Author: Deyan

This year, NIO has been quite “productive”. In May, NIO officially announced the launch of a sub-brand for the mass market with the code name Alps. The models of this brand are expected to be delivered starting in 2024. Now, before Alps has even made its debut, media has uncovered news of a third brand: Codenamed “Firefly”, it is positioned in the mid-to-low-end market, with prices ranging from 100,000 to 200,000 yuan, or even below 100,000 yuan.

From no new model deliveries in the past two years to delivering three new models and revealing two sub-brands this year, Is NIO gearing up for a bloodbath against its competitors?

The Expanding Market in the Low-End Segment

For domestic new energy vehicle companies, the July sales data was somewhat surprising. NETA and Leap Motor, who take the low-end route in the market, surpassed NIO XPeng for the first time and took the top two spots in the domestic new energy vehicle sales ranking. According to NIO, the demand for orders is still at a high level, but due to the shortage of pressure casting parts, several thousand fewer ET7s were produced. Li Bin even appealed to all supplier partners to withstand the pressure at the event.

Judging from the product positioning, NIO has almost secured its position as the leader in new energy vehicle sales in the 500,000 yuan segment. However, just as we cannot make a comparison between BBA and Volkswagen or Toyota in terms of sales, there is always limited growth space for NIO in this price range. Correspondingly, there is an increasingly hot demand and competition in the low-end market.

In the 200,000 to 300,000 yuan new energy market, the fiercest competition among domestic new energy vehicle companies, independent brands, and more and more new car manufacturers including AITO, which relies on Huawei’s support, have come to the forefront, with sales of over 10,000 units in three months. Baidu’s new car has also made its debut, and Xiaomi, which is expected to be the first electric car for young people, is set to roll out its soft-model car in September and deliver it in the first half of 2024.

The practice of building a new brand and grafting it onto a mature supply chain and production line has also been perfected by Chang’an, SAIC, Geely, Great Wall, and BYD; as for traditional multinational car companies such as Volkswagen, GM, Toyota, and BBA, they naturally won’t miss out on the domestic electric car feast. By continuously increasing the pace of putting new cars into the smart electric vehicle field, they hope to get a slice of the fastest-growing sub-market in China’s auto market.

Despite Li Bin’s constant emphasis that NIO, as a mid-to-high-end brand with an average selling price of over 400,000 RMB, does not need to compete in sales volume with other competitors, how can NIO not be tempted by such a huge market worth 200,000 or even 300,000 RMB? At this point, launching a lower-positioned sub-brand to seize the market has become a logical choice.

Despite Li Bin’s constant emphasis that NIO, as a mid-to-high-end brand with an average selling price of over 400,000 RMB, does not need to compete in sales volume with other competitors, how can NIO not be tempted by such a huge market worth 200,000 or even 300,000 RMB? At this point, launching a lower-positioned sub-brand to seize the market has become a logical choice.

Can the New Car Effect and the Brand Sink Turn the Tide?

Under the intensifying competition in the new energy market, NIO has raised two big flags: launching new cars and sinking the brand.

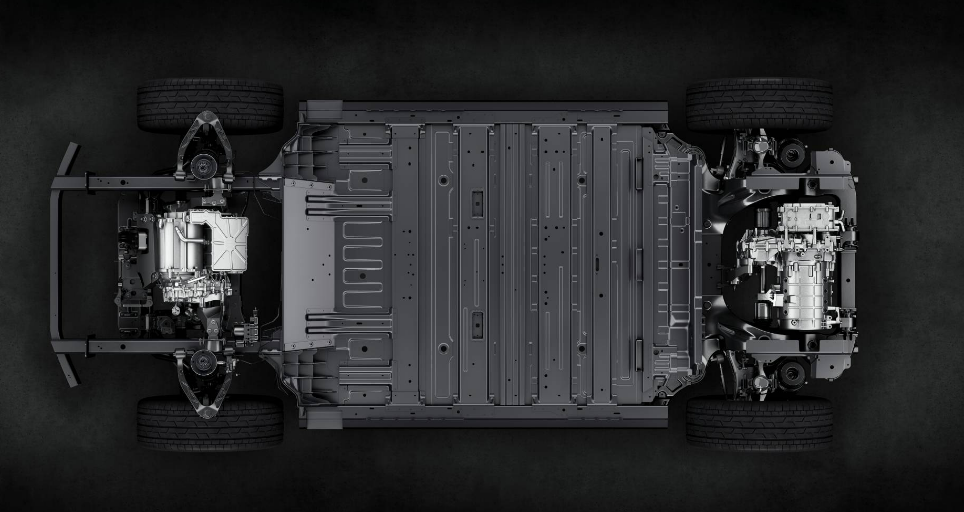

In 2022, in addition to the already launched ET7, NIO is still waiting to deliver two new models, ET5 and ES7. In terms of product power, the previous generation of NIO’s vehicles based on the NT1.0 platform has been somewhat inadequate. Their once-prided highlights have now become the standard equipment of many newer models.

Therefore, NIO plans to deliver three new models based on the NT2.0 platform in 2022, among which ET7, which has already been delivered, is positioned higher and its higher selling price means this will not be a model for large sales volume. As for ET5, it has become the hope of NIO’s sales volume. Through stronger product power and higher cost-effectiveness, it is an indispensable mission to seize a share of Model 3 and BMW 3 Series. As long as NIO can attract some of the consumers of these two models to switch to the ET5, NIO will likely be able to gain a foothold in terminal deliveries.

In addition to the ET5, NIO has also launched the ES7 based on the NT2.0 platform. To maximize sales volume, NIO even allows ES7 to coexist with ES6 and ES8.

At the brand level, after officially announcing the release of a new sub-brand called “ALPS” targeting the 200,000 to 300,000 RMB range, the original NIO brand will stick to the above 300,000 RMB range. If, as rumored, NIO’s third brand covers the market price of 100,000 to 200,000 RMB, NIO will establish a brand matrix covering the high, medium and low end markets.

Using the reputation and appeal accumulated by the NIO brand, NIO views “ALPS” and a brand new entry-level brand as the key to improving its sales volume by launching the brands into the sinking market to attack other brands.

Examples of constructing a brand matrix through sub-brands are not uncommon in traditional automotive brands, such as SAIC Volkswagen with Audi+Volkswagen+Skoda or SAIC GM with Cadillac+Buick+Chevrolet, which could serve as a reference for NIO in building its brand matrix.

However, is this road going to be as smooth as Nio expected? That brings us to the challenges faced by multi-brand operations.

Challenges Faced by Multi-Brand Operations

In China, managing multiple brands is not an easy task.

To create sufficient differentiation between different sub-brands, automakers need to have substantial technical reserves; otherwise, clashes between sub-brands are inevitable. For smart EVs, at least enough differentiation is needed in core areas such as vehicle platforms, three-electric systems, intelligent cabins, and autonomous driving systems.

Furthermore, Nio only has a price range of 100,000 yuan for each brand. How to create differentiation with limited investment and technical reserves within limited positioning intervals is a challenge that Nio has to face.

From the perspective of the ALPS brand, Nio is likely to let the NT1.0 platform play its residual heat, support the ALPS brand through moderate transformation, and use the updated NT2.0 platform to build Nio’s current products, creating differentiation between the two brands. Since the platform and technology are readily available, the cost of transformation is relatively controllable, and the brands can quickly seize the market.

According to previous reports, ALPS is likely to share the battery swap system with Nio. This means that compared with competitors with the same price, the advantage of ALPS in battery swapping and energy recovery has become a major selling point.

As for Nio’s third sub-brand, if it wants to create a more affordable brand underneath the ALPS brand, it needs to be re-evaluated. Technically, building a new low-cost entry-level vehicle platform and product is not necessarily difficult. However, how to further control costs and find a unique selling point after cost compression are challenges that Nio has to face. After all, not every automaker in China has the ability and experience to build low-cost cars like Wuling.

When products reach the 100,000-yuan level, the products will be in close competition with each other. The services and battery swapping abilities that Nio is proud of are based on high investments, which are difficult to reuse in products at this price. Even whether the new sub-brand can join Nio’s existing battery swap system is still unknown. Without services and battery swapping, what will the third sub-brand of Nio rely on to achieve success in the lower-end market?

There is another point that must be emphasized: entry-level brands may not necessarily increase sales volume.Taking Volkswagen China as an example, it has developed two entry-level brands, Skoda and Jetta, for the North and South markets, respectively. However, the sales volume has always been mediocre. For Jetta, in the first half of 2022, the total sales volume was just 76,654 units, while the overall sales of FAW Volkswagen reached 886,000 units, accounting for less than 9%. The idea of low-end sales is not necessarily effective.

Therefore, pushing the brand down under the existing strong brand aura does not necessarily lead to an immediate increase in terminal delivery.

In conclusion, the automotive industry is a profit-driven industry that requires scale. Without sufficient support, the profitability of a single brand will be constrained. Moreover, a brand-new sub-brand is likely to cause division within the existing brand, making it difficult to allocate research and development, molds or even factory costs.

Different from launching a high-end and low-end series under the same brand, launching a brand-new sub-brand can establish a complete product matrix. However, it also means that marketing, advertising channels, and even the car owner’s community app all need to start from scratch. The increased operating costs behind it will also be a significant burden.

As one of the best-known new forces in domestic car manufacturing, Li Bin did not intend to repeat the old path of fighting among multiple sub-brands. However, focusing only on the current high-end market is not Li Bin’s intention.

For domestic new car brands, focusing limited resources on strategic models and launching a quality car is currently the mainstream choice and the shortcut to success for new car companies. However, as the penetration rate of new energy vehicles increases, it will become increasingly difficult to rely solely on one or two popular products to dominate the market. The new energy market will also blossom like the current fuel vehicle market.

From this perspective, expanding the upper and lower limits of the brand and gradually establishing a product matrix that covers high, middle, and low-end markets is almost the path every new car brand needs to take to grow stronger. NIO has taken the lead by launching a sub-brand.The expansion of a brand from top to bottom is always challenged but much easier than extending from the bottom up. This is why NIO became the first new force car company to announce the establishment of a sub-brand, with a mid to high-end positioning providing it with the confidence and starting line to enter the lower-end market.

However, NIO’s pace in promoting its sub-brands is not as urgent as imagined. According to current reports, it is expected that NIO’s sub-brand “Alps,” announced in the first half of this year, will not start production until 2024. As for the third brand uncovered by the media, it is likely to start after 2024.

Whether NIO’s sub-brand can truly achieve a reduction in dimensions and reshuffle the electric vehicle market depends on its products.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.