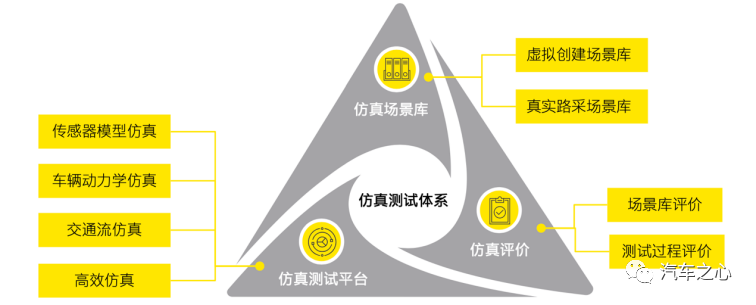

In the simulation testing system, the simulation scene library, simulation testing platform, and simulation evaluation are all interconnected and indispensable.

Specifically, the scene library includes virtually created scenes and real road scenes collected. Some compare it to the standard of exam questions used to evaluate the quality of simulation software. The simulation testing platform is built based on simulation models of sensors, dynamics, and traffic flow, and allows for simulation testing to be completed in corresponding scenes, much like taking an exam. The simulation evaluation can be likened to a “grading standard”, which evaluates and provides feedback on the testing process and results, such as whether it can travel safely and efficiently to the destination.

In reality, most automakers face challenges in each step of autonomous driving simulation testing: insufficient scene library coverage, incompatible formats across the industry, high mileage and numerous scenes leading to long testing times, significant deviations between simulation testing and actual road tests resulting in low trustworthiness, and an incomplete simulation evaluation system resulting in poor feedback, to name a few.

For example, one automaker reported that an autonomous driving vehicle passed simulation testing for braking in rainy and snowy weather, but in actual road tests, deviations in judgment for braking distance and time occurred due to changes in friction coefficients, which is a typical deficiency in the authenticity of simulation testing.

The aforementioned factors all directly impact the efficiency of the simulation. The general manager of an R&D department of a certain automotive company expressed that the company can only advance several dozen to several hundred kilometers of testing per day, leading to a process that’s too slow.

The aforementioned factors all directly impact the efficiency of the simulation. The general manager of an R&D department of a certain automotive company expressed that the company can only advance several dozen to several hundred kilometers of testing per day, leading to a process that’s too slow.

Autonomous driving cloud services can help solve these issues by constructing a comprehensive and diverse library of realistic simulation scenarios, establishing a comprehensive system of model simulations that simulate real-life driving scenarios, and implementing efficient simulation tests of autonomous driving vehicles in various complex scenarios through customized multidimensional targets, achieving one-stop simulation services. This not only supplements the limitations of actual road testing but also improves development efficiency, accelerating the commercialization of autonomous driving vehicles.

One automotive cloud service provider revealed to Automotive Industry Heart that their cloud-based large-scale parallel simulation supports the simultaneous completion of multiple simulation tasks across various scenarios, and the daily simulated testing mileage of vehicles reaches millions of kilometers.

Automotive Industry R&D Pain Demands Enabling Support from Professional Automotive Clouds

Many automotive companies have realized the importance of cloud services for autonomous driving, and corresponding investment is rapidly increasing. Data shows that in 2020, investment in this area by automotive companies accounted for more than 60% of the overall investment in automotive digitalization.

However, there are different ways for automotive companies to get on the cloud, which can be broadly divided into two types: self-built private clouds and purchased public clouds (hybrid clouds).

A small percentage of automotive companies with stronger IT capabilities or new businesses mainly rely on self-built clouds (private clouds) and only outsource certain cloud computing and cloud storage services for graphic data. This approach is beneficial to automotive companies in terms of grasping core data and developing algorithmic technology capabilities across the entire process, creating differentiated products.

However, self-built private clouds have the disadvantages of high cost, difficulty, and long construction time. Additionally, it’s challenging to flexibly respond to the massive data storage and fluctuating high computing power demand during the R&D process. If capacity expansion is needed for private clouds, new hardware and resources must be purchased or leased, which restricts the speed of iterative development for autonomous driving.

Public clouds perfectly solve this problem. Not only can they provide strong computing power, but their data management capabilities are also beyond doubt. This has caused automotive companies to turn to public clouds in recent years. According to the data from iiMedia Research, in 2020, the scale of public clouds surpassed that of private clouds in China, becoming the most important market for cloud computing.

A VP of the information technology department of a certain automotive group stated that the company’s purchasing scale for public clouds has increased significantly year after year. “Just the cloud storage alone, the budget for 2022 is going to increase by about 30% compared to 2021, and cloud computing has also increased by 26% year on year.”

It should be noted that data management is only the basic capability of cloud services; how to use the cloud to dig deep into data value and enable autonomous driving is the core demand of automotive companies.

The difficulties for automotive companies now lie in the business-enablement layer — which data to use, how to use it, and how to securely and efficiently use it, which requires the input of capabilities based on the resources provided by the cloud.A certain IT director of a car group fully agrees with this, thinking that cloud service providers should provide enterprises with lighter R&D scenarios at the SaaS level, so that they can focus on the core research and development, such as preparing autonomous driving training models for companies to use directly.

This expectation puts very high demands on cloud service providers, meaning that they not only need ICT capabilities but also need to understand automobiles, have professional knowledge reserves, and can achieve deep integration of the two.

This is particularly evident in the problem of the breakpoint in the autonomous driving toolchain. As mentioned earlier, the key control points for autonomous driving algorithm development mainly include data collection, perception model training, simulation testing, and on-road testing, which are connected by the toolchain and run through the entire core development process.

Generally speaking, the toolchain for each key control point is often provided by different suppliers, that is, “segmented development”. For example, simulation tools companies are used for the simulation link, and labeling tools companies are used for labeling. This causes car companies to often encounter “breakpoints” in the process of autonomous driving research and development and iteration.

“When we deal with data transmission, algorithm loading, and model adaptation, we need to use multiple toolchains. However, due to the lack of industry standards, the compatibility between these toolchains is very poor, which forces us to spend a lot of time adapting.”

A self-driving R&D engineer gave an example that the company had used discrete toolchain solutions provided by various suppliers, but it took several months just to debug the link, making the whole development team suffer.

To solve this pain point, it is necessary for automotive cloud service providers to have the ability to provide or integrate a unified toolchain, open up the upstream and downstream links, and help car companies quickly run (data-driven) pipelines.

The “white paper” believes that the demand of car companies for cloud services has shifted from the “resource cloud” of the IaaS and PaaS layers to the “capability cloud” of the SaaS layer, and no longer satisfies the cloud service targeting a single business in a scenario, but hopes to extend vertically to multiple businesses, solve “data silos” and “business fragmentation”, and form systematic outputs with a single line.

However, some industry insiders have expressed doubts about this: Does cloud service providers’ deep involvement in core autonomous driving businesses mean that car companies have given up half of their “soul”?

This kind of worry touches on the hidden worries of some car companies. For example, on the one hand, for efficiency reasons, they hope that a single supplier can provide a full-stack toolchain, and on the other hand, out of the concern for “security and independence”, they want to cooperate in a decentralized way, or even through self-developed toolchains, to continue their control position in the ecosystem.

A certain IT director of a car group frankly states that one of the considerations for choosing an automotive cloud service provider is whether they can separate the underlying coupling. “Collaboration between businesses is not about the integration of the cloud. We value more whether cloud service providers can flexibly adapt to our needs.”In fact, cloud service providers are already decoupling various modules to help automakers reduce costs and increase efficiency, while ensuring that the latter still have control over cloud capabilities.

According to a certain automotive cloud provider, its tools are divided into four parts: data, training, simulation, and supervision, completely open and unbound, and customers can replace them at any time. The White Paper concludes that this marks a new shift in cloud service models from “giving fish” to “teaching how to fish”.

Conclusion

As autonomous driving enters large-scale commercialization, a huge data revolution is unfolding and reshaping the automotive industry.

On the one hand, data brings challenges to automakers, and to cope with the generation, processing, and interaction of massive data, cloud services need to be introduced to provide ICT resources support for automakers based on powerful storage and computing capabilities.

On the other hand, data also means infinite value, and professional automotive cloud service providers need to be called upon to fully tap the value in the SaaS layer and enable business development for automakers.

From the latest development trends, automakers’ demand for cloud service construction has shifted from simple access to cloud resources to specialization in various vertical scenarios of intelligent connected vehicles, deeply integrated into business development, and adapted to cloud capabilities.

To adapt to this change, cloud service providers and automakers need to strengthen communication and align their needs, and work together: automakers identify business units that urgently need cloud service support, while cloud service providers leverage their deep insight into the automotive intelligent connected business to provide application value inputs for automakers.

At the same time, automakers and cloud service providers also need to build a development cooperation ecosystem that not only relieves automakers of concerns about being “locked in” and undifferentiated, but also allows cloud service providers to play to their advantages of high efficiency and low cost, and thus work together to accelerate the industry’s overall transformation process.

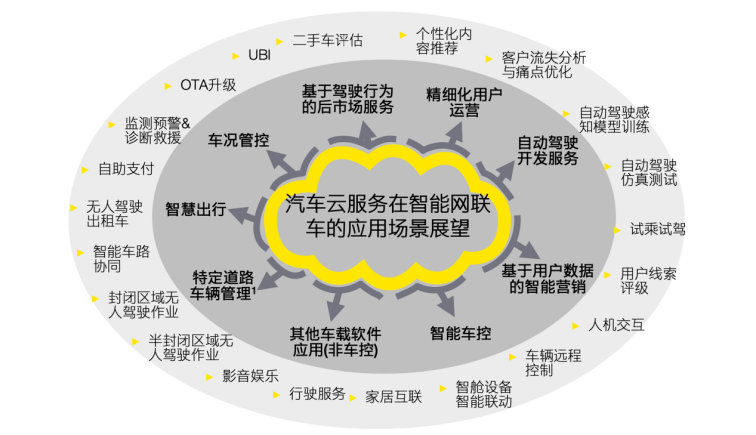

It is worth noting that autonomous driving is just one scenario in which cloud services empower intelligent vehicles. Under the digital wave, automotive cloud services also help to foster new business models for connected cars.

The White Paper points out that in the era of intelligent connected vehicles, automakers rely on their natural data resources and customer acquisition advantages, making services shift from the original endpoint of vehicle product transactions to the starting point of providing vehicle full life-cycle services. Cloud services can help automakers collect and actively explore data values, enhance user experience, and create value and revenue for automakers.

Specifically, automotive clouds promote the implementation of many specific application scenarios, such as remote diagnosis, road rescue, fault monitoring, status detection, OTA cloud services, UBI, used car evaluation, etc., break down data barriers in various fields, and create a more diverse automotive ecosystem.

# A White Paper Released by EY and Huawei: From Rafting to River Cruise, Cloud Services Empower the Intelligent and Connected Upgrades of the Automotive Industry

# A White Paper Released by EY and Huawei: From Rafting to River Cruise, Cloud Services Empower the Intelligent and Connected Upgrades of the Automotive Industry

Recently, EY and Huawei jointly released a white paper on the application of cloud services to the automotive industry. The white paper provides a comprehensive analysis of the impact of cloud services on the automotive industry and explores the opportunities and challenges faced by the industry in the process of digital transformation.

The white paper points out that with the rapid development of cloud technology and the continuous penetration of cloud services, the application of cloud services in the automotive industry has gradually become a trend. In the future, the integration of cloud services and the automotive industry will bring more opportunities for the development of intelligent and connected cars.

The white paper also analyzes the current status and development trend of cloud services in the automotive industry, and puts forward several suggestions for the development of cloud services in the industry. Finally, the white paper proposes that the automotive industry should seize the opportunities brought by cloud services, actively embrace digital transformation, and accelerate the development of intelligent and connected cars to meet the needs of consumers and promote the healthy and sustainable development of the industry.

Video Source: EY

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.