Article by Wu Xianzhi and Leng Zelin

Edited by Wang and Pan

One day in the first half of 2021, PIX Moving founder Yu Chuan introduced his entrepreneurial project–a skateboard chassis, which had both scientific explanation and described a broad prospect–to investors.

“You guys did a great job on the PPT,” they said.

Passionate speeches and promising prospects did not win the favor of capital, but were instead doused with cold water by investors. In China, PIX Moving, which targets the mid-to-low-speed market, and the start-up company, Yupao Technology, which targets the high-speed passenger car market, have both been met with skepticism by investors who couldn’t understand the skateboard chassis. At the same time, both companies have been misunderstood by people during their recruitment process.

On November 10, 2021, Rivian’s founder Scaringe pushed the button on Nasdaq, changing everything in China.

Yu Chuan told Photon Planet that after Rivian went public, the outside world changed its view of the skateboard chassis. “Sometimes there’s no need to explain what a skateboard chassis is. When investors open Rivian’s prospectus, they can deduce for themselves.” Those investors who had previously rejected Yupao Technology also changed their attitude and resumed negotiations that had been interrupted.

Some traditional automakers’ suppliers have made a lot of effort in the project proposal of skateboard chassis. “The idea is good, but the resistance is high. The leaders think it’s not too late to enter the market when the wind blows and a few pigs fall.” Photon Planet learned that many traditional automakers’ skateboard chassis or CTC (Cell to Chassis, i.e. battery-chassis integration) projects have been launched one after another.

Li Hua (alias), a former Great Wall Motor engineer, said that Great Wall was originally planning to launch its own chassis product in 2025, but due to factors such as the epidemic, system inertia, and cost considerations, the plan may have to be pushed back.

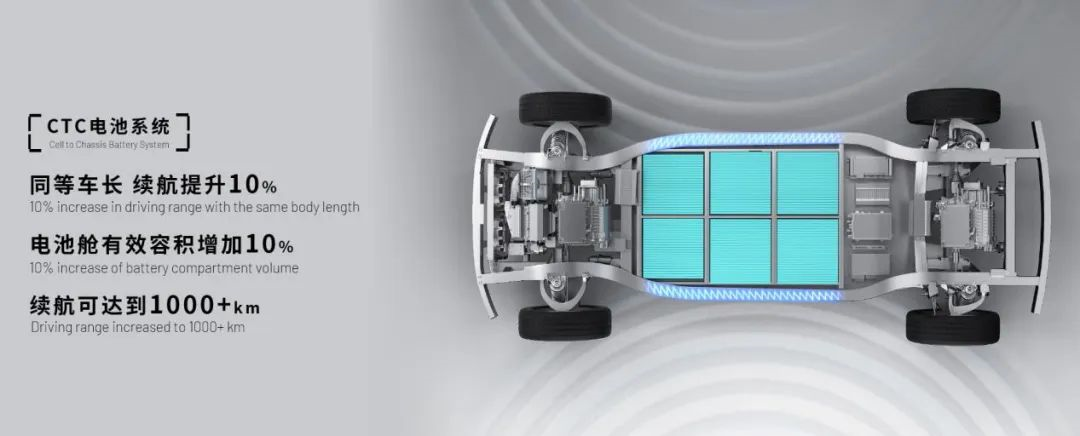

New forces are never absent from any transformation of cars, and the chassis is no exception. For example, in April, Leapmotor introduced CTC battery-chassis integration solution.

The transformation surrounding the chassis directly affects the layout of battery cells. Therefore, we also see that the giant of power batteries has put forward its own plan. On July 21, CATL released the CTP (Cell to Pack, i.e. battery to battery pack) 3.0 Kirin battery, while BYD simply packed the chassis and battery together and launched CTB (Cell to Body, i.e. battery and body integration).

A chassis attracts start-ups, traditional automakers, new car manufacturers, and even battery suppliers. Some want to integrate batteries with the chassis, some want to integrate the whole vehicle, and some want to separate the upper and lower bodies.There is already an undercurrent surrounding the chassis, where those who haven’t sat at the table want to, and those who have don’t want to leave.

Host Manufacturers Must Have “Bottoms-Up Awareness”

“In order to guard against fires, thefts, and Ning Wang.”

Regarding the recent release of Ningde Times’ third-generation Cell to Pack (CTP) Kirin battery, a traditional automotive engineering manager, Zhao An (pseudonym), said, “In the past, host manufacturers made compromises with batteries, and it is impossible for them to stand idly by as Ning Wang threatens the chassis.” He cannot imagine an ambitious giant taking advantage of its core advantage to overshadow host manufacturers.

“If Ningde Times takes control of bottom-chassis conversations, then host manufacturers’ pants will also be taken off.”

Currently, several completely different paths have formed around “Cell”. One is the traditional Cell-To-Module (CTM), which integrates battery cells and modules together, takes up 40% of space, and is difficult to improve battery life. BYD promotes Complete Vehicle Battery (CTB), which integrates the entire battery with the vehicle body. This system is difficult for other car manufacturers to replicate for two reasons: BYD has a high degree of self-sufficiency, and it sacrifices industrial cooperation and partnerships for economies of scale.

Zhao An believes that BYD’s CTB system is relatively closed, and no one except BYD can do it. “The core of the automotive industry is efficiency, so each link has a clear division of labor. BYD has a lower external dependency, so CTB helps release the system’s value.” However, he also believes that the CTB technology has closed off the possibility of external innovation, “Mr. Wang cannot always rely on reverse engineering to catch up with others.”

The third solution is CTP. If the battery pack is likened to a box of chocolates, CTP is roughly understood as removing the packaging of each chocolate, freeing up more space. Ningde Times can also increase its power in the chassis through this new method. It is understood that only Ideal Auto is currently in talks with them, while other automakers either use CTC and CTB or remain silent about their own internal 996 teams.

Even if Ningde Times’ CTP approach is not adopted, some people believe that this approach is currently unparalleled in terms of advantages.

A technology employee from a new force said that some of Ningde Times’ CTP technology performance parameters will make some host manufacturers jealous. “The utilization rate of Ningde Times’ CTP battery space reaches 72%, higher than the capacity utilization rates of the CTC from LI and Tesla and the CTB from BYD. The latest 255 watt-hour battery pack also outperforms other manufacturers in terms of energy density.”

The fourth solution is CTC, which involves the integration of the chassis and battery, similar to CTP, but also involves modifications to the chassis, all for the purpose of increasing vehicle battery life. It should be noted that these four technical routes not only involve the core battery technology of power battery giants, but also involve the host manufacturers’ view of the chassis as the “soul.”

Former Great Wall engineer Li Hua believes that the game revolving around batteries may enter a new phase with the arrival of CTC technology. “As the most advanced technology, CTC actually mainly weakens the battery manufacturers’ bargaining power.” From the perspective of an automaker, it is equivalent to regaining bargaining power.

As a result, we have seen that many automakers’ CTC technologies are either already in operation or undergoing testing.

Tesla was the first to publicly release its CTC patent technology, while Leapmotor Motors launched its own CTC solution in May of this year. A technician at Leapmotor Motors stated that the two technologies have different focuses. Leapmotor’s CTC and traditional CTP have similar repair steps, which are easier to disassemble and maintain. Tesla has a high level of integration, but it also leads to a significant increase in disassembly difficulty.

“If Tesla does maintenance later, it must first remove the seats from the interior and then remove the various panels under the seats before it can remove the battery pack.”

In this competition, traditional automakers currently appear to be somewhat hesitant.

Li An believes that it is not that existing players in the automotive industry are unwilling to try new technologies, but rather that they are often constrained by a variety of reasons and cannot seek change. Photon Planet has learned that although various parties have different considerations for technology routes, most engineering personnel agree that “innovators’ anxiety” is generally present in the automotive industry chain.

As we all know, the gross profit margin of complete vehicles is limited, and companies on the industrial chain can often only achieve profits by improving efficiency and reducing costs. Pursuing economies of scale means that automakers are more willing to adopt incremental improvements rather than revolution. Moreover, the automotive industry chain is not only long but also broad. Any changes in any link can lightly shake the supplier cake or heavily disrupt themselves and even the entire industry chain. Therefore, external forces are needed to promote change.

Yu Pao Technologies’ Business and Communications Vice President Xu Hua mentioned a detail that may support the above statement. When she contacted Bosch, she found that they not only did not hold a grudge against the skateboard chassis but even participated in the investment of Leapmotor Technologies.

“They actually need to do a lot of adaptation, such as software adaptation for a certain model. When they switch to another car, they have to start over. The core reason is that chassis-like low-level technology is completely different, and lack of standardization will cause unnecessary consumption of manpower, material, and financial resources for them.”

Bosch’s attitude shows to a certain extent that some automakers or Tier1 have already realized the importance of “chassis revolution”, but relative to Tier1, automakers have a greater and heavier historical inertia.

Unexpected Skateboard Chassis

During the process of combating Ningwang, most automakers have deliberately or unintentionally focused on chassis technology – integrating battery cells into the chassis can at least mitigate the threat posed by battery-dominated chassis to a certain degree.However, with the launch of Rivian, the skateboard chassis technology has entered people’s field of vision, and new chassis technologies have emerged, which have made some automakers feel that others are eyeing their main territory. Yu Chuan told Photon Planet that indeed many OEMs and Tier 1 companies have visited the Guiyang factory for inspection this year, and their attitude is mainly focused on understanding and paying attention.

Xu Hua of YouPai Technology also discovered similar situations: “The OEMs are under great pressure, they need to balance the sales volume of their on-sale models and pay attention to the landing of forward-looking technologies, which is very demanding for the team. After all, every one of them involves resource investment. For OEMs, the most important thing is sales volume, especially for companies like NIO where their monthly sales volume is strongly related to their market value.”

There was once an opinion that some of the new forces that have not yet launched their first car and have no “historical burden” will become the main customers of skateboard chassis. However, Photon Planet learned from PIX Moving that they have not contacted giants such as Xiaomi and OPPO, and instead, some third and fourth-line OEMs are more confident about the future of skateboard chassis.

A technician from LingPao mentioned, “The skateboard chassis arranges components such as batteries, electric drive systems, suspensions, and brakes in a chassis similar to a skateboard. The advantage is that compared to traditional vehicle design, the space of the chassis is larger and its applicability is better. A chassis can be adapted to different car models to reduce costs. One can refer to Rivian as well as Canoo, which provides skateboard chassis for Apple.”

Jiang Tao, the general manager of LingPao’s strategic and product planning department, once spoke from the perspective of new forces, discussing why they chose CTC instead of skateboard chassis.

“The skateboard chassis is a recently emerging technical approach, and there will definitely be its application scenarios. But from LingPao’s perspective, we understand that for private cars, especially private regular SUV models, skateboard chassis is not particularly suitable. The concept of skateboard chassis is based on the structure of “non-load-bearing body” that was previously used for large SUVs, pickups, and trucks. In the past, for pickup truck models, once the body was removed, it could be driven away with a steering wheel, that’s the logic.”

A technician from that OEM also told Photon Planet that the main reason was still due to cost constraints, and they couldn’t provide too much advance volume.

But Xu Hua of YouPai Technology believes that skateboard chassis and CTC technology are two different dimensions, and the two can coexist. “CTC, including CTB, CTM, etc., focus on the dimension of batteries, while skateboard chassis stands on the dimension of universality and is compatible with various battery systems, including battery swapping.”

One remarkable advantage of the skateboard chassis is that it can reduce the development cycle and cost of new platforms, thereby enhancing competitiveness, and the automaker can get rid of low-profit margins. In addition, the skateboard chassis provides car companies with a new solution to improve the overall mechanical quality of vehicles.

One remarkable advantage of the skateboard chassis is that it can reduce the development cycle and cost of new platforms, thereby enhancing competitiveness, and the automaker can get rid of low-profit margins. In addition, the skateboard chassis provides car companies with a new solution to improve the overall mechanical quality of vehicles.

However, what obstructs the integration of car companies is not only the “historical burden” on the table, but also a deeper reason – data.

At the recent Baidu Apollo RT6 media meeting, Photon Planet asked Baidu’s Chief Architect Yin Ying directly about the data problem. Instead of answering that question directly, he mentioned the importance of data for the autonomous driving team in terms of technical upgrades.

The automaker’s answer is only one: it is impossible.

“Tesla not using lidars and only using a pure vision solution makes sense. Building the Model3 with a low-cost approach, running data quickly through the sheer volume of upgrades and boosting backend data volumes can then be used to train your own autonomous driving model.” Li Hua believes that suppliers can only adjust according to the needs of the automaker, and may not be able to obtain data.

Yu Chuan believes that even if car companies have a demand for skateboard chassis in the future, they cannot open all kinds of data to themselves. “Some automakers who don’t care about data may be a solution. They only care if you provide them with high-performance and cost-effective products. Another way is to establish some whole vehicle projects through the community. This way we can establish the initiative on data in areas that do not involve user privacy.”

Automakers are not homogeneous. Once they face survival or improvement problems, they will still open some data. “Because the chassis involves tuning, suppliers cannot do it without data, so the automaker will still provide relevant data.” Xu Hua believes that partial opening is also possible.

Upturning from the bottom of the car

From a technical point of view, CTC, CTP, and CTB technologies do not seem to have particularly big conflicts with the skateboard chassis. If viewed from the two main paths of the power battery, CTC may have a higher affinity with the skateboard chassis.

CATL mainly promotes CTP batteries to consolidate the battery swap mode with technical advantages. The CTC, due to the integration of the power battery with the chassis, makes the automakers prefer supercharging paths. An automotive engineer believes that compared with battery swaps, supercharging may have a slight advantage.

“Leapmotor had mentioned the issue of expanding to 800V supercharging when CTC was released. Ideally, it can achieve the five-minute charging advertised by OPPO that year, but it is still in the internal planning stage.”

We got a more technical answer from Yu Chuan: the upper body of the electric vehicle is mainly the weak electricity part, relatively safe, while the lower body is the strong electricity part. Considering safety factors, it is necessary to separate and decouple the upper and lower bodies. However, the problem is precisely on decoupling.Once the separation of upper and lower body of the car happens, it may lead to a revolutionary change in the entire vehicle manufacturing process. For example, the upper and lower body will rely on a universal interface – not to mention the dispute between Type-C and Lightning routes for mobile phone charging interfaces, not just in the automotive industry.

A car needs to go through four processes: stamping, welding, painting, and final assembly, which are essentially an assembly line production with clear division of labor. As a skateboard chassis that adapts to flexible manufacturing and personalized manufacturing properties, it may overturn tradition.

In the process of continuous contact with car companies, two start-up companies of skateboard chassis have also discovered deeper problems.

Xu Hua believes that “In the process of innovative technology towards mass production, challenges of recognition must be encountered. In the R&D process, the whole R&D team will have some inertial thinking due to different backgrounds of personnel. How to turn the established thinking into thinking of skateboard chassis is actually a big challenge.”

Yu Chuan analyzed the current situation and future prospects of skateboard chassis from the perspective of the industry. He believes that existing automobile manufacturing is facing the scale of the assembly line economy, while future automobile manufacturing needs to face consumers. Users will customize their appearance, headlights, and even upper body, which will pose a huge challenge to traditional vehicle manufacturing.

If chassis, battery, upper body, shell, and autonomous driving kits are produced by modules, car companies can launch customized products according to individual needs. “If you just treat the skateboard chassis as a product and apply it in the original paradigm and system, its value cannot be truly realized, and we have to wait for changes in the industry chain for it to ultimately burst out its advantages.”

The original equipment manufacturers have also noticed the advantages of skateboard chassis for product iteration, but mostly remained in an ambiguous position. Just as Zhao An said, “The cooperation between the supply chain companies and the car manufacturers is actually a seesaw of discourse power. If someone’s discourse power is heavy, then they may have stronger control. The weaker side of discourse power is more willing to compromise and cooperate in various aspects.”

PIX Moving has already realized this.

When we communicated with Yu Chuan, he recalled a challenge encountered in cooperation with a foreign special vehicle Tier1. “The other party is larger and has a deeper history than us. In the face of a cooperation of tens of millions, we basically have to match their needs and do products according to their suggestions, including product rhythms, commercial validation, product testing, etc., which are basically dominated by them.”

However, domestic customers are completely different. We have previously described in the article “2022, the Battle of Auto Parts”, the situation where Great Wall did not adjust the time but modified the plan repeatedly, and PIX Moving has also encountered similar situations. Foreign customers will provide clear and actual processes and deadlines, while domestic customers have no similar ideas, hoping to achieve product level in one go.

In addition, customers will also use “The competitor does not charge development fees” as an excuse to press for lower prices. It is impossible to know whether they have actually charged fees or not.The pressure of working with large corporations left a lasting memory with him. “When working with a certain large domestic client, because there was some delay in the schedule, they sent someone to the workshop to be a ‘supervisor’. They said that if this order was not done well, we should not continue to work in this circle in the future.”

Under pressure, some engineers would go to the temple to burn incense before each delivery. Once, a certain engineer even pasted the “Love to Crash” logo on the garage door. Yu Chuan laughed, “They said it was a seal, giving the product a soul.” But objectively, under high-intensity work, Pix Moving’s team was also driven towards maturity.

Commercial Use First, Passenger Use Later

Compared to CTC, the skateboard deck currently faces greater challenges in the high-speed market, especially in passenger cars.

“We hope to standardize hardware and platform software. Only when we achieve this, will automakers see how many personalized experiences we can provide to the market. The most important point is that the skateboard deck is not only at the hardware level but also the soft power that can bear the injection of electrical architecture, intelligence, automation, cloud integration, and the ability to continuously update through OTA.”

In low-speed scenarios, the skateboard deck will run faster, such as various special-purpose vehicles and commercial vehicles. Because the market demand is highly fragmented and customized, the skateboard deck has a better prospect.

In fact, not only the skateboard deck but also new technologies such as autonomous driving are landing in the above scenarios. We have seen the global layout of the low-speed unmanned vehicle of New Stone Age has been initially completed. During the pandemic, its distribution capability has been tested.

Whether it is a skateboard deck or CTC, CTB, CTP battery pack, “Three Integration” is driving the transformation of the entire automotive industry chain comprehensively. Regarding technology iteration, Xu Hua used Nokia dropping out in the era of smartphones as an example to summarize the automotive industry chain under technology iteration: “At first, they are uninterested. In the second stage, they don’t understand it. In the third stage, they understand it, but they cannot catch up.”

New technology will inevitably bring new value.

As an engineer from a certain traditional automaker said: traditional OEMs such as SAIC, Great Wall, and BYD only earn a little profit per car sold. In the eyes of new forces in the market, who still cares about that small profit?!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.