Author: Xiong Ruifeng

Special phenomenon during off-season!

The saying goes “Golden September and Silver October”, September and October are often the peak seasons for car sales in a year, and on the contrary, in our perception, July and August are usually the off-season for new car sales.

However, thanks to the chemical reaction composed of the national series of policies to promote consumption and the factors of the auto market itself, a “special” phenomenon of off-season not being off-season in July’s passenger car market has arisen. Mainstream automakers continue to play the trump card of “promoting sales and increasing volume”, and new energy vehicles continue to rise, leading to a huge change in the demand structure of passenger car products. According to statistics, the sales volume of China’s passenger car market in July reached 1.818 million units, a decrease of 6.5% compared with June, but it directly increased by 20.4% YoY, achieving the second-highest YoY growth rate during the same period in nearly ten years.

The cumulative retail sales of passenger cars from January to July reached 11.079 million units. Benefiting from the preferential policy of automobile purchase tax, the demand suppressed in April and May was released in June and July, and the dealers increased their preferential efforts to make up for their previous losses. Therefore, China’s auto market achieved a certain degree of recovery in the first seven months.

Looking at the specific data, except for MPV, the four major types of passenger cars in China saw fast growth in July compared with the same period last year. Among them, the growth rate of new energy vehicle sales in July was the most significant, achieving a staggering growth of 117.3% YoY. The sales of sedans also achieved a YoY growth rate of 24.8%.

In terms of specific manufacturers, benefiting from the continuous improvement of logistics and supply chain in various regions and the recovery of the industry, coupled with the introduction of policies to promote consumption, the automobile industry has achieved effective growth. Automakers that sold more than 100,000 units include BYD Auto, FAW Volkswagen, SAIC Volkswagen, Changan Auto, and Geely Auto. Among them, BYD surpassed the common winner FAW-Volkswagen, winning the championship with a score of 159,000 units.

The Sylphy returns to the top!

In terms of sales of subdivided car models, the sales volume of sedans in China’s domestic market in July was 903,000, a YoY increase of 24.8% and a MoM decrease of 8.5%; the cumulative sales volume from January to July was 5.49 million units, a YoY decrease of 1.3%.

From the specific ranking, Dongfeng Nissan Sylphy once again surpassed the frequent champion Wuling Hongguang MINIEV with a monthly sales volume of 39,065, continuing to hold the championship of the sedan sales chart, while Wuling Hongguang MINIEV steadily held on to the second place with a sales volume of 37,128 (a YoY increase of 20.9%).

Thanks to the strong performance of the BYD brand, models such as Qin, Han and Dolphin continued to surge into the top ten of the sedan sales chart in July, among which Qin series boldly won the third place in sales with a YoY increase of 100.2%, it’s unbelievable; the fourth place was our old friend, SAIC Volkswagen Lavida, which achieved good sales of 30,257 with a stable performance.

In terms of cumulative sales volume from January to July, although Sylphy won the championship with a cumulative sales volume of 246,287 vehicles, its YoY decline of 15.4% – compared with Wuling Hongguang MINIEV’s YoY increase of 19.7% in second place – showed that the gap between the two is rapidly narrowing; the third place is not surprisingly held by SAIC Volkswagen Lavida (sales volume: 190,566 vehicles); the fourth place is BYD Qin (sales volume: 180,423 vehicles); and the fifth and sixth places are occupied by the evergreen vines of Camry and Corolla.

Fierce battle of the Strong!

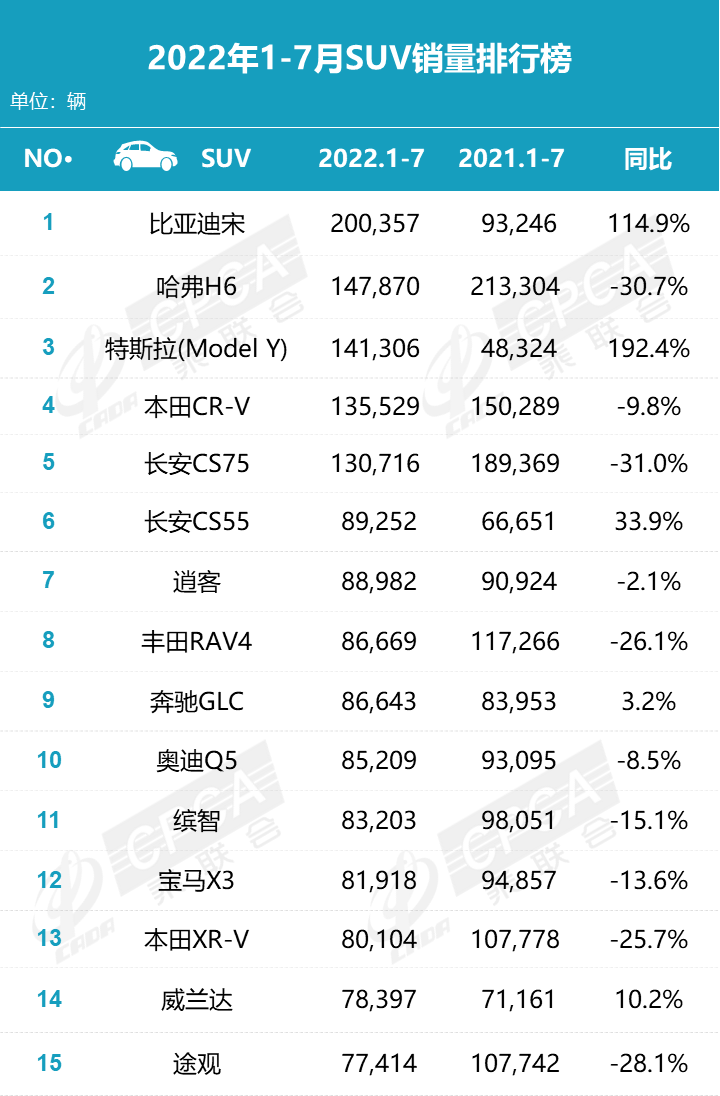

As for SUV performance, the sales volume in July reached 832,000, a YoY increase of 18.9% but a MoM decrease of 5.3%; the cumulative sales from January to July were 5,076,000, a YoY decrease of 3.7%.

Looking at specific models, the BYD Song series once again won the first place with a sales volume of 37,784, thanks to its outstanding product strength and price competitiveness, both BYD Song Pro and BYD Song PLUS achieved good sales.

In second place is the veteran Haval H6. Although it had held the top spot in monthly sales for several months, with the rapid increase in the penetration rate of new energy vehicles, its sales growth pressure has become relatively high. However, fortunately, its sales achieved a breakthrough in July, reaching 24,374 vehicles.

In second place is the veteran Haval H6. Although it had held the top spot in monthly sales for several months, with the rapid increase in the penetration rate of new energy vehicles, its sales growth pressure has become relatively high. However, fortunately, its sales achieved a breakthrough in July, reaching 24,374 vehicles.

I thought the third place should be Tesla Model Y, but unexpectedly, Dongfeng Honda CR-V performed exceptionally well, with sales reaching 22,636 units in July, a year-on-year increase of 48.3% (It is worth mentioning that CR-V will be upgraded soon).

The fourth place is BYD Yuan Plus, achieving a monthly sales record of 19,239 units; followed closely by Changan CS75, ranking fifth with 19,122 units.

In addition to the above-mentioned SUVs, Toyota RAV4, X-Trail, Tiguan, Mercedes-Benz GLC, and Audi Q5 ranked 6-10, among which X-Trail, Tiguan, Mercedes-Benz GLC, Audi Q5 and other models have achieved a large year-on-year increase in sales.

In the cumulative SUV sales list from January to July, BYD Song family continued to maintain the first place, with a cumulative sales of 200,357 units, a year-on-year increase of 114.9%. Haval H6 and Tesla Model Y ranked second and third with sales of 147,870 and 141,306 units, respectively; Honda CR-V and Changan CS75 also have a cumulative sales of over 100,000 units, ranking fourth and fifth.

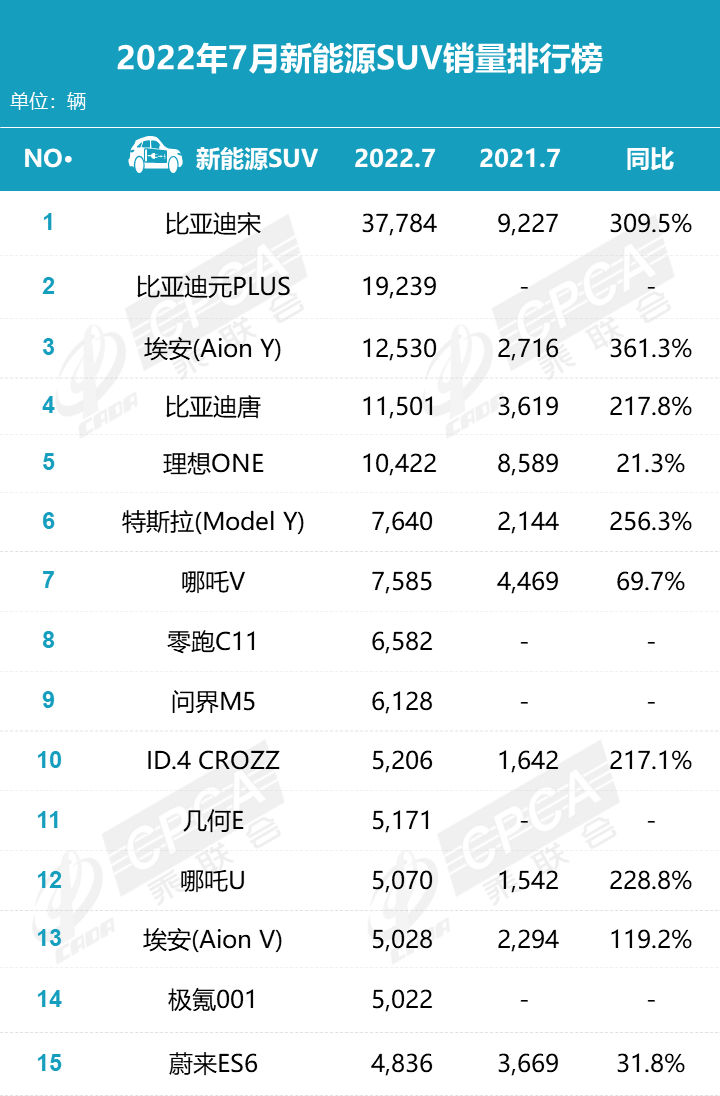

From the sales performance of SUVs in July, new energy SUVs still occupy a significant advantage. The BYD Song new energy, Yuan Plus new energy, Aion Y, and other models have performed well. Although the competition in the SUV market is more intense, for new energy SUVs, it is ushering in a better era, and its future performance is worth looking forward to.

Amazing! The 5 Series has actually surpassed the 3 Series!

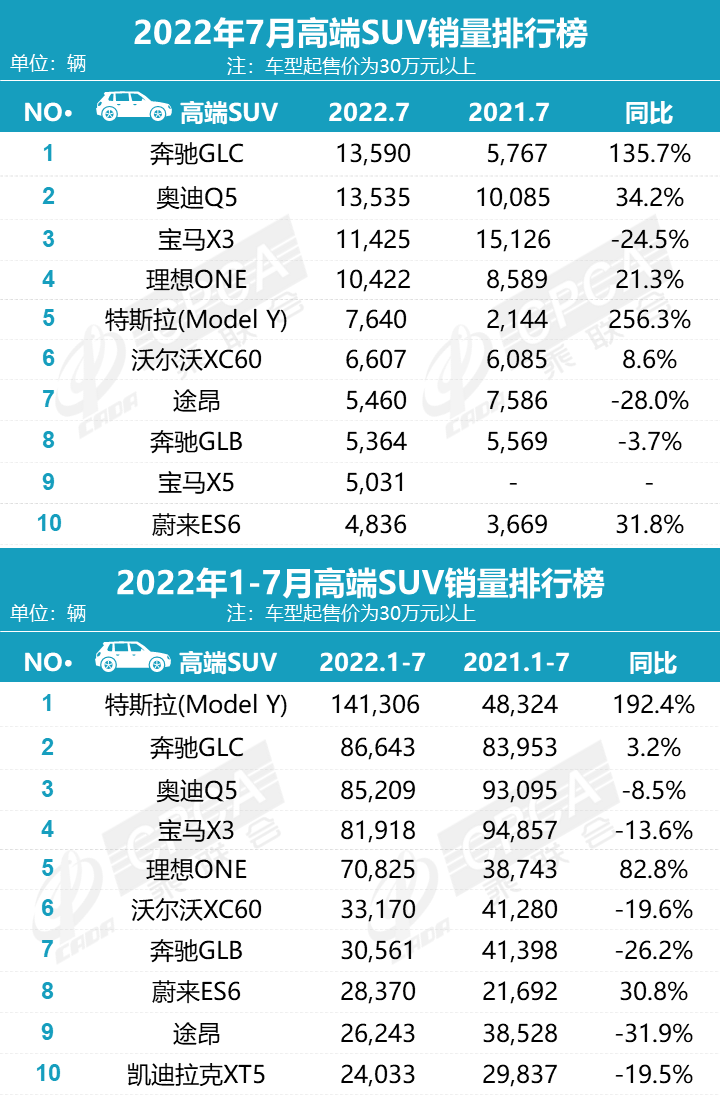

Thanks to the support of various policies, sales of luxury brands (models priced over 300,000 yuan) were in full swing in July.

In the luxury sedan market of July, Mercedes-Benz, Audi, and BMW continued to dominate the top three positions with adjusted rankings. Among them, Mercedes-Benz C-Class achieved a fierce growth in sales, successfully winning the sales champion in the luxury sedan industry with a result of 15,308 units, with a staggering year-on-year growth rate of 128.9%. In addition, BMW 5 Series as the current “core product” closely followed it with a result of 14,866 units, and a year-on-year growth rate of 7.5%. The June’s first Audi A4 fell out of the top three ranks and ranked fourth with 13,717 units.

The 5th to 6th ranks continue to be occupied by Mercedes-Benz, Audi, and BMW, among which the Mercedes-Benz E-Class sold 13,158 units, outperforming Audi A6L (sales: 12,546 units).

It is worth mentioning that the newly launched pure electric version of BMW 3 Series, the BMW i3, entered the top ten list, which shows that consumers still have a high level of preference for BMW models. In addition, Chinese brand models such as NIO ET7 and Hongqi H9 continue to make the list.

In the luxury SUV sector, Mercedes-Benz GLC (sales: 13,590 units), Audi Q5 (sales: 13,535 units), and BMW X3 (sales: 11,425 units) took turns dominating the market. Among them, GLC had a year-on-year growth rate of 135.7%, indicating that the performance of BBA is still strong. The fourth place is the familiar face, the Ideal ONE, with a monthly sales volume reaching 10,422 units.

However, it is not difficult to see that both the luxury sedan and SUV markets have recovered comprehensively, especially the luxury SUV market has exploded. With the implementation of related subsidy policies and the comprehensive connection of the supply chain, sales of luxury brands have basically returned to pre-epidemic performance.

BYD “Targeting” All the Way ForwardIn the new energy vehicle market, the improvement of supply combined with the expectation of rising oil prices has brought about a hot market. The increase in oil prices and the locked-in electricity prices have driven a surge in demand for electric vehicles, with sales reaching 486,000 in July alone, an increase of 117.3% year-on-year, and a decrease of 8.5% month-on-month. From January to July, the cumulative sales data reached 2.733 million, an increase of 121.5% year-on-year. Following the monthly change pattern, it is expected that the annual production and sales will exceed 5 million vehicles in 2022.

Looking specifically at the data, BYD still leads the pack with an astonishing sales volume of 158,957, an increase of 247.2% year-on-year, and a market share of 32.7%, which is out of reach for other brands and is the only automaker on the list that exceeded 100,000 and reached 150,000 units.

SAIC-GM-Wuling took second place with sales of 40,383, followed by Geely with sales of 30,769. It is worth mentioning that Tesla, which had previously appeared in the top three, sold only 8,461 units this month due to production capacity issues, ranking fifteenth and experiencing negative year-on-year growth.

In the new energy car segment, SAIC-GM-Wuling’s Hong Guang Mini EV still ranks first with sales of 37,128 units, an increase of 20.9% year-on-year. Second, fourth, and fifth places were occupied by BYD Qin new energy (sales: 33,933 units, an increase of 102.3% year-on-year), BYD Han (sales: 25,270 units, an increase of 207.9% year-on-year), and BYD Dolphin (sales: 20,493 units).

In addition, the top three cumulative sales from January to July were still dominated by SAIC-GM-Wuling’s Hong Guang Mini EV, BYD Qin, and BYD Han, while Tesla’s Model 3 fell to fifth place.

In terms of new energy SUVs, BYD Song continues to lead the way, achieving sales of 37,784 vehicles, a YoY increase of 309.5%; in second place is the BYD Yuan PLUS, with monthly sales also reaching 19,239 vehicles; third place is the Aiways Y (sales: 12,530 vehicles).

In terms of new energy SUVs, BYD Song continues to lead the way, achieving sales of 37,784 vehicles, a YoY increase of 309.5%; in second place is the BYD Yuan PLUS, with monthly sales also reaching 19,239 vehicles; third place is the Aiways Y (sales: 12,530 vehicles).

It has to be said that in July, the new energy passenger car market reached a historic high, with BYD leading the major manufacturers. With the multi-pronged approach of self-owned car companies in the new energy route, the market base continues to expand. As many as 16 companies with sales exceeding 10,000 vehicles, accounting for 83.4% of the total new energy passenger car sales.

Among the new forces, Xpeng, NIO, Li Auto, LI, Leapmotor, and WM Motor all performed well in terms of YoY and MoM sales growth in the month, especially the second-tier brands such as NIO and Leapmotor, which also have advantages in the segmented market.

In conclusion

Although the domestic automobile market experienced a serious decline from March to April, luckily the passenger car market gradually stabilized in May, and the passenger car market saw explosive growth in June and July. With the continuous launch of new energy vehicles in recent months and the gradual completion of some companies’ capacity expansion projects, the sales of new energy passenger cars will maintain a good trend of MoM growth, making the first half of the year a success for the Chinese auto market.

With the start of the second half of the year, competition among car companies will become even more intense, with monthly sales of new energy passenger cars expected to exceed 600,000 from August to December, further achieving sustained high growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.