Title: The Evolution of Sub-brands of NIO

Author: ZeLin Leng

Editor: Pan Wang

In the last article “NIO’s July “Catastrophe””, we have already analyzed the delivery performance of the new forces in July, which showed two different trends, with the waist force rising collectively and the top three declining simultaneously month-on-month.

This does not mean that the high-end new energy market has reached saturation. On the contrary, its higher price and gross margin still attract many car companies to follow suit. The self-owned brands that have been pressed down by joint ventures for many years, such as Xiaokang, which got rich by microvans, Dongfeng, which started with trucks, and various “poses” are being used to enhance their brand image and increase prices.

The “rolling” of the new energy market first rolled out in the high-end market.

Most of the internal rolling of the low-end market only exists in one aspect, and consumers can satisfy their needs with as much money as they have. However, the rolling of the high-end market is all-round, because when the price comes to three or five hundred thousand, 8155 is standard equipment, front double-wishbone and rear multi-link are only basic, multi-zone voice, large screen, navigation driving functions, etc., as long as the budget is adequate, finding a supplier is not difficult within the perfect supply chain system.

Under the siege of multiple brands, it is becoming increasingly difficult for automakers to differentiate themselves, and expanding their market intervals to break through overall sales is obviously a good way.

Recently, it was reported that NIO’s planning for the third brand has been put on the agenda. According to media reports, NIO’s third brand will be responsible for the mid-to-low-end market with a price below 200,000 yuan, the same as the second brand, Alps, and will operate independently with its own responsible person and R&D system.

From this point on, NIO’s multi-brand strategy has taken shape. This brand is responsible for the market above 300,000 yuan, Alps is focused on the 200,000 – 300,000 yuan interval, and the third brand will cover the remaining price range.

NIO seems to expect to find the next breakthrough of the enterprise through independent operations in multiple markets, after all, NIO has been hovering around the 10,000 monthly delivery mark for too long.

However, as a top-tier new force, XPeng and IDEAL have completely different strategies and clearly stated that they will fight with a single brand.

Due to the short founding time of new forces and the lack of sufficient user, capital, and technology accumulation, the market share of this brand cannot be said to have an absolute advantage, so concentrating limited resources on a single brand is the most reliable way.

This also inevitably makes outsiders think that NIO’s ambition is too big, eating from the bowl and looking at the pot.

In fact, the embryonic form of NIO’s multi-brand strategy may be earlier than what outsiders see now, and it has evolved into the current framework after experiencing trying, stopping, and revising.At the end of June, the Chairman of Changan Auto, Zhu Huarong, the rotating Chairman of Huawei, Xu Zhijun, and the Chairman of CATL, Zeng Yuqun sat side by side in front of a pure electric sports SUV. Among the roles played by these three people were both host factories and suppliers, rising stars and old veterans of the automotive industry. However, there is no doubt that all three are key figures in the current new energy vehicle market.

The three leaders came together to represent their respective backings for the launch of a new car – the Avatr 11. The official meaning of the name Avatr is the embodiment of another self in a parallel world.

But if parallel universes really exist, then perhaps Zhu Huarong and Li Bin, CEO of NIO, might be sitting at the Avatr 11 press conference in another universe.

Because the predecessor of Avatr was Changan NIO, and its concise and clear name promptly revealed its “components”.

Turning back time to 2018, Changan NIO was created by NIO and Changan, each holding 45% of the shares while the management team owns the remaining 10%. In the same year, following the same pattern and naming convention, NIO established Guangzhou NIO with Guangqi.

Guangqi NIO launched its first concept car and its HYCAN joint venture brand shortly after its establishment. Guangqi provided GEP2.0 platform and production line, while NIO provided delivery, service, and energy supply system.

Although it seems to adopt the strengths of various parties, in essence, they are just an extension of their own systems with little effort spent.

At the same time, the high-end positioning of NIO and the cost-effective positioning of Guangqi E-An have determined the ceiling and floor prices of the HYCAN JV. Therefore, the first model HYCAN007 had a similar positioning as the AION LX with similar platform, power, and production line, but actually sold at a higher price.

Guangqi NIO failed to make a splash in the new energy market, and Changan NIO had never launched a car during the cooperation.

Liao Bing, CEO of the joint venture, mentioned in his resignation that “the capital structure of Guangqi NIO determines that various aspects will be greatly restricted. The resources given by shareholders cannot satisfy the company”.

In simple terms, the money was not enough.

Without support from shareholders, it is often difficult to find a reliable “investor” in the market. According to publicly available financing information, the disclosed financing amount of the joint venture was only over 2 billion yuan, while Avatr’s two rounds of financing were only 5 billion yuan. In the automotive market, which requires hundreds of billions or even more capital, this amount of funds is almost undoubtedly not enough to survive.

In the end, these two joint ventures ended in similar ways with similar processes. One was renamed as CATL Innovation Technology, and the other was renamed as Avatr Technology.

It can be said that Changan NIO and Guangqi NIO were the “experimental products” produced due to the consideration of factors such as funds and time in NIO’s early implementation of a multi-brand strategy.Looking at the history of the automobile industry, the birth of sub-brands can be achieved through two methods: either by joint venture or by self-incubation. After eliminating the wrong answer, even if the remaining answer is difficult, NIO can only move forward to face the challenge.

Are Three Brands Redundant?

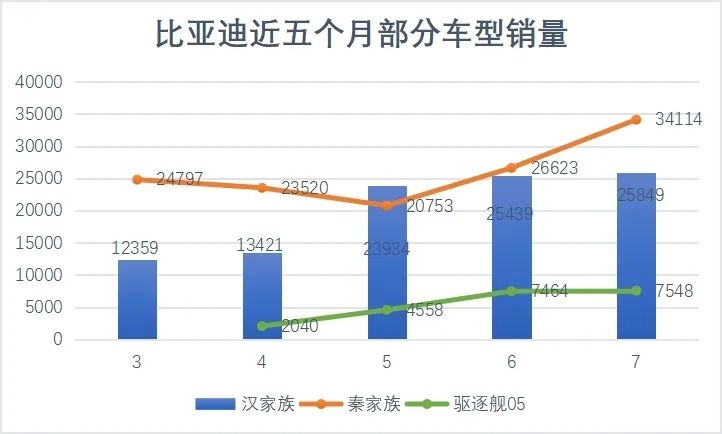

In July, BYD’s vehicle sales exceeded 160,000 units, and its current product line covers the 100,000-300,000 yuan range, with the Dynasty and Ocean series.

The former is based on the same model and offers both plug-in hybrid and pure electric versions. The overall design style is more stable. The latter is mainly a pure electric vehicle based on the e3.0 platform, and the appearance and interior design are more youthful.

If we set aside the design style and focus on the model and power mode, there is some overlap between the two series. However, at present, there is no evidence that the two are affecting each other’s sales. On the contrary, they are driving the overall sales of BYD brand to new highs.

For example, in July, the sales of the BYD Qin family reached 34,114 units, while the Ocean series of the same level, the E5 Destroyer, sold 7,548 units. The sales data for each model alone is good.

Looking at the sales trend over a longer period, they are all showing a upward trend.

Therefore, from this perspective, a brand already has a sufficiently high market share in the 100,000-300,000 yuan new energy market.

Some time ago, Li Bin clearly stated that the NIO brand will not launch a model cheaper or smaller than the ET5, meaning that the starting price of RMB 328,000 is already the “bottom” for NIO.

As Li Bin has invested a lot of money, time and energy into creating a unique atmosphere around the NIO brand, it will be difficult for latecomers to surpass it in the car market. Therefore, distinguishing the brand below 300,000 yuan is a move to preserve the original brand advantages.

However, is it a bit redundant to further divide the 100,000-300,000 yuan market?

On the surface, NIO has planned a third brand to cover a wider range, but in fact, it should be understood as creating a brand specifically for the 200,000-300,000 yuan price range. Therefore, the third brand is probably not NIO’s focus, and the range covered by “Alps” may be the market that NIO values.

As mentioned earlier, the low-end market and the high-end market have different focuses, and for the “ambiguous” market between the two, the market environment and consumer demands are more complex.In the market environment, from the early Model 3 to the Han EV, XPeng P7, and the recent four electric vehicles (Seal, Deep Blue SL03, NETA S, and Leapmotor C01) that have been launched continuously, all are actively vying for this market share.

Meanwhile, competition among various car models is also very fierce. If the competing car models have low range, manufacturers will stack batteries or launch extended-range models; if the intelligent level is not high, they will carry high-performance chips and launch “futures” features such as navigation and assisted driving; if the space is small, they will increase the wheelbase, etc. In short, under limited costs, carmakers not only need to compete for “the best of XX” but also to have as many advantages as possible compared with competing models.

From a demand perspective, consumers with budgets of two or three hundred thousand yuan often have more diverse needs. They need to analyze the matching degree between car models and their own needs in the tedious emphasis of many manufacturers. However, consumers’ familiarity with new energy vehicles is far less than that of gasoline-powered cars, which gives enterprises an opportunity to create demand. Therefore, consumers’ actual purchasing behavior is also easily influenced by corporate publicity.

Finding demand, creating demand and creating an atmosphere are all skills that NIO excels at. Independent teams and objective conditions of segmented markets will become a magnifying glass. Even if Alpi failed, there is still the “double insurance” of the third brand.

NIO’s “Double Guarantee”

At the end of 2013, Huawei released the Glory brand to benchmark Xiaomi, which was unstoppable at the time. The following year, Glory became an independent new brand to restrain Xiaomi, and Huawei began to show its skills in the high-end market, grabbing Samsung’s market share and competing with Apple.

NIO’s strategy is similar to the relationship between Huawei and Glory. For example, NIO has been benchmarking BBA, while low-end brands are most likely not to mention such publicity because their products are used to compete with domestic manufacturers.

Whether it is new forces such as NIO or other traditional automakers, all are actively seeking expansion under this unprecedented great change.

However, the methods used are different. Companies such as Tesla, XPeng, and Qiantu tend to occupy the market by offering different-priced models, while NIO requires high-end maintenance for which it must make a division. It planned two sub-brands in one go, which seems like a “double insurance.”

From the early GAC and Changan NIO, to the current Alpine and third brand, NIO’s desire for sub-brands is very clear.

In addition to adopting a platform development strategy for some technologies to share R&D costs, many of NIO’s layouts also require sufficient output support. Obviously, this is very difficult in the high-end market, which typically costs hundreds of thousands of yuan.

For example, the battery swapping mode, which NIO promotes vigorously, can increase the utilization rate of the battery swapping station. According to Li Bin’s previous revelations, the batteries of new and old brands will not be interchangeable, but the battery swapping station is likely to be universal.As for battery swapping, it is just one part of NIO’s full-cycle battery strategy. Recently, NIO invested 220 million yuan in Shanghai and set up a research and development project that includes lithium-ion battery cells and packs. Although it does not involve production lines, Li Bin has clearly stated that NIO’s long-term direction in battery field will be to adopt a strategy of self-production plus outsourcing.

From the beginning stages of companies like Bumblebee and Faraday, they needed to rely on their own brand’s orders to slowly build up.

However, double insurance is equal to double effort. Different brands need their own research and development systems, sales channels, and after-sales systems, which require more personnel. From NIO’s experience during its “darkest hour,” personnel management and operating efficiency are not its strengths.

At the same time, NIO’s own business layout is similar to the “expanding pie” model. In addition to the above-mentioned multi-brand strategy, battery swapping, and battery R&D, NIO has also laid out in many industries such as mobile phones, chips, and high-end intelligent driving. With limited funds and energy, who comes first and who comes last? All of these are testing NIO’s coordination abilities.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.