Author: Zhu Yulong

The commodity of automobiles has strong macroeconomic attributes. After the difficult year of chip shortages in 2021, no one knows if 2022 will continue to decline. In July, the overall situation of European car consumption was unsatisfactory due to the macroeconomic, inflation, and energy price burdens.

-

Germany’s passenger car sales in July decreased by 12.9% year-on-year to 206,000 units.

-

France’s passenger car sales in July decreased by 7.1% year-on-year to 108,000 units.

-

UK’s passenger car sales in July decreased by 9% year-on-year to 112,000 units.

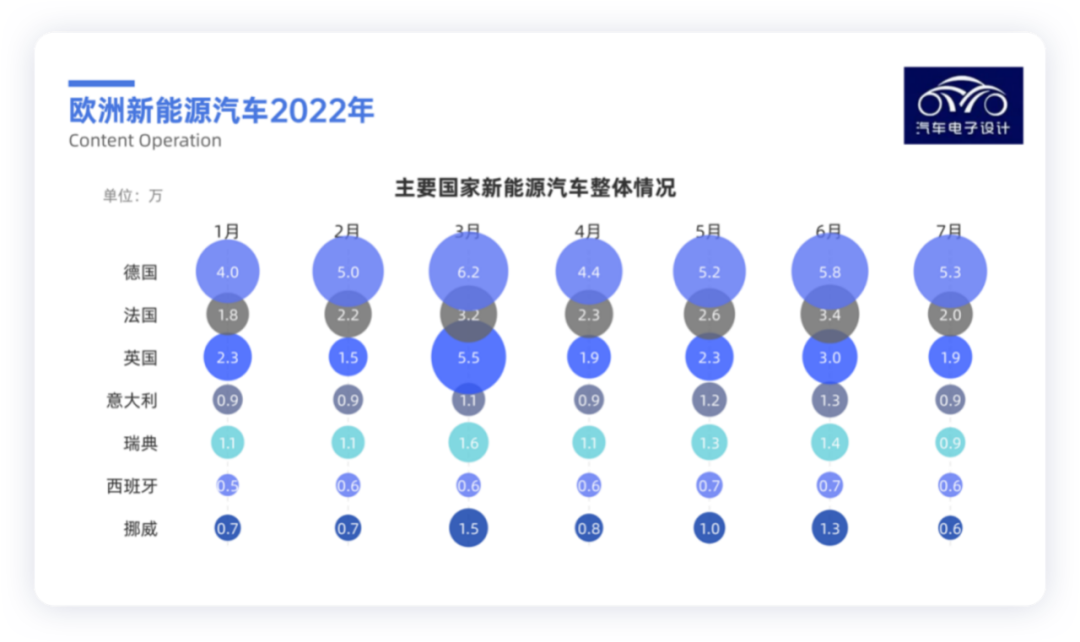

The bigger problem is that the growth of overall new energy vehicles in Europe has also entered a period of slowdown. Germany has 53,000, France has 20,000, the UK has 19,000, Italy has 9,000, Sweden has 9,000, Spain and Norway have 6,000, and the total adds up to 121,000.

The situation of new energy vehicles

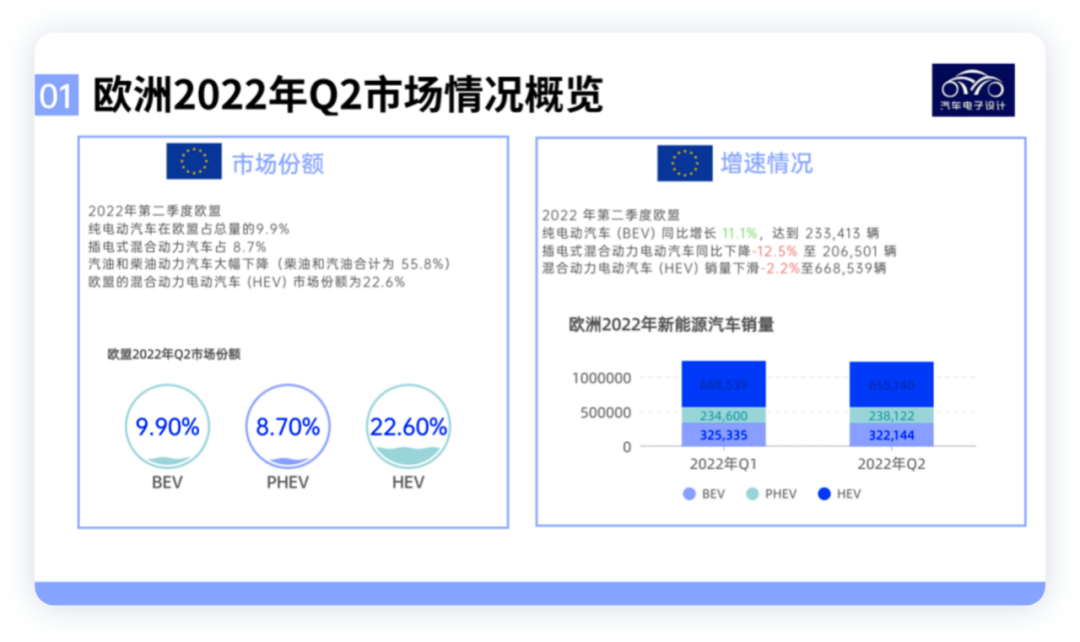

Since 2022, there has been a significant difference in pure electric vehicles and plug-in hybrids in Europe. We can see that there are large differences in the growth rates of BEV and PHEV in different countries, which indeed shows a divergence.

Pure electric vehicles

Overall, from the perspective of year-on-year data, the growth rate of pure electric vehicles is still relatively high in various countries. Relative to plug-in hybrids, pure electric vehicles have faster growth rates and higher absolute numbers in Germany, Sweden, France, and the UK. Plug-in hybrids are generally decreasing by 20%, and currently, countries with a high number of hybrids like Italy and Spain still have an advantage. Compared with China’s development stage, Europe is similar to China in 2019, and the increase in volume requires subsequent financial demand as new energy vehicle subsidies begin to partially relax. The new energy vehicle industry in Europe is currently encountering a bottleneck period. Except for the cases of small countries with sparse populations like Norway and Sweden, Europe as a whole encountered bottlenecks when the penetration rate reached 20%.

My understanding is that due to the existence of 48V and HEV in Europe, these fuel vehicles are in a transitional period, and PHEVs are more like alternatives to pure electric vehicles. It’s too difficult for European automakers to directly transition to PHEVs by abandoning P2DCT and P1/P2 48V and upgrading engines and DHT gearboxes. Therefore, the BYD approach may not be suitable for these European companies.

Updates on European automakers

In July, the main players were Volkswagen Group, Stellantis, BMW, and Mercedes-Benz, as Tesla was absent.

Tesla

After the opening of the Berlin factory, Tesla has not yet solved its supply problem in Europe. Tesla sold 78,277 vehicles in Europe in the first half of 2022, including 39,969 Model Ys and 338,280 Model 3s. Tesla’s sales in Europe are expected to be better in the second half of the year in Berlin, and they also hope to export vehicles from the Shanghai factory.

Stellantis

In the first half of 2022, Stellantis sold 105,413 electric vehicles in Europe, which exceeded Tesla and was second only to Volkswagen Group. Stellantis is mainly engaged in small and medium-sized businesses, mainly promoting sales in France, Spain, and Italy. The best-selling electric vehicle is the Fiat New 500.

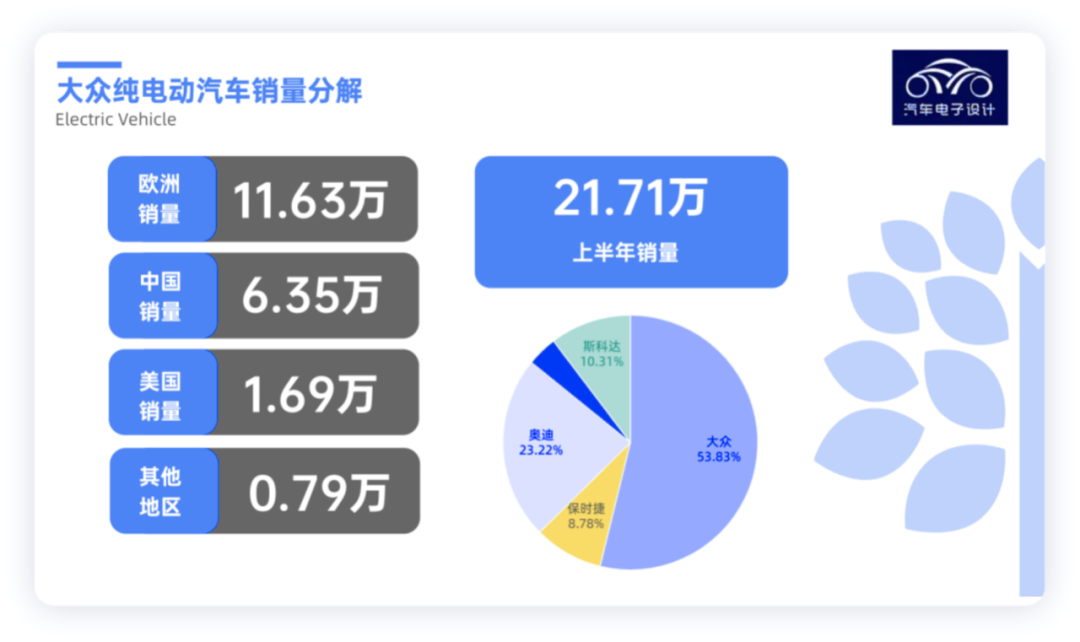

Volkswagen Group

Volkswagen Group sold 116,307 electric vehicles in Europe in the first half of the year. The main sales area is Europe, accounting for about 54%.

Conclusion: The European automotive industry is currently at a crossroads. In my personal opinion, China’s growth rate belongs to the second growth, and there will be a big adjustment in 2023. After the concentrated delivery in November-December, there will be a big gap, and this is my personal judgment.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.